CRA Simplifies Access to Government Benefits: Navigating the world of government benefits in a new country can be a daunting experience, especially for newcomers to Canada. However, the Canada Revenue Agency (CRA) is making it easier for immigrants to access crucial financial support by simplifying the process of applying for federal benefits. With a new, user-friendly online system, eligible newcomers can apply for a variety of benefits, ranging from the GST/HST Credit to the Canada Child Benefit. In this article, we’ll break down the steps to access these benefits, provide a guide on eligibility, and offer tips on how to navigate the system like a pro.

CRA Simplifies Access to Government Benefits

The CRA’s move to simplify benefit applications for newcomers to Canada is a welcome change for many. By streamlining the process through an easy-to-use online platform, the CRA is helping newcomers get the support they need to thrive in their new home. Whether you’re applying for the GST/HST Credit, Canada Carbon Rebate, or the Canada Child Benefit, the process is faster, easier, and more accessible than ever before.

Key Takeaways:

- The CRA now offers a user-friendly online platform for applying for benefits.

- Key benefits include the GST/HST Credit, Canada Carbon Rebate, and Canada Child Benefit.

- The application process is fast—usually taking under 20 minutes.

- Make sure to update your information regularly to receive the correct amount of benefits.

Navigating the world of government benefits in Canada doesn’t have to be confusing. With the right tools and knowledge, you can quickly and easily access the financial support you deserve. And if you’ve just landed in Canada, these benefits are a great way to help make your transition smoother.

| Benefit | Eligibility | Application Process | Important Links |

|---|---|---|---|

| GST/HST Credit | Low- and moderate-income individuals/families | Apply online through CRA’s website | CRA – GST/HST Credit |

| Canada Carbon Rebate | Residents eligible for carbon pricing relief | Apply online | |

| Canada Child Benefit (CCB) | Families raising children under 18 (18 months residency for temp. residents) | Submit online after acquiring a SIN | |

| Application Time | Typically less than 20 minutes per benefit | Fast, efficient, and online-only | CRA Newcomer Guide |

The Canada Revenue Agency (CRA) has launched a new initiative to help newcomers to Canada access important financial benefits quickly and easily. Gone are the days of filling out paper forms and waiting for months to get approved. Thanks to the CRA’s streamlined process, new immigrants and residents can now apply for benefits such as the GST/HST Credit, Canada Carbon Rebate, and Canada Child Benefit (CCB) with just a few clicks. This move is designed to make settling into Canada easier and more affordable.

Whether you’ve recently arrived in Canada or you’re looking for ways to maximize the benefits you’re eligible for, this guide will walk you through everything you need to know. Let’s get into the nuts and bolts of how the CRA is simplifying benefit access for newcomers and how you can take full advantage of it.

Overview of CRA Benefits

Before diving into the process of applying, let’s first understand what these benefits are and who can qualify for them. These programs provide much-needed financial assistance to low-income families and individuals in Canada.

1. GST/HST Credit

This credit is a tax-free quarterly payment to help low- and moderate-income individuals and families offset the cost of the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) they pay on goods and services. The credit is aimed at making life more affordable for those struggling with the everyday cost of living.

Who is eligible?

- Canadian residents who file taxes in Canada and have a low-to-moderate income.

- The amount you receive depends on your income and family size.

The CRA uses your tax information to determine eligibility, so it’s important to file your taxes regularly. This credit can help ease the financial strain that comes with living in a country with high living costs like Canada.

2. Canada Carbon Rebate

This rebate helps Canadians offset the cost of carbon pricing, which is a tax on carbon emissions intended to reduce greenhouse gas emissions. The rebate is a quarterly payment designed to ease the burden of the carbon tax.

Who is eligible?

- Residents of Canada who are eligible for carbon pricing relief.

Carbon pricing is an initiative designed to encourage cleaner energy consumption. The rebate is especially beneficial for newcomers who might find these taxes overwhelming when adjusting to life in Canada.

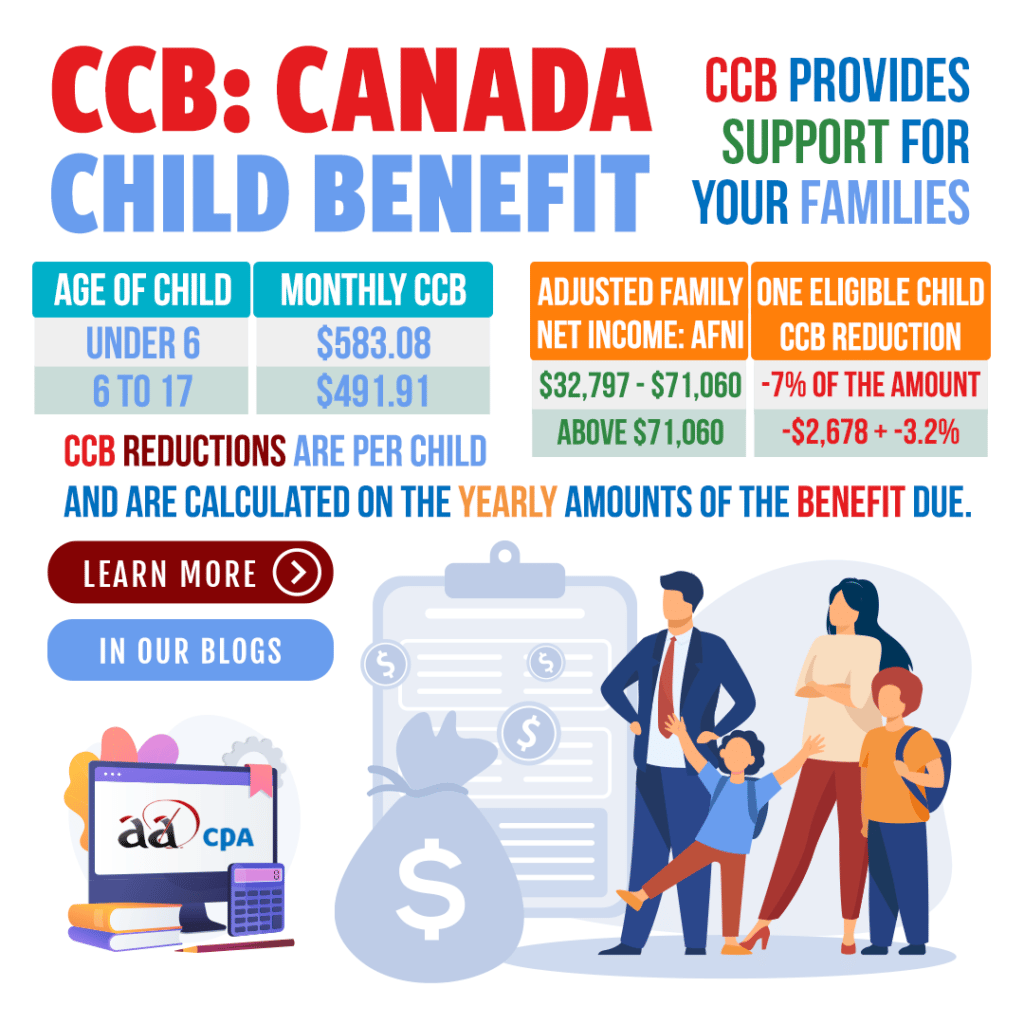

3. Canada Child Benefit (CCB)

The CCB is a tax-free monthly payment to eligible families who are raising children under the age of 18. This benefit helps families with the cost of raising children. For temporary residents, you must have lived in Canada for at least 18 months to qualify.

Who is eligible?

- Families raising children under the age of 18. For temporary residents, you must have lived in Canada for at least 18 months to qualify.

The Canada Child Benefit is a great support tool for parents and guardians raising children. This benefit varies depending on factors like your income, the number of children you have, and whether they are under 18 years old. Even if you don’t qualify for the full benefit, a partial benefit may still be available.

Additional Tips:

If you’re living in a province where the carbon tax is high, the rebate can offset some of your energy costs. Additionally, families with multiple children will likely receive larger Canada Child Benefit payments.

Key Eligibility Criteria for All Benefits:

- Residency Status: To qualify for these benefits, you must be a resident of Canada for tax purposes.

- Income Reporting: You’ll need to report your income for the last 36 months, even if you haven’t filed a tax return yet.

- Documentation: Some documentation will be required, such as proof of residency or proof of children (in the case of the Canada Child Benefit).

How to Apply for CRA Simplifies Access to Government Benefits?

Applying for CRA benefits used to involve a lot of paperwork, but now the agency has made it simpler than ever for newcomers to apply. Here’s a step-by-step guide on how to access and apply for these benefits.

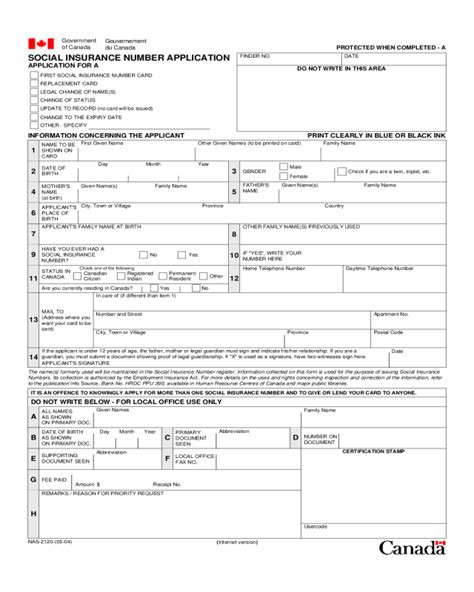

Step 1: Obtain Your Social Insurance Number (SIN)

Before you can apply for any government benefits in Canada, you’ll need to have a Social Insurance Number (SIN). This is a unique identification number that allows you to work and access government services and benefits.

You can obtain your SIN through Service Canada. If you’ve just arrived in Canada, you can apply for your SIN online or at a Service Canada Centre.

Step 2: Create Your CRA Account

Once you have your SIN, you need to create a CRA My Account. This online portal allows you to apply for benefits, check your eligibility, and track the status of your applications. Creating an account is free and easy, and you’ll have access to all the information you need in one place.

Step 3: Submit Your Application

Now that you have your CRA account set up, it’s time to apply for the benefits you’re eligible for. Here’s how to apply for each benefit:

- GST/HST Credit: Log in to your CRA account and follow the prompts to apply for the GST/HST Credit. You’ll need to provide information about your income and family size.

- Canada Carbon Rebate: If you’re eligible for this rebate, you’ll be asked to provide details about your residency and income. Once your application is submitted, you’ll receive quarterly payments.

- Canada Child Benefit (CCB): If you have children, the CCB can help offset the costs of raising them. Apply online by submitting the required information, including proof of your child’s birth and your residency status.

The entire process typically takes less than 20 minutes for most newcomers.

Step 4: Wait for Approval

Once your application is submitted, the CRA will review it. You may be asked to provide additional documents or information. Generally, you’ll receive an approval decision within a few weeks, and payments will start shortly thereafter.

Step 5: Keep Your Information Updated

It’s important to keep your CRA account information up to date, especially if your income or family situation changes. Update your account anytime there is a change, such as a new child or a change in income, to ensure you’re receiving the right amount of benefits.

CRA Surprise Payout Coming Summer 2025 – Are You Getting It?

Canada Child Benefit 2025: Exact Payment Dates From June to September Revealed!

Canada Housing Benefit 2025: Exact Payment Dates and Amounts You Need to Know