Amazon Plans to Launch Its Own Currency: In recent news, Amazon, the global retail giant known for revolutionizing online shopping, is reportedly planning to launch its own digital currency—a stablecoin. This bold move could shake up the entire financial landscape. But what does this mean for you as a consumer, business owner, or even a casual shopper? Is it a game-changer or just another tech experiment? Let’s break it down. As the world shifts toward digital solutions, traditional banking systems, credit cards, and even cash are being replaced by innovative alternatives like cryptocurrency. But Amazon, being the powerhouse that it is, is looking to do something different—take the reins of its financial transactions, cutting out middlemen, and potentially offering a more streamlined and cost-effective way of doing business.

Amazon Plans to Launch Its Own Currency

Amazon’s move to create its own stablecoin could completely change the way we pay for things, both online and in stores. The idea of a digital currency controlled by one of the world’s most trusted brands has the potential to reduce transaction fees, speed up payments, and improve security. However, before this dream can become a reality, Amazon must navigate regulatory hurdles and earn consumer trust. As with any bold new venture, only time will tell if Amazon’s stablecoin will become the norm or fade into the background. But one thing is clear: this move has the potential to disrupt the financial sector and change the way we think about money.

| Key Data & Stats | Facts & Insights |

|---|---|

| Amazon’s Stablecoin | A digital currency pegged to the U.S. dollar. |

| Transaction Fees | U.S. businesses paid $187.2 billion in 2024 credit card fees. |

| GENIUS Act | Regulatory framework for stablecoins under discussion. |

| Impact on Visa & Mastercard | Both companies saw stock declines after Amazon’s announcement. |

| Consumer Benefits | Lower fees, faster payments, and currency stability. |

What Is a Stablecoin and Why Does It Matter?

Before diving into the potential impact of Amazon’s stablecoin, let’s first understand what a stablecoin is. In simple terms, a stablecoin is a type of cryptocurrency that is designed to maintain a stable value, unlike Bitcoin or other cryptocurrencies that can experience wild price fluctuations. This is achieved by pegging the coin to a reserve of assets, like the U.S. dollar or gold.

For example, if Amazon launches its stablecoin, it could be worth exactly 1 USD at any given time, ensuring that users don’t need to worry about their digital wallets losing value. Imagine buying a book online for $20—using a stablecoin, the price will remain the same whether you’re in the U.S., Japan, or any other country.

So why would Amazon want to create its own currency? Here’s why this is a big deal:

- Lower Transaction Costs: If Amazon eliminates the need for credit card companies like Visa and Mastercard, it could cut out hefty transaction fees, which cost U.S. businesses billions each year. In fact, businesses in the U.S. paid $187.2 billion in credit card fees in 2024.

- Faster Transactions: Traditional banking systems often take a while to process payments, especially for international transactions. With Amazon’s stablecoin, payments could be made almost instantly, which is a huge advantage for both consumers and businesses.

- Global Reach: Amazon operates globally, and having its own currency could make it easier for shoppers from different countries to buy products without the hassle of exchanging currencies or dealing with the fluctuations of foreign exchange rates.

- Trust and Security: Since Amazon already has a massive user base and a reputation for being reliable, customers are more likely to trust their stablecoin. And since stablecoins are built on blockchain technology, they provide a secure, transparent way to track transactions.

Regulatory Challenges: Will Amazon’s Stablecoin Pass the Test?

Even though the idea sounds promising, there are several regulatory hurdles that Amazon will need to clear before launching its stablecoin. The most significant of these is the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins). This legislation is currently under review in the U.S. Senate and aims to create a regulatory framework for stablecoins, ensuring that they are safe and transparent.

If the GENIUS Act is passed, it would give Amazon and other companies the green light to issue stablecoins without running into legal roadblocks. However, until then, Amazon will have to tread carefully. This is especially true given the concerns that government agencies like the Federal Reserve and the U.S. Treasury might have about the impact of such a move on the broader financial system.

But despite these challenges, the potential for stablecoins in the business world is undeniable. Companies like Walmart and Expedia are already considering similar moves.

The Impact on the Financial Sector: Is the Future of Payments Changing?

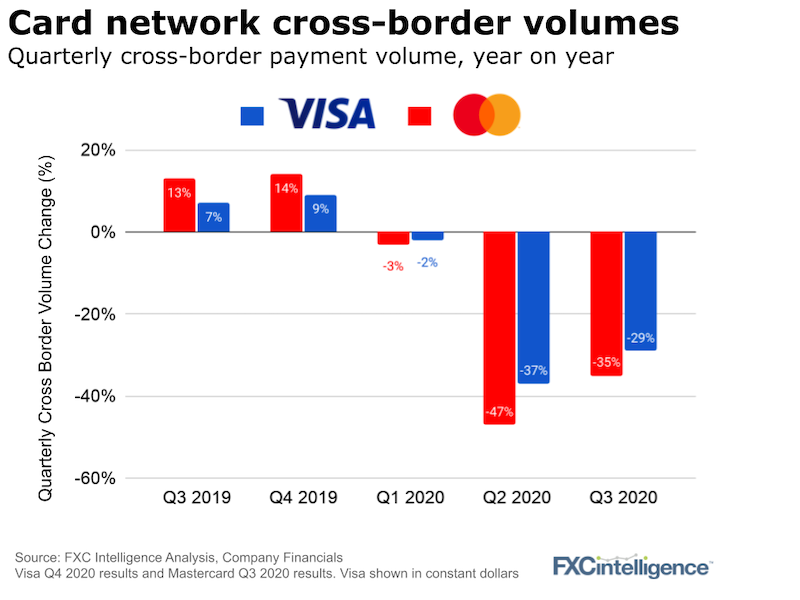

The idea of a corporate stablecoin could potentially disrupt traditional financial institutions. Companies like Visa, Mastercard, and PayPal that facilitate online payments would face increased competition from companies that issue their own currencies. In fact, after Amazon’s plans for a stablecoin were leaked, shares of both Visa and Mastercard dropped, reflecting investors’ concerns about a future where Amazon could control much of the payment process.

However, this doesn’t mean that Amazon’s stablecoin would be a guarantee of success. For one thing, widespread adoption of a corporate digital currency depends on consumer trust. How secure and user-friendly will Amazon’s platform be? Will customers feel comfortable using it for all their transactions? These are questions that Amazon must answer before it can roll out its stablecoin to the masses.

Another factor is the stability of the underlying assets. If the value of the stablecoin is tied to the U.S. dollar, Amazon must ensure that it has a solid reserve of dollars to back the currency. Otherwise, it could fall victim to the same volatility that has plagued cryptocurrencies like Bitcoin in the past.

The Role of Blockchain Technology in Amazon’s Stablecoin

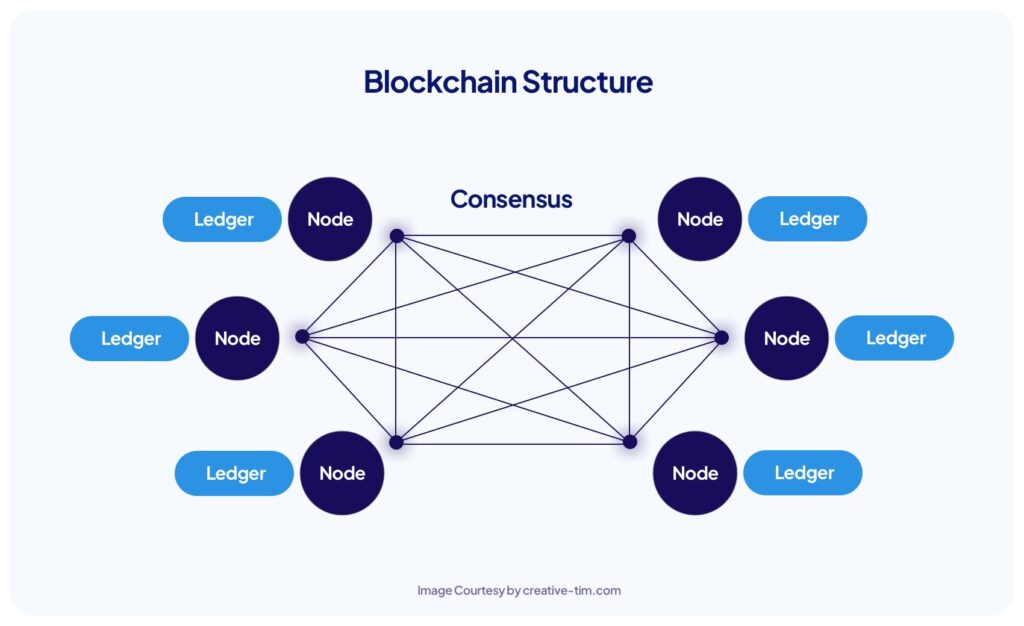

One of the key technologies behind Amazon’s stablecoin is blockchain, the same technology that powers Bitcoin and other cryptocurrencies. But how does blockchain fit into this picture?

Blockchain is a decentralized, distributed ledger technology that allows secure and transparent record-keeping of transactions. For Amazon’s stablecoin, this means that every transaction made using their digital currency will be logged on the blockchain, making it virtually impossible to tamper with the transaction history. This creates a high level of transparency and security for both consumers and Amazon.

Additionally, blockchain’s decentralized nature could potentially reduce Amazon’s reliance on centralized payment systems, allowing it to operate more independently and reduce transaction fees.

How Could Amazon Plans to Launch Its Own Currency Affect Consumers?

Consumers may stand to benefit greatly from Amazon’s digital currency. Here are just a few of the ways it could impact you:

- Lower Costs: By cutting out middlemen, Amazon could pass savings onto consumers in the form of lower product prices or fewer hidden fees.

- Faster Payments: No more waiting days for your payment to clear. With Amazon’s stablecoin, transactions could be completed in seconds.

- Security: Blockchain technology ensures that your transactions are recorded securely, making it much harder for anyone to tamper with your purchases.

- Rewards and Loyalty Programs: Amazon could integrate loyalty programs with its stablecoin, allowing customers to earn digital rewards, discounts, or even cashback on purchases, giving shoppers even more incentive to use the currency.

As a consumer, if Amazon’s stablecoin becomes widely adopted, it could transform the way we think about money and payments. But for now, we’ll have to wait and see how the regulatory landscape unfolds.

Ancient 2,000-Year-Old Coin Fetches $3 Million—Collectors Stunned by Historic Auction