Money Americans in Their 50s Have Saved in Their 401(k)s: When you hit your 50s, the reality of retirement starts to feel closer, and if you’re like many Americans, you’re likely wondering: How much should I have saved by now? The 401(k) is a central piece of retirement planning for many workers, and it’s crucial to understand where you stand in comparison to others. This article breaks down the key numbers, the savings trends, and gives you practical advice on how to ensure you’re on track to retire comfortably.

Money Americans in Their 50s Have Saved in Their 401(k)s

Saving for retirement can feel overwhelming, especially in your 50s when time seems to be running out. But with the right strategies, it’s entirely possible to make up for lost time. Maximize your 401(k) contributions, take full advantage of employer matches, and start reviewing your retirement plan regularly. By taking small, consistent actions, you’ll put yourself on the path to a more secure retirement.

| Topic | Key Data | Professional Insights |

|---|---|---|

| Average 401(k) Balance (50-59) | $192,300 (Fidelity, Q4 2024) | Many Americans are underprepared for retirement. Aiming for 6-8 times your salary by age 50-60 is ideal for a secure future. |

| 401(k) Median Balance (45-54) | $48,301 (Vanguard) | Half of the people in their 50s have saved less than $50k in their 401(k). Catch-up contributions can significantly boost retirement savings. |

| Catch-Up Contributions | $7,500 allowed for people 50 and older (2025) | Older workers can contribute more to their 401(k) to make up for lost time and potentially reach retirement savings goals quicker. |

| Employer Contributions | Nearly 90% of savers receive employer match contributions | Employer contributions are a significant source of growth in your 401(k). It’s vital to take full advantage of this free money. |

| Retirement Savings Target | Experts recommend 6x salary by age 50, 8x by age 60 | Building your retirement savings requires planning. Use benchmarks like salary multiples to gauge if you’re saving enough. |

Understanding the 401(k) Landscape

Let’s kick things off with a basic understanding of a 401(k). A 401(k) is a retirement savings account offered by employers in the U.S., where employees can contribute a portion of their paycheck pre-tax (or post-tax, if using a Roth 401(k)). Some employers will also contribute to your 401(k) through matching funds, which can be a big boost to your retirement nest egg.

Over the years, 401(k)s have become a cornerstone of retirement planning. This type of account is intended to grow over time, building a retirement fund that will ideally provide for you when you stop working. But how much should you have saved by the time you’re in your 50s? Let’s break down what the average American has saved and what experts recommend.

How Much Do Americans in Their 50s Have Saved?

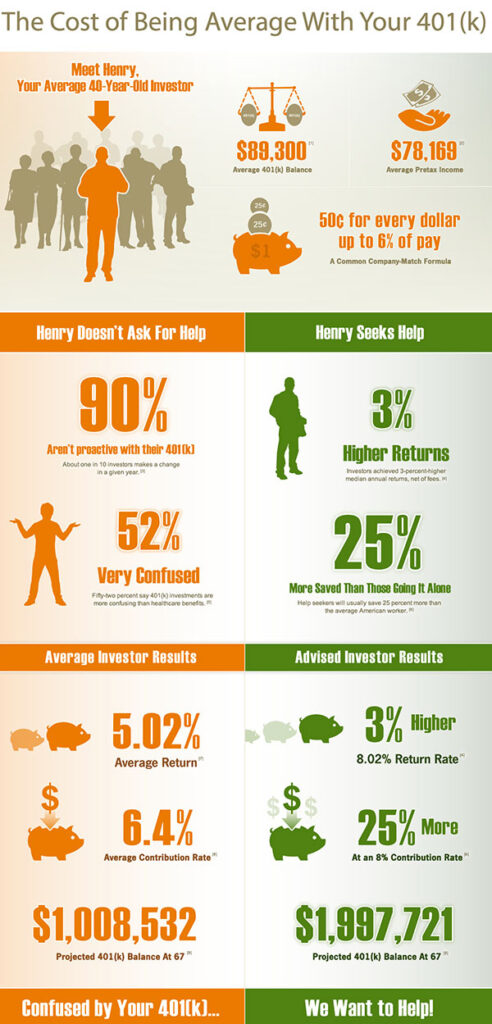

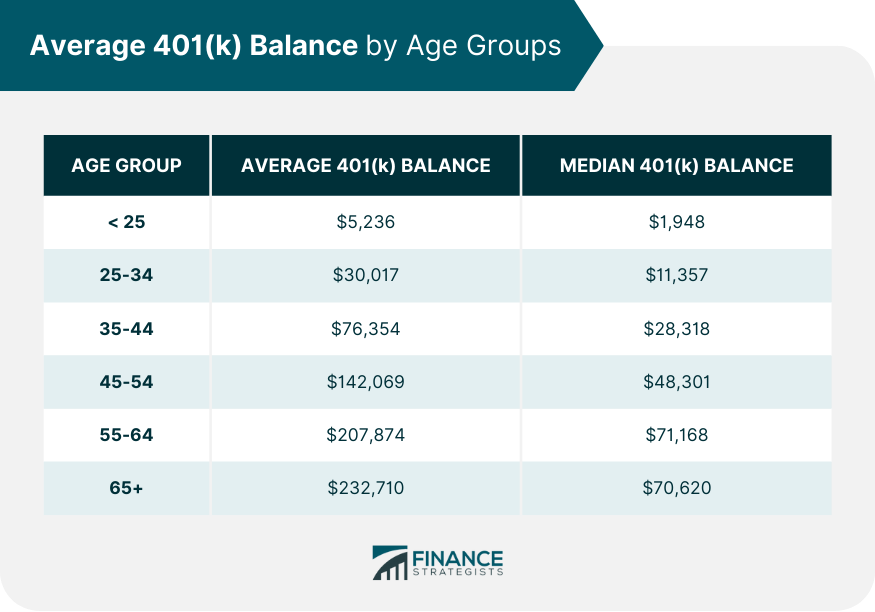

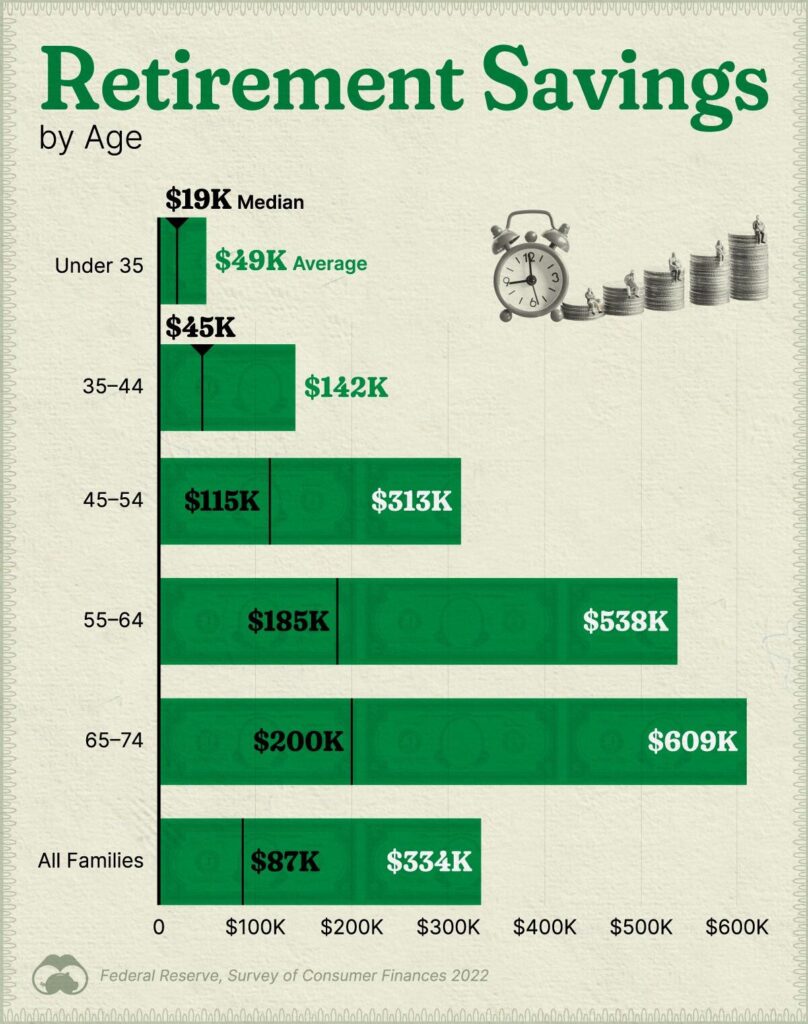

According to Fidelity, by the end of 2024, Americans in their 50s (aged 50-59) had an average 401(k) balance of $192,300. While that sounds like a decent sum, it’s important to understand that the average doesn’t mean that everyone has saved this much. It’s skewed by people who are well above the average—like the few who have large nest eggs. Many people in their 50s are falling short of what they need.

Vanguard reports that individuals aged 45-54 have a median balance of $48,301, which means half of these individuals have less than this amount saved. It’s clear that many people need to step up their savings efforts, especially in their 50s when retirement is just around the corner.

What Should You Aim For?

Financial experts recommend aiming for a multiple of your salary saved by certain ages. For instance, by the time you reach 50, you should aim to have saved about 6 times your salary. By 55, you should strive for 7 times your salary, and by 60, the goal is to have 8 times your salary saved.

If you haven’t reached these goals yet, don’t panic. It’s never too late to take action. Here’s where catch-up contributions come in. Once you turn 50, the IRS allows you to contribute an additional $7,500 per year to your 401(k) (this is on top of the regular contribution limit of $23,500 in 2025). These extra contributions can help you make up for lost time and boost your savings in a meaningful way.

Why Many 50-Somethings Are Behind in Their Savings?

So, why are so many people in their 50s not hitting their retirement savings targets? Several factors can contribute:

- Earlier Life Stages: Many people are still paying off debt, like mortgages or student loans, and are juggling other financial obligations. This can leave little room to save for retirement.

- Lack of Financial Literacy: Not everyone is well-versed in the details of retirement savings, leading to missed opportunities to grow their 401(k) balance.

- Living for Today: It’s easy to focus on the present and put off saving for retirement. However, time flies, and before you know it, you’re in your 50s trying to catch up.

- Economic and Job Changes: Life changes such as job losses or career transitions can disrupt retirement savings plans. In some cases, individuals may cash out their 401(k) balances when changing jobs, which can significantly set back their retirement goals.

- Late Start: Some people might not start saving until later in life, which means they miss out on the power of compound interest, which is critical for retirement savings growth.

Practical Tips for Boosting Your 401(k) Savings

Now, let’s talk about actionable steps you can take to improve your 401(k) savings:

- Maximize Catch-Up Contributions: Once you turn 50, don’t leave money on the table. Contribute the maximum allowed by the IRS to your 401(k) and use the catch-up contributions to make up for lost time.

- Take Advantage of Employer Matches: Make sure you’re contributing enough to get the full match from your employer. If they match up to 5%, aim to contribute at least that amount. It’s free money!

- Automate Your Contributions: Set up automatic contributions from your paycheck so that you don’t have to think about it. This ensures consistency and helps you save without having to take extra action each pay period.

- Review Your Investment Strategy: As you get older, you may need to adjust your 401(k) investments to reduce risk. Typically, people in their 50s may want to start shifting from more aggressive investments to more stable ones as they get closer to retirement.

- Increase Savings Rate: If you can afford it, consider increasing your contribution rate every year. Even small increases can add up over time, especially if your employer matches your contributions.

- Review Your 401(k) Regularly: Take the time to check your 401(k) every year and adjust your investment strategy or contribution rate as necessary. Staying on top of things will help you stay on track.

- Diversify Your Investments: Make sure your 401(k) is not overly concentrated in a single type of investment, such as stocks. Diversification can help reduce risk while still offering the opportunity for growth.

Case Study: Real-Life Example of Catching Up on 401(k) Savings

Let’s consider the case of Laura, a 53-year-old school teacher. When Laura was in her 40s, she wasn’t saving aggressively for retirement due to her focus on her kids’ education and a mortgage. By the time she turned 50, she had saved around $70,000 in her 401(k). Laura knew she needed to step it up, so she began contributing the maximum allowed under the catch-up provisions. By 55, her balance had grown to over $160,000.

Laura’s story shows that even if you’re starting late, catch-up contributions can help you make significant progress. If you have the discipline to stick with the plan and make small adjustments along the way, you can still reach your retirement savings goals.

Alternative Retirement Accounts to Consider

If you’re maxing out your 401(k) or want additional options, consider other retirement accounts, such as:

- IRAs (Individual Retirement Accounts): You can contribute to a traditional IRA or a Roth IRA in addition to your 401(k). For 2025, the contribution limit for IRAs is $6,500 ($7,500 if you’re 50 or older).

- Health Savings Accounts (HSAs): Though primarily for healthcare costs, an HSA also offers tax-free growth and can be a valuable tool for retirement if used correctly.

- Brokerage Accounts: While these are not retirement-specific accounts, opening a regular brokerage account and investing in stocks, bonds, or mutual funds can supplement your retirement savings.

Average 401(k) Contribution Rate Revealed — Are You Saving Enough to Retire?

Americans Are Saving More Than Ever for Retirement — So Why Are 401(k) Balances Shrinking?

Your 401(k) Might Be Down; But New Data Shows Savers Aren’t Backing Off