GST/HST Credit Payments Set to Arrive in July: The GST/HST Credit is a vital benefit for many Canadians, helping low- and modest-income individuals and families offset the cost of Goods and Services Tax (GST) and Harmonized Sales Tax (HST) they pay on everyday goods and services. As the July 2025 payment date approaches, it’s essential for eligible Canadians to understand who qualifies, how the payments work, and how to ensure they don’t miss out on these crucial funds. In this guide, we’ll walk you through everything you need to know about the upcoming GST/HST Credit payments in July 2025. Whether you’re a first-time applicant or just need to refresh your knowledge, this article provides all the details you’ll need to receive your payment on time. From eligibility criteria to payment details, we’ve got you covered!

GST/HST Credit Payments Set to Arrive in July

The GST/HST Credit is a crucial benefit that helps many Canadians reduce the financial burden of everyday expenses. By understanding the eligibility criteria, ensuring your tax information is up-to-date, and filing on time, you can ensure that you’re on track to receive the payment when it arrives in July 2025. Whether you’re a first-time recipient or a long-time beneficiary, this credit is a helpful tool in managing living costs and getting a little extra support.

| Key Topic | Details |

|---|---|

| Eligibility for GST/HST Credit | Must be a Canadian resident, at least 19 years old, and meet income thresholds. |

| Payment Date | July 4, 2025 |

| Payment Frequency | Quarterly (July, October, January, April) |

| Maximum Payment Amounts | $533 for singles, $698 for married/common-law couples, and $184 per child. |

| Income Threshold | Phase-out begins at $45,521 for the family net income in 2024. |

| Official Website | Canada Revenue Agency – GST/HST Credit |

Understanding the GST/HST Credit

What is the GST/HST Credit?

The GST/HST Credit is a tax-free payment designed to assist low- and modest-income individuals and families by reimbursing some of the GST and HST paid on everyday expenses. This payment is distributed by the Canada Revenue Agency (CRA) to eligible Canadians every quarter.

For the July 2025 payment, the CRA will be sending funds to eligible recipients on July 4, 2025. If you’re eligible for the credit, you will either receive a direct deposit into your account or a cheque (which may take up to 10 business days to arrive if mailed).

How Does the GST/HST Credit Work?

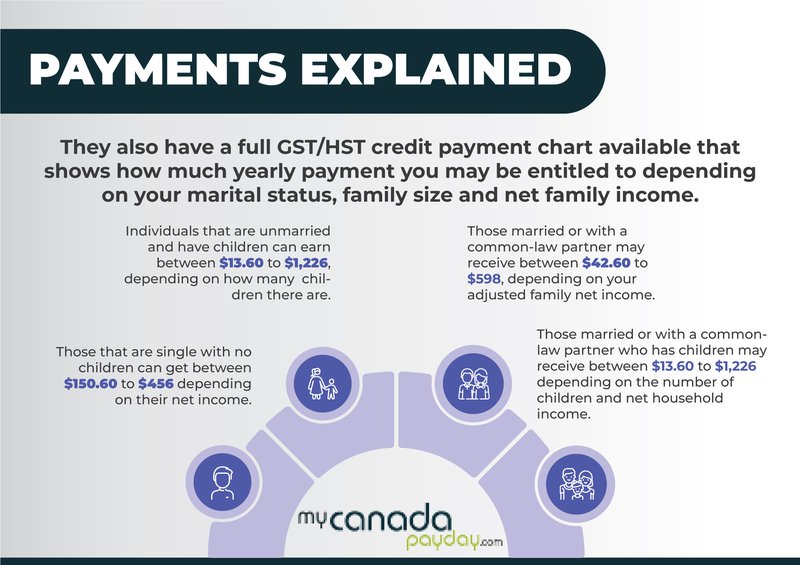

The amount you receive depends on your family net income, marital status, and number of children (if applicable). It’s designed to help individuals and families offset the cost of the GST and HST they pay when buying items like groceries, clothing, and other essentials.

Let’s break it down with a practical example:

- Single Individuals: If you’re a single person with no children, you can receive up to $533 annually.

- Couples: Married or common-law couples can receive up to $698.

- Children: Each child under 19 adds an additional $184 to your annual total.

The payment is divided into four quarterly installments throughout the year, which means you’ll get a portion of this amount every three months.

Why Is the GST/HST Credit Important?

This credit is particularly important for those who might be feeling the squeeze of rising living costs. For example, a single parent raising a child might find that the GST/HST Credit helps to reduce the financial strain of everyday expenses, like buying school supplies or paying for necessities. For low-income Canadians, these quarterly payments are a lifeline, helping to make ends meet.

Who Is Eligible for the GST/HST Credit?

The GST/HST Credit is not a one-size-fits-all benefit. To ensure the right people receive the credit, the Canada Revenue Agency (CRA) has set up eligibility rules that you need to meet.

Basic Eligibility Criteria

- Be a Canadian Resident: You must be a resident of Canada for income tax purposes, which means living in Canada on the last day of the month before the payment (e.g., June 30 for the July payment).

- Age Requirement: To qualify, you must be at least 19 years old by July 1, 2025. If you’re under 19, you must either:

- Have a spouse or common-law partner, or

- Be a parent who lives (or lived) with a child.

- Tax Filing: You must have filed your 2024 tax return. Even if you didn’t have any income, the CRA requires your tax return to process your eligibility.

- Income Limits: There are income thresholds that determine if and how much you’ll receive. If your income is too high, you might not qualify for the credit. The phase-out for a single person begins at around $45,521 of net income, and for families, the phase-out starts around $45,521 as well.

How to Apply for the GST/HST Credit Payments Set to Arrive in July?

The great news is that you don’t have to apply separately for the GST/HST Credit if you’re already filing your taxes. The CRA will automatically assess your eligibility based on your 2024 tax return. However, there are some steps you can take to ensure you don’t miss out:

- File Your Tax Return: Make sure you file your 2024 tax return on time. If you haven’t filed your taxes yet, do so as soon as possible. The CRA uses your family net income and other factors to determine your eligibility.

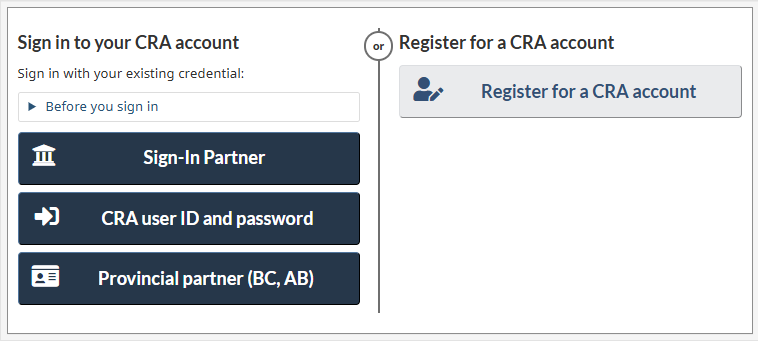

- Update Your Information: If you’ve had changes in your life, like moving to a new address, getting married, or having a child, make sure the CRA has your up-to-date information. You can update your details through the CRA’s My Account portal.

- Direct Deposit: To get your payment faster, set up direct deposit with the CRA. This way, your payment will go straight to your bank account.

Additional Tip:

If you didn’t receive the payment in the past, it might be because the CRA doesn’t have your tax return. Double-check that your tax return is filed and that your information is up to date.

What Happens if You’re Not Eligible?

If you find out you’re not eligible for the GST/HST Credit, there are other benefits you can explore. For example:

- Canada Child Benefit (CCB): If you have children, you might be eligible for the Canada Child Benefit, which helps with the cost of raising kids.

- Other Financial Support Programs: Depending on your situation, you might qualify for other forms of support, like income assistance, social benefits, or tax relief.

If you think you should be receiving the GST/HST Credit and haven’t, contact the CRA for further assistance.

The Impact of the GST/HST Credit on Canadians

For many Canadians, the GST/HST Credit provides much-needed financial relief. With the cost of living continuing to rise, this credit offers a way for low- and modest-income families to keep more of their hard-earned money.

A Real-World Example

Imagine a single parent living in a city like Toronto, with two children under 19. The total amount of GST/HST they could receive annually might be:

- $533 for being a single person,

- $184 for each child under 19, totaling $368.

This means they could receive a total of $901 annually, divided into four quarterly payments of approximately $225.25. This amount can go towards covering groceries, gas, or any other everyday expenses. For many families, this can make a huge difference in managing their budget throughout the year.

Canada Confirms Extra GST Payment—Here’s How Much You’ll Get in 2025!

Canada’s $2200 Payment Hits This Month—Are You Eligible for the Cash?

Canada Child Benefit 2025: Exact Payment Dates From June to September Revealed!