GST/HST Credit in July 2025: The Goods and Services Tax (GST) and Harmonized Sales Tax (HST) credit is a key benefit offered by the Canadian government, designed to help lower-income households offset the cost of the GST/HST that they pay on goods and services. If you’re a single adult, married couple, or have a family with young children, this credit can put some extra cash in your pocket. The upcoming July 2025 payment is expected to be significant, and many Canadians are eager to find out how much they will receive, who qualifies, and how the process works. In this article, we’ll dive deep into the specifics of the GST/HST credit for July 2025, breaking down eligibility criteria, payment amounts, and offering practical advice on how to ensure you get your share. We’ll also answer common questions, give you helpful tips on how to avoid missing out, and offer a step-by-step guide to help you understand the entire process.

GST/HST Credit in July 2025

The GST/HST Credit is an important benefit for low- to middle-income Canadians. If you qualify for the upcoming payment in July 2025, it could provide much-needed relief. By understanding the eligibility criteria, payment amounts, and how to apply, you can ensure that you receive the full amount you’re entitled to. Remember, the key is to file your taxes on time, keep your personal information updated, and ensure you meet the eligibility criteria. Stay informed, and the next GST/HST Credit payment could give you that extra financial cushion when you need it most.

| Topic | Details |

|---|---|

| Payment Date | July 5, 2025 – Payments begin on this date, depending on your eligibility and payment method. |

| Eligibility Criteria | Residents of Canada, over 19 years old, with a net income below a certain threshold. Must have filed taxes. |

| Payment Amounts | Single adults can receive up to $133.25, couples up to $174.50, and an additional $46 per child. |

| Who Qualifies | Those under the family net income threshold, aged 19+, and with children or a spouse qualify for the credit. |

| Important Reminder | File your taxes to ensure eligibility; the CRA automatically assesses if you qualify. |

| Official Resource Link | Canada Revenue Agency |

What is the GST/HST Credit?

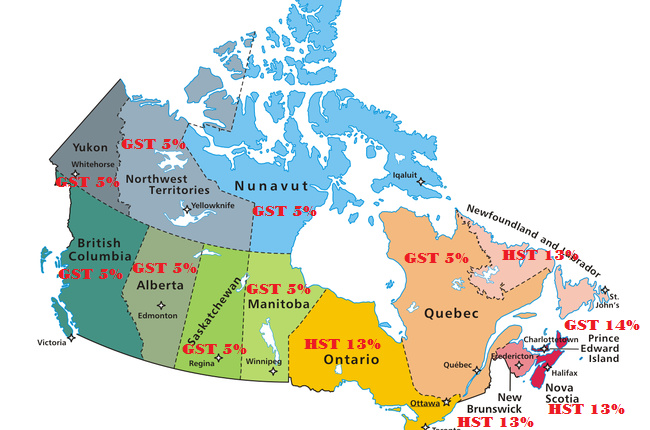

The GST/HST credit is a tax-free quarterly payment provided by the Canadian government to help low- and modest-income individuals and families offset the cost of the GST/HST that they pay on goods and services. The credit isn’t meant to cover all your taxes but helps ease the financial burden for those who need it the most.

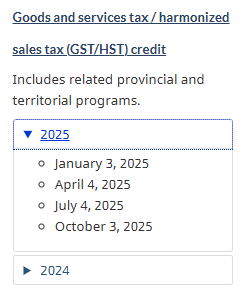

The payments are issued four times a year: in January, April, July, and October. The next big payment is set for July 2025. For Canadians who are struggling to keep up with everyday expenses, this could be a helpful boost.

In 2025, the government is continuing its commitment to assisting citizens, with several factors influencing the exact amount each eligible person will receive. Your family size, income, and other factors play a critical role in determining the payment amount.

Key Eligibility Criteria for July 2025

It’s crucial to understand if you qualify for the GST/HST credit in July 2025. To be eligible, there are a few basic requirements:

1. Age Requirement

You must be 19 years or older by July 1, 2025. If you’re younger than 19, you may still qualify if you have a child or you’re married or living common law.

2. Residency

You need to be a Canadian resident for tax purposes. This means you live in Canada most of the year and pay taxes here.

3. Income Threshold

The GST/HST credit is aimed at helping low-income individuals and families. For families, the phase-out begins when adjusted family net income exceeds $45,521. If you earn more than this, your payments will gradually reduce or stop entirely.

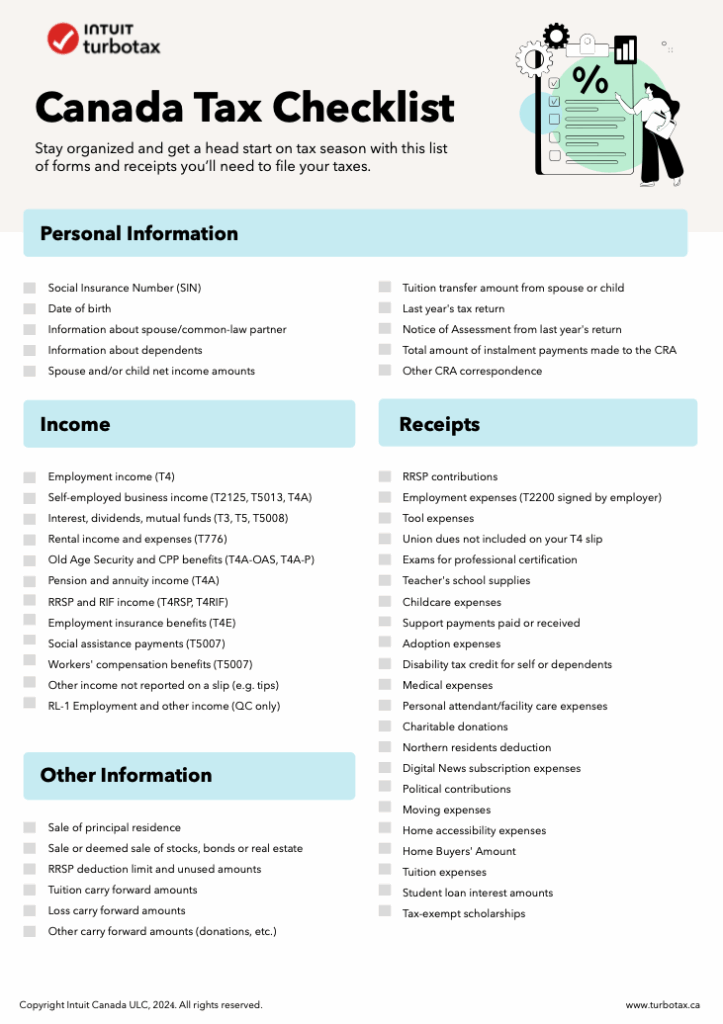

4. Tax Filing

One of the most important steps in securing the GST/HST credit is to have filed your 2024 income tax return. Even if you had no income in 2024, you must file to receive the credit. The CRA uses your income information from your tax return to calculate your eligibility.

How Much Will You Receive in July 2025?

The amount you’ll receive depends on your family situation and your adjusted net income. For July 2025, the government has set some typical payment estimates:

- Single Adult: Up to $133.25 per quarter.

- Couple (Married/Common-Law): Up to $174.50 per quarter.

- Each Eligible Child (Under 19): An additional $46 per child per quarter.

These amounts are estimates based on the 2024 tax return, and they can change depending on your specific situation. Remember that these payments are not intended to cover all your GST/HST expenses—just a small portion to ease the financial burden.

Example:

Let’s say you’re a single adult with a modest income under the eligibility threshold. You might receive $133.25 every three months, helping to cover some of the costs of daily goods and services taxed under GST/HST.

If you’re a couple with a young child, the amount could increase to $220.75 per quarter ($174.50 for you and your partner + $46 for the child).

How to Ensure You Get Your GST/HST Credit in July 2025?

The good news is that you don’t have to apply separately for the GST/HST credit. Here’s how the process works:

1. File Your Taxes

Ensure that you’ve filed your 2024 tax return. This is the first step in determining your eligibility. The CRA uses the information from your tax return to determine your eligibility and calculate your credit.

2. CRA Will Assess

Once your taxes are processed, the Canada Revenue Agency (CRA) will automatically assess whether you qualify for the GST/HST credit and determine the amount you’ll receive.

3. Update Your Information

It’s essential to keep your information up-to-date with the CRA. This includes your marital status, number of children, and address. If there are any changes in your family situation (e.g., a child is born, you move, or you get married), notify the CRA to ensure that your payment amounts are accurate.

4. Payment Method

If you’re eligible, the CRA will send the payment via direct deposit (if you’ve registered for it) or by cheque. Direct deposit is the fastest and most reliable method.

5. Keep Track of Payment Dates

The payments are issued on specific dates, such as July 5, 2025, for the upcoming payment. You can check your payment status through the CRA My Account portal to stay informed.

Canada Confirms Extra GST Payment—Here’s How Much You’ll Get in 2025!

$680 Financial Aid Coming in 2025; Check CRA’s GST/HST Payment Dates & Eligibility Now

Canada Housing Benefit 2025: Exact Payment Dates and Amounts You Need to Know

Additional Tips for Maximizing Your Benefits

1. Keep Your Information Updated with the CRA

When there’s a change in your family situation, such as having a child or getting married, make sure to notify the CRA. This will help you avoid any delay or miscalculation in your GST/HST credit.

2. Register for Direct Deposit

If you haven’t already done so, it’s a good idea to register for direct deposit. Not only does it ensure that your payments arrive on time, but it’s also more secure and convenient than waiting for a cheque in the mail.

3. File Your Taxes Early

To ensure you don’t miss out on your credit, try to file your taxes as early as possible. If you’re self-employed or have a complicated tax situation, it’s especially important to give yourself enough time to file accurately.

4. Understand the Phase-Out Rules

If your income exceeds the eligibility threshold, keep in mind that your GST/HST credit payments will gradually decrease. If you’re close to the threshold, managing your income carefully could help you qualify for the full payment.

5. Look for Additional Benefits

If you’re already receiving the GST/HST credit, you may also be eligible for other government benefits, such as the Canada Child Benefit (CCB) or the National Child Benefit. Be sure to explore all of your options.