Canada Child Benefit Gets a Boost: The Canada Child Benefit (CCB) has been a cornerstone of financial support for families across Canada, and starting in July 2025, it’s set to get a boost. For many families, this increase is more than just a monthly payment—it’s an opportunity to ease the financial burden of raising children in a world where the cost of living continues to rise. This article breaks down the upcoming changes to the CCB, who is eligible, and how the benefit can help you and your family.

Canada Child Benefit Gets a Boost

The Canada Child Benefit is an invaluable tool for families across Canada, and the upcoming boost in July 2025 will provide much-needed relief to parents struggling with rising costs. From covering everyday expenses to supporting your child’s education and healthcare, the CCB can make a significant difference in your financial stability. Remember to file your taxes on time, keep your information updated, and take advantage of additional provincial benefits.

| Feature | Details |

|---|---|

| Boost in CCB Payments | $619/month for children under 6, $522/month for children 6-17 (as of July 2025). |

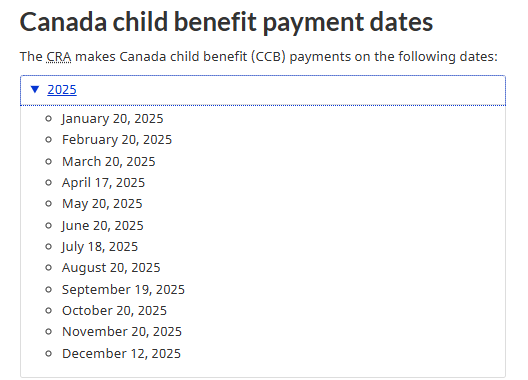

| Payment Frequency | Monthly payments on the 20th of each month, with exceptions for weekends/holidays. |

| Eligibility | Canadian residents, responsible for child care, filing a 2024 tax return. |

| Additional Benefits | Extra support for children with disabilities through the Child Disability Benefit (CDB). |

| Provincial & Territorial Benefits | Varies by location, may offer additional benefits based on income. |

| Official Website | Canada Revenue Agency |

Understanding the Canada Child Benefit (CCB)

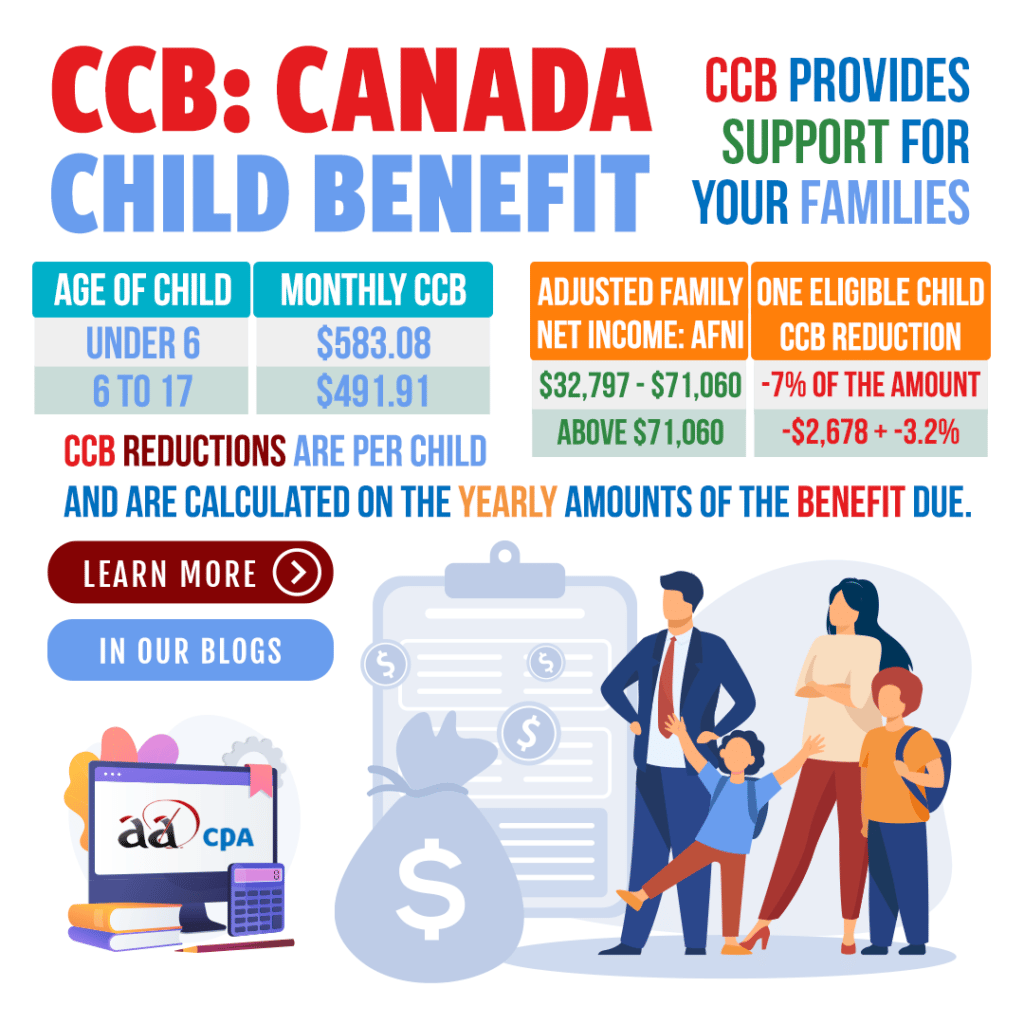

Before diving into the specifics of the 2025 increase, let’s take a moment to understand the Canada Child Benefit itself. The CCB is a financial aid program provided by the Canadian government to help families with children under 18 years old. It aims to assist with the costs of raising children and reduce child poverty across the country. What sets the CCB apart from other forms of assistance is its income-testing nature—meaning families with lower incomes receive higher payments.

The payment amount depends on factors like the number of children in the family, the ages of the children, and the adjusted family net income (AFNI). It’s available to Canadian residents, and you must file a tax return to qualify. The CCB has played a key role in reducing financial strain for families, and the upcoming boost is expected to provide even more relief.

What’s Changing in July 2025?

In July 2025, the CCB payment amounts will increase. This increase reflects the government’s continued commitment to supporting families amidst rising inflation and living costs. Here’s a quick look at the new payment amounts:

- For children under the age of 6: Families can receive up to $619 per month.

- For children aged 6 to 17: Families can receive up to $522 per month.

These increases are not only reflective of inflation but also aim to ensure that families can better manage rising living costs, from groceries to rent to healthcare.

Why is the CCB Getting a Boost?

As the cost of living continues to climb, particularly in urban areas, families are feeling the financial squeeze. The increase in CCB payments helps offset rising costs for food, housing, healthcare, and other basic necessities. The government understands that raising children comes with significant expenses, and the CCB is designed to help ease some of that burden.

How the CCB Can Help Your Family?

The Canada Child Benefit is more than just a handout—it’s a vital tool for families to stay afloat and thrive in today’s economy. Whether it’s covering the cost of school supplies, helping with daycare, or contributing to savings for your child’s future, the CCB can be a lifeline for parents across Canada.

1. Everyday Living Expenses

Families can use their monthly CCB payments to cover everyday costs such as food, utilities, and transportation. This is especially important for lower-income families, who often spend a larger portion of their income on basic needs.

2. Education and Enrichment

For children, the CCB can help cover education-related expenses. From school supplies to after-school programs and extracurricular activities, the extra money from the CCB can make a significant difference in your child’s development and overall quality of life.

3. Healthcare and Medical Expenses

Raising children often involves unexpected medical costs, from dental work to prescription medications. The CCB can help families manage these expenses, ensuring that kids get the healthcare they need.

How to Qualify for the Canada Child Benefit Gets a Boost?

To qualify for the CCB, you must meet several basic eligibility criteria. The process is relatively straightforward, but it’s essential to understand the requirements to ensure you get the full benefit.

Eligibility Criteria

- Residency: You must be a Canadian resident for tax purposes.

- Primary Caregiver: You must live with the child and be primarily responsible for their care.

- Tax Filing: You must file a 2024 tax return. The amount you receive will be based on your adjusted family net income (AFNI).

- Child’s Age: The CCB applies to children under the age of 18.

Income Limits

If your family’s AFNI is under $34,863, you’ll qualify for the maximum benefit. As your family’s income increases, the CCB payments will decrease gradually. Families with higher incomes will still receive a reduced benefit, but the amount will be lower.

Maximizing Your CCB Payments

To ensure that you are receiving the maximum benefit, here are a few tips that may help you make the most of your Canada Child Benefit:

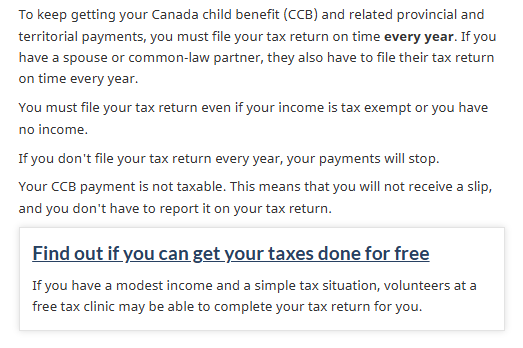

1. File Your Taxes on Time

Your CCB eligibility is based on your income, so it’s crucial to file your taxes on time every year. The amount you receive in CCB payments is calculated based on your Adjusted Family Net Income (AFNI) from the previous year. Filing late can delay or even reduce your benefits, so it’s essential to stay on top of this.

2. Keep Your Information Updated

If your family situation changes (for example, if you have another child or experience a change in income), it’s important to update your information with the Canada Revenue Agency (CRA). Keeping your details up-to-date ensures that your payments are accurate.

3. Apply for Additional Benefits

In some provinces and territories, there are additional child benefits that you may qualify for, which can supplement the federal CCB. For instance, Ontario offers an additional Ontario Child Benefit (OCB), and Quebec has its own family benefits program. Be sure to check if there are extra benefits in your province.

The Child Disability Benefit (CDB)

For families with children who have disabilities, there is additional support available through the Child Disability Benefit (CDB). This benefit offers up to $3,411 per year (or $284.25 per month) for children who are eligible for the Disability Tax Credit. The CDB is income-tested, so the amount you receive will depend on your adjusted family net income.

Key Points to Remember About the CDB:

- Eligibility: Your child must be eligible for the Disability Tax Credit (DTC).

- Payment Amount: Up to $284.25 per month.

- Application: Apply through the Canada Revenue Agency.

Managing Your Family’s Finances With the CCB

Receiving the CCB can significantly ease the financial burden of raising children, but it’s important to use the money wisely. Here are a few ideas on how you can make the most of your monthly CCB payment:

1. Create a Family Budget

A family budget helps you track your expenses and save money. With the CCB, you can allocate funds for necessities, savings, and even special family activities. A well-managed budget can ensure that the money you receive goes as far as possible.

2. Set Up a Savings Fund

Consider using part of your CCB payments to create a savings fund for your children’s future. Whether it’s for their education or as a nest egg for their adult life, saving a portion of the CCB each month can set them up for success.

3. Invest in Your Child’s Development

The CCB isn’t just for survival—it can also help fund your child’s growth. From educational programs to extracurricular activities, investing in your child’s development can have long-term benefits.

Additional Provincial & Territorial Benefits

Besides the federal CCB, many provinces and territories offer extra child benefits that can increase the amount of support you receive. For example:

- British Columbia: The BC Family Benefit offers additional monthly payments, depending on your family’s income and number of children.

- Ontario: Families in Ontario also receive the Ontario Child Benefit (OCB), which is paid monthly and is intended to support low- to moderate-income families.

Each province has its own eligibility criteria and payment structure, so it’s important to check with your local government to ensure you’re receiving all the benefits you’re entitled to.

Canada Child Benefit 2025: Exact Payment Dates From June to September Revealed!

Canada Child Benefit Set for July 18 — Check If You Qualify & When You Get Paid!

Minimum Wage Hike Across Canada: See What Your Province Is Paying Starting Soon