Centrelink Payments in 2025 Explained: Centrelink payments play an essential role in supporting Australian citizens who need financial assistance due to unemployment, age, disability, or family responsibilities. These payments are designed to offer security and financial aid, allowing recipients to focus on improving their situation without worrying about basic needs. With changes set to take place in 2025, it’s important to stay updated on what you’re entitled to and how these changes could affect your future. In this article, we’ll provide you with a breakdown of the new policies and adjustments to Centrelink payments in 2025, including eligibility requirements, payment increases, and how these changes will impact various groups. Whether you’re a pensioner, jobseeker, parent, or caregiver, understanding these updates is vital to securing the support you need.

Centrelink Payments in 2025 Explained

In 2025, Centrelink is increasing payments across the board to support Australian citizens who need financial help. Whether you’re a senior, jobseeker, parent, or caregiver, there’s a payment available to assist you. These changes aim to offer a bit more financial breathing room, helping recipients cover essential living costs while they focus on improving their lives. By staying informed about eligibility and the changes to payments, you can make sure you’re getting the most support possible.

| Payment Type | Current Payment (2025) | Eligible Recipients | Important Change |

|---|---|---|---|

| Age Pension | $1,149 (single) | Seniors aged 66.5+ | 2.4% increase from 1 July 2025 |

| JobSeeker Payment | $781.10 (single) | Jobseekers over 22 years old | Payment increase from 1 July 2025 |

| Parenting Payment | Varies | Parents with children | 2.4% increase |

| Paid Parental Leave | 18 weeks at National Minimum Wage | Primary caregivers | Extended to 24 weeks by 2026 |

| Family Tax Benefit | $227.36-$295.82 per fortnight | Families with children | Payment increase from 1 July 2025 |

| Carer Supplement | Varies | Carers of eligible individuals | Automatic payment in July 2025 |

A Breakdown of Centrelink Payments in 2025

Age Pension: What’s New in 2025?

If you’re a senior looking forward to the Age Pension, 2025 brings some good news. The Age Pension will see an increase, giving recipients a little more to work with. From 1 July 2025, the full Age Pension will rise by 2.4%. For a single person, the maximum fortnightly payment will be $1,149, and couples will receive $1,732.20 combined.

If you’re wondering if you’re eligible for the Age Pension, it’s based on two main tests: income and assets. For singles, full pension eligibility requires assets below $321,500 if you own a home or $579,500 if you don’t. For couples, the thresholds are $481,500 (owning a home) or $739,500 (not owning a home).

JobSeeker Payment: Changes to Support the Unemployed

The JobSeeker Payment is a lifeline for Australians who are unemployed and seeking work. In 2025, JobSeeker payments will increase as well. For single individuals with no children, the maximum fortnightly payment will rise to $781.10. This payment aims to ease the pressure on jobseekers during their search for employment, especially in a challenging job market.

If you’re looking for specific eligibility criteria, such as age or income limits, Services Australia has a detailed guide for that. JobSeeker recipients must also meet various activity requirements, like participating in job search activities or attending interviews.

The payment increase is just one part of the plan to support Australians struggling to find work. The goal is to provide relief while you look for stable employment or upskill in preparation for new opportunities.

Parenting Payment: For Families Raising Children

Parenting payments are there to support parents who are raising children. Whether you’re a single parent or part of a couple, you may be eligible for the Parenting Payment. In 2025, this payment will also see a 2.4% increase, making it easier for parents to meet the needs of their children.

Parents of children under 8 years old may be eligible, and the amount you receive depends on your circumstances. This payment is meant to support you in providing for your family while you’re not working, and it’s a critical resource for single parents in particular.

Paid Parental Leave: Extended Support for New Parents

In an effort to support families during the critical early months of a child’s life, Paid Parental Leave is set to increase significantly in 2025. The duration will increase to 24 weeks by 2026, offering more support for parents taking time off to care for their newborns. In 2025, you’ll be able to receive 18 weeks of pay at the National Minimum Wage, which is a great boost for primary caregivers.

Additionally, the government has expanded the scheme to allow Dad and Partner Pay, which gives fathers or partners up to 2 weeks of pay to support the family.

If you’re planning to take parental leave, make sure to check eligibility requirements and apply in advance.

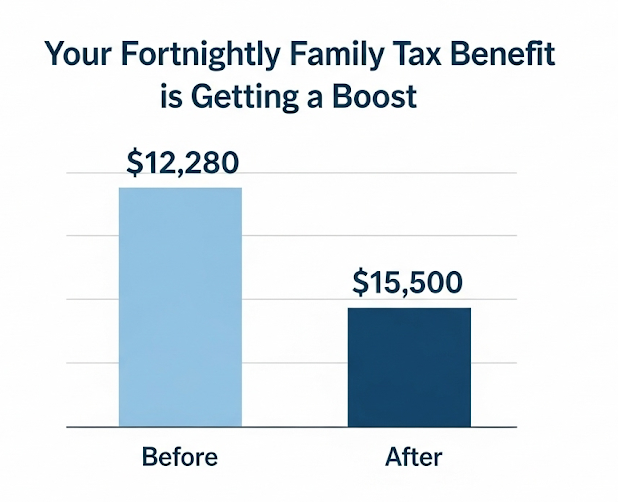

Family Tax Benefit: More Support for Families

The Family Tax Benefit helps families with the costs of raising children. In 2025, Part A of the Family Tax Benefit will increase to $227.36 per fortnight for children under 13 and $295.82 for children aged 13 and older. Meanwhile, Part B will increase to $193.34.

This payment is especially helpful for low- and middle-income families, as it can offset the costs of schooling, healthcare, and other essential needs.

Carer Supplement: For Those Who Provide Care

If you’re caring for a loved one with a disability or health issues, the Carer Supplement provides financial relief. In 2025, the Carer Supplement will be issued automatically between 3 July and 1 August, making it easier for carers to manage their financial needs.

This supplement is paid to individuals who are the primary carers for someone eligible for certain Centrelink payments, such as the Disability Support Pension. The Carer Supplement can be a valuable source of financial assistance when providing full-time care.

How Centrelink Payments in 2025 Explained Are Calculated?

When it comes to Centrelink payments, the amount you’re entitled to depends on a number of factors, including your income, assets, and family situation. Understanding how these payments are calculated can help you make the most of the support available.

Income Test

For most payments, your income level will impact the amount you receive. The income test looks at your income from all sources, including:

- Wages or salary from employment

- Investment income (e.g., interest, dividends)

- Business income (if you run your own business)

If you earn more than the income threshold set by Centrelink, your payments may be reduced. Make sure you report your income regularly to avoid overpayments or underpayments.

Assets Test

Centrelink also applies an assets test to determine eligibility. This test looks at your assets, including:

- Savings and investments

- Property (if not your primary residence)

- Cars and valuable items

If your assets exceed the set threshold, your payments will be reduced or you may no longer qualify for financial assistance. Keep in mind that the family home is not counted in the assets test, but other property and valuables might be.

How to Maximize Your Payments?

To maximize your payments, keep your income and assets within the limits that allow you to receive the full benefit. It’s also important to update your details with Centrelink regularly to ensure your payments are accurate and up-to-date. Missing or incorrect information can lead to delays or penalties.

Breaking Down the $3,000 Centrelink Payment — What’s Really Happening in 2025

$400 Centrelink Cost of Living Payment Coming in 2025; Check Eligibility and Payment Date

Centrelink $600 Cash Boost Arriving Soon; Exact Payment Dates and Who’s Eligible