CRA Benefit Payments Set for July 2025: CRA Benefit Payments Set for July 2025 are right around the corner, and for millions of Canadians, these funds can make or break the monthly budget. Whether you’re raising kids, navigating retirement, working low-wage jobs, or living with a disability, the Canada Revenue Agency (CRA) has several benefit programs designed to ease financial pressure. Understanding when these payments arrive, how much you’re eligible for, and what steps you need to take is crucial. This guide is built for everyone—from a 10-year-old learning what taxes are to a financial expert managing clients’ retirement portfolios. Let’s dig into the full scoop.

CRA Benefit Payments Set for July 2025

July 2025 is shaping up to be a major payday for many Canadians. From families with young children to retirees and working adults with disabilities, CRA’s benefit programs are essential tools to help ease financial burdens. But here’s the catch—you have to be proactive. Make sure your taxes are filed, your info is current, and you’re signed up for direct deposit. Don’t leave money on the table. These benefits are yours. You just need to claim them.

| Benefit Name | Payment Date (July 2025) | Monthly/Quarterly Amounts | Who Should Watch For It |

|---|---|---|---|

| GST/HST Credit | July 4 | $133 (single), $174 (couple), $184 per child | Low/moderate income families or individuals |

| Ontario Trillium Benefit | July 10 | Up to $121.75/month or lump sum if under $360 | Ontario residents with energy/property expenses |

| Advanced Canada Workers Benefit (ACWB) | July 11 | $265 (single), $456 (families), $136.83 disability | Low-income workers and families |

| Canada Disability Benefit (CDB) | July 17 | Up to $200/month | Approved Canadians with disabilities |

| Canada Child Benefit (CCB) | July 18–19 | $666/child under 6, $562/child ages 6–17 | Parents of eligible children |

| CPP, OAS & GIS | July 29 | CPP: Avg $900, Max $1,433; OAS: $735–$808; GIS: Up to $1,098 | Seniors aged 65+ |

Why CRA Benefits in July 2025 Matter?

Increased living costs, rising inflation, and growing income gaps make these payments more important than ever. July is especially critical because many of the benefits are either updated or reset based on newly filed tax data from 2024. This month includes quarterly GST/HST payments, mid-year adjustments, and new benefit launches like the Canada Disability Benefit (CDB), approved earlier in 2024.

This isn’t just free money—these are targeted, income-tested, tax-free supports meant to level the playing field. They reflect your family size, income, province of residence, and health or work status.

Detailed Breakdown of CRA Benefit Payments Set for July 2025

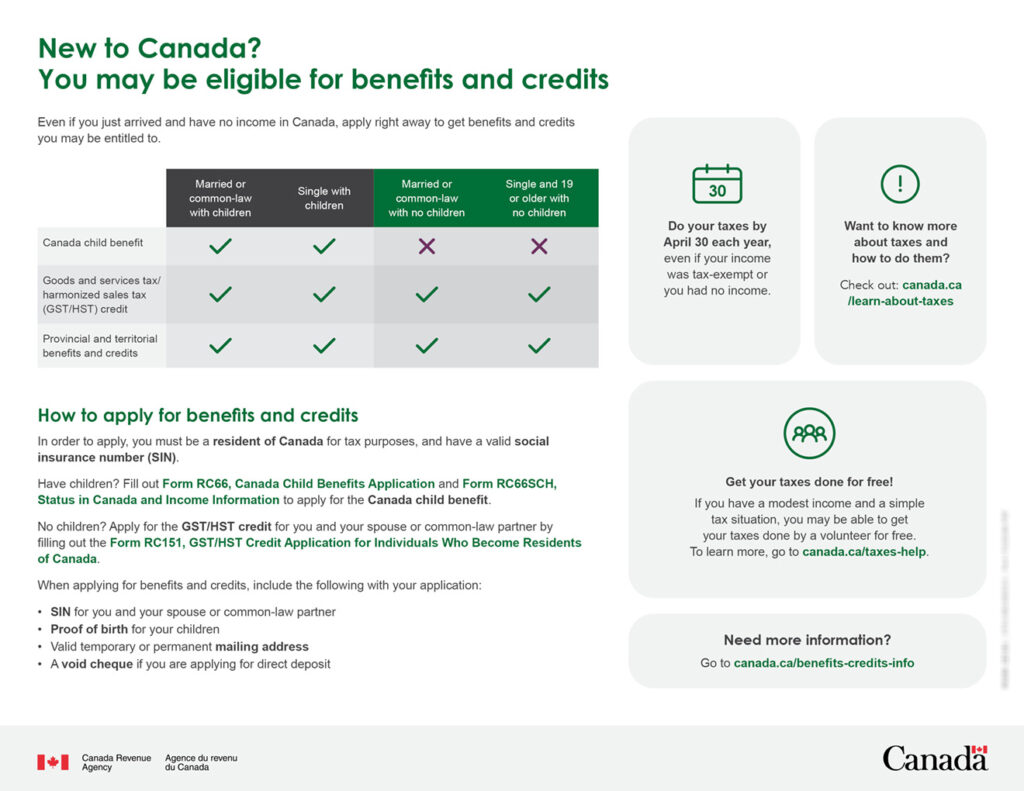

1. GST/HST Credit – July 4, 2025

What it is: A tax-free quarterly payment that offsets the Goods and Services Tax (GST) and Harmonized Sales Tax (HST) paid on everyday purchases.

Who qualifies:

- Canadians age 19 or older

- Families with adjusted net income below ~$52,000 (based on 2024 taxes)

- Must file 2024 tax return to qualify

How much:

- $133 for single individuals

- $174 for married/common-law couples

- Additional $184 per child under 19 in your care

Tax tip: Newcomers may qualify after 18 months of residence.

2. Ontario Trillium Benefit (OTB) – July 10, 2025

What it is: A combined payment of three credits—Ontario Energy and Property Tax Credit (OEPTC), Northern Ontario Energy Credit (NOEC), and Ontario Sales Tax Credit (OSTC).

Who qualifies:

- Ontario residents who pay property tax, rent, or energy costs

- Income below ~$42,000 (single) or ~$52,000 (families)

- Filed 2024 taxes with the ON-BEN application

How much:

- Up to $121.75 per month for seniors

- Lump sum in July if total benefit is $360 or less

- Additional amount for residents of long-term care or reserves

Tax tip: The OTB is not automatic—you must apply through your Ontario tax return.

3. Advanced Canada Workers Benefit (ACWB) – July 11, 2025

What it is: An advance payment of the refundable Canada Workers Benefit (CWB), paid to workers with low income.

Who qualifies:

- Age 19+ and earning work income

- No full-time school enrolment unless you have dependents

- Income thresholds vary by province and family status

How much:

- Up to $265 for single individuals

- Up to $456 for families

- Additional $136.83 for those eligible for the Disability Tax Credit (DTC)

Tax tip: You’ll receive 50% of your 2025 estimated benefit in three advance installments. The rest comes after you file 2025 taxes in spring 2026.

4. Canada Disability Benefit (CDB) – July 17, 2025

What it is: A new monthly federal payment introduced in 2024 to help working-age Canadians with disabilities.

Who qualifies:

- Must be approved for the Disability Tax Credit (DTC)

- Aged 18–64

- Income-tested and non-taxable

- Application approved by June 30 to qualify for July 2025 back pay

How much:

- Up to ~$200 per month depending on income

- Paid monthly with retroactive lump sum for previous months if late

Tax tip: DTC applications can take several weeks. Apply early to avoid delays and get retroactive support.

5. Canada Child Benefit (CCB) – July 18–19, 2025

What it is: A tax-free monthly payment to help families with the cost of raising children.

Who qualifies:

- Parents or guardians of children under 18

- Filed 2024 taxes

- Must reside with child and be primarily responsible for care

How much:

- Up to $666.41/month per child under age 6

- Up to $562.33/month per child aged 6 to 17

- Based on 2024 adjusted net income

Tax tip: Parents sharing custody may each receive 50% of the benefit. Keep CRA updated with custody arrangements.

6. CPP, OAS, and GIS – July 29, 2025

What they are: Monthly retirement and supplemental benefits for seniors.

Who qualifies:

- CPP: Based on your contributions during working years, starts at age 60+

- OAS: Paid to Canadians aged 65+ with at least 10 years of residency

- GIS: Additional payment for low-income OAS recipients

How much (July 2025 estimates):

- CPP: Max $1,433.44/month; average ~$900

- OAS: $734.95/month (age 65–74), $808.44 (75+)

- GIS: Up to $1,098.71/month (single)

Tax tip: GIS and OAS are income-tested annually. Filing your taxes on time ensures uninterrupted payments.

How to Get Ready for Your CRA Payments?

- File your 2024 taxes. Most benefits are calculated from this. No return = no payment.

- Register for direct deposit. Get paid faster and avoid mailing delays.

- Set up CRA My Account. Track payment history, update your info, and apply for benefits online.

- Review your marital and custody status. Changes here impact benefit amounts.

- Keep your income information current. Income changes can adjust or stop certain benefits.

Common Mistakes That Could Delay Your Benefits

- Filing taxes late

- Forgetting to apply for the Disability Tax Credit

- Using outdated banking info

- Not reporting changes in address or marital status

- Assuming you’re automatically enrolled in all benefits

Canada Child Benefit 2025: Exact Payment Dates From June to September Revealed!

$680 Financial Aid Coming in 2025; Check CRA’s GST/HST Payment Dates & Eligibility Now

CRA Announces $1,200 Extra Help for Low-Income Seniors; Are You Eligible for the Bonus?