Big Change Coming to Social Security Overpayment Rules: If you’re receiving Social Security benefits, there’s a major change starting in July 2025 that could seriously affect your monthly check. The Social Security Administration (SSA) will start withholding up to 50% of your monthly benefits to recover any overpayments made in the past. And no—this isn’t just a scare tactic. It’s a real policy shift that will impact millions of Americans if they don’t act fast. This guide will break everything down: what the change means, why it’s happening, how it could impact your benefits, and most importantly—how to protect yourself.

Big Change Coming to Social Security Overpayment Rules

The Social Security overpayment rule change taking effect in July 2025 is a big deal—especially for those living on a fixed income. While it’s aimed at recovering billions in past overpayments, it could also create serious hardship for retirees, people with disabilities, and their families. But here’s the good news: you’re not powerless. You have the right to appeal, ask for a waiver, or negotiate a fair repayment. What’s important is that you act fast when you receive a notice—and know where to turn for help. Stay informed, stay prepared, and remember: your benefits are worth protecting.

| Topic | Details |

|---|---|

| What’s Changing | SSA will start withholding up to 50% of monthly benefits to recover overpayments |

| Effective Date | July 2025 |

| Who’s Affected | Recipients of OASI, SSDI, survivors’ benefits with unpaid overpayments |

| Previous Rule | 10% benefit withholding (unless negotiated) |

| Why It Matters | SSA made over $72 billion in improper payments from 2015–2022 |

| Action Needed | Respond within 30–60 days to SSA notice or face automatic deductions |

| SSA Resource | SSA.gov – Overpayment Info |

What’s the Big Change to Social Security Overpayment Rules?

Beginning July 2025, SSA will increase the maximum monthly withholding from 10% to 50% of your benefits to recover past overpayments. This means if you were accidentally overpaid—even years ago—and don’t take action when notified, you could lose half of your monthly check until the debt is paid.

Whether you’re getting retirement, disability (SSDI), or survivor benefits, the new rule applies across the board.

Even if the overpayment wasn’t your fault, SSA still expects repayment unless you dispute or waive it through the proper channels.

Why Is the SSA Doing This?

The main reason? Massive overpayment debt.

Between 2015 and 2022, the SSA issued over $72 billion in improper payments, according to the Office of the Inspector General. These overpayments stem from:

- Delayed income or employment updates

- Reporting errors

- Delays in death records

- Living arrangement changes not updated in time

- Internal system miscalculations

Facing pressure from Congress, the SSA is now being much more aggressive in collecting these funds. Originally, they proposed withholding 100% of benefits, but after public backlash, they capped the new withholding at 50%—still a significant hit for anyone on a fixed income.

A Brief History of SSA Overpayment Problems

The problem of overpayments isn’t new. In fact, Social Security overpayments have been a recurring issue for decades. What has changed is how the SSA is choosing to enforce collection.

In 2023, widespread news coverage highlighted shocking cases where retirees and disabled Americans had their entire checks withheld, leaving them unable to pay for food, rent, or medicine. The public outcry led SSA to announce it would:

- Notify recipients more clearly

- Improve the waiver and appeal process

- Set the maximum automatic withholding at 50%

Despite improvements, the burden still falls on the recipient to take action.

Real-Life Example: How This Affects Americans

Let’s say Shirley, age 67, receives $1,900 per month in retirement benefits. In 2022, SSA discovered an error from five years earlier and claims she was overpaid by $6,000. She receives a letter about it in early 2025.

If Shirley doesn’t respond within 60 days of the letter, SSA will begin withholding $950 per month starting July 2025. That means three full months where she only receives $950—half her check.

That’s enough to disrupt her rent, bills, and grocery budget—even if the overpayment was caused by SSA’s error.

Who’s Affected by This Big Change Coming to Social Security Overpayment Rules?

The rule impacts a wide range of beneficiaries, including:

- Retirees (Old-Age and Survivors Insurance, or OASI)

- SSDI recipients (people with disabilities)

- Survivors of deceased workers

- Children receiving benefits from a deceased parent’s record

- Spouses and other dependent beneficiaries

Even if the overpayment occurred years ago, SSA can still come after it—there’s no statute of limitations.

What You Can Do If You Get an Overpayment Notice?

Here’s a detailed plan of action to protect your benefits:

Step 1: Open the Mail and Read the SSA Notice

SSA sends overpayment notices by mail. Don’t ignore them—they contain:

- The overpayment amount

- The time frame of the overpayment

- The reason SSA thinks it occurred

- Your right to appeal, dispute, or request a waiver

- The deadline for responding

Most notices give you 30 to 60 days to act.

Step 2: If You Disagree, File for Reconsideration

Think the SSA got it wrong? You can file a Request for Reconsideration using Form SSA-561.

This tells SSA, “I don’t agree with this, and I want you to take another look.”

File online or download the form from SSA.gov. While they review your case, SSA will not start withholding your benefits.

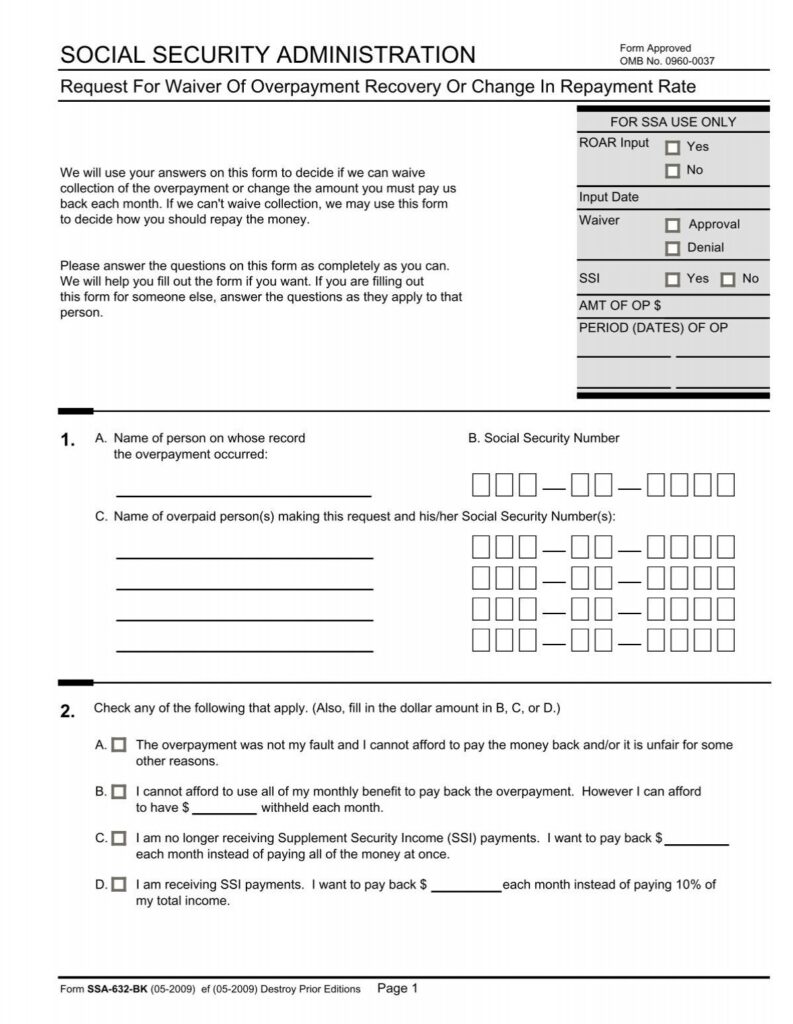

Step 3: If You Can’t Afford to Pay, Request a Waiver

If the overpayment wasn’t your fault, and paying it back would cause hardship, you can file a waiver request with Form SSA-632-BK.

You’ll need to show:

- The overpayment wasn’t caused by you knowingly

- Paying it back would prevent you from meeting basic needs

SSA may require financial documentation like income, expenses, and bank statements.

Step 4: Ask for a Reasonable Payment Plan

Don’t want to dispute it—but can’t afford to lose half your check? Ask for a lower repayment rate using Form SSA-634.

Propose a smaller amount—say, $100/month—and submit supporting documents (rent receipts, utility bills, medical costs).

Legal and Legislative Updates: Will Congress Step In?

In response to public pressure, some lawmakers have introduced the Social Security Overpayment Fairness Act, which would:

- Prohibit SSA from collecting overpayments older than 10 years

- Cap withholding at 10%

- Shift more responsibility onto SSA to prove the overpayment was valid

This legislation hasn’t passed yet, but it’s gaining traction.

What If You’re Already on a Repayment Plan?

If you’ve already arranged a repayment agreement with the SSA, your plan should remain unchanged. SSA has stated it won’t automatically increase your withholding rate if you’ve complied with a prior agreement.

However, if your circumstances change, you can renegotiate your repayment plan by submitting updated financial documentation.

Where to Get Help?

Navigating SSA overpayments can feel overwhelming. But help is out there:

Local Resources:

- Your local SSA field office

- Area Agency on Aging in your state

- State Disability Advocates

National Support:

- National Council on Aging (NCOA)

- AARP Benefits Assistance

- Disability Rights Legal Center

Legal Aid:

Low-income individuals may qualify for free legal representation via Legal Services Corporation.

Top Democrat Demands Answers as Social Security Wait Times Skyrocket Despite Doge Cuts

SSI and Social Security 2025 Payouts Revealed—Check the New National Averages Now

Social Security Faces Collapse by 2034—Retirees Beware of Major Cuts to Your Benefits