Is It Possible to Inherit Credit Card Debt? When someone passes away, the question of how their debts are handled can be complicated and a source of anxiety for surviving family members. One common question is: Can credit card debt be inherited? The short answer is no, but there are nuances you need to be aware of to navigate this potentially confusing issue. This article will break down the facts, explain your rights, and offer practical advice on what to do if you find yourself dealing with the financial aftermath of a loved one’s passing.

Is It Possible to Inherit Credit Card Debt?

Inheriting credit card debt might seem like an overwhelming prospect, but in most cases, you are not responsible for paying off the debt unless you were a joint account holder or co-signer. Credit card companies can only go after the estate of the deceased, and if there are insufficient assets, the debt may be written off. The key takeaway here is to handle the estate properly and consult a legal professional if necessary. As you navigate this challenging time, stay informed and don’t hesitate to ask for help from experts who can guide you through the process. Understanding your responsibilities and rights can help ensure that you don’t face any surprises in the aftermath of a loved one’s passing.

| Topic | Key Insight | Data & Sources |

|---|---|---|

| Can Credit Card Debt Be Inherited? | No, credit card debt isn’t inherited by family members unless they were co-signers or joint account holders. | Federal Trade Commission |

| Who Is Responsible for Credit Card Debt? | The deceased’s estate is responsible for paying off the debt using their assets. Only joint account holders or co-signers are personally liable. | American Bar Association |

| Steps to Take | Inform the credit card issuer, stop using the card, assess the estate, and consult a lawyer to settle the debt properly. | National Consumer Law Center |

| What Happens if There’s Insufficient Estate Funds? | The debt may go unpaid, and creditors will typically write it off if the estate cannot cover it. | Investopedia |

The Basics: Credit Card Debt After Death

When someone passes away, their credit card debt doesn’t automatically get transferred to the people they leave behind. It may sound like something out of a horror story, but the truth is, debt doesn’t simply get passed on to your loved ones. Instead, credit card debt, like other debts, is handled through the estate of the deceased person. But let’s dig a bit deeper and explain how this all works.

An estate is the total value of a deceased person’s assets—bank accounts, real estate, vehicles, and other personal property. When a person dies, their estate is responsible for paying off any outstanding debts they may have, including credit card bills. If the estate does not have enough money to cover the debts, the creditors (like the credit card companies) may write off the remaining balance.

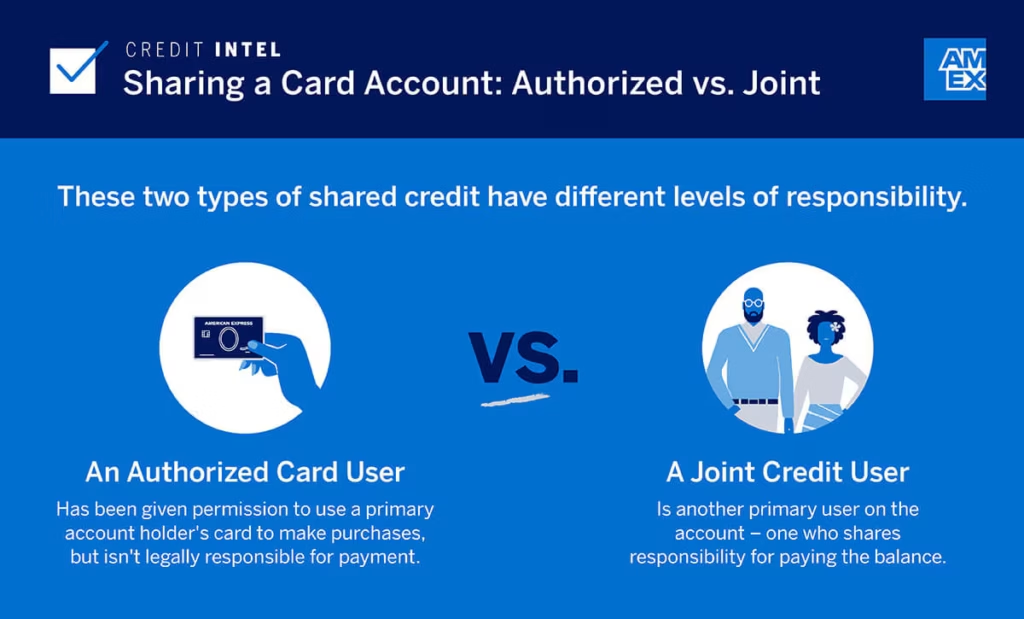

Here’s the kicker: if there’s a co-signer or joint account holder on the credit card, that person is responsible for the debt. But if you were just an authorized user, you have nothing to worry about. This is a big distinction and one that can clear up a lot of confusion.

Who Is Responsible for the Debt?

So, who is responsible for paying the credit card debt once someone dies? It’s a fair question, and understanding who’s on the hook can save a lot of heartache.

1. The Deceased’s Estate

The main responsibility for paying off the deceased’s debts, including credit card bills, falls to the estate. If the estate has enough assets (cash, property, or investments), the debts will be settled using those assets. Only after the debts are paid can the remaining estate be distributed to the beneficiaries (those who inherit the deceased’s property).

For example, if a person passes away with a house, savings account, or other assets, these will be sold or used to pay off any debts, including credit card debt, medical bills, or personal loans. Once all debts are settled, any remaining assets are distributed to the heirs.

2. Co-signers and Joint Account Holders

If someone was a co-signer on the credit card, they are responsible for the debt. For example, if a parent co-signed their child’s credit card, and the parent passes away, the child is responsible for paying off the debt. The same goes for joint account holders. If a deceased person had a joint credit card account holder, that individual would be fully responsible for the debt.

This is why it’s important to understand the differences between being an authorized user and a joint account holder. If you co-signed a credit card application or were a joint holder, you are legally obligated to pay off the debt, regardless of whether the primary cardholder has passed away.

- Authorized User: If you were just added as an authorized user to a credit card, you are not liable for the debt. You were given access to use the card but did not agree to be responsible for the debt. Being an authorized user on the card doesn’t make you financially responsible for the charges.

- Joint Account Holder: As a joint account holder, you are equally responsible for the debt. If the primary cardholder dies, the debt is still yours, and you will be expected to continue making payments on it. If the estate doesn’t have enough assets to cover the debt, the creditors can come after the joint account holder for repayment.

3. Spouses

In some states, a surviving spouse may have some liability for the deceased spouse’s debt, especially if the debt was accumulated during the marriage. However, this largely depends on the state’s community property laws. These laws, which only apply in certain states, can make both spouses equally liable for debts incurred during the marriage.

In community property states like California, Arizona, and Nevada, a surviving spouse may be responsible for debts, including credit card debt, even if they weren’t a co-signer. This means if the credit card debt was accumulated during the marriage, the spouse may be responsible for the debt after the primary cardholder’s death. However, in non-community property states, the surviving spouse is typically not liable for their deceased spouse’s credit card debt unless they were a joint account holder or co-signer.

What Happens If There’s Not Enough Money to Pay the Debt?

Now, what happens if the deceased’s estate doesn’t have enough assets to cover the credit card debt? In this case, creditors usually write off the remaining balance. The debt doesn’t transfer to family members or heirs. However, the estate’s executor (the person responsible for managing the estate) may need to inform the creditors that there are insufficient funds, and they will stop trying to collect on the debt.

If the estate is insolvent (doesn’t have enough funds), the creditors must follow a set process to claim debts. The estate’s debts will be paid in order of priority. For example, secured debts (like a mortgage) are usually settled first, followed by unsecured debts like credit card bills. If the estate can’t pay all debts, credit card companies and other unsecured creditors may receive little to nothing.

This can get tricky if there are other outstanding debts, such as mortgages, personal loans, or medical bills, as creditors often have to be paid in order of priority. Credit card companies, while typically lower on the list, still might not get their full payment.

How Debt Affects Inherited Property?

Inherited property can also be impacted by the deceased’s debt. If the estate has significant debt and insufficient assets to cover it, the estate may have to sell inherited assets, such as real estate, to satisfy the creditors. In other words, the inherited property could potentially be sold to pay off outstanding debts.

For example, let’s say a person dies with a home worth $300,000 but has credit card debt totaling $40,000. If there’s not enough liquid cash in the estate, the house may need to be sold to cover the debts, leaving little to no inheritance for the heirs.

Beneficiaries should be aware of this and be prepared to address any potential claims on inherited property before accepting the inheritance. In some cases, beneficiaries may choose to renounce the inheritance (i.e., turn it down) to avoid having to deal with these financial complications.

Tips for Protecting Yourself from Inheriting Debt If It Is Possible to Inherit Credit Card Debt?

While you can’t prevent the death of a loved one, there are some ways you can protect yourself from inheriting unwanted debt:

- Understand Credit Agreements: Before becoming a joint account holder or co-signer, understand the responsibilities involved. If you’re just an authorized user, you won’t be responsible for the debt.

- Have Open Conversations: Discuss financial matters with your loved ones. Make sure you know if there are any outstanding debts or if they have any debt relief plans in place, such as life insurance or debt settlement strategies.

- Monitor Your Own Finances: Keep track of your credit cards and any shared accounts, especially if you’re a co-signer or joint account holder. Being aware of your financial commitments can help prevent unpleasant surprises.

Common Misconceptions About Inheriting Debt

There are a lot of myths surrounding the issue of debt inheritance. Here are a few of the most common misconceptions:

- Myth 1: I’ll inherit all of my parents’ debt.

Fact: You’ll only inherit debt if you were a joint account holder or co-signer. Otherwise, you are not responsible for paying off their credit card debt. - Myth 2: My parents’ credit card companies can come after me.

Fact: If you were not a co-signer or joint account holder, credit card companies cannot come after you for the debt. They may attempt to collect from the estate. - Myth 3: All debts must be paid before inheritance.

Fact: While debts must be settled from the estate, there may not be enough assets to cover everything. If that’s the case, creditors may write off the remaining balance.

How to Protect Your Family from Inheriting Debt?

If you want to ensure that your family isn’t burdened with your debt when you pass, consider these strategies:

- Get Life Insurance: Life insurance can provide your loved ones with the financial support they need to cover outstanding debts after your death. Term life insurance, for example, can cover specific debts like mortgages or credit card balances.

- Create a Will: A will helps ensure that your assets are distributed according to your wishes, which can include the settlement of any debts. Having a clear will can help guide the executor of the estate in dealing with debt and assets.

- Debt Forgiveness: Consider seeking out debt forgiveness programs or negotiating with creditors to reduce your liabilities, especially if you have substantial debt. Some programs offer debt relief for those facing significant financial hardship.

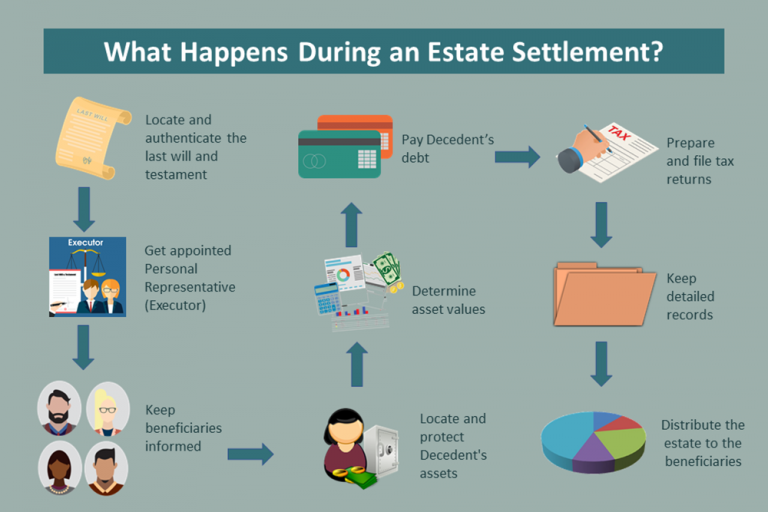

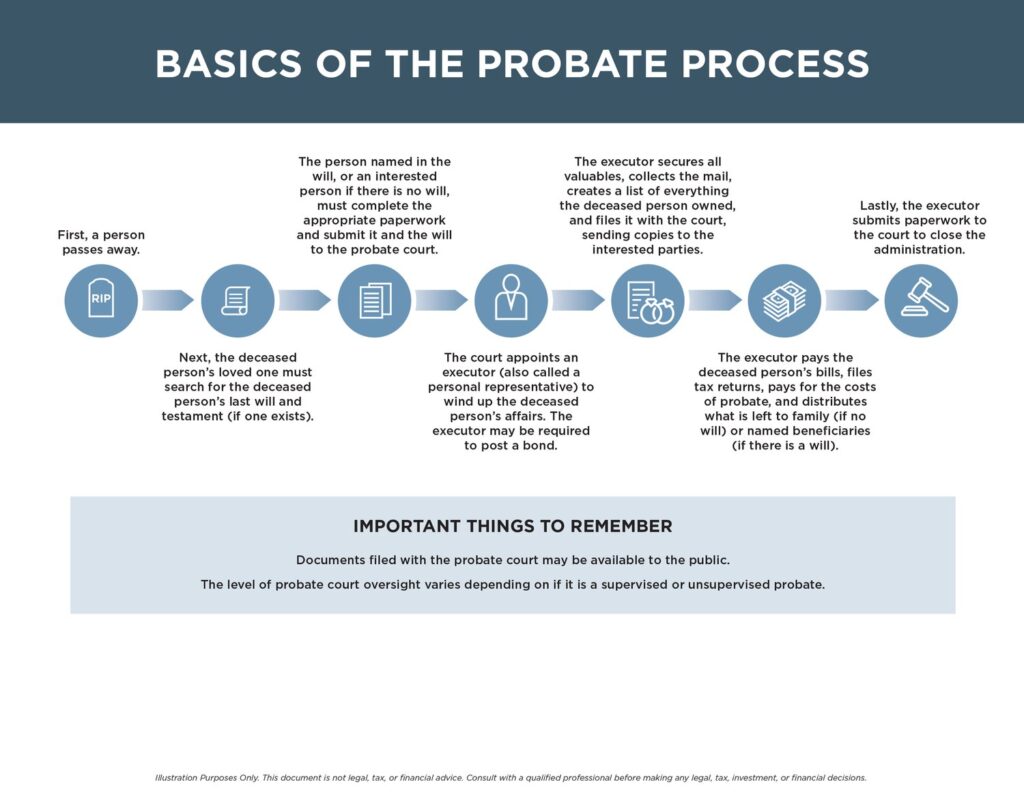

The Role of Probate in Debt Settlement

Probate is the legal process of administering a deceased person’s estate. This process includes paying off debts and distributing assets to beneficiaries. If the estate has debts, the probate court will oversee the settlement of these debts. In cases where there are insufficient assets, creditors may be unable to collect the full amount owed.

The probate process typically involves validating the will, identifying and appraising the assets, paying off debts, and finally distributing the remaining assets to the heirs. During this time, it is crucial that the executor of the estate works with the courts and creditors to ensure all obligations are met in a fair and legal manner.

Student Loan Debt Could Haunt You Into Retirement—Even Your Benefits Aren’t Safe

Japan’s Debt Is Shrinking, but Experts Warn the Real Economic Trouble Is Just Beginning

How to Graduate Debt-Free: Proven Tips to Slash College Costs Before It’s Too Late

Other Types of Debt That May Be Inherited

While credit card debt is a big concern for many, there are other types of debt that may affect heirs, including mortgages, student loans, and medical bills. For example:

- Mortgage Debt: If the deceased had a mortgage, the surviving family members may be able to assume the mortgage, or the property may need to be sold to pay off the debt.

- Student Loans: Federal student loans are typically discharged upon death, but private student loans may be inherited by a co-signer.

- Medical Debt: In some cases, medical bills can be significant. Like other debts, if the estate has enough assets, these bills are paid from the estate before assets are distributed to heirs.