New GST Payment Dates Announced: The Canada Revenue Agency (CRA) has released the official GST payment and filing dates for the 2025–2026 fiscal year, and if you’re running any kind of business in Canada—whether a corporation, sole proprietorship, side hustle, or freelancer—this is info you can’t afford to ignore.

The Goods and Services Tax (GST), combined with Harmonized Sales Tax (HST) in participating provinces, must be collected and remitted to the government at regular intervals depending on your revenue, filing frequency, and business structure. In this updated and detailed guide, we’ll explain exactly when you need to file and pay, what happens if you miss a deadline, how to claim credits back, and how to keep things running smoothly. Whether you’re managing payroll in Alberta or selling art on Shopify in Ontario, here’s a clear, no-fluff guide that makes the topic of GST compliance in Canada approachable, accurate, and immediately useful.

New GST Payment Dates Announced for 2025–2026

The 2025–2026 GST/HST calendar in Canada gives businesses a predictable framework for compliance. By understanding your obligations—whether monthly, quarterly, or annual—you stay out of trouble, avoid penalties, and keep your finances tight. From tracking expenses to claiming ITCs, using the right tools and maintaining good records can make a huge difference in how smoothly your business runs. Don’t wait until the deadline. Make your tax plan now, stay ahead of the game, and build a stronger financial foundation for your future.

| Aspect | Details / Stats | Official Reference |

|---|---|---|

| GST Filing Frequency | Monthly, Quarterly, or Annual based on annual revenue thresholds | CRA GST Overview |

| Monthly Deadlines | File return by 11th of next month; pay by the 20th | CRA |

| Quarterly Deadlines | Q1: Apr 30, Q2: Jul 31, Q3: Oct 31, Q4: Jan 31 | CRA |

| Annual Deadlines | File by June 15 for previous fiscal year | CRA |

| Late Penalties | 1% of balance owed + 0.25% per month (up to 12 months) | CRA |

| Interest Rate | CRA Prime + 4% daily compounding | CRA |

| Registration Threshold | $30,000 in gross revenue annually | CRA |

| Claiming Credits | Input Tax Credits (ITCs) on business expenses | CRA |

Why These GST Dates Matter More Than Ever?

Understanding your specific filing deadlines is critical because the CRA doesn’t send constant reminders—and late payments can result in costly penalties and interest. If your business doesn’t submit GST returns on time or underreports its collections, you could be flagged for audit, or worse—face compounded interest and tax reassessments.

For small businesses in Canada, cash flow is everything. Filing and paying on time ensures you’re not throwing money away in penalties or struggling with back taxes during peak business seasons. It also helps build your credibility if you’re applying for financing, partnerships, or grants.

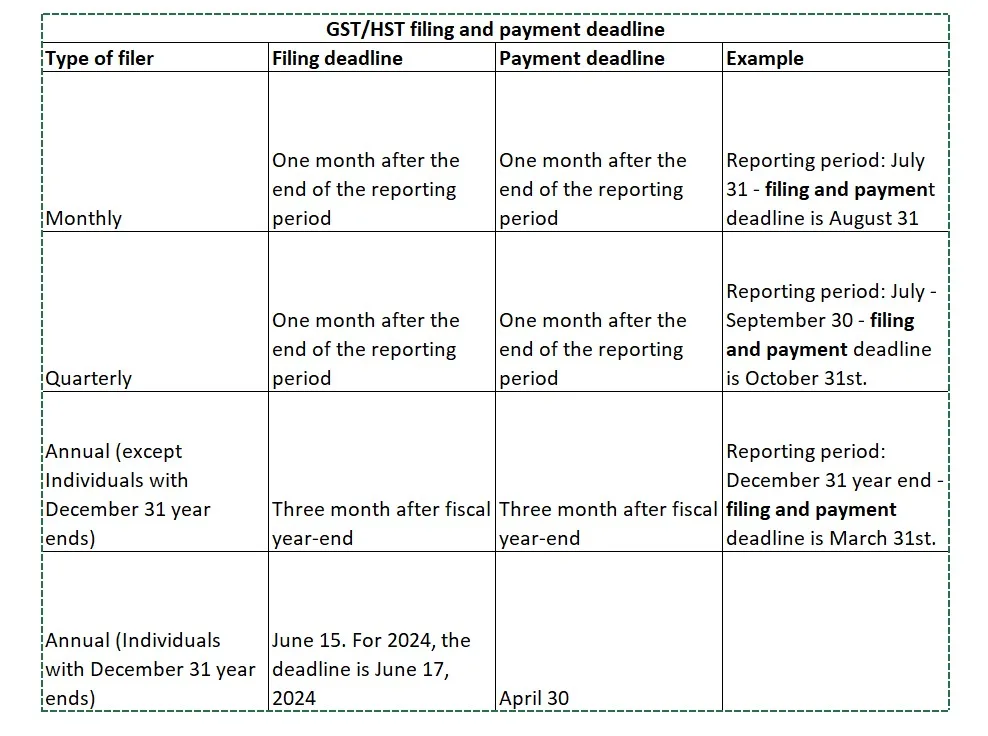

GST Filing Categories in Canada: Monthly, Quarterly, Annual

Every registered business falls into one of these categories:

1. Monthly Filers

This applies to businesses earning more than $1.5 million annually in taxable supplies. These businesses are required to file monthly GST/HST returns.

- Return due: by the 11th of the following month

- Payment due: by the 20th of the following month

This is typically best suited for high-volume businesses where large tax amounts are collected regularly.

Example: A wholesaler earning $3.2 million per year must file April’s GST return by May 11 and submit payment by May 20.

2. Quarterly Filers

For businesses with $30,000 to $1.5 million in annual revenue, quarterly filing is allowed. This is one of the most popular options for SMEs in Canada.

- Q1 (Jan–Mar): due by April 30

- Q2 (Apr–Jun): due by July 31

- Q3 (Jul–Sep): due by October 31

- Q4 (Oct–Dec): due by January 31

3. Annual Filers

If your revenue is under $1.5 million, you may choose to file annually. This is common for sole proprietors, freelancers, and small home-based businesses.

- Filing deadline: June 15 of the following year

- Payment deadline: Still due by April 30, even if the return is filed later

Note: Even if you file annually, you’re still expected to track GST throughout the year and remit it as required. It’s not “set it and forget it.”

How to Register for GST/HST in Canada?

You must register for GST/HST if your gross revenue exceeds $30,000 over four consecutive calendar quarters. Even if you earn less than that, voluntary registration has benefits—like claiming input tax credits (ITCs).

Registration Process:

- Go to the CRA My Business Account portal:

https://www.canada.ca/en/revenue-agency/services/e-services/e-services-businesses/business-account.html - Provide your business number (BN), legal name, and banking details.

- Choose your filing frequency (monthly, quarterly, annual).

Once registered, you must charge GST/HST on taxable goods and services, file returns on time, and maintain adequate records.

Step-by-Step Guide to Filing and Paying GST

1. Track Your Sales and Expenses

Use a spreadsheet or software to record:

- All taxable sales and GST collected

- All eligible business purchases and GST paid

2. Calculate Net Tax

GST collected on sales – GST paid on business expenses = Net GST owed (or refundable)

3. File Return

Log into your CRA portal and submit:

- GST34 for regular filers

- GST62 for annual return filers

4. Make Payment

- Online banking

- CRA “My Payment” portal

- Pre-authorized debit (PAD)

- Cheque or bank teller with remittance slip

5. Save Receipts and Confirmation

Save copies of:

- Submitted returns

- Payment confirmation

- Supporting invoices (CRA may audit)

Understanding Input Tax Credits (ITCs)

Input Tax Credits (ITCs) let you recover GST/HST paid on goods and services used in your business operations.

Common Examples:

- Office rent

- Computers and tech gear

- Marketing services

- Subcontractor fees

- Inventory and raw materials

Example Calculation:

If you collected $8,000 in GST on sales but spent $2,000 on eligible purchases, you remit only $6,000. Keep receipts for 6 years.

Note: You cannot claim ITCs on:

- Personal expenses

- Meals and entertainment (limits apply)

- Capital property not used in your business

GST for Freelancers, Gig Workers & Sole Proprietors

If you’re self-employed and earn over $30,000/year, the CRA expects you to register and collect GST/HST, even if you’re not incorporated.

You must:

- Collect GST on invoices

- Track eligible business expenses

- File annually or quarterly

- Claim ITCs to lower your remittance

Common professions affected:

- Graphic designers

- Rideshare drivers (Uber, Lyft)

- Online sellers (Etsy, Shopify)

- Consultants and contractors

Even side hustlers must comply once they cross the $30,000 threshold. Failing to register on time can result in retroactive tax and penalties.

New GST Payment Dates Announced: What Happens If You File Late?

The CRA applies the following penalties:

- 1% of the tax owing, plus

- 0.25% per month (up to 12 months)

- Daily compounding interest on both tax owed and penalties at CRA’s prescribed rate (usually Prime + 4%)

Example: If you owe $5,000 and file 3 months late, your penalty is $5,000 × 1% = $50 plus 0.75% ($37.50), plus interest.

Filing even a few days late can cost you, so it’s worth setting calendar reminders and automating where possible.

Tools and Resources to Help You File GST

| Tool / Resource | Purpose |

|---|---|

| CRA My Business Account | Main GST/HST filing and payment portal |

| QuickBooks Canada | Accounting + automated GST tracking |

| Wave Accounting | Free accounting software for small businesses |

| FreshBooks | Cloud invoicing + tax compliance |

| CRA Business Helpline | 1-800-959-5525 for business tax support |

| CRA Forms & Publications | https://www.canada.ca/en/revenue-agency/services/forms-publications.html |

Canada Child Benefit 2025: Exact Payment Dates From June to September Revealed!

Canada Confirms Extra GST Payment—Here’s How Much You’ll Get in 2025!

Canada’s $2200 Payment Hits This Month—Are You Eligible for the Cash?