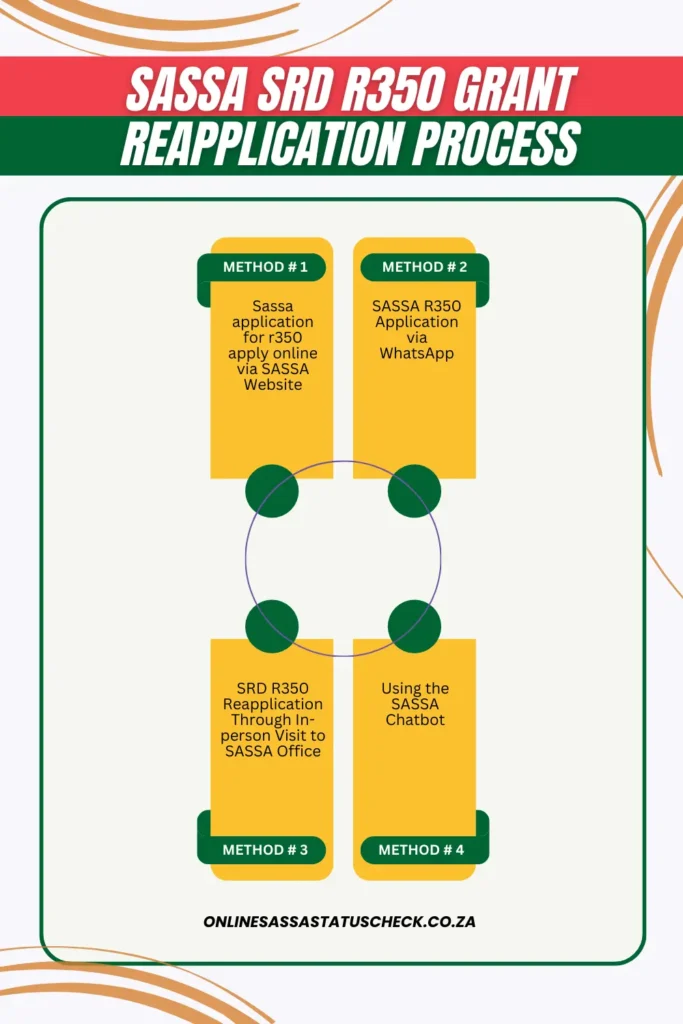

What Happens If You Exceed the SASSA Income Threshold? If you’re a South African Social Security Agency (SASSA) grant recipient, it’s crucial to stay informed about income thresholds and eligibility requirements. Exceeding these thresholds can have serious consequences, including having to repay the money you’ve received and potentially losing your grant. Whether you’re a recipient or a professional working with SASSA beneficiaries, understanding the ins and outs of these rules is essential.

What Happens If You Exceed the SASSA Income Threshold?

To avoid these issues, it’s crucial to stay on top of your income and report any changes as soon as possible. By keeping accurate records, understanding the thresholds, and seeking professional advice when needed, you can ensure that your relationship with SASSA remains smooth and that you continue receiving the financial support you need.

| Key Aspect | Details |

|---|---|

| Income Threshold | Varies by grant type (Older Persons, Child Support, etc.). |

| Repayment Consequences | Beneficiaries may be required to repay overpaid amounts. |

| Action Steps | Report income changes promptly, keep records, and verify eligibility. |

| Examples of Thresholds | For Older Persons, a single person cannot earn more than R97,320 annually. |

| Verification Process | SASSA may ask for documents such as payslips and bank statements. |

| Important Websites | SASSA Official Website |

Exceeding the income threshold is something no one wants to happen, especially if you depend on a SASSA grant. In this article, we’ll walk through what happens if you go over these thresholds, explain why it’s important to stay on top of your finances, and how you can avoid unnecessary penalties or disruptions to your grant.

What Are SASSA Grants?

The South African Social Security Agency (SASSA) provides financial assistance to citizens in need through a variety of grants. These grants include the Older Persons Grant, Child Support Grant, Care Dependency Grant, and Social Relief of Distress (SRD) Grant. Each of these grants helps different groups of people, from seniors to caregivers to parents.

However, these grants come with certain rules. One of the most important rules is that there are income thresholds for eligibility. This means there are specific income limits that determine whether you qualify for a grant or not. If your income exceeds these thresholds, you may lose your eligibility for the grant or be required to pay back the money you’ve already received.

Understanding the SASSA Income Threshold?

Each SASSA grant has its own income threshold, which differs depending on factors like age, marital status, and the specific grant you’re receiving. Here’s a breakdown of income thresholds for some of the most common SASSA grants:

1. Older Persons Grant

- Single applicants: Must not earn more than R97,320 per year (about R8,110/month).

- Married applicants: Must not earn more than R194,640 per year (about R16,220/month).

2. Child Support Grant

- Single caregivers: Must not earn more than R61,200 per year (about R5,100/month).

- Married caregivers: Must not earn more than R122,400 per year (about R10,200/month).

3. Care Dependency Grant

- Single applicants: Must not earn more than R250,800 per year (about R20,900/month).

- Married applicants: Must not earn more than R501,600 per year (about R41,800/month).

4. Social Relief of Distress (SRD) Grant

- Applicants: Must have less than R624 in their bank accounts to qualify.

These thresholds are set to ensure that only those who truly need financial support from SASSA receive it. If your income or assets increase beyond these thresholds, SASSA will re-evaluate your eligibility for the grant.

What Happens If You Exceed the SASSA Income Threshold?

If you exceed the income limit while receiving a SASSA grant, there are a few key consequences to be aware of. Let’s go through them one by one.

1. Repayment of Overpaid Funds

One of the most significant consequences of exceeding the income threshold is the requirement to repay the overpaid funds. For example, if you were receiving the Child Support Grant and your income surpassed the limit, SASSA might determine that you received money you weren’t eligible for. As a result, you could be asked to repay the entire amount that was overpaid.

In some cases, the repayment might be quite large. For instance, a recipient who exceeded the income threshold by R3,360 (more than five months’ worth of the Child Support Grant) was forced to repay the amount. Repayment plans may be offered, but it’s important to understand that not reporting your income changes promptly can lead to significant financial consequences.

2. Suspension of Grant Payments

If SASSA determines that you’re no longer eligible for a grant due to an income overage, your grant payments may be suspended until the issue is resolved. This can be a serious issue, especially if you depend on the grant to meet your daily needs.

For example, if you’ve been receiving the Older Persons Grant and your income increases, SASSA might suspend your payments until they’ve reviewed your eligibility. If you fail to comply with the income verification process, you might even lose your grant permanently.

3. Reevaluation and Verification Process

When SASSA discovers that you’ve exceeded the income threshold, you’ll likely be asked to undergo a verification process. This involves providing supporting documents like:

- Payslips

- Bank statements

- Proof of assets

- Identification documents

If SASSA believes that you’ve incorrectly reported your income, they will conduct a full review, and you might be required to attend a verification appointment. You’ll need to show evidence that your financial situation has changed, which can take time and effort.

4. Legal Action (In Extreme Cases)

In extreme cases, SASSA may take legal action to recover the overpaid funds. This is generally a last resort, and most cases won’t escalate to this level. However, it’s still important to comply with SASSA’s rules and report any changes to your income as soon as they happen.

How to Avoid Exceeding the SASSA Income Threshold?

You can avoid running into problems with SASSA by taking the following proactive steps:

1. Report Changes in Income Promptly

If your financial situation changes and your income exceeds the threshold, notify SASSA immediately. The sooner you inform them, the less likely it is that you’ll face penalties or overpayments.

2. Keep Accurate Records

It’s essential to keep clear and accurate records of all your financial transactions, including income, assets, and any other forms of support you receive. If SASSA requests proof of your income, having these records on hand will make the process much easier.

3. Review the Threshold Regularly

Stay updated on the latest income thresholds by checking the official SASSA website or official publications. The thresholds may change annually, and it’s important to know if your eligibility is affected.

4. Consult a Professional If Needed

If you’re unsure about your eligibility or need help understanding SASSA’s rules, it’s a good idea to consult a professional. This could be a legal advisor, financial planner, or a SASSA representative. Getting advice before making decisions can help you avoid mistakes.

What to Do If You’ve Already Exceeded the Threshold?

If you’ve already exceeded the income threshold and received an overpayment notice from SASSA, don’t panic. Here’s what you can do:

Step 1: Contact SASSA Immediately

The first thing to do is reach out to SASSA’s help desk or visit your local office. They will explain the process and may offer solutions such as a payment plan for repaying the overpaid amount.

Step 2: Submit Documentation

Prepare all necessary documents (like payslips, bank statements, and identification) to show your current financial situation. SASSA may need to verify your income and assets to determine the correct repayment amount.

Step 3: Follow Up Regularly

Stay in touch with SASSA to ensure that your case is processed smoothly. Sometimes, long waiting periods can occur, so regular follow-ups can help keep things on track.

Real-Life Case Studies

Case Study 1: The Child Support Grant Overpayment

Jane, a single mother, received the Child Support Grant for several years. However, when she received a promotion at work, her income increased, surpassing the SASSA threshold. SASSA noticed the discrepancy and asked Jane to repay the overpaid grant amount. Jane worked out a repayment plan with SASSA, and though it was a financial strain, she was able to adjust and continue receiving her other benefits.

Case Study 2: The Care Dependency Grant Suspension

John, who cares for his disabled daughter, was receiving the Care Dependency Grant. When his wife got a new job, their combined income exceeded the allowable threshold. As a result, John’s grant was suspended while SASSA conducted an income review. After presenting proof of their new income, John’s grant was reinstated, but only after a lengthy review process.

Grant Recipients Struggle With SASSA’s Frustrating In‑Person Verification Process, Face Delays

Missed Your SASSA Payment? Here’s How to Quickly Reapply or Get a Reissue!

SASSA R5000 Pension Boost in 2025—Here’s How to Apply for the R1370 Grant and Receive Payments