CPP and OAS Payment Dates for June 2025: Canada Pension Plan (CPP) and Old Age Security (OAS) payment dates for June 2025 are set, and it’s super important to know when those funds arrive. Whether you’re managing bills, planning a trip, or tracking retirement income, understanding the when, how much, and what affects your payments is key. For June 2025, both CPP and OAS payments are scheduled for Thursday, June 26. That’s the day funds will likely be in your bank for direct deposit, or sent via cheque. Let’s unpack everything from historical context to tax tips, tools, and why it matters for newbies and financial pros.

CPP and OAS Payment Dates for June 2025

Having a clear understanding that your CPP and OAS payments are due June 26, 2025, gives you timely confidence. But it’s more than just that—knowing how much, planning bank details, tax implications, clawbacks, plus getting help with digital tools, can radically improve your financial well-being. Stay on top of direct deposit changes by June 23, track your income thresholds, estimate GIS eligibility, and lean on tools like MSCA, calculators, and financial advisors. When you’re informed, you’re empowered.

| Program | Payment Date (June 2025) | Max Monthly Payment | Taxable | Official Link |

|---|---|---|---|---|

| CPP | June 26, 2025 | $1,433 @ 65 (max); avg ~$900 | Yes | Canada.ca/CPP |

| OAS | June 26, 2025 | $727.67 (65–74); $800.44 (75+) | Yes | Canada.ca/OAS |

| GIS | June 26, 2025 | Up to $1,086.88 (single) | No | Canada.ca/GIS |

| Banking Deadline | June 23, 2025 | — | — | My Service Canada |

Why These Dates Matter?

Predictable payment dates help you:

- Pay rent or mortgage on time

- Schedule bills like utilities, internet, phone, or streaming

- Avoid late fees or overdraft charges

- Sync monthly cash flow with part-time work, investments, or pensions

When the date is buried in government documents, you lose clarity. But when it’s clear, you can plan properly.

Historical Context and Evolution

The CPP and OAS programs were introduced to support Canadians in retirement:

- CPP launched in 1966 after cross-country agreement. Each province joined by the early 1970s. Contributions are shared between employers, employees, and the self-employed.

- OAS started in 1952. It was universal for anyone 70 and older. Over time, it lowered to age 65 and saw big expansions and periodic top-ups.

Payment timing began shifting—originally monthly around the 1st—then standardized to the third-last business day as banking digitalized. That ensures beneficiaries get money before month-end weekend holds. That date also avoids holiday issues.

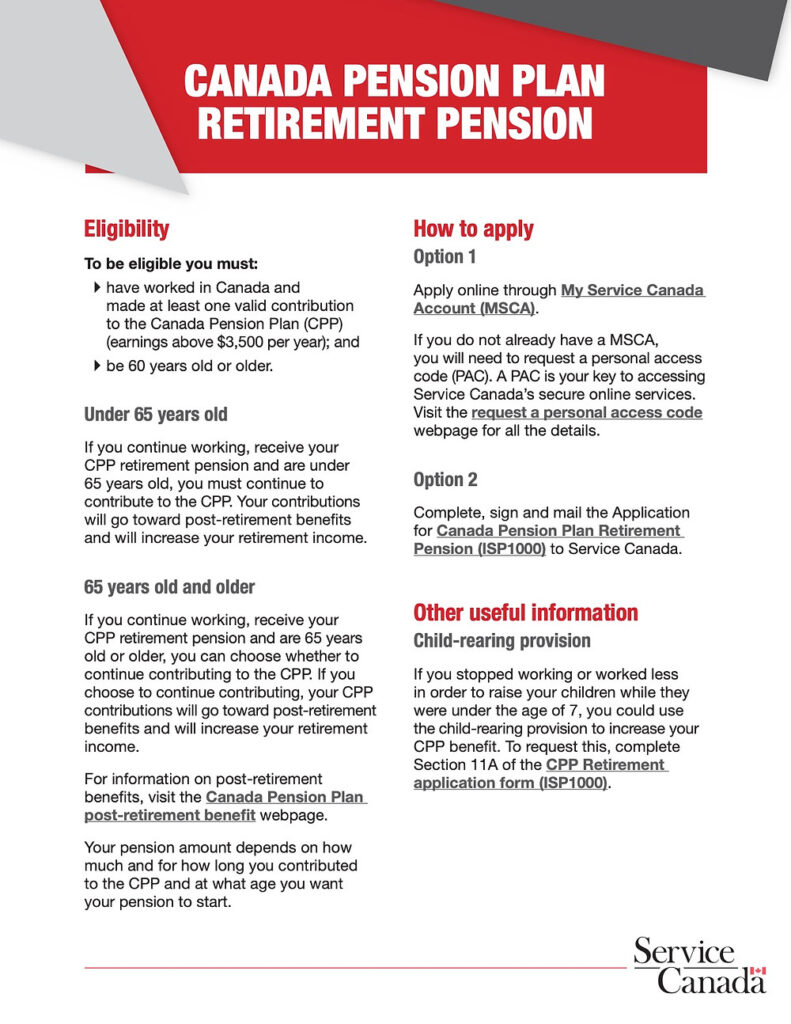

Understanding CPP

How CPP Works

- You contribute based on your earnings every year during your working life.

- If you’re employed, your employer contributes too; if self-employed, you pay both parts.

- Retirement benefits are available from age 60 (reduced) to 70 (increased).

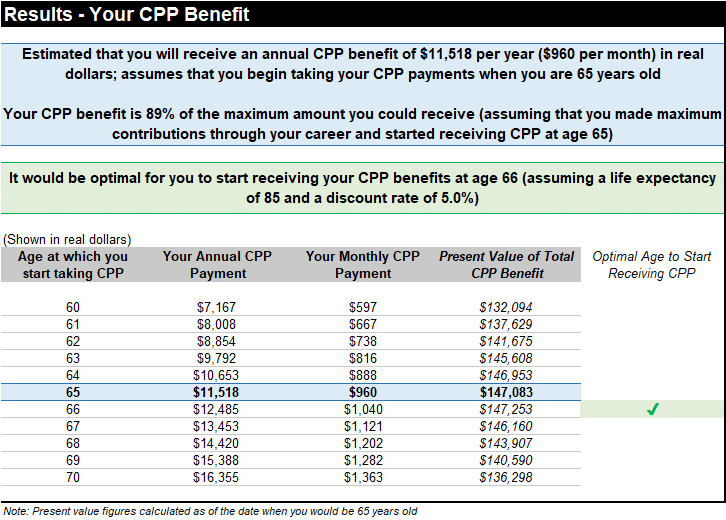

CPP Payment Amounts

- The maximum CPP monthly payment for someone turning 65 in January 2025 is $1,433.

- The average monthly amount at age 65 is around $900, depending on your contribution history.

How Payments Are Determined

- Based on how much you contributed

- Includes indexation to inflation (whenever combined CPP contributions and year’s average wage change)

- Can be deferred up to age 70 for a boost, especially valuable later in retirement

Understanding OAS

What OAS Is

- Offered to Canadians aged 65+, regardless of contribution history

- Eligibility based on living in Canada at least 10 years after age 18

- Top-ups called Allowances and Guaranteed Income Supplement (GIS) support low-income seniors

OAS Payment Amounts

- For June–August 2025:

- Age 65–74: $727.67 monthly

- Age 75+: $800.44 monthly

- Means-tested based on your income

Clawback Rules

- If your net world income (for 2024 tax year reporting in 2025) exceeds ~$93,208, OAS starts getting clawed back.

- By $151,978, it could be fully recovered.

- Those over 75 have a slightly higher threshold.

Guaranteed Income Supplement (GIS)

- Available to low-income OAS recipients

- Paid monthly alongside OAS

- Maximum of $1,086.88 for single seniors (June 2025)

- Non-taxable

- Calculated based on combined net income and marital status

Step-by-Step: Checking Your CPP and OAS Payment Dates for June 2025 Status

- Log in to your My Service Canada Account (MSCA)

- Go to “Public pensions (CPP/OAS/GIS)”

- View upcoming payments, previous amounts, and tax withholding

- Update banking info under “Direct deposit”

- Adjust tax withholding or request extra deductions

Banks usually require three business days to process changes, so June 23 is your cut-off for June disbursement.

What If Payment Is Late or Missing?

Common issues to check:

- Bank account change – Confirm information in MSCA

- Lapsed email or mailing address – Canada uses this info for notices

- System delays – Canada Post or bank systems sometimes lag

- Clawbacks or garnishments – Tax owing, maintenance orders, or other deductions

- Holiday hold-ups – June 26 lands on a Thursday, so it’s usually safe. But always ready.

You should hear from Service Canada via email or letter if a payment is significantly delayed.

Tax Planning and Withholding

- CPP and OAS are taxable social benefits

- You receive T4A(P) for CPP and T4A(OAS) slips in February for the prior year

- Required to report these on your income tax return

- Voluntary tax withholdings can prevent owing money in April

- Marginal tax strategies:

- Use RRSP locked-in accounts or LIFs

- Delay CPP/OAS to reduce taxable RRSP withdrawals

- Use TFSAs for tax-free savings

- Income-split with a spouse or partner for low-income pensioner families

What Happens If You Keep Working?

- You keep contributing to CPP if under 65 and working

- After 65, contributions stop unless you elect to continue

- Income from work can affect:

- OAS clawback eligibility

- GIS ineligibility

- Canada allows continued contributions after 65, especially valuable if earnings exceed average income indexes

Tips for Newcomers and Returning Canadians

- OAS eligibility requires 10 years of residency after age 18 in Canada

- For those living abroad, counts as residence if you were Canadian at departure

- CPP is portable—can continue contributing via home country under a social security agreement

- Yet need to apply for OAS separately if outside Canada

- Get your My Service Canada account set up right away

Tools and Resources

- CPP and OAS payment calendar

- Online CPP and OAS calculators – estimate future benefits

- Tax guides on RRSPs, TFSA vs RRSP, and clawback thresholds

- Legal and financial planning resources for estate and financial security

- Videos or infographics on pension planning

Protecting Yourself from Scams

Be cautious of:

- Requests for gift cards, Bitcoin, or similar payments

- Unprompted calls or texts referencing your SIN

- “Too-good-to-be-true” pension amnesty offers

- Official sources will never ask for full SIN by email or text

Schedule of 2025 Payments

Below is the remaining payment schedule:

| Month | CPP/OAS Payment Date |

|---|---|

| July | July 29, 2025 |

| August | August 27, 2025 |

| September | September 25, 2025 |

| October | October 29, 2025 |

| November | November 26, 2025 |

| December | December 22, 2025 (early for holidays) |

This helps with long-term planning and budgeting.

Canada’s Retirement Pension Just Increased to $1,364; Find Out If You’re Getting the Raise

2025 Canada Pension Plan Changes Are Here — What Every Retiree and Worker Must Know Now

CPP Retirement Payments Set to Rise in 2025; Check Your New Benefit Rate and Payout Dates

Personal Note from an Experienced Retirement Planner

Twenty years working hands-on with Canadian seniors taught me how impactful clear payment schedules and a solid pension plan can be. My grandma used to call me every February scratching her head at what RRSP withdrawals would cost her in tax. This same logic applies to OAS and CPP — being proactive and understanding how much and when means you’re always one step ahead.

I once worked with a couple in their early 70s. They were drowning in OAS clawbacks because they kept large RRSPs fully exposed. When we restructured their savings using TFSAs and delayed CPP a year later, their monthly income rose and taxes dropped. It’s real change some clear steps make.