Britons Uncover ‘Hidden Horror’ in Pensions: Have you ever thought about your pension, expecting it to be a cozy nest egg for when you retire? Well, brace yourselves because the future of pensions is about to change in a way that could cause a significant financial shock to your family’s future. The UK government has announced a shift in pension laws, and it might not be the warm financial security blanket we once thought. You might be looking at hefty tax bills for your heirs, which could wipe out their inheritance and leave them scrambling for ways to manage. So, what’s really happening? Let’s break it down for you, step by step, so you can make sure you’re prepared for what’s to come. Whether you’re close to retirement or just starting to plan for your future, understanding these changes is critical.

Britons Uncover ‘Hidden Horror’ in Pensions

The pension tax changes looming in 2027 could have a major impact on your family’s future finances. With the possibility of double taxation on pensions, families might face an unexpected financial burden when they least expect it. But don’t panic. By reviewing your estate plan, seeking expert advice, and staying informed, you can protect your family from the worst of these changes. So, start planning today to ensure your legacy is passed on smoothly, and don’t let these tax changes take you by surprise. Your family’s future is worth it.

| Key Detail | Information |

|---|---|

| Pension Tax Change | Pensions will now be included in the taxable estate for inheritance tax (IHT) purposes. |

| Inheritance Tax (IHT) Threshold | IHT threshold is £325,000, plus an additional £175,000 for the family home (if passed to direct heirs). |

| Impact on Pensioners | Double taxation could hit pensions above £325,000, with tax rates potentially reaching 67%. |

| Awareness Level | Less than 50% of UK adults are aware of these looming pension tax changes. |

| Recommended Action | Seek financial advice and review your estate planning strategies before 2027. |

What’s Changing in Pension Laws?

So, let’s rewind a bit. Up until now, pensions were largely safe from inheritance tax (IHT). If you passed away and left your pension to your loved ones, it was generally free from extra tax charges. However, a huge shift is on the horizon. Starting in April 2027, pensions will be included as part of your taxable estate when calculating IHT. This means that your pension might no longer just be a “simple” retirement fund. Instead, it could be a massive tax burden for your family once you’re gone.

This change is aimed at stopping the growing trend of using pensions as a tax shelter for intergenerational wealth transfers, a strategy that’s been used to avoid taxes. While this makes sense for the government, it has some serious implications for families who might have relied on their pension as a crucial part of their inheritance planning.

Double Taxation: A New Reality?

Here’s where things get a bit dicey: double taxation. If you pass away after the age of 75, your pension funds might be taxed both for inheritance tax (IHT) and income tax. The income tax part is standard—your pension has always been taxable as income when it’s drawn down. But when it comes to IHT, your pension might now be subject to an additional charge. This means that the pension could be taxed again once it’s passed on to your heirs, leading to a hefty chunk being taken out. The combined tax could leave your family with up to 67% of the pension fund evaporated.

Why Does This Matter to You?

Well, if you’re like most folks, you probably have a pension fund that you’ve been contributing to for years, thinking of it as a safe way to take care of your future and that of your loved ones. But with these changes, there’s a real risk that your heirs might not get nearly as much as you’ve planned. It’s crucial to understand how this might affect your estate, especially if you’ve been saving aggressively in your pension to leave behind a solid financial base for your family.

Take, for example, the case of a couple with two children. They have a pension pot of £1,000,000. Previously, the money in that pension was shielded from inheritance tax. But after 2027, that £1,000,000 could face both inheritance tax and income tax, leaving their kids with much less than expected.

How This Could Affect Your Family’s Finances

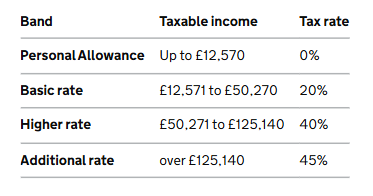

If your pension is substantial enough, it could easily push your estate above the £325,000 IHT threshold, which is the current exemption limit for inheritance tax. On top of that, there’s an additional £175,000 allowance if you’re passing on a family home to direct descendants. If your pension and estate exceed these thresholds, your heirs could be looking at an IHT bill that they weren’t prepared for.

Let’s say your estate, including your pension, comes to £500,000. With the new tax laws, the inheritance tax could be as much as 40% of the amount above the threshold. This means that, after you pass, your heirs might get a smaller slice of the pie than you anticipated. Your pension’s value could be severely diminished by taxes, leaving your loved ones with little to inherit.

What You Can Do to Prepare As Britons Uncover ‘Hidden Horror’ in Pensions

Step 1: Consult a Financial Advisor

The best thing you can do right now is to sit down with a financial planner or a certified tax advisor who specializes in estate planning. These experts will help you evaluate your pension, estate, and any other assets to get a comprehensive plan for minimizing your family’s tax burden. They may suggest some alternative strategies to protect your wealth and reduce potential tax hits.

Step 2: Review Your Estate Plan

It’s time to revisit your estate plan. If you haven’t done so in a while, it’s probably a good idea to update your will and consider different ways to distribute your wealth. Perhaps it’s time to think about trusts or other financial tools that could help lower the impact of taxes on your estate. There are also strategies like gifting money to your heirs during your lifetime, which could reduce the taxable estate and avoid some of the pain later on.

Step 3: Consider Drawing Down Your Pension Early

If your financial situation allows it, you might want to consider withdrawing your pension funds earlier. By taking money out of your pension now, you reduce the amount left in the pot when you pass away. This strategy might help lower the tax burden on your heirs. However, be careful about early withdrawals—there are tax implications and potential penalties, so make sure to consult with an expert before making any decisions.

Step 4: Explore Pension Alternatives

Depending on your needs, it may be worth looking into other retirement savings vehicles that don’t face the same risks. For example, ISAs (Individual Savings Accounts) are not subject to inheritance tax. While pensions have been a go-to for retirement saving, alternatives like ISAs, or even life insurance policies with a written trust, can sometimes offer more favorable terms for inheritance planning.

Step 5: Stay Informed and Monitor Changes

Tax laws are always changing, so it’s important to stay informed. The last thing you want is to be caught off-guard when these changes take effect. Keep in touch with your financial planner and monitor updates from trusted sources like the UK Government and financial news outlets. The more informed you are, the better prepared you’ll be to make sound decisions for your family’s future.

Extra £90 Coming Soon for Millions in the UK—Check If You Qualify!

The £694 State Pension Error That Could Cost You 17 Years of Lost Money

Thousands of UK Pensioners Could Be Owed £11,725—Check This DWP List Now

How the New Tax Rules Could Affect Your Retirement?

It’s essential to remember that pensions were designed to be an income stream for when you retire, but this new tax overhaul could change how much money you end up with in your later years. Pensions are now taxed as part of your estate, meaning that the lump sum your family inherits could be significantly reduced. This, of course, puts more pressure on your financial strategy leading up to retirement. If you haven’t already, you may need to re-evaluate your future income plans.