U.S. Social Security Trust Fund Could Run Out by 2033: “Is Social Security going to run out?” It’s a big question—and one that’s on the minds of millions of Americans. From younger workers just starting their careers to retirees depending on their monthly checks, the future of Social Security matters to just about everyone.

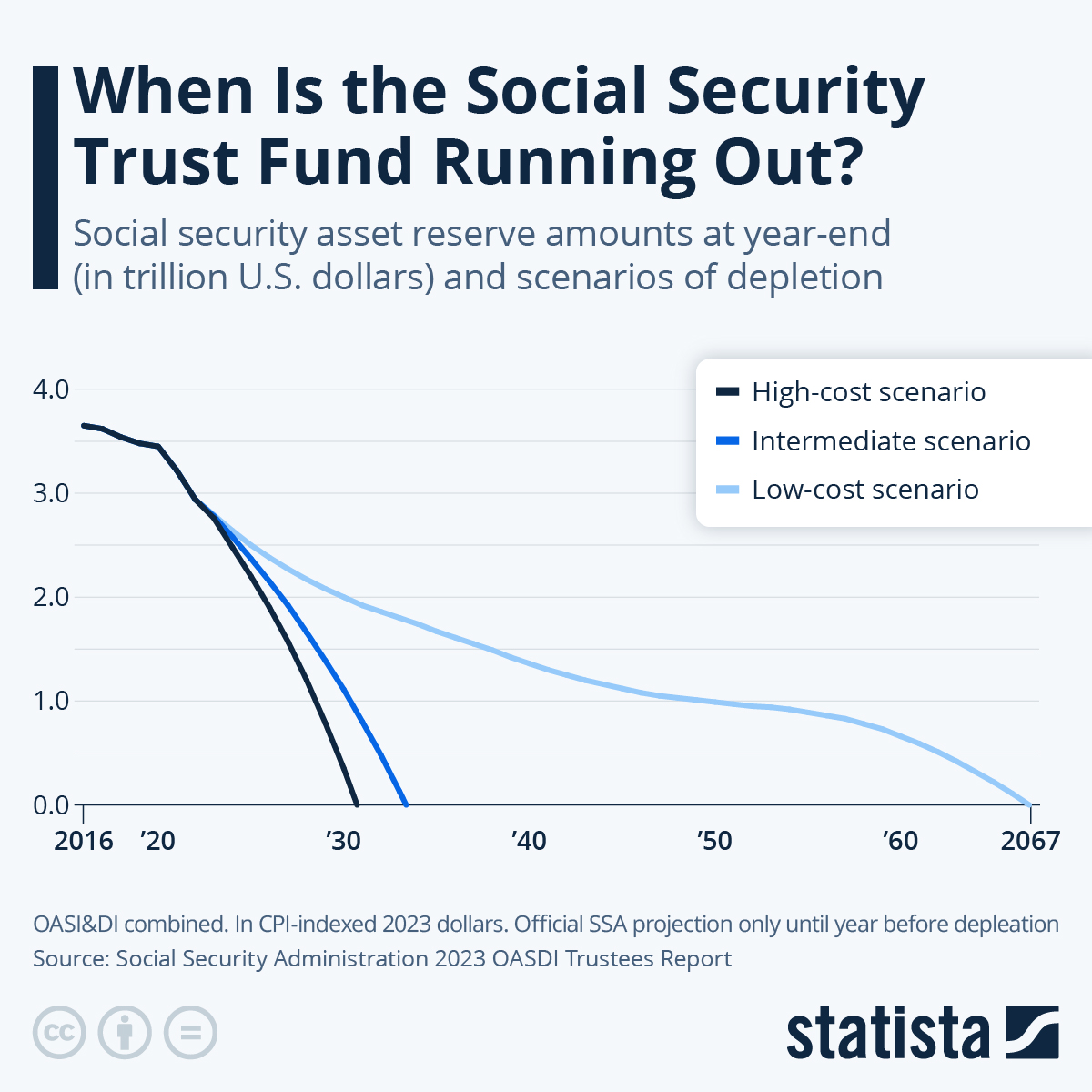

According to the latest 2024 Social Security and Medicare Trustees Report, the Old-Age and Survivors Insurance (OASI) Trust Fund, which pays retirement benefits, is projected to run dry by 2033. When that happens, unless changes are made, benefits could be cut by as much as 23%. That’s a huge blow to retirees and workers planning their futures. This article will explain exactly what that means, how we got here, and what you can do—whether you’re in your 20s, 40s, or already retired—to protect your future.

U.S. Social Security Trust Fund Could Run Out by 2033

The potential depletion of the U.S. Social Security Trust Fund by 2033 is a serious issue—but it doesn’t have to be a personal crisis. With smart planning, informed decisions, and timely action, you can protect your financial future. Whether you’re 25 or 65, taking proactive steps today can soften the blow of any future benefit cuts. Congress has options to fix the system. Meanwhile, you have options to prepare. Stay informed. Stay ready. And take control of your retirement destiny.

| Topic | Details |

|---|---|

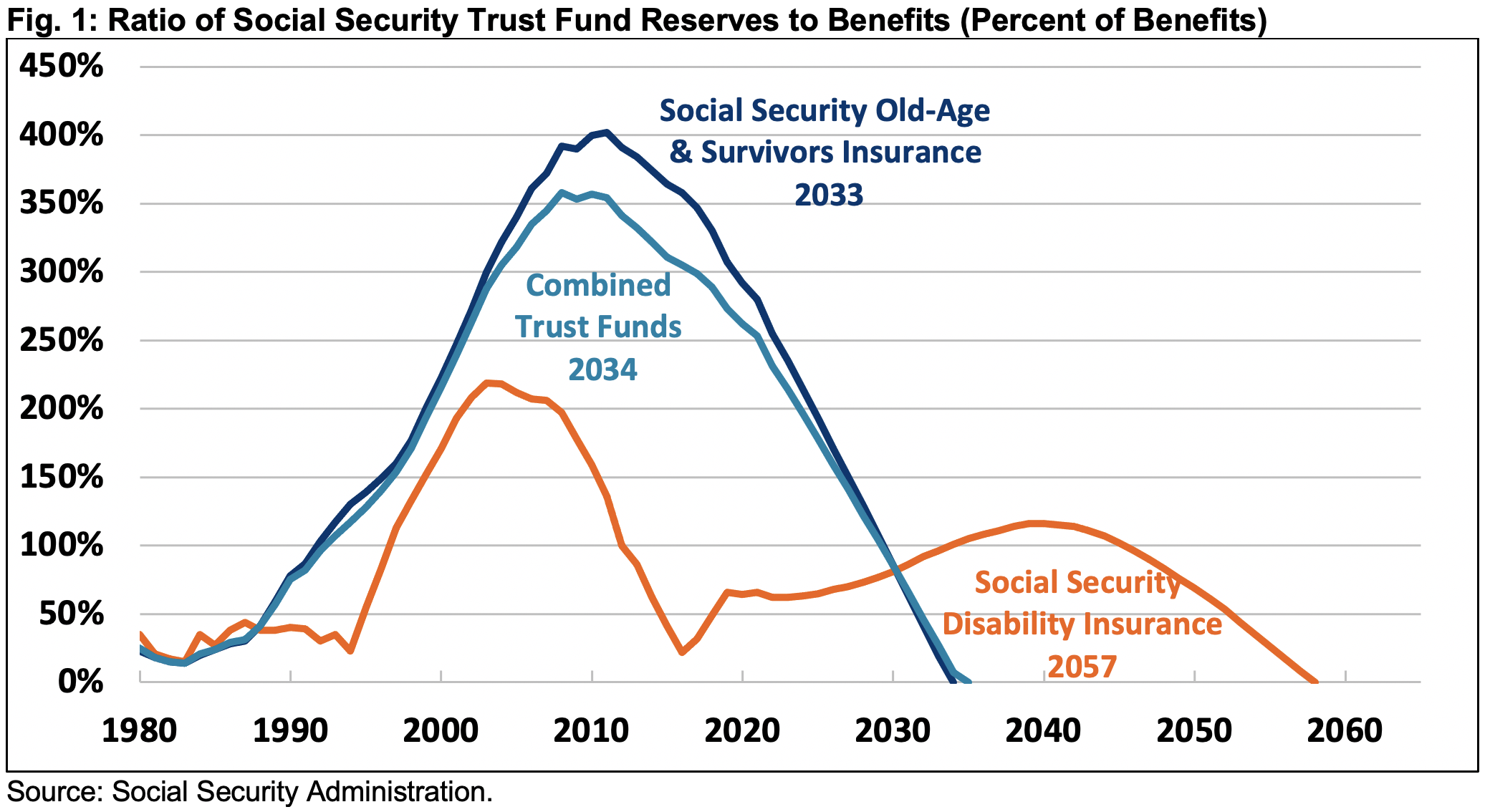

| Depletion Year | 2033 (OASI), 2034 (OASDI combined) |

| Benefit Cuts | Estimated 23% cut in monthly retirement benefits |

| Medicare Impact | Part A Hospital Insurance could only cover 89% of costs |

| Workers per Retiree | Down from 5.1 in 1960 to 2.4 today |

| Current Recipients | Over 69 million Americans |

| Payroll Tax | 12.4% (split evenly between employer and employee) |

| Official Source | ssa.gov/oact/TRSUM |

A Quick History of Social Security

Social Security was signed into law in 1935 during the Great Depression to provide a safety net for older Americans. It worked well for decades, especially when more people were working than retiring.

Back in 1960, there were over 5 workers for every retiree. Today, that number has dropped to just 2.4 workers per retiree, and it’s expected to keep shrinking. Why?

- The baby boomer generation is retiring en masse.

- People are living longer than ever before.

- Birth rates have declined, meaning fewer workers to support the system.

- The payroll tax cap hasn’t adjusted fast enough to keep up with economic realities.

Simply put: more people are taking out of the system than putting in.

How the Trust Fund Works?

Social Security is primarily funded through payroll taxes—you pay 6.2%, and your employer matches it, for a total of 12.4%. These funds go directly to current retirees, not into a savings account for you personally.

When more money came in than went out (mainly in the 1980s and 1990s), the surplus was stored in the Social Security Trust Fund. But now, benefit payments exceed income. To make up the difference, the government has been dipping into the Trust Fund.

By 2033, that reserve could be exhausted. If Congress takes no action, only the incoming payroll taxes will be available—enough to pay about 77–81% of scheduled benefits.

What This Means for Different Age Groups?

Current Retirees

If you’re already retired or close to it, you’ll probably receive full benefits for a while. But if nothing changes, your monthly checks could be reduced by nearly a quarter starting in 2033.

For example, if you receive $2,000 a month now, you could be looking at about $1,540 per month after 2033.

Millennials and Gen Z

Younger workers face the possibility of:

- Reduced future benefits

- Later retirement ages

- Higher payroll taxes

While Social Security will likely still exist when you retire, it may look very different from today.

High-Income Earners

The government currently only taxes wages up to $168,600 (2025). One of the potential fixes is to raise or eliminate this cap, meaning high earners may pay more in payroll taxes in the future.

Possible Solutions Under Discussion

Congress has several policy options to address the shortfall. Some of these proposals include:

Raise the Payroll Tax Rate

Even a modest increase from 12.4% to 14.8% could extend the program’s life by decades.

Eliminate or Raise the Income Cap

Currently, wages above the cap aren’t subject to Social Security tax. Removing or raising this cap would significantly increase revenue.

Gradually Increase the Full Retirement Age

Right now, the full retirement age is 67 for most workers. Raising it to 68 or 69 could reduce long-term obligations.

Adjust Cost-of-Living Adjustments (COLA)

Reducing or slowing COLA increases would save money but would reduce the buying power of benefits over time.

Means Testing

This would reduce or eliminate benefits for high-income retirees.

Each option has pros and cons and affects different groups of Americans differently.

Actionable Strategies to Prepare for U.S. Social Security Trust Fund Could Run Out by 2033

Regardless of what Congress does or doesn’t do, you should prepare. Here’s how:

1. Delay Claiming Benefits

If you wait until age 70, you’ll receive about 8% more per year for each year you delay past your full retirement age.

This strategy is especially powerful if you’re in good health and expect a long retirement.

2. Diversify Your Retirement Income

Don’t rely solely on Social Security. Use:

- 401(k)s and IRAs

- Roth accounts for tax-free withdrawals

- Real estate or rental income

- Part-time or freelance work

3. Maximize Tax-Advantaged Accounts

Use Health Savings Accounts (HSAs), 401(k)s, and traditional or Roth IRAs to save for the long haul while reducing your tax bill today.

4. Track Your Benefits

Check your earnings history and future benefits estimate at ssa.gov/myaccount.

Mistakes in your earnings history can reduce your benefits, so fix errors as soon as you spot them.

Tips by Age Group

In Your 20s and 30s

- Start saving early—even small amounts matter

- Automate savings into retirement accounts

- Learn basic investing skills

In Your 40s and 50s

- Max out 401(k) and catch-up contributions

- Review your Social Security statement annually

- Consider long-term care insurance

In Your 60s

- Create a retirement income plan

- Time your benefit claim wisely

- Consider working part-time to delay claiming and grow your benefit

Tools and Resources

Use these to take charge of your retirement future:

- Social Security Estimator: ssa.gov/benefits/retirement/estimator.html

- SmartAsset Retirement Calculator: smartasset.com

- AARP Social Security Resource Center: aarp.org

- CFPB Budgeting Tools: consumerfinance.gov

- NewRetirement Planner: newretirement.com

These tools can help you estimate benefits, adjust strategies, and plan better.

Expert Insights

Kathleen Romig of the Center on Budget and Policy Priorities notes:

“Social Security is not going bankrupt. It’s a solvable issue. But delaying reform makes the fix harder.”

Economist Alicia Munnell from Boston College says:

“The sooner we act, the less dramatic the solution needs to be.”

CPI Surprise Alters 2026 COLA Forecast; Social Security Recipients Could See Unexpected Changes

Social Security Cuts Paused! What It Means for Student Loan Defaulters in 2025

What Can You Do Today?

Here’s your quick action plan:

- Create or log into your SSA account to check your benefits.

- Talk to a financial planner about how changes might affect your retirement.

- Increase your retirement savings contribution—even by 1%.

- Share this article with family and coworkers to raise awareness.

- Contact your representative to express support for long-term Social Security reforms.