Canada’s Retirement Pension Just Increased to $1,364: Canada’s retirement pension has just received a significant boost in 2025, with many retirees now eligible to receive up to $1,364 per month from the Canada Pension Plan (CPP). This increase has sparked a lot of buzz among those nearing retirement, but the question on everyone’s mind is: Are you getting the raise? Whether you’re already collecting CPP, planning for the future, or just starting to explore the benefits available to you as a Canadian, understanding how this change will impact you is crucial. But don’t worry, we’ve got you covered. In this article, we’ll break down what you need to know, including who’s eligible for the raise, how much you can expect, and what you can do to ensure you’re getting the maximum benefit possible.

Canada’s Retirement Pension Just Increased to $1,364

Canada’s retirement pension system has just received a major update, making it a little easier for retirees to live comfortably as the cost of living continues to rise. The new maximum CPP payment of $1,364 is a great step forward, but it’s important to remember that this is the maximum, and not everyone will qualify for this amount. Be sure to review your contributions, consider delaying your payments, and understand how both CPP and OAS can provide the financial support you need in retirement.

Whether you’re planning for the future or already in retirement, understanding these details will help you get the most out of your pension benefits. Check your CPP Statement of Contributions and ensure that you’re set up to take full advantage of these increases. By taking advantage of the programs and strategies discussed, you can maximize your retirement income and live your golden years with peace of mind.

| Key Information | Details |

|---|---|

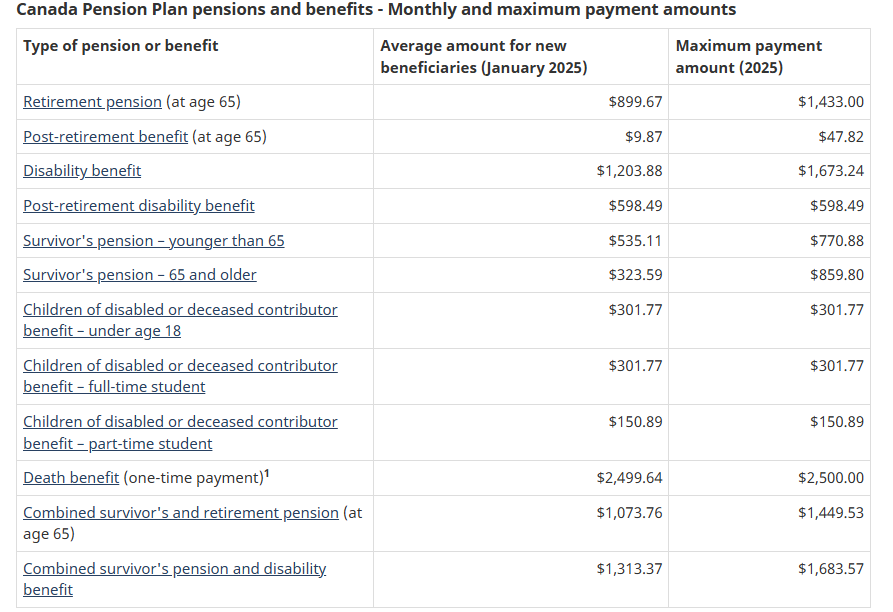

| New CPP Payment Increase | $1,364 per month for those with 39+ years of maximum contributions |

| Eligible Age for Full CPP Payment | 65 (can be started as early as 60 or as late as 70) |

| CPP Payment at Age 70 (Deferral) | Approximately $1,433 per month |

| OAS Payment (Ages 65-74) | $727.67/month |

| OAS Payment (Ages 75+) | $800.44/month |

| Maximum Combined CPP & OAS | Around $2,200–$2,300 per month |

| OAS & GIS (Guaranteed Income Supplement) | Additional benefits for low-income seniors |

| Official Reference | Canada.ca |

Understanding the Canada Pension Plan (CPP)

The Canada Pension Plan (CPP) is one of the main pillars of retirement income in Canada. It’s a government-run program that provides monthly payments to people who have worked and contributed to the plan throughout their careers. As of 2025, the maximum CPP payment has increased to $1,364 per month, reflecting the rising cost of living and other economic factors.

However, there’s a key point to remember: this is the maximum amount you can receive if you’ve contributed the highest possible amount over a long career. Most people will receive less than this, as the amount depends on your contributions and how long you’ve been contributing.

How Is the CPP Payment Calculated?

The amount of CPP you receive depends on the following factors:

- How much you’ve contributed: Contributions are made as a percentage of your income, up to a certain annual limit. The more you’ve earned and contributed, the higher your monthly payment will be.

- When you start receiving CPP: If you start collecting your CPP at age 65, that’s when you’ll receive the full benefit. If you start early, at age 60, your payments will be lower, but if you wait until age 70, your payments will be higher.

- How long you contributed: The longer you contributed to the CPP, the more you’ll receive. If you’ve contributed for at least 39 years, you’ll be eligible for the maximum payment.

The Big Question: Are You Getting the $1,364?

To determine whether you’ll be getting the maximum $1,364 or a different amount, you need to look at the following:

- Check your CPP contributions: Have you been consistently contributing over the years? If you haven’t worked long enough or at high enough earnings, your monthly payment will be lower than the maximum.

- Consider your starting age: If you’re starting CPP at age 65 or later, you’re on track to get as close as possible to the maximum. Starting earlier means a reduction in your monthly amount.

The Impact of the CPP Increase in 2025

In 2025, the CPP payment increase reflects the need to adjust for the rising costs of living. The amount of $1,364 per month is a step up from the previous year, ensuring that retirees don’t fall behind as inflation and expenses climb.

While $1,364 is the maximum for those who contributed at the highest level, it’s important to note that not everyone will receive this amount. For example, someone who contributed at the average level might receive around $800 to $1,000 per month, depending on their work history.

This increase also shows how the government recognizes the economic struggles faced by seniors and retirees in a world of inflation and higher living costs.

How Does This Compare to Old Age Security (OAS)?

Alongside CPP, Canada offers another vital program for seniors: the Old Age Security (OAS) pension. The OAS program provides basic financial support to Canadians over the age of 65 who have lived in the country for a certain number of years.

- OAS payment at age 65: As of 2025, the standard OAS payment for individuals aged 65-74 is $727.67 per month.

- OAS payment at age 75+: Seniors aged 75 and older will receive a higher OAS amount, $800.44 per month.

OAS is especially important because it’s available to nearly all Canadians, regardless of how much they earned or worked, as long as they meet the residency requirement.

Combining CPP and OAS for Total Retirement Income

When combined, CPP and OAS can provide a solid financial foundation for Canadian seniors. For those who qualify for both, the total monthly pension can reach up to $2,200–$2,300, depending on contributions, age, and other factors. Adding in other benefits like the Guaranteed Income Supplement (GIS) for low-income seniors can further raise the total amount.

Steps to Ensure You’re Maximizing Your Canada’s Retirement Pension Just Increased to $1,364

To make sure you’re getting the most from your CPP and OAS, follow these practical tips:

1. Review Your CPP Contributions

Check your CPP Statement of Contributions regularly. This will tell you how much you’ve contributed and what your estimated benefits will be. If you’ve missed any years of contribution, consider making voluntary contributions to maximize your future payments.

2. Consider Delaying Your CPP

If possible, delay collecting your CPP until age 70. By deferring your payments, you’ll receive an additional 8.4% per year for each year you wait past age 65. This can lead to a significant boost in your monthly pension.

3. Understand the OAS Eligibility Criteria

Make sure you qualify for OAS by checking your residency and income history. OAS payments are based on the number of years you’ve lived in Canada after age 18, with a full pension requiring at least 40 years of residency.

4. Maximize Your Earnings During Your Working Years

The more you earn (up to the contribution maximum), the more you can contribute to CPP. If you’re nearing the end of your working years, consider maximizing your earnings or contributing the highest possible amount to secure a higher monthly pension.

Canada Pension Boost Coming in June 2025; Here’s How Much More CPP and OAS You’ll Get

CPP Retirement Payments Set to Rise in 2025; Check Your New Benefit Rate and Payout Dates

CPP and OAS Getting a Raise This June; CRA Reveals Exact Pension Increases

Additional Benefits for Low-Income Seniors

Beyond CPP and OAS, there are other programs available to low-income seniors that can help bridge the financial gap. One of these programs is the Guaranteed Income Supplement (GIS), which is added to your OAS payments if your income is below a certain threshold.

For instance, if you have a low income, you could be eligible for additional monthly payments through GIS, making your retirement income significantly higher than the standard OAS payment.

This is an important program for seniors facing financial hardship. Keep in mind, the eligibility for GIS depends on both your income level and your family status. You can apply for GIS through Service Canada, and they’ll determine your eligibility based on your financial situation.