Social Security Could Run Out Sooner Than Expected: Social Security, the bedrock of financial support for millions of Americans, could be facing a serious funding shortfall sooner than expected. The program, which provides benefits to retirees, disabled individuals, and survivors of deceased workers, is in danger of running out of money. While it isn’t going bankrupt overnight, there’s a significant risk that, unless changes are made, the system might only be able to pay about 83% of promised benefits starting in 2035. So, what does this mean for you and how can you prepare for potential benefit cuts? In this article, we’ll break down what’s happening with Social Security’s funding, why it’s such a big deal, and what you can do to protect yourself. We’ll also dive into the impact of possible cuts, who they’ll affect, and how experts suggest we address this looming issue. Let’s take a look at the current state of Social Security and help you understand how this could affect your future financial plans.

Social Security Could Run Out Sooner Than Expected

Social Security is facing a serious funding shortfall, and unless changes are made, millions of Americans could face reduced benefits starting in 2035. While this situation is not ideal, there are steps you can take now to prepare. By saving more for retirement, delaying benefits, and diversifying your income sources, you can ensure that you’re financially secure, even if Social Security benefits are reduced in the future. Remember, Social Security isn’t going anywhere, but it’s up to us to plan ahead and ensure we’re ready for whatever changes may come.

| Key Points | Details |

|---|---|

| When | Social Security trust fund could be depleted by 2035. |

| What | Social Security may only pay 83% of promised benefits after 2035. |

| Average Benefit | The average monthly retirement benefit is about $1,976, which could drop by 17%. |

| Impact | Retirees could see cuts of $340 a month, significantly affecting those relying on Social Security for most of their income. |

| Who is Affected | Millions of Americans, especially seniors and vulnerable communities (e.g., Black and Hispanic communities). |

| Solutions | Raising payroll taxes, increasing the retirement age, adjusting taxable income caps, or means testing benefits. |

| How to Prepare | Save more for retirement, delay claiming benefits, and diversify retirement income sources. |

The State of Social Security Today

Since its inception in 1935, Social Security has been a safety net for Americans in retirement or those unable to work due to disability. The idea behind it was simple: people pay into the system while they’re working, and then, when they retire or become disabled, they receive benefits that help cover their living expenses. Social Security has been a cornerstone of financial security for seniors, and it plays a crucial role in reducing poverty rates among older Americans.

However, as the baby boomer generation ages and life expectancy increases, the financial strain on Social Security is becoming more noticeable. According to the Social Security Administration (SSA), the trust funds that pay for benefits are projected to be depleted by 2035. This means that, unless Congress acts soon, retirees could face a substantial reduction in their benefits.

While the system is not bankrupting in the way many people assume, it faces a serious solvency issue. The reason for the impending shortfall is that there are fewer workers contributing to the system relative to the number of retirees. A larger portion of the population is entering retirement age and claiming benefits, while fewer younger workers are entering the workforce to pay into the system. This demographic shift places a strain on the fund, making it difficult for Social Security to meet its long-term obligations.

Why This Is a Big Deal?

In 2024, about 67 million people are expected to receive Social Security benefits. For many, these benefits are their primary source of income, especially for those who don’t have other retirement savings. The average monthly benefit for a retiree is around $1,976. A 17% cut would reduce that to about $1,640 per month. For someone who relies on Social Security as their main income, that’s a significant loss.

The impact will be particularly hard for minority communities. According to research, Black and Hispanic Americans rely more heavily on Social Security for retirement income compared to their white counterparts. A reduction in benefits could push many of these individuals and families into poverty, exacerbating existing wealth disparities. This is particularly concerning because Social Security acts as a lifeline for these communities, who are less likely to have substantial retirement savings or other forms of wealth.

The reduction in benefits would not only impact individuals but also have ripple effects throughout the economy. Many retirees use their Social Security payments to cover basic living expenses—food, housing, utilities, and healthcare. A sudden drop in those payments would mean that many retirees will have to make tough decisions about what to spend money on, leading to an overall reduction in consumer spending. This could have wider economic consequences, particularly in sectors that depend on consumer spending.

Understanding Social Security Funding and the 2035 Deadline

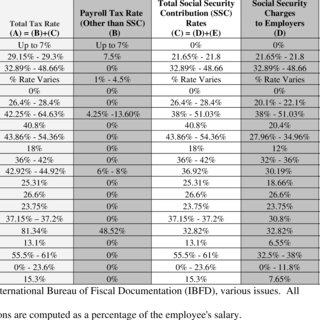

Social Security is funded through payroll taxes under the Federal Insurance Contributions Act (FICA), with both employees and employers contributing 6.2% of earnings up to a certain limit. For 2024, the cap is $176,100. These taxes are paid into the Social Security trust funds, which then pay benefits to eligible individuals.

However, the financial health of Social Security is at risk because of two main factors:

- Demographic Shifts: The aging population means more people are retiring and drawing benefits, while fewer workers are entering the workforce to contribute to the system.

- Longer Life Expectancy: As life expectancy increases, retirees are drawing benefits for a longer period, which puts more pressure on the system.

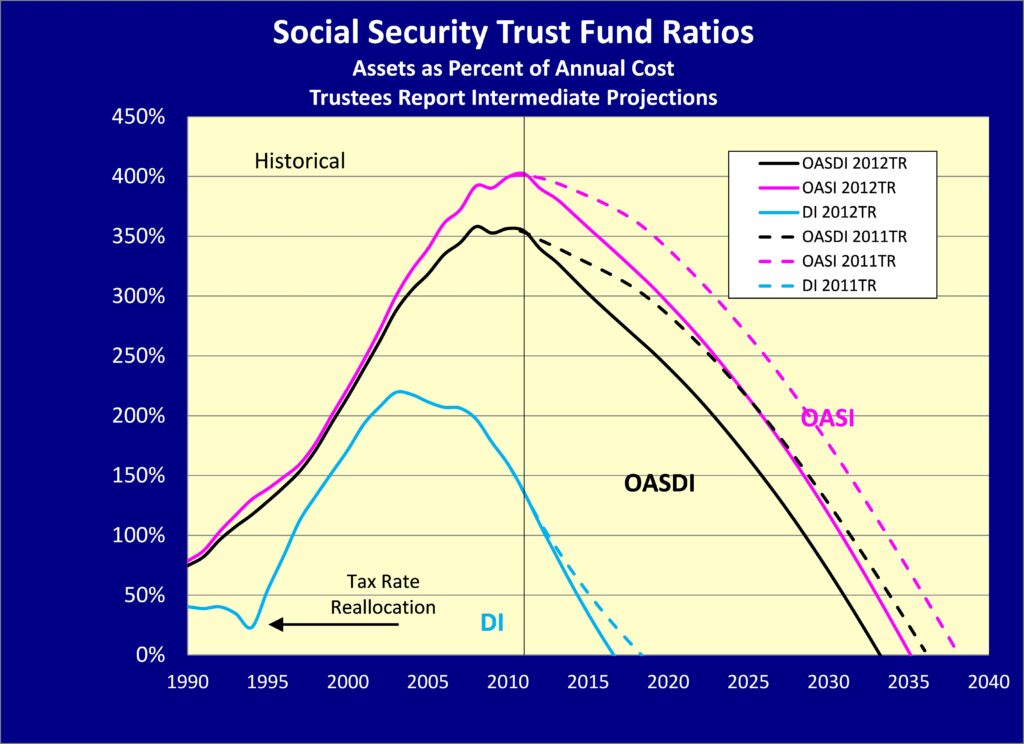

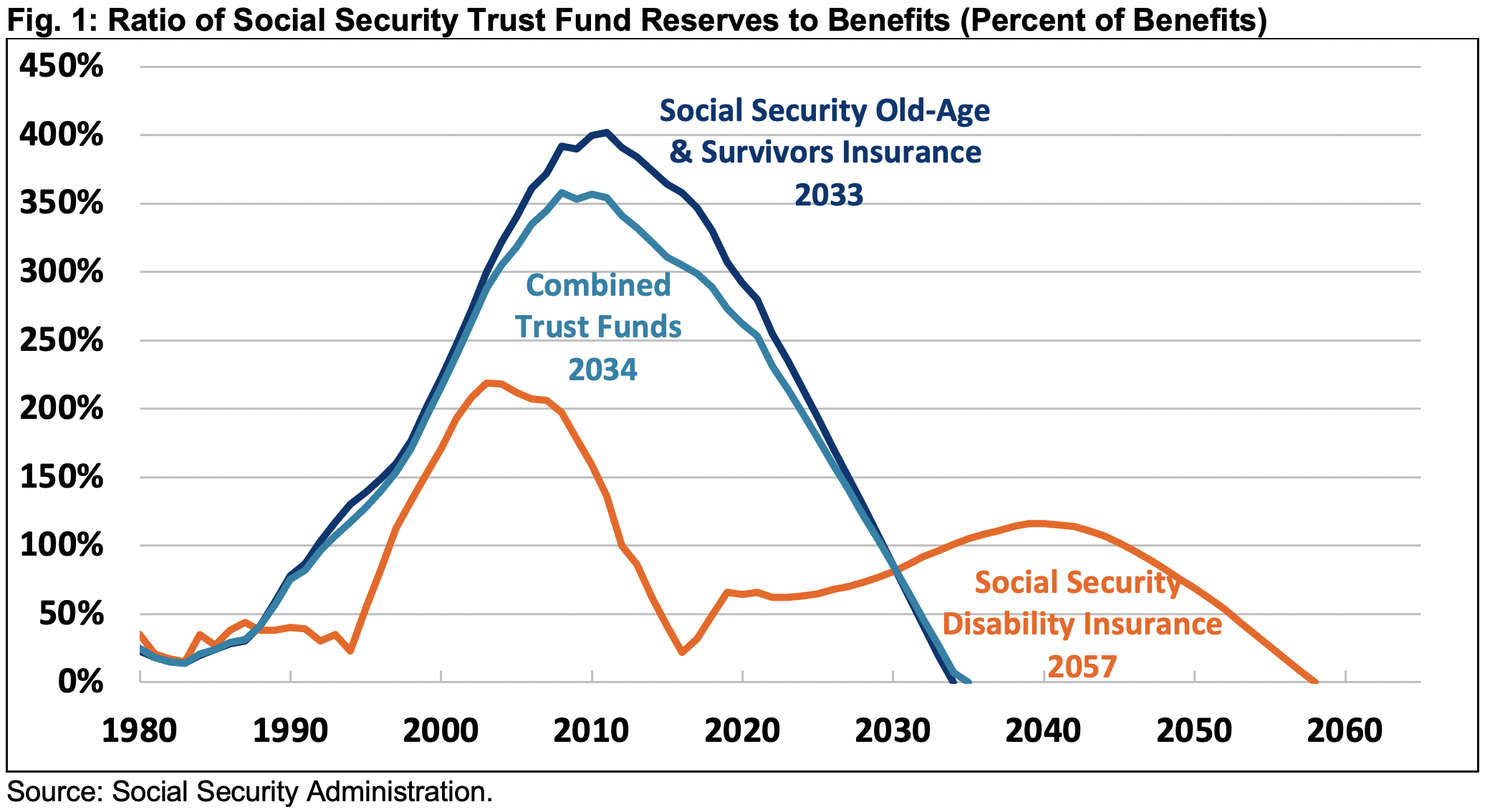

The Social Security Trustees’ annual report has projected that the trust fund reserves will be depleted by 2035 unless corrective actions are taken. This would result in a situation where Social Security can only pay out benefits from the payroll taxes it collects each year. Currently, that amount is expected to cover only about 79% to 83% of the benefits owed to retirees.

While this doesn’t mean that Social Security will disappear entirely, it does mean that the program could fall short of meeting its obligations to beneficiaries, leading to reductions in payments. For those who depend on Social Security for the majority of their retirement income, these cuts could be catastrophic.

The Impact of Social Security Cuts

Imagine this: You’ve spent your whole life working, and now that you’re retired, Social Security is the primary source of your income. A reduction of 17% in your monthly benefit would mean a significant cut to your quality of life. For many seniors, this is a terrifying thought. If your monthly Social Security check is your only income, what happens if it’s reduced?

For individuals already living paycheck to paycheck, a 17% cut would likely mean having to make tough financial decisions. You may need to reduce spending on food, utilities, healthcare, and other essential items. This could cause a significant decline in your standard of living, especially since many retirees are on fixed incomes.

Not only would this hurt retirees, but it could also create a domino effect across various sectors of the economy. Retirees might have less to spend, which could harm businesses that depend on consumer spending. In turn, this could slow economic growth and put further strain on the overall economy.

What Can Be Done to Fix Social Security Could Run Out Sooner Than Expected?

While there’s no easy fix, experts have proposed several solutions that could extend the life of the program and prevent drastic cuts. Let’s take a look at the most common proposals:

1. Raising Payroll Taxes

One of the simplest ways to increase revenue for Social Security is to raise payroll taxes. Currently, workers pay 6.2% of their income (up to $176,100) in Social Security taxes. Raising the payroll tax rate by just 2%—or about 1% each from employees and employers—could significantly reduce the projected shortfall. This would generate more revenue, ensuring that the program has enough funding to pay full benefits.

While this option would increase the financial burden on workers and employers, it would also provide much-needed funding to ensure the long-term solvency of the program.

2. Raising the Retirement Age

Another option is to gradually increase the full retirement age, which is currently 66 or 67, depending on when you were born. By raising the age at which you can collect full benefits, Social Security would reduce the total amount of benefits paid out over a person’s lifetime. This would help the program save money and extend its solvency.

Increasing the retirement age may not be popular, especially for individuals in physically demanding jobs or those who don’t have the option to keep working past a certain age. However, it is a proposal that would help ensure the long-term stability of the system.

3. Increasing the Taxable Income Cap

Right now, Social Security taxes only apply to the first $176,100 of income. Earnings above this amount are not subject to Social Security taxes. By eliminating or raising this cap, high earners would pay more into the system, increasing revenue.

This solution is considered more equitable because it ensures that those with higher incomes contribute their fair share to Social Security. Raising the cap could have a significant impact on the financial stability of the program.

4. Implementing Means Testing

Means testing involves reducing or eliminating benefits for wealthier individuals who don’t rely on Social Security for their livelihood. This could help direct resources to those who need them most, ensuring that the program continues to provide support for vulnerable populations.

While controversial, means testing could be an effective way to make Social Security more sustainable by reducing benefits for those who are financially secure.

5. Special Considerations for Disability and Survivors Benefits

It’s also important to consider how these cuts will impact people receiving disability and survivors’ benefits. Disability recipients depend on Social Security for their livelihood, and even a small reduction in benefits could have a disproportionate effect. For these populations, solutions should involve targeted adjustments to make sure these groups are not left behind.

How to Prepare for Potential Cuts?

Whether or not you’re nearing retirement, it’s essential to start thinking about how Social Security cuts could affect your future. Here are a few steps you can take to prepare:

1. Save More for Retirement

Given the uncertainty, it’s smart to save more than you think you’ll need for retirement. Experts recommend saving at least $100,000 or more in retirement accounts like a 401(k) or IRA to provide a cushion in case your Social Security benefits are reduced. The earlier you start saving, the better.

2. Delay Claiming Benefits

If possible, consider delaying your Social Security claim until you reach age 70. By waiting, your monthly benefit will be higher, and you’ll be able to offset potential reductions in benefits. This strategy can maximize your income during retirement, providing more financial security.

3. Diversify Your Retirement Income

Don’t rely solely on Social Security. Look into other retirement income sources, such as rental properties, stocks, or bonds. Diversifying your income streams will help ensure you have a backup plan if Social Security benefits fall short.

4. Monitor Policy Changes

Stay up-to-date with discussions in Congress about Social Security. This could give you insight into potential reforms or proposals that might impact you. Understanding these changes will allow you to adjust your financial planning accordingly.

5. Consider Working Longer

For some, working longer is an option that can help offset reduced Social Security benefits. Continuing to work not only increases your lifetime earnings but also allows you to delay taking Social Security, which will increase the amount you receive when you do start collecting.

SSI and Social Security 2025 Payouts Revealed—Check the New National Averages Now

Hidden Threat to Social Security Could Cost Retirees Thousands — What You Must Know Now

Social Security Employees Sound Alarm on Delays; Here’s How Your Benefits Could Be Affected