What’s Really Inside the Senate’s New Budget Bill: When someone calls a budget bill “Big, Beautiful, and Bold,” you know it’s going to shake things up. That’s exactly what’s happening with the One Big Beautiful Budget Act (OBBBA) — a sweeping proposal backed by former President Donald Trump and recently advanced in the Senate.

This bill isn’t just some political fireworks. It has real consequences for everyday Americans: from the taxes you pay and the healthcare you receive, to the food on your table and the benefits your state can afford. Whether you’re working shifts, raising kids, or running a business — this budget could change your money, your support systems, and your future. We’re breaking it all down clearly so you can see what’s coming and what it means for you.

What’s Really Inside the Senate’s New Budget Bill?

The Trump-backed One Big Beautiful Budget Act is both sweeping and controversial. It offers permanent tax relief for many Americans and aims to simplify parts of the tax code. But it also proposes significant cuts to Medicaid and SNAP, programs that millions of families rely on. As debate heats up in Washington, the key question is this: Who should carry the financial load — and who gets the biggest break? This bill touches nearly every corner of American life, from your hospital to your dinner table. Make sure you’re informed — and ready.

| Topic | Details |

|---|---|

| Bill Name | One Big Beautiful Budget Act (OBBBA) |

| Backed By | Former President Donald Trump |

| Main Changes | Medicaid cuts, SNAP reforms, 2017 tax cuts extended |

| Medicaid Impact | Up to 11.8 million may lose coverage by 2034 (CBO) |

| SNAP Impact | Over 3 million may lose food benefits (AP News) |

| Tax Code Updates | Tip/overtime income tax-free, SALT deduction cap raised to $40K |

| Estimated Debt Impact | $2.8–$5.7 trillion added to national debt by 2034 (CBO) |

| Learn More | Congress.gov Bill Page |

Background: How We Got Here

This bill builds on years of Republican efforts to make Trump-era tax policies permanent and reduce what they view as overreliance on federal welfare programs. Back in 2017, Congress passed the Tax Cuts and Jobs Act, lowering both individual and corporate taxes. However, those cuts were set to expire in 2025 unless renewed.

At the same time, programs like Medicaid and SNAP ballooned in size during the COVID-19 pandemic. Critics say these programs became too generous, too expensive, and too easy to abuse. Supporters argue they’re critical lifelines for vulnerable Americans — and that any cuts could push millions deeper into poverty.

Now, in 2025, the new Senate bill aims to make those tax breaks last forever — while cutting federal support for healthcare and nutrition programs. It’s a bold shift in how the U.S. handles taxation and public welfare.

Medicaid: What’s on the Chopping Block?

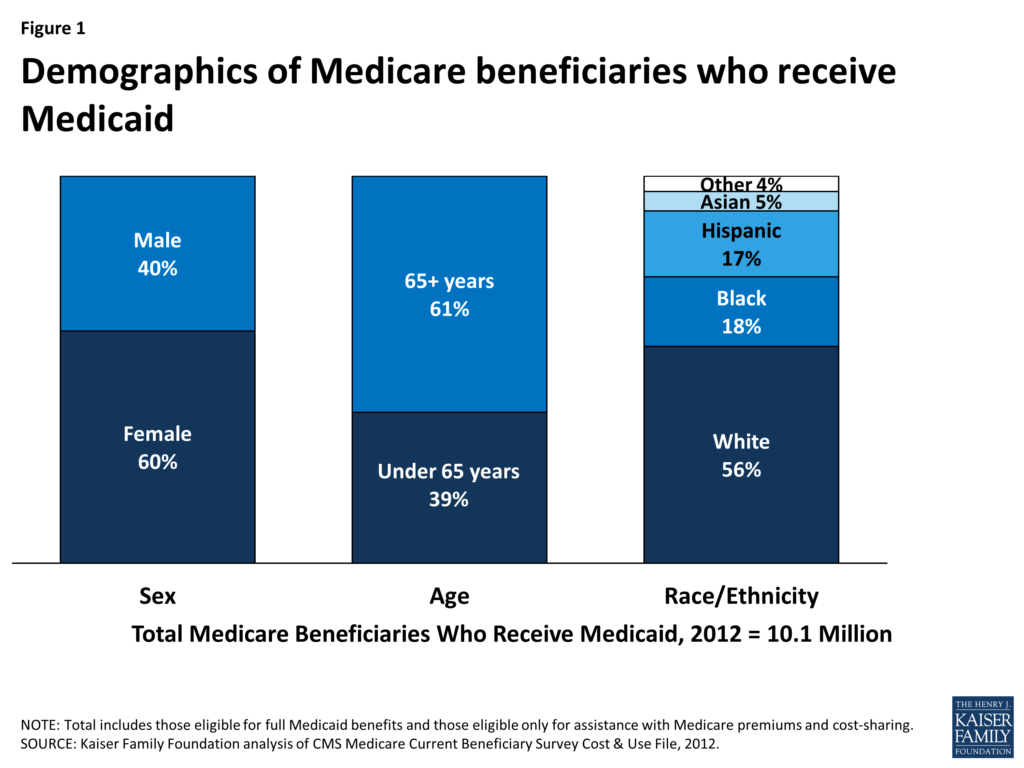

Medicaid currently covers about 85 million people, including children, people with disabilities, and low-income adults. It’s jointly funded by federal and state governments, but under this new plan, states could find it harder to fund their programs.

What’s Changing?

- Provider Tax Cap: States use provider taxes to help fund Medicaid, but this bill lowers the allowable tax from 6% to 3.5% by 2031. That means states lose one of their key funding tools.

- Work Requirements: Adults with children over age 14 must work a set number of hours or meet new eligibility conditions to stay enrolled in Medicaid.

- Coverage Reductions: The Congressional Budget Office (CBO) estimates 10.9 to 11.8 million people could lose Medicaid coverage over the next decade.

Why It Matters?

- Rural hospitals, which heavily depend on Medicaid reimbursements, could face closure.

- Parents working low-wage or gig jobs may lose coverage due to irregular hours or missed reporting deadlines.

- The added administrative work could overwhelm state agencies, making it harder to manage enrollments and renewals.

According to policy analysts, these types of work requirements have already failed in states like Arkansas, where thousands were dropped from coverage due to confusion or technical issues.

SNAP (Food Stamps): A Tightening Belt

The Supplemental Nutrition Assistance Program (SNAP) currently helps about 42 million Americans — from working families to disabled veterans. While it’s federally funded, states share the cost of administration.

What’s Changing?

- State Cost Shifting: States will now cover 75% of the administrative costs (currently 50%) and 5% of the benefit costs — a major financial burden for lower-income states.

- Error Rate Penalties: If states have more than a 6% error rate in determining eligibility, they’ll face federal fines.

- Estimated Impact: According to the CBO, over 3 million Americans could lose SNAP benefits by 2034.

What’s at Risk?

- Children, who make up nearly half of SNAP recipients, could face food insecurity.

- Older adults and the disabled, who often rely on SNAP as a supplemental income, might struggle to requalify.

- Some states may respond by tightening eligibility even further or reducing benefit levels.

Tax Cuts: Who Gets What?

If you’re focused on your paycheck and tax return, this is where things get interesting.

Key Tax Provisions

- 2017 Tax Cuts Extended: These include lower personal income tax rates, larger standard deductions, and reduced corporate taxes.

- Tip and Overtime Income Exempt: Service workers and hourly employees won’t pay taxes on this income.

- SALT Deduction Cap Raised: The State and Local Tax deduction cap jumps from $10,000 to $40,000 for five years.

- Child Tax Credit: Rises from $2,000 to $2,200 per child, now indexed to inflation.

- Senior Deduction: Grows from $4,000 to $6,000.

MAGA Savings Accounts

This new investment vehicle works like a Roth IRA, allowing Americans to invest post-tax dollars and grow their savings tax-free. Critics say the branding is political; supporters argue it encourages financial literacy and independence.

Who Benefits?

- Higher-income earners benefit most from SALT increases and investment tax cuts.

- Small business owners continue to benefit from extended pass-through income deductions.

- Working-class Americans enjoy simplified tax returns and exemptions on hourly income — though the overall dollar gain is smaller.

State-by-State Impact of What’s Really Inside the Senate’s New Budget Bill?

How this bill plays out will vary widely by state:

- Blue states like California and New York gain from the SALT cap expansion but may struggle to cover rising Medicaid and SNAP costs.

- Red states with leaner budgets may cut back on public assistance or increase red tape.

- Swing states like Pennsylvania and Arizona will become key battlegrounds in how these changes are implemented — and politically judged.

Pros and Cons of the Bill

| Supporters Say | Critics Say |

|---|---|

| Locks in lower taxes and encourages savings | Benefits the wealthy more than the working class |

| Adds personal responsibility through work requirements | Could result in millions losing access to vital services |

| Reduces federal bureaucracy and waste | Pushes costs onto states already struggling financially |

| Incentivizes work and reduces fraud in SNAP/Medicaid | Adds red tape that hurts the most vulnerable populations |

What Experts and Analysts Are Saying

- The CBO estimates the bill would add $2.8 to $5.7 trillion to the national debt by 2034.

- The Brookings Institution warns the bill “overemphasizes cuts that hurt low-income Americans to pay for tax breaks that disproportionately benefit the rich.”

- Meanwhile, Heritage Foundation analysts argue that “states need more control, not less accountability,” and that the reforms would “encourage stronger state governance.”

Senate Republicans Reveal the Quiet Changes They Want in Trump’s ‘Big, Beautiful Bill’

How the ‘Big Beautiful Bill’ Steals $1,600 from Those Who Can Least Afford It—CBO Explains

Survivors Could Be Owed $255 from Social Security; Here’s Who Qualifies for the Lump Sum