Australia Confirms 12 Percent Superannuation Guarantee: The Superannuation Guarantee (SG) is one of the cornerstones of Australia’s retirement system, ensuring that employees are building up savings for their later years. On July 1, 2025, the employer contribution rate to superannuation will officially increase to 12%, marking the culmination of a decade-long effort to boost retirement savings across the country. This increase promises to have a significant impact on both employees’ retirement funds and employers’ payroll processes. In this article, we’ll explore what the SG increase means for employees and employers, the practical steps to take, and how you can make the most of your superannuation to secure a comfortable future. Whether you’re a young worker just starting your career or an employer looking to comply with the latest rules, this guide has you covered.

Australia Confirms 12 Percent Superannuation Guarantee

The increase in the Superannuation Guarantee to 12% is a step forward in ensuring that Australians have sufficient retirement savings. This boost will result in more financial security for employees, especially over the long term. Both employees and employers need to stay informed and proactive to make the most of this change. Employees should look into voluntary contributions and managing their super funds effectively, while employers must ensure they remain compliant with the updated requirements. The Australian government’s commitment to superannuation reform will continue to shape the retirement landscape for years to come, ensuring that Australians can retire with confidence.

| Key Takeaways | Details |

|---|---|

| Superannuation Rate | Employers will contribute 12% of employees’ wages to their superannuation fund. |

| Impact on Employees | For employees earning $60,000, the contribution increases from $6,900 to $7,200 annually. |

| Impact on Employers | Employers must update payroll systems to reflect the new 12% rate. |

| Government Contributions | Super will now also apply to government-funded paid parental leave. |

| Tax Changes | Future earnings on balances above $3 million will be taxed at 30%. |

What Is Superannuation and Why Does It Matter?

In simple terms, superannuation is the money set aside during your working life to support you once you retire. It’s like a savings plan, but instead of being paid to you directly, it’s managed by a super fund, which then invests that money to help it grow over time.

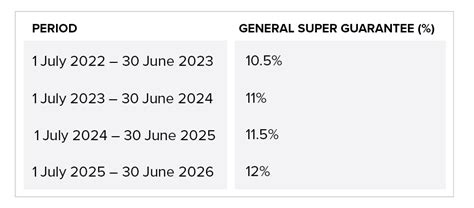

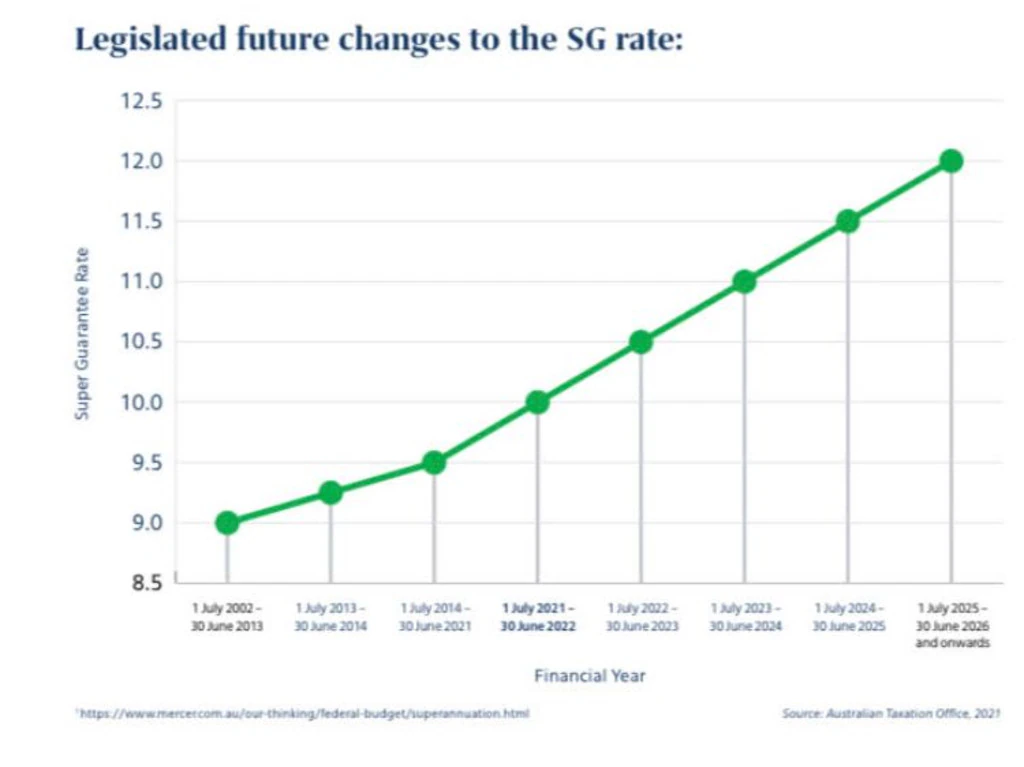

The Superannuation Guarantee is a requirement that forces employers to contribute a certain percentage of their employees’ wages into a super fund. This amount has steadily increased over the past few years and will reach 12% by July 1, 2025. This gradual increase aims to ensure Australians have enough money to live comfortably in retirement.

Breaking Down the 12% Superannuation Guarantee

As of July 1, 2025, Australian employees will see a significant boost in their retirement savings with the increase to 12% superannuation contributions from employers. This may seem like a small change, but its long-term impact on your financial future is profound.

- For employees earning $60,000 annually, the annual contribution will rise from $6,900 to $7,200, an increase of $300.

- For employees earning $100,000, the contribution will go from $11,500 to $12,000, increasing by $500.

These additional contributions might seem modest on an annual basis, but over a working lifetime, the cumulative effect of compound interest means a significantly larger retirement savings pool. This is especially true for younger workers who have more years to benefit from compound growth.

The Importance of This Increase for Younger Workers

Younger employees stand to benefit the most from the 12% SG contribution, thanks to compound interest. The earlier in your career you start contributing to your super, the more time your money has to grow. For instance, if a 25-year-old employee starts contributing at the 12% rate, by the time they turn 65, they could have substantially more than someone who started saving later in life.

Additionally, young workers often have smaller salaries at the beginning of their careers. A higher super contribution, even if modest, can still amount to a significant increase in their savings over time.

Understanding the Role of Employers in the Australia Confirms 12 Percent Superannuation Guarantee

Employers are required by law to contribute the 12% superannuation on behalf of eligible employees. The process for employers is straightforward: they need to ensure their payroll systems are updated to reflect the new contribution rate starting July 1, 2025.

But it’s not just about updating the rate. Employers must also ensure that contributions are made to the correct super fund, and they need to track whether the super is paid on time. Failure to do so can result in penalties, including Superannuation Guarantee Charge (SGC), which includes unpaid super, interest, and an administrative fee.

Employers should also note the upcoming requirement for Payday Super, which will be mandatory from July 1, 2026. This requires employers to pay super contributions in real-time, alongside employee wages. This change ensures that employees have up-to-date records of their super and reduces the risk of errors.

How to Maximize Your Superannuation?

As an employee, the increase in SG contributions is a great opportunity to boost your retirement savings, but there are additional steps you can take to grow your super even further.

1. Make Voluntary Contributions

In addition to your employer’s 12% contribution, you can make voluntary contributions to your super. This can be done via salary sacrifice, where part of your pre-tax salary is directed into your super fund, reducing your taxable income.

2. Choose the Right Super Fund

Not all super funds are created equal. Some have higher fees and worse investment returns. Shopping around for the best super fund can lead to significantly better returns over the long term. Look for a fund with low fees and a strong performance history.

3. Consolidate Multiple Super Funds

If you’ve worked for different employers over the years, you may have multiple super funds. Consolidating these funds into one can save on unnecessary fees and make it easier to track your super balance.

Government Policies and Future Changes

The Australian government is constantly making tweaks to the superannuation system to ensure its long-term sustainability and fairness. Here are a few key changes that are coming:

- Super on Paid Parental Leave – From July 1, 2025, government-funded paid parental leave will also be subject to superannuation contributions. This ensures that even during periods of leave, parents can continue to build up their super savings.

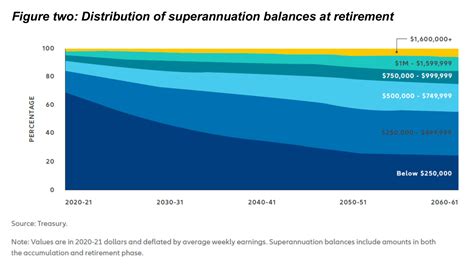

- Tax Changes for High-Balance Super Funds – Starting July 1, 2025, a 30% tax will be levied on earnings from super balances over $3 million, up from the current 15%. This change is intended to ensure that those with the most significant super balances are contributing fairly to the system.

Example Scenarios

To make this clearer, let’s look at a couple of real-life examples:

- Sarah, aged 30, earns $60,000 per year. Over the next 35 years, Sarah’s employer will contribute 12% of her salary into her super fund. This incremental increase, compounded over decades, will make a huge difference to her retirement fund by the time she turns 65.

- James, aged 45, earns $100,000 per year. Though he has fewer years until retirement, James will still benefit from the increase in SG contributions. This means a $500 increase in his super every year, which, compounded over time, will result in a substantial increase in his retirement savings.

Super Guarantee Hits 12 Percent—What Australia’s New Rule Means for Your Retirement Paycheck

$400 Centrelink Cost of Living Payment Coming in 2025; Check Eligibility and Payment Date

Centrelink $600 Cash Boost Arriving Soon; Exact Payment Dates and Who’s Eligible