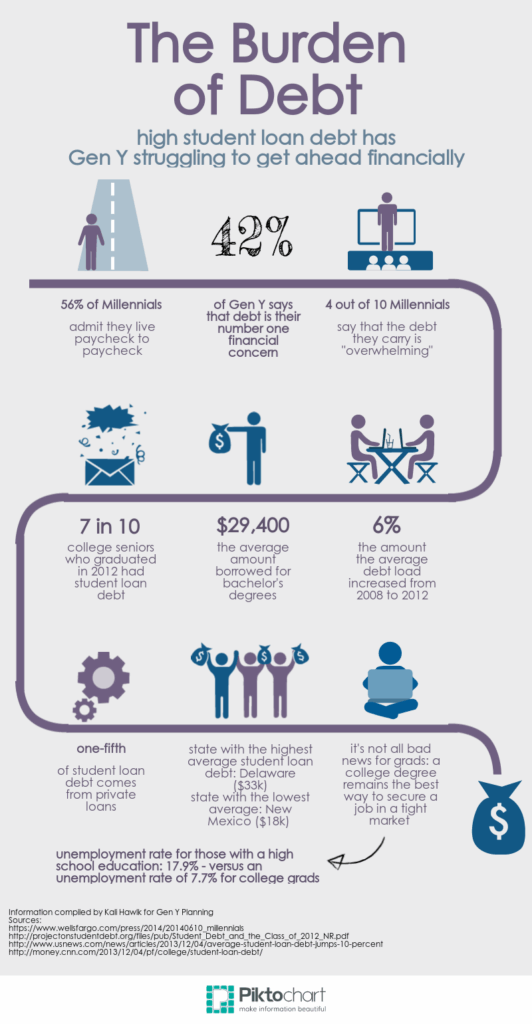

The Viral TikTok Hack That Claims to Erase Your Student Loan Debt: Student loans are a burden that many Americans carry, with the average student loan debt in the U.S. reaching over $37,000 per borrower. While these loans can feel overwhelming, they are often the price many people pay for higher education and a better future. However, in recent times, a viral TikTok hack has emerged, claiming to erase student loan debt simply by disputing it on your credit report. This technique has raised eyebrows and sparked curiosity among borrowers. But does it really work, or is it just another internet myth? Let’s break down this viral TikTok trend, understand the facts, and explore the reality behind it. We’ll also provide actionable advice for dealing with student loan debt, using safe and legal methods to take control of your financial future.

The Viral TikTok Hack That Claims to Erase Your Student Loan Debt

The viral TikTok hack claiming to erase student loan debt by disputing it on your credit report is misleading and risky. While it might temporarily remove the debt from your credit report, it doesn’t eliminate the loan, and the consequences can be severe. Instead of resorting to shortcuts, consider legal and effective options like income-driven repayment plans, loan forgiveness programs, and refinancing. These methods will help you manage your debt safely and responsibly, putting you on the path to financial freedom. For those struggling with their student loans, it’s important to seek out trusted resources and professional advice. By taking a proactive approach, you can find a solution that works for your unique situation and avoid falling victim to harmful financial myths.

| Key Data & Stats | Details |

|---|---|

| Average U.S. Student Loan Debt | $37,000 per borrower |

| Total U.S. Student Loan Debt | $1.8 trillion |

| Average Monthly Payment for Federal Loans | $400 |

| Student Loan Default Rate | 10% |

| TikTok Hack Risk | Can damage credit score and lead to legal consequences |

| Official Resources | Federal Student Aid |

| Income-Driven Repayment Plans | Payments based on income; potential for loan forgiveness |

| Public Service Loan Forgiveness | Forgiveness after 120 qualifying payments for public service workers |

What’s the TikTok Hack All About?

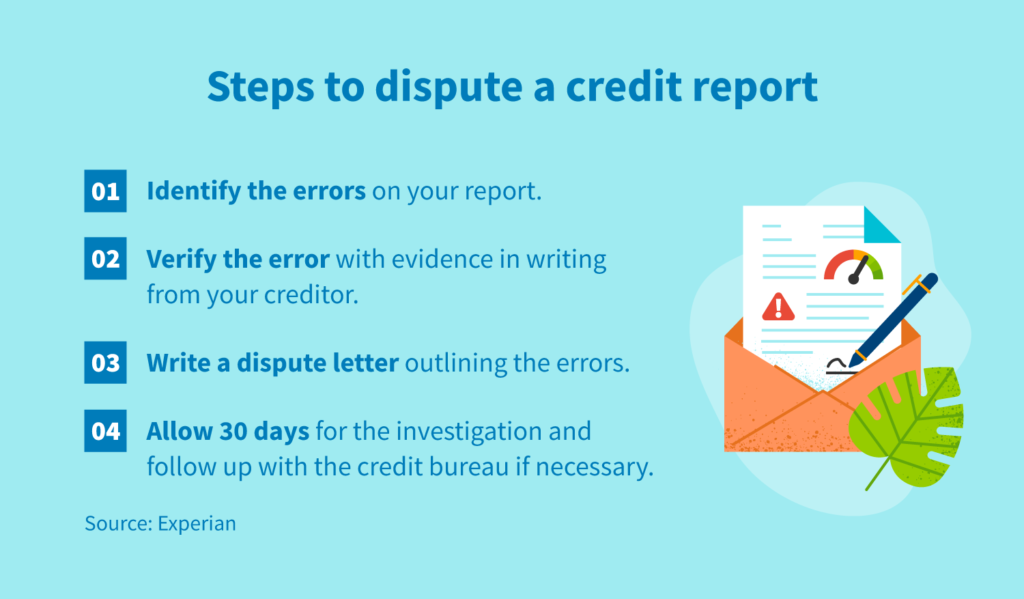

If you’ve spent any time on TikTok recently, you might have come across a video claiming that you can erase your student loan debt by simply disputing it on your credit report. The process is described as filing a dispute with the credit bureaus, saying that the student loans are inaccurate, unverifiable, or missing important details.

While this may seem like an appealing shortcut to clearing your debt, the truth is far more complex and risky. Let’s take a look at why this hack may not work as advertised.

Why Doesn’t The Viral TikTok Hack That Claims to Erase Your Student Loan Debt Work?

1. The Loans Aren’t Erased, Just Hidden

Disputing student loans on your credit report might temporarily remove them from view. However, this doesn’t erase the debt itself. The loans can still be there, just waiting to be reinstated once the credit bureaus investigate. Worse, you can face legal action for attempting to mislead the credit bureaus. Once the loans are reinstated, you might end up with more legal trouble, including wage garnishment or tax refund seizures.

2. It Can Damage Your Credit Score

While the dispute is pending, your credit score might initially improve because the loans are temporarily removed from your credit report. But once the loans are reinstated, the credit bureaus may mark the dispute as “fraudulent”, which can cause your credit score to drop significantly. This will make it harder for you to get loans, mortgages, or even certain jobs that require a good credit score.

3. Legal Repercussions

Filing a false dispute can be seen as a form of fraud. If discovered, you could face fines or other penalties. The risk of legal action far outweighs the potential short-term benefit of removing the loans from your credit report. In the long run, this could put you in an even worse financial position.

So, What Should You Do Instead?

While the TikTok hack may seem like an easy fix, there are much better and safer ways to manage your student loan debt. Let’s dive into some tried-and-true methods that can help you reduce or eliminate your debt without putting your financial future at risk.

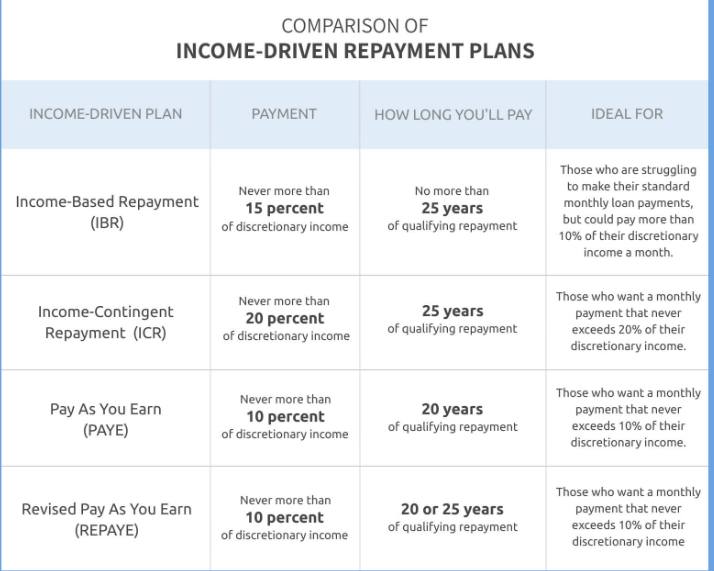

1. Income-Driven Repayment Plans

One of the most effective ways to manage your student loan debt is through income-driven repayment (IDR) plans. These plans adjust your monthly payments based on your income and family size. In some cases, your monthly payment could be as low as $0 if your income is very low.

After 20 or 25 years of qualifying payments, depending on the plan, any remaining balance could be forgiven. This can be a lifeline for many borrowers, especially those who are struggling to make their monthly payments.

2. Public Service Loan Forgiveness (PSLF)

For those working in the public sector, there’s a loan forgiveness program called Public Service Loan Forgiveness (PSLF). After you make 120 qualifying monthly payments while working for a government or non-profit employer, your remaining loan balance could be forgiven. This program has helped thousands of people reduce or eliminate their student loans, making it a great option for those in public service jobs.

3. Refinancing Your Loans

If you have a stable income and a good credit score, refinancing your student loans could help you secure a lower interest rate. Refinancing can save you money on interest over the life of the loan, helping you pay off your debt faster. Be cautious, though—if you refinance federal loans into private loans, you lose access to federal protections, such as income-driven repayment plans or loan forgiveness programs.

4. Explore Forgiveness Programs for Teachers

Teachers, especially those working in low-income areas, may be eligible for loan forgiveness through the Teacher Loan Forgiveness Program. If you teach for five consecutive years in a qualifying school, you could have up to $17,500 of your federal student loans forgiven. This program has helped many educators reduce their student loan burden.

5. Seek Financial Counseling

Navigating student loan repayment can be tricky, and sometimes, it’s helpful to get guidance from a professional. Certified financial planners or student loan counselors can help you create a repayment strategy that works best for your unique financial situation. They can also guide you through any available forgiveness or repayment options.

Additional Legal Considerations

If you ever find yourself facing overwhelming student loan debt, it’s important to be aware of the legal protections and responsibilities in place for borrowers. One option worth exploring is deferment or forbearance.

- Deferment allows you to temporarily postpone payments on your student loan if you meet certain criteria, such as returning to school or experiencing financial hardship. During deferment, interest may not accrue on your federal loans, which is a bonus.

- Forbearance, on the other hand, allows you to temporarily stop or reduce your payments, but interest will continue to accrue, including on subsidized loans.

Both options should be used sparingly, as they can extend your repayment period and increase the overall amount you owe.

Key Programs That Can Help

Many borrowers are unaware of the full range of assistance programs available to them. Here are a few more to consider:

- Veterans Affairs Loan Forgiveness: Veterans may qualify for loan forgiveness under the Veterans Affairs (VA) benefits program. The specific benefits depend on your service history and can include loan forgiveness or payment reduction.

- State-Specific Loan Forgiveness Programs: Several states offer student loan forgiveness for residents who work in certain professions or geographic areas. Check with your state’s higher education or financial aid office for more details.

Student Loan Relief at Last? Here’s Why the Department of Education Just Lowered Interest Rates

Say Goodbye to Budget Stress—This Viral Ring Trick Is Flipping Financial Education on Its Head

Americans Admit Wasting Tons of Money on These 5 Things—Are You Guilty Too?