Benefit Cheat Who Stole £53,000 Only Loses £36 a Month: When the UK public found out that a benefit cheat who stole over £53,000 in taxpayer money is only being asked to repay £36.97 a month, outrage was swift and widespread. Many people took to social media and local forums, questioning how such a small penalty could possibly reflect the seriousness of the crime.

This isn’t just a tabloid headline—it’s a real-life case that touches on deeper issues in our justice and welfare systems. From the Department for Work and Pensions (DWP) to local courts, this case has shined a light on how benefit fraud is handled and what it means for the average taxpayer. Whether you’re a concerned citizen, a policy analyst, or someone working in public service, understanding this case offers important insights into how public funds are managed—and sometimes mismanaged.

Benefit Cheat Who Stole £53,000 Only Loses £36 a Month

Marie Buchanan’s case is about more than just one woman. It’s about a justice system that’s struggling to balance compassion with accountability. While it’s crucial to protect vulnerable individuals from falling through the cracks, it’s equally important to uphold the integrity of public funding. A more balanced, transparent, and consistent approach to benefit fraud isn’t just possible—it’s necessary. For justice, for taxpayers, and for the future of the UK’s welfare system.

| Topic | Details |

|---|---|

| Total Fraud Amount | £53,532.28 |

| Monthly Repayment | £36.97 deducted from Universal Credit |

| Fraudster | Marie Buchanan, 50, Middleport, Stoke-on-Trent |

| Type of Fraud | Failed to declare partner’s income (2019–2023) |

| Sentence | 21 weeks in prison (suspended), 15 days rehabilitation |

| DWP Fraud & Error Cost (2023-24) | £9.7 billion (DWP.gov.uk) |

| Reporting Benefit Fraud | gov.uk/benefit-fraud |

Benefit Cheat Who Stole £53,000 Only Loses £36 a Month Case: What Actually Happened?

Marie Buchanan started off making legitimate benefit claims for Employment Support Allowance (ESA) and Housing Benefit, both of which are meant to support people who are out of work due to illness or low income. These benefits are lifelines for many struggling UK residents.

However, things changed when Buchanan’s partner began self-employment in 2019, which should have been reported to the DWP. She failed to disclose this crucial change, allowing her to continue receiving benefits she was no longer fully entitled to.

Between April 2019 and April 2023, she received:

- £31,694.35 in ESA

- £21,837.63 in Housing Benefit

After an investigation by the DWP and Stoke-on-Trent City Council, Buchanan was taken to court, where she pleaded guilty to two counts of benefit fraud. The result? A 21-week prison sentence—suspended for 12 months—and 15 days of rehabilitation activity. She was also ordered to start repaying the money via her Universal Credit payments, at a rate of just £36.97 per month.

Why Is Everyone So Angry?

This story went viral not just because of the crime—but because of the reaction from the justice system. The idea that someone could steal more than £53,000 and face only a suspended sentence and small repayments sparked anger across the country.

For many, the issue boils down to fairness. Here’s why people are upset:

- The penalty seems too soft for the amount of money taken.

- The repayment rate is minimal, making it virtually impossible to recover the funds within a lifetime.

- Other fraudsters have been jailed for similar or even smaller amounts.

Take Maria Krawiec, a 70-year-old woman from West Lothian. She exaggerated her disability and fraudulently claimed over £50,000, receiving a 14-month jail sentence despite repaying only £292. In another case, Haley Higginbotham pocketed £141,000 over nine years, receiving a suspended sentence but facing harsher scrutiny.

The inconsistency in punishment is what fuels much of the frustration. People feel like justice depends too much on who you are, not what you did.

Expert Commentary

Experts in law and criminal justice agree that the system needs a serious rethink.

Dr. Susan Morton, a criminal justice lecturer at the University of Birmingham, stated:

“Sentencing in benefit fraud cases lacks uniformity. While mitigating circumstances are important, the public needs to see that fraud has meaningful consequences—especially when large sums of public money are involved.”

Joanne Baker, a former DWP fraud investigator, added:

“We need sentencing guidelines that better reflect both the financial impact and intent behind fraud. The current structure allows serious offenders to escape with light penalties simply because they remain on benefits.”

These insights underline a growing need for reforms that not only prevent fraud but also deal with offenders fairly and firmly.

A Broken Repayment System?

Many are questioning how repayment amounts are calculated. For those on Universal Credit, the DWP can only deduct a limited percentage of monthly payments to prevent financial hardship. In Buchanan’s case, this came out to just under £37 per month.

That means:

- It would take over 120 years to repay the full amount

- The government may never recover most of the stolen money

Even if Buchanan’s financial situation improves, the process to reassess and increase repayments is slow and complicated. Critics argue this method doesn’t scale based on the seriousness of the crime, which defeats the purpose of restitution.

The Bigger Picture: How Much Is Benefit Fraud Costing the UK?

According to the DWP’s 2023–24 report, fraud and error cost the UK £9.7 billion—up from £8.6 billion the year before. That includes both intentional fraud and accidental overpayments.

The highest-risk areas include:

- Universal Credit fraud

- Housing Benefit overpayments

- Pension Credit misreporting

This isn’t pocket change. To put it in perspective, £9.7 billion could fund the annual salaries of over 250,000 nurses or build hundreds of new schools.

International Comparison: How the U.S. Handles Benefit Fraud

In the United States, benefit fraud is treated with much greater severity. Here’s how the systems compare:

| UK | USA |

|---|---|

| Suspended sentences common for low-income offenders | Federal prison sentences common |

| Flat-rate repayments (e.g., £36/month) | Wage garnishment, tax refund seizures |

| Case-by-case sentencing with wide variation | Mandatory sentencing for large-scale fraud |

In fact, U.S. courts can seize bank accounts, vehicles, and properties used in connection with the crime. Offenders are often barred from receiving benefits in the future. This tough approach deters repeat offenses and ensures more consistent recoveries.

What Needs to Change: A Practical Guide for Reform

1. Income-Based Repayments

Instead of flat repayments, the system should use a percentage-based model. For instance, 10% of any future earnings above a threshold could be automatically diverted toward repayments.

2. Transparent Sentencing Guidelines

The Sentencing Council should publish clearer rules for benefit fraud, similar to those for theft or tax evasion. This would prevent wildly inconsistent outcomes across different courts.

3. Faster Case Reviews

DWP needs resources to regularly reassess offenders’ financial situations. If income rises, repayments should rise accordingly.

4. Early Fraud Detection Tools

Invest in artificial intelligence and big data analytics to catch fraud earlier—before it turns into a multi-year problem. This is already being done in Canada and the U.S. with positive results.

Public Reaction

The British public didn’t hold back. Social media lit up with frustration, confusion, and even sarcasm:

“So if I rob a bank but promise to pay £5 a week, I’m good?” – Twitter user

“Hardworking people are punished for being late on rent, but this is okay?” – Reddit comment

Many feel these stories erode trust in the benefits system, which is essential to supporting society’s most vulnerable.

Call to Action

If you believe the system needs change:

- Contact your MP and advocate for sentencing reform

- Stay informed by checking DWP updates and fraud statistics

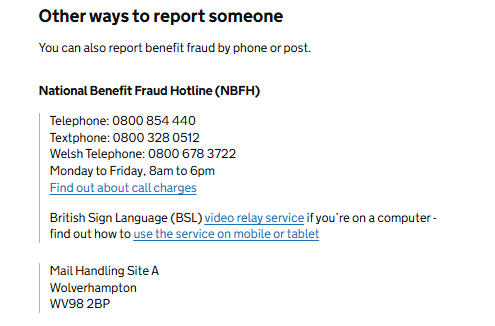

- Report concerns if you suspect someone is cheating the system

Public engagement is key to ensuring these issues stay in the spotlight.