Centrelink Clarifies Payment Rules for 58,000 Caravan Dwellers: When it comes to navigating government policies, especially ones that affect your financial support, clarity is key. For Australians living in caravans, boats, or relocatable homes, Centrelink’s recent clarification on payment rules provides much-needed transparency. If you’re one of the 58,000 Australians currently residing in a caravan, or if you’ve been living the nomadic lifestyle, you’re probably wondering how these rules affect your Centrelink payments. Don’t stress. We’ve got the breakdown of what these changes mean for you and how to ensure you’re receiving the benefits you’re entitled to. In this guide, we’ll walk you through the fine print, making it easier to understand how you’re affected by Centrelink’s payment guidelines.

Centrelink Clarifies Payment Rules for 58,000 Caravan Dwellers

If you’re living in a caravan, boat, or relocatable home, Centrelink’s clarification on payment rules is a win for you. As long as your home is your principal place of residence and you don’t own the land, your eligibility for payments like the Age Pension or Disability Support Pension remains safe. However, always keep in mind that your other assets (like vehicles or savings) will still be taken into consideration. These rules bring peace of mind to the growing community of mobile dwellers in Australia. So, whether you’re hitting the road or settled in a park, make sure you understand the fine details to keep your benefits intact.

| Key Detail | Information | Link to Official Resources |

|---|---|---|

| Who is Affected? | 58,000 Australians living in caravans, boats, or relocatable homes | Services Australia |

| Main Rule | Caravans and mobile homes are exempt from the assets test | |

| Assets Test Exemption | Applies if you don’t own the land your mobile home sits on | |

| Rent Assistance Eligibility | Available if paying site or mooring fees and don’t own land | Seniors Discount Club |

| Other Assets Counted | Vehicles, investments, and other property are considered in assets test |

What Exactly Does Centrelink Clarifies Payment Rules for 58,000 Caravan Dwellers Mean?

In simple terms, Centrelink is giving a green light for Australians living in caravans, boats, or relocatable homes to continue receiving their benefits—without fear of losing their payments. So, whether you’re parked in a caravan park or permanently living in a boat, these changes are good news.

Here’s the scoop: Your mobile home (as long as it’s your principal place of residence) is exempt from the assets test. This means your caravan, boat, or relocatable home won’t be counted as an asset when Services Australia reviews your eligibility for payments like the Age Pension or Disability Support Pension. However, there are some important details you need to keep in mind to make sure you’re not missing out on any benefits.

What You Need to Know About the Fine Print?

While the good news is clear, let’s take a deeper dive into the fine print and break down the key factors that will determine whether you qualify for certain Centrelink payments.

1. The Exemption Rule: Your Caravan is Your Home

If you’re living in a caravan, boat, or relocatable home, you’re in a good position as long as your home is your principal place of residence and you don’t own the land it sits on. For example, if you’re renting a spot at a caravan park or paying for a mooring for your boat, your mobile dwelling will be considered exempt from the assets test.

This is a critical rule because if you own your home outright but the land it’s on is owned by someone else, you don’t have to worry about your caravan or boat affecting your Centrelink eligibility. In fact, the land you don’t own is treated separately from the mobile dwelling.

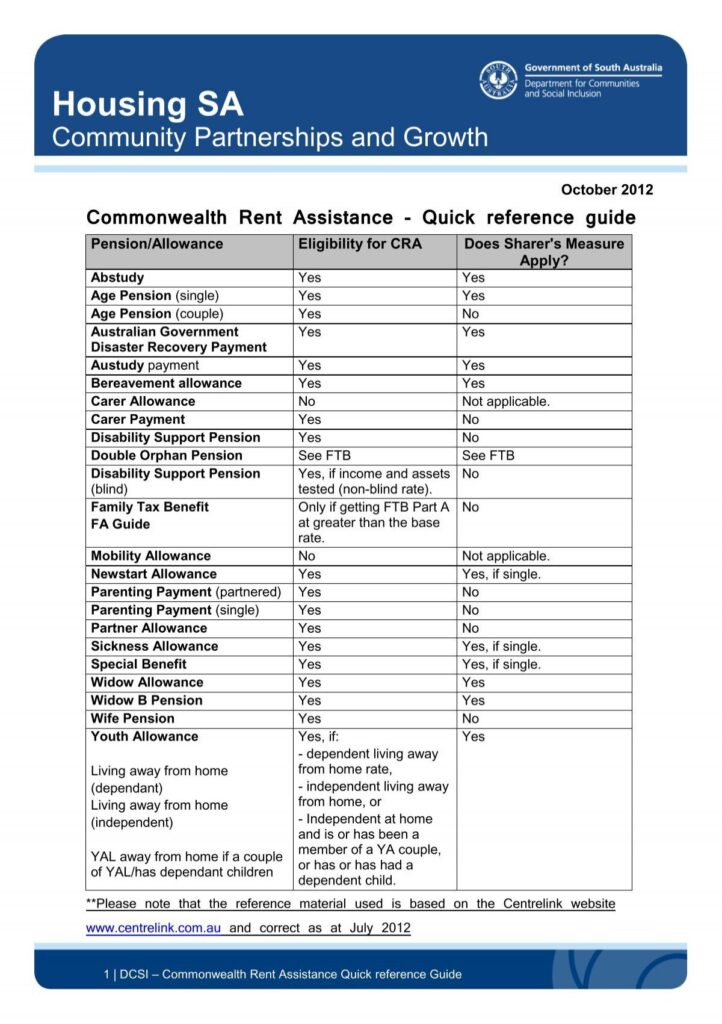

2. Rent Assistance: Who Qualifies?

You may be wondering, “Can I still get rent assistance?” Yes, you can—if you meet the right criteria. If you are paying for a site or mooring fee to park your caravan or boat and don’t own the land, you may qualify for Commonwealth Rent Assistance (CRA). This is an extra payment from the government to help with the cost of housing.

However, if you own the land where your caravan or boat is parked—even if you don’t live in a permanent home—your eligibility for CRA changes. In this case, owning the land may disqualify you from receiving rent assistance but won’t affect your mobile home’s exemption from the assets test.

3. Your Other Assets: What’s Included in the Assets Test?

While your mobile home is exempt from the assets test, don’t forget that other assets will still be taken into account when Services Australia assesses your eligibility. These include:

- Cars: Any vehicle you own (besides your home) will count as an asset.

- Financial Investments: Stocks, bonds, or savings accounts can all count as assets.

- Real Estate: Any property you own besides your principal place of residence will affect your payment eligibility.

It’s important to note that if you own a second property, for example, even if you’re living in a caravan, it could impact your Centrelink payments.

4. Special Circumstances: Retirement Villages and Over-55s Parks

If you’re living in a retirement village or a park specifically for people over the age of 55, different rules may apply. While the general exemption rules for caravans, boats, and relocatable homes still stand, the specifics might change depending on your individual circumstances. It’s always a good idea to check directly with Services Australia for a more tailored response to your situation.

The Rise of Mobile Living: A Trend You Can’t Ignore

In the 2021 Census, it was recorded that over 58,000 Australians were living in caravans, and that number is only growing. In today’s world, many families are opting for a more nomadic lifestyle, either because of high housing costs or a personal desire for more freedom.

This trend is not just about the lifestyle—it’s also a financial decision. Living in a caravan or a boat can save you money on rent or mortgages, and for some, it’s a way to travel while still receiving necessary government support.

If you’re one of the growing number of Australians choosing to live on the move, these Centrelink rules will give you some peace of mind, knowing that your home doesn’t need to be a burden when it comes to your financial assistance.

$400 Centrelink Cost of Living Payment Coming in 2025; Check Eligibility and Payment Date

Centrelink $600 Cash Boost Arriving Soon; Exact Payment Dates and Who’s Eligible

Breaking Down the $3,000 Centrelink Payment — What’s Really Happening in 2025

Historical Context of Caravan Living in Australia

Australia has a long history of caravan living, dating back to the early 20th century when camping became a popular pastime. In recent decades, however, the concept of living in a caravan, boat, or relocatable home has taken off for more practical reasons—especially due to the skyrocketing costs of housing. The ability to live affordably, maintain a simple lifestyle, and even travel while maintaining benefits is incredibly appealing for many Australians.

The Impact of COVID-19 on Caravan Living

The COVID-19 pandemic had a profound effect on the way people approach housing. With lockdowns, travel restrictions, and economic uncertainty, many Australians turned to mobile living as an affordable and flexible option. The rise of remote work and the ability to live on the go without committing to expensive property ownership was a game changer for many families.

Real-Life Examples: How Caravan Dwellers Are Navigating Centrelink

Take Jane and Mark, a couple in their 40s who decided to sell their suburban home and move into a caravan. Not only did they downsize, but they also found that the rules around caravan living allowed them to continue receiving their pension payments. With their mobile home being their principal place of residence and their site fees covered under the rent assistance program, they were able to travel the country without losing their government support.