Social Security’s Future Looks Uncertain: Social Security is one of the most important sources of income for many Americans during retirement. But as the system faces growing financial challenges, many are beginning to question whether they should claim their Social Security benefits sooner rather than later. The system was designed to support individuals once they stop working, but with projections suggesting that Social Security funds could run out in the next decade, it’s clear that uncertainty is growing.

In this article, we’ll dive deep into the future of Social Security, what it means for you, and whether claiming early could be a wise decision or a costly mistake. Whether you’re nearing retirement or just beginning to plan for your future, understanding how Social Security fits into your broader retirement strategy is crucial. We’ll also provide practical steps, examples, and advice to help you make an informed decision.

Social Security’s Future Looks Uncertain

Social Security is a crucial component of retirement planning, but its future is uncertain. Understanding the potential shortfall and how to strategically claim your benefits can help you navigate this uncertainty. By evaluating your personal situation, considering delaying your claim, and consulting with experts, you can maximize your benefits and ensure a more financially secure retirement.

| Topic | Details |

|---|---|

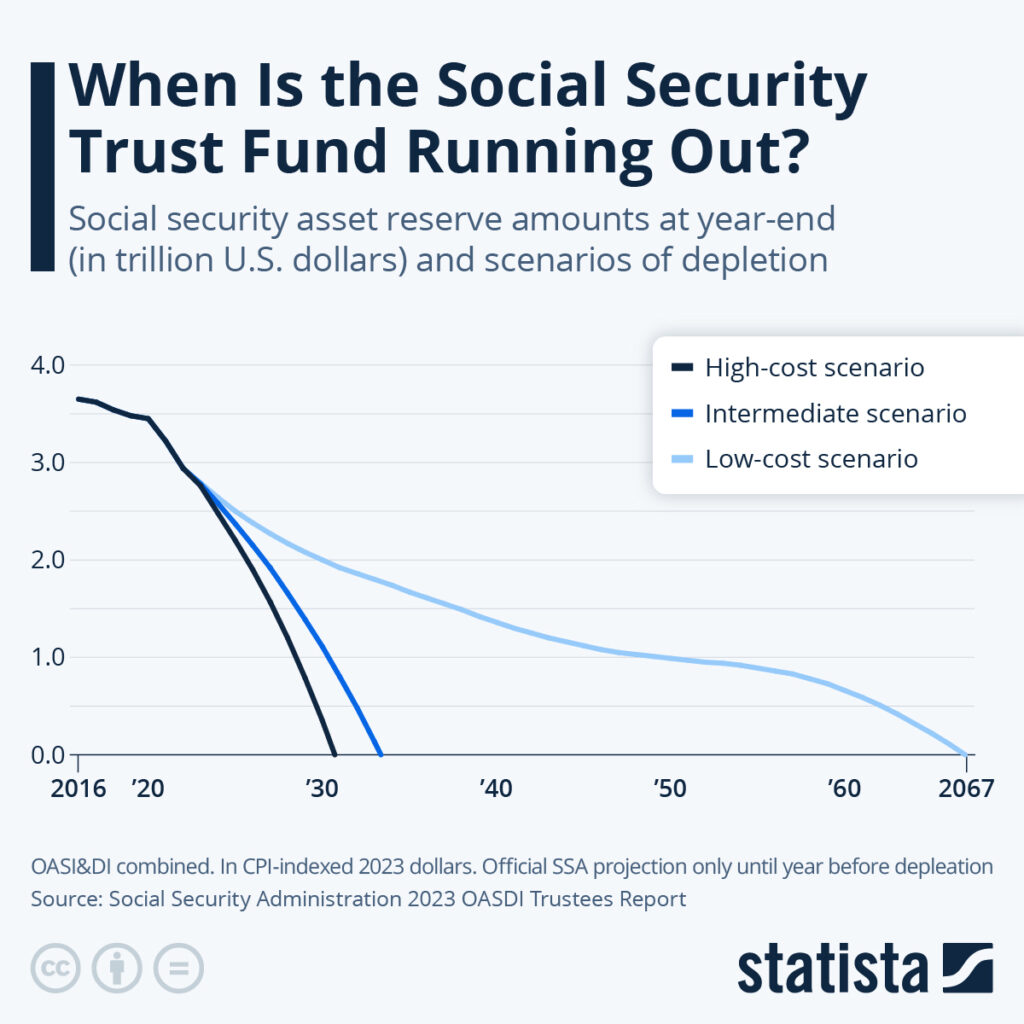

| Projected Social Security Shortfall | The Social Security trust fund may run out by 2033, leading to a potential 23% benefit cut. |

| Increase in Early Claims | More people are claiming Social Security early due to future uncertainties. March 2025 saw nearly 581,000 claims. |

| Claiming Early vs. Delaying | Early claims reduce benefits by up to 30%, while delaying benefits until age 70 increases monthly payments by 24%. |

| Expert Advice on Delaying Claims | Financial experts recommend delaying claims if possible to maximize long-term benefits. |

| Social Security Strategy Resources | Seeking advice from a financial planner or Social Security expert can provide personalized guidance. Source |

The Social Security Crisis: Understanding the Shortfall

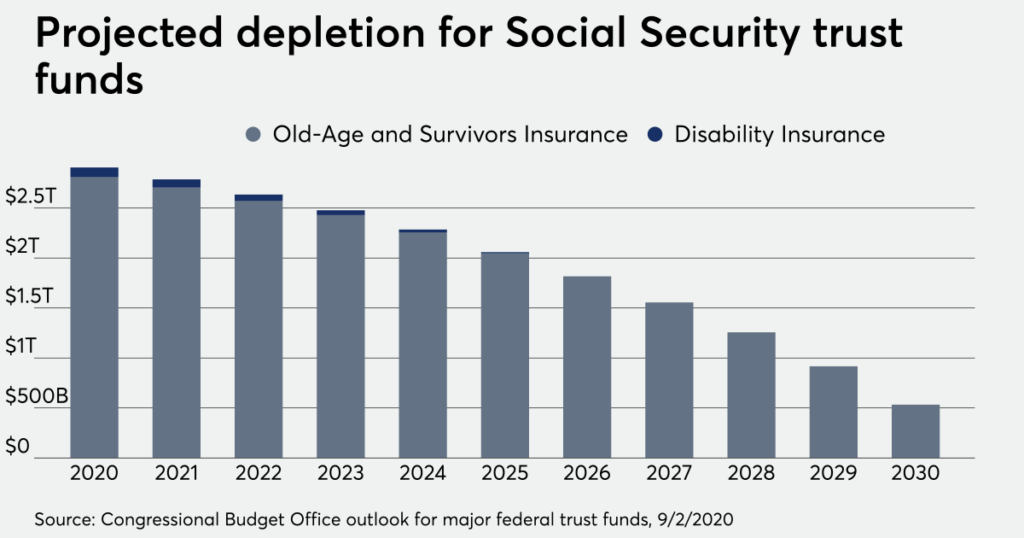

Social Security was introduced in 1935 with the goal of providing a safety net for older Americans, and it has since become the cornerstone of retirement income for millions of citizens. However, it’s facing a crisis. According to the latest report from the Social Security Board of Trustees, the trust fund will likely run out by 2033. When that happens, the Social Security Administration will only be able to pay out about 77% of the scheduled benefits.

This has raised concerns for retirees who depend on Social Security for their monthly living expenses. For example, a person expecting $2,000 per month could see that amount reduced to $1,540, a significant cut.

Should You Claim Social Security Early?

With such uncertainty surrounding Social Security’s future, more and more people are opting to claim their benefits earlier than they initially planned. But is claiming early the right decision? Let’s explore the pros and cons of claiming early versus waiting until your Full Retirement Age (FRA) or even delaying until age 70.

Early Claims: The Drawbacks

Claiming Social Security benefits as early as possible, at age 62, seems like a tempting option for many, especially if you have immediate financial needs. However, this choice comes with a trade-off. When you claim early, your benefits are permanently reduced.

For example, if your FRA is 67 and you decide to claim at age 62, you could see a reduction of up to 30% of your monthly benefit. While claiming early means you’ll start receiving money sooner, it also means that you’ll receive a lower amount for the rest of your life.

Moreover, there are additional considerations. Claiming early might make sense if you need the income right away, but it’s not the best long-term strategy, especially for individuals who expect to live into their 80s or 90s.

The Case for Waiting: A Bigger Payout Later

On the other hand, delaying Social Security claims can lead to significantly higher monthly benefits. For each year you delay claiming after your FRA, your monthly benefit increases by about 8% until age 70. For example, if your monthly benefit is expected to be $2,000 at age 67, waiting until age 70 would increase that amount by around $480, bringing your total benefit to $2,480 per month.

If you have the financial flexibility to wait and are in good health, this strategy could help you secure more substantial monthly payments, which may be essential for a long retirement.

Key Factors to Consider If Social Security’s Future Looks Uncertain

The decision to claim Social Security early or wait depends on several personal factors. Here’s a breakdown of key considerations:

1. Health and Life Expectancy

One of the most important factors in deciding when to claim Social Security is your health. If you’re in poor health and don’t expect to live long into retirement, claiming early might make sense. On the other hand, if you’re healthy and anticipate a long life, waiting for the larger monthly payout could be more beneficial.

2. Financial Needs and Savings

If you’re financially secure with other sources of income, it might make sense to delay Social Security for a larger benefit later on. However, if you need the money right away and don’t have other sources of income, claiming early could be necessary.

3. Spousal Benefits

If you’re married, you should consider how your decision to claim benefits will affect your spouse. In some cases, one spouse may benefit from delaying while the other claims early. Additionally, you can choose to claim spousal benefits, which could provide additional income for you and your spouse.

4. The Social Security Earnings Test

If you choose to claim Social Security before your FRA and continue working, be aware that your benefits will be reduced if your earnings exceed a certain threshold. However, once you reach your FRA, you can earn any amount without your benefits being affected.

What Happens if Social Security Runs Out?

If Social Security’s trust fund is depleted by 2033, it will still be able to pay out benefits from ongoing payroll taxes. However, these payments will only cover about 77% of the scheduled benefits. This means that retirees could face a 23% reduction in their monthly payments unless Congress acts to reform the system.

For individuals already in retirement, a reduction in benefits could lead to difficult financial choices. That’s why it’s critical to plan ahead and understand the potential risks involved. Some experts suggest diversifying your retirement income by relying on other sources of income such as 401(k)s, IRAs, or annuities.

How to Maximize Your Social Security Benefits?

If you’re planning to claim Social Security, here are a few ways to maximize your benefits:

- Work for 35 Years

Social Security benefits are calculated based on your highest 35 years of earnings. The more years you work—and the higher your earnings—the larger your benefit will be. - Delay Your Claim

As discussed, delaying your claim until age 70 can result in a higher monthly benefit. If you can afford to wait, this could be one of the best strategies to maximize your Social Security income. - Coordinate with Your Spouse

Married couples can employ strategies such as the “file and suspend” option, where one spouse files for benefits but suspends payments to allow the other spouse to claim a spousal benefit. - Consider the Timing

Consider the timing of your claim in relation to your personal circumstances. If you’re working part-time or not in need of the income immediately, waiting a few years could significantly increase your benefits.

Social Security Faces Collapse by 2034—Retirees Beware of Major Cuts to Your Benefits

Big Changes to Social Security in 2025: Who Can Still Claim Full Retirement Benefits?