Brits Could See £6,000 Pension Boost Under Labour: A bold claim making headlines across the UK. But what does it really mean? And who gets the money? Labour’s proposed reforms aim to shake up the current pension system by combining small pension pots into large investment funds, unlocking higher returns and lower fees for millions of workers. The idea is rooted in simple math: bigger funds = better deals + smarter investments = more savings in your pocket. Whether you’re 22 and just starting out or 55 and counting down to retirement, this reform could have a big impact on your financial future. Here’s everything you need to know.

Brits Could See £6,000 Pension Boost Under Labour

Let’s be real—pensions aren’t exactly dinner table conversation. But they should be, especially when something as big as this reform could put thousands of extra pounds into your retirement pot. Labour’s plan to shake up the UK’s pension system might seem like political jargon on the surface, but underneath, it’s about something personal: your future. It’s about making sure the money you work hard to save actually works just as hard for you. It’s about cutting out waste, getting smarter with investments, and giving ordinary workers—whether you’re full-time, part-time, or somewhere in between—a fair shot at a comfortable retirement.

And the best part? You don’t have to be a financial expert to benefit. This change is designed to lift everyone, even if you’ve never paid much attention to your pension before. So, whether you’re just starting your career or already thinking about winding down, it’s worth staying informed. Because when your pension grows quietly in the background, that’s peace of mind you can carry into the future. Your retirement deserves that kind of attention. You deserve it.

| Feature | Details |

|---|---|

| What is it? | Labour pension reform to boost retirement savings |

| Estimated benefit | £6,000 average increase in pension savings per worker |

| Who qualifies? | Workers with Defined Contribution pensions and LGPS members |

| How it works | Consolidation into £25B+ “megafunds” to cut fees and raise returns |

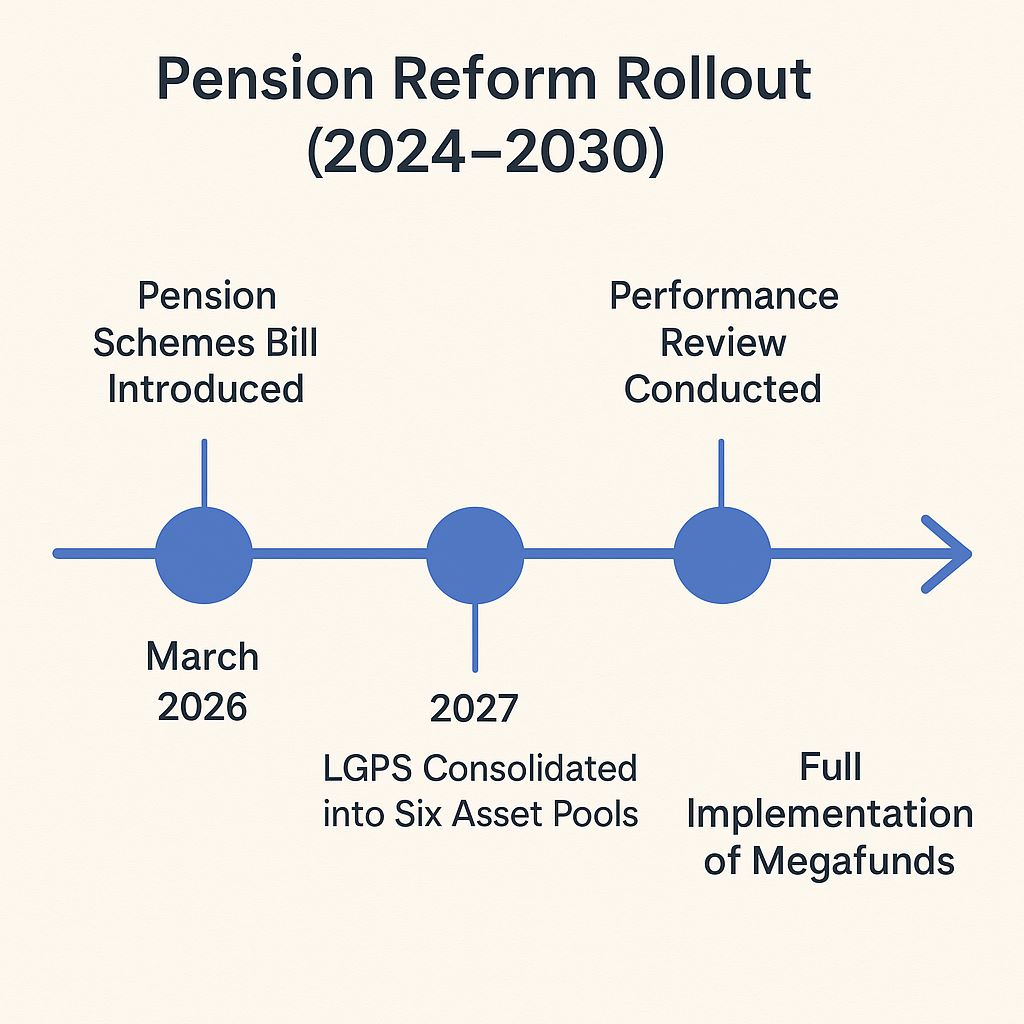

| Timeline | LGPS consolidation by 2026; broader reforms by 2030 |

| Source | UK Treasury official statement |

Why Labour’s Pension Reform Is a Big Deal?

The core of Labour’s pension proposal is the idea of consolidation. By merging multiple smaller schemes into a few large funds, the plan expects to unlock better investment opportunities and save on management costs.

According to estimates, a typical saver could earn £6,000 more over their working life under the reformed system. That’s based on:

- Reduced annual management charges

- Access to more profitable, long-term investments like infrastructure

- Professional, centralized fund management

The idea mirrors strategies already proven successful in Australia, Canada, and the Netherlands, where large pension pools deliver consistent, high-quality returns for workers.

A Short History of UK Pensions

The UK pension system has evolved dramatically over the last few decades. Here’s a brief snapshot:

- Before 2000s: Most pensions were Defined Benefit (DB), meaning you were promised a set payout upon retirement.

- Now: Over 90% of new pensions are Defined Contribution (DC), where your final amount depends on how much you and your employer contribute—and how well those funds are invested.

- Problem: Many DC pensions are managed by small providers, resulting in high fees, inconsistent returns, and poor retirement outcomes—especially for part-time workers and low earners.

Labour’s plan aims to modernize the system by building a future-proof model where everyone benefits, not just those with financial advisors or high salaries.

Who Qualifies for the Pension Boost?

Labour’s reforms are focused on two major groups:

1. Workers with Defined Contribution (DC) Pension Schemes

If your pension depends on regular contributions and investment performance (most private sector pensions today), you’re likely eligible.

These include:

- Auto-enrolment workplace pensions

- Personal pensions like SIPPs

- Stakeholder pensions

2. Members of the Local Government Pension Scheme (LGPS)

The LGPS serves over 6.3 million public sector workers. Labour’s plan will consolidate 86 existing LGPS funds into six asset pools by 2026.

This includes:

- Teachers

- Council workers

- NHS administrative staff

- Part-time and lower-income earners

If you’ve worked in public service, you may already be part of LGPS without realizing it.

How the Brits Could See £6,000 Pension Boost Under Labour Works?

Here’s how the policy would actually play out:

Step 1: Fund Consolidation

Multiple smaller pension schemes will be combined into “megafunds”, each managing at least £25 billion in assets. These super funds will have:

- Enhanced buying power

- Professional investment managers

- Access to global markets and major UK infrastructure projects

Step 2: Reduced Costs

With size comes bargaining power. These funds can negotiate lower management fees and streamline administrative costs. It’s estimated this could save the system £1 billion per year.

Step 3: Improved Returns

Larger funds have access to high-performing asset classes that small funds typically can’t afford. This includes:

- Green energy projects

- Technology start-ups

- Infrastructure like roads, bridges, and schools

Step 4: Legal Backing via Pension Schemes Bill

The Pension Schemes Bill is expected to pass during the next parliamentary session. It will outline fiduciary duties, reporting requirements, and transition processes for fund managers.

Real-Life Examples

Let’s see how these changes could affect people at different stages of their careers:

Example 1: Emily, 23, Starting First Job

- £25,000 annual salary

- Saves 8% per year over 45 years

- Without reform: ~£120,000 pension pot

- With reform: £126,000 or more (due to lower fees and better returns)

Example 2: Mike, 50, Council Worker

- £35,000 annual salary

- LGPS member for 20 years

- With improved investment access and pooled returns, could see £2,000–£4,000 added to his pension without extra effort.

How the UK Compares to Other Countries?

| Country | Pension System | Average Returns | Reform Focus |

|---|---|---|---|

| UK | Mixed DC/DB | ~3-5% | Consolidation & cost control |

| Australia | Superannuation | 7–8% | Compulsory saving, large pooled funds |

| Canada | CPP/QPP | 6–7% | Centralized, professionally managed |

| USA | 401(k), IRA | Varies (3–10%) | Private savings, often unmanaged |

Labour’s policy brings the UK closer to countries like Canada and Australia, where pensions are managed like sovereign wealth funds—large, professional, and focused on long-term growth.

What Experts Are Saying

“This is a once-in-a-generation opportunity to overhaul a system that has long disadvantaged ordinary workers.”

— Nigel Peaple, Director of Policy, PLSA

“Larger, pooled funds are the only way to unlock the infrastructure investment needed for growth.”

— UK Treasury spokesperson

“Most UK workers don’t realize they’re paying too much in fees. Reform is vital.”

— Institute for Fiscal Studies (IFS) report, 2024

Potential Challenges and Concerns

Not everyone is cheering. Some concerns include:

- Riskier Investments: Chasing returns in infrastructure and tech can backfire.

- Loss of Local Oversight: Smaller schemes often provide personalized support and tailored advice.

- Transition Complexity: Migrating data and member records to megafunds will take time and precision.

However, strong regulation and governance under the Pension Schemes Bill is expected to mitigate these risks.

Practical Advice for Workers and Savers

If you want to stay ahead of the curve, here’s what to do:

- Check your pension provider

Use your HR department or pension portal to see who manages your funds. - Trace old pensions

Visit the Pension Tracing Service to locate forgotten pots. - Calculate your future pot

Use the MoneyHelper Pension Calculator. - Don’t panic or withdraw early

Withdrawing early comes with tax penalties and slows down growth. - Talk to an advisor

If you’re unsure about how this affects you personally, consult a regulated financial advisor.

Thousands of UK Pensioners Could Be Owed £11,725—Check This DWP List Now

Extra £90 Coming Soon for Millions in the UK—Check If You Qualify!

Labour Says You Could Save £6,000 More—But Will Their Pension Plan Deliver?