Americans Admit Wasting Tons of Money on These 5 Things: In today’s economy—where prices are sky-high, student loan payments are back, and grocery bills feel more like rent—every dollar should work for you, not against you. Yet despite the rising cost of living, Americans admit they’re still wasting a surprising amount of money on avoidable things. From drive-thru coffee to subscriptions you forgot you had, these financial slip-ups can quietly cost you thousands each year. In this guide, we’ll break down the top 5 ways Americans waste money, why it happens, and exactly how you can stop it—without feeling deprived or cutting out everything fun.

Americans Admit Wasting Tons of Money on These 5 Things

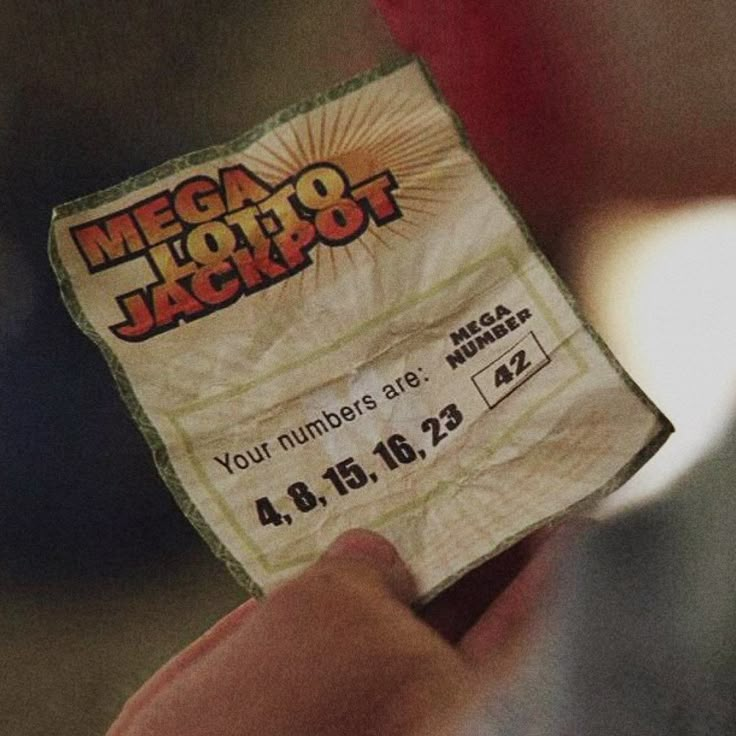

We all waste money sometimes—on coffee, late-night Amazon scrolls, or trying to win the lottery. But if you can identify just one of these leaks and fix it, you’re already ahead of most. Financial freedom isn’t about perfection. It’s about paying attention, making better decisions, and keeping your money aligned with your goals. The sooner you get intentional with your spending, the faster you’ll stop wasting and start winning.

| Topic | Details |

|---|---|

| Top Money Wasters | Dining out, impulse spending, unused gym memberships, forgotten subscriptions, lottery tickets |

| Estimated Annual Loss per Adult | $1,497 |

| Main Psychological Drivers | Emotional spending, stress relief, instant gratification |

| Affected Groups | Millennials and Gen Z overspend on digital services; Gen X and Boomers overbuy lottery and convenience items |

| Suggested Tools | YNAB, Rocket Money, Acorns, Trim, Chime |

| Recommended Resources | Consumer.gov, FTC Subscription Guide |

1. Dining Out: The $3,500 Habit

Let’s face it—eating out is part of American culture. From food trucks to lunch meetings to Friday-night DoorDash, it’s convenient, tasty, and often more social than cooking at home.

But convenience comes at a cost. A report from the U.S. Bureau of Labor Statistics shows that the average household spends around $3,500 per year on meals outside the home.

And it’s not just full meals—it’s the “small stuff” that adds up fast:

- $5 daily coffee = $1,300/year

- $15 fast food lunch twice a week = $1,560/year

- $30 takeout once a week = $1,560/year

That’s $4,420/year for one person—easily enough for a vacation, emergency fund, or down payment.

What You Can Do:

- Prep meals in advance on Sundays

- Limit dining out to 1–2 times per week

- Download cashback and restaurant rewards apps

- Track your “food outside home” category in a budgeting app like YNAB or Mint

2. Impulse Spending: Amazon Deals and Target Runs

Ever go into a store for paper towels and leave with $140 worth of candles, slippers, and throw pillows? You’re not alone.

A 2024 survey by SlickDeals revealed that the average American spends $314 per month on impulse purchases—that’s nearly $4,000 a year!

Where It Happens Most:

- Target and Walmart

- Amazon “lightning deals”

- TikTok and Instagram “must-haves”

- Late-night online shopping

Why It Happens:

Impulse buys are emotional, not logical. When we’re stressed, bored, or even celebrating, we treat ourselves. Shopping releases dopamine, which gives us a temporary high—much like eating sugar.

Fix the Leak:

- Use a 24- or 48-hour rule: Wait before buying anything non-essential

- Install “pause cart” browser extensions like Icebox or StayFocusd

- Avoid shopping while tired or emotional

- Make a list and stick to it—don’t browse “just to see what’s new”

3. Unused Gym Memberships: Paying to Not Show Up

January rolls in, and you’re all about that #NewYearNewMe energy. You sign up for a gym, go a few times, then life happens.

Gyms know this pattern well—that’s why they offer annual plans at steep discounts. According to Statista, more than half of all gym members go less than twice per week, and nearly 20% stop going entirely after 3 months.

Real Cost Breakdown:

- $40/month gym membership = $480/year

- Add $100 startup and $60 in locker/shower extras = over $600/year

What to Try Instead:

- Use free home workout apps (Nike Training Club, YouTube’s FitnessBlender)

- Join a local YMCA or community center with cheaper rates

- Try class-based fitness (e.g., 10-class passes, virtual classes)

- Cancel unused memberships and sign up later if you stay consistent

4. Subscriptions You Forgot About

Streaming services. Magazines. Meal kits. Cloud storage. Meditation apps. The list goes on.

It’s easy to sign up for a free trial and forget to cancel. Many services rely on auto-renewing billing cycles to sneak under your radar. C+R Research found that most people underestimate their monthly subscription costs by 2–3x.

What This Looks Like:

- Netflix, Hulu, Disney+, Prime Video, Apple TV

- Peloton or fitness apps

- Apple iCloud or Dropbox

- Audible, Skillshare, Duolingo Plus, etc.

How to Audit Subscriptions:

- Log into your Apple or Google Play subscriptions dashboard

- Check your credit card for recurring charges

- Use tools like Rocket Money or Trim to flag unused subscriptions

- Consolidate or bundle streaming platforms

- Set reminders to cancel free trials

Pro Tip: Audit your subscriptions every 3 months and decide what brings real value.

5. Lottery Tickets and Gambling “Entertainment”

It may sound harmless—$5 scratch-offs, fantasy football leagues, or a few Powerball tickets. But lottery spending adds up fast.

According to Statista, Americans spent over $105 billion on lottery tickets in 2023 alone. That’s more than they spent on books, games, and movie tickets combined.

The Numbers:

- $5/week = $260/year

- $20/month = $240/year

- Add in the occasional casino or sports betting app = $500–$1,000/year for some users

The Reality Check:

The odds of winning a major Powerball jackpot are 1 in 292 million. You’re literally more likely to be struck by lightning.

Smarter Alternatives:

- Save your “lottery budget” in a high-yield savings account

- Use Acorns to invest your spare change

- Replace gambling with goal-based savings (vacation, emergency fund)

How to Take Control of Americans Admit Wasting Tons of Money on These 5 Things: A 5-Step Guide

Step 1: Track Every Dollar

You can’t fix what you don’t measure. Use apps like YNAB, Mint, or GoodBudget to categorize your spending.

Step 2: Do a Spending Audit

Print your last 2–3 bank statements. Highlight every expense that didn’t give you long-term value. You’ll be surprised.

Step 3: Create Budget Buckets

Set monthly limits for eating out, subscriptions, and entertainment. Use the envelope method or a debit card-only strategy to stay on track.

Step 4: Automate Your Savings

Set up automatic transfers to savings every payday—before you even see the money.

Step 5: Keep It Fun and Flexible

Give yourself a “guilt-free fun” fund each month. Budgeting should support your lifestyle, not restrict it.

Expert Advice

“You don’t need to eliminate every splurge. The key is spending with intention. Budget for joy, but cut the mindless habits that don’t move your life forward.”

— Tiffany Aliche, aka The Budgetnista

“Most people don’t have a money problem—they have a behavior problem. Change your habits, and your bank account will follow.”

— Dave Ramsey, Financial Author and Coach

Americans Are Saving More Than Ever for Retirement — So Why Are 401(k) Balances Shrinking?

59% of working Americans fear Social Security will dry up—here’s how to plan ahead

Retiring on a Budget? These Cities Are Perfect for Grandkids Who Visit Often