Do CPP and OAS Increases Happen on Your Birthday: That’s a question many Canadians ask as they approach key retirement ages like 60, 65, and 75. It sounds logical—maybe even celebratory—that your pension benefits would show up like a birthday gift. But the truth is a little more… bureaucratic. Still, there’s good news. If you’re receiving Old Age Security (OAS) or planning for the Canada Pension Plan (CPP), understanding when and how much your payments increase is crucial. This guide will break it down into plain English that even a 10-year-old could follow—while still offering expert insights for professionals, financial planners, and retirees alike.

Do CPP and OAS Increases Happen on Your Birthday?

Pension increases may not land on your birthday, but they do come predictably—and with a little planning, you can make the most of them. Old Age Security (OAS) includes a 10% increase at age 75, delivered the month after your birthday. It’s also adjusted quarterly for inflation. Canada Pension Plan (CPP) starts based on when you apply (between ages 60–70), with bonuses for delaying and penalties for starting early. It’s adjusted every January based on inflation and can grow significantly with enhanced contributions. Understanding the timing, inflation factors, and application rules helps ensure you get every dollar you’re entitled to.

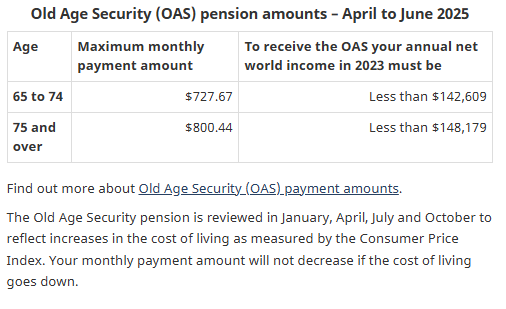

| Program | When It Starts | Type of Increase | Amount & Frequency | Source |

|---|---|---|---|---|

| OAS 75+ Boost | Month after turning 75 | One-time permanent boost | 10% increase; up to ~$800/month (as of mid-2025) | Canada.ca – OAS |

| OAS COLA | Every Jan, Apr, Jul, and Oct | Inflation-adjusted | Varies; ~1.0% for July–Sept 2025 | Government of Canada |

| CPP Payments | Month after you apply (age 60–70) | Age-adjusted | -0.6%/month early; +0.7%/month delayed | Canada.ca – CPP |

| CPP COLA | Every January | Inflation-adjusted | 2.6% increase in January 2025 | Same |

| CPP Enhancement | Rolling since 2019 | Contribution-based | Up to 50% more if maxed out over 40 years | Same |

What Is Old Age Security (OAS)?

OAS is a monthly pension benefit available to most Canadians once they reach age 65. Unlike CPP, OAS doesn’t depend on your work history or past earnings—it’s residency-based. If you’ve lived in Canada for at least 10 years after turning 18, you qualify for partial benefits. With 40 years of residency, you’re eligible for full OAS.

You don’t get OAS on your 65th birthday—rather, it begins the month after you turn 65. That rule applies whether you apply early or delay.

What Happens When You Turn 75?

One of the most important boosts in the OAS program comes at age 75. In July 2022, the federal government implemented a 10% permanent increase to OAS for all seniors aged 75 and over.

But it’s not automatic on your birthday. Here’s the key detail:

- You become eligible the month after your 75th birthday.

- For example, if your birthday is August 3, your 10% boost begins in September.

This increase is permanent and reflects the government’s recognition that older seniors typically face higher medical, caregiving, and living costs.

As of mid-2025, OAS for seniors under 75 is approximately $727.67/month. For those 75 and older, it jumps to about $800.44/month—thanks to that 10% bump.

How Does OAS Handle Inflation?

OAS is indexed to inflation through a quarterly Cost of Living Adjustment (COLA) system. Adjustments are made in:

- January

- April

- July

- October

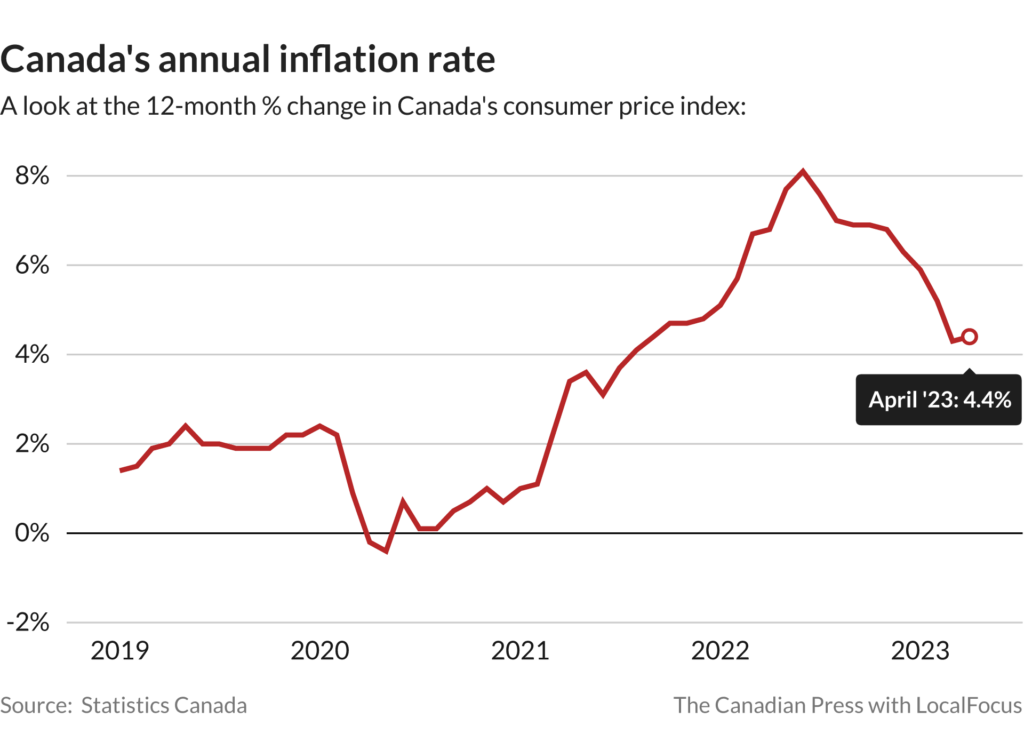

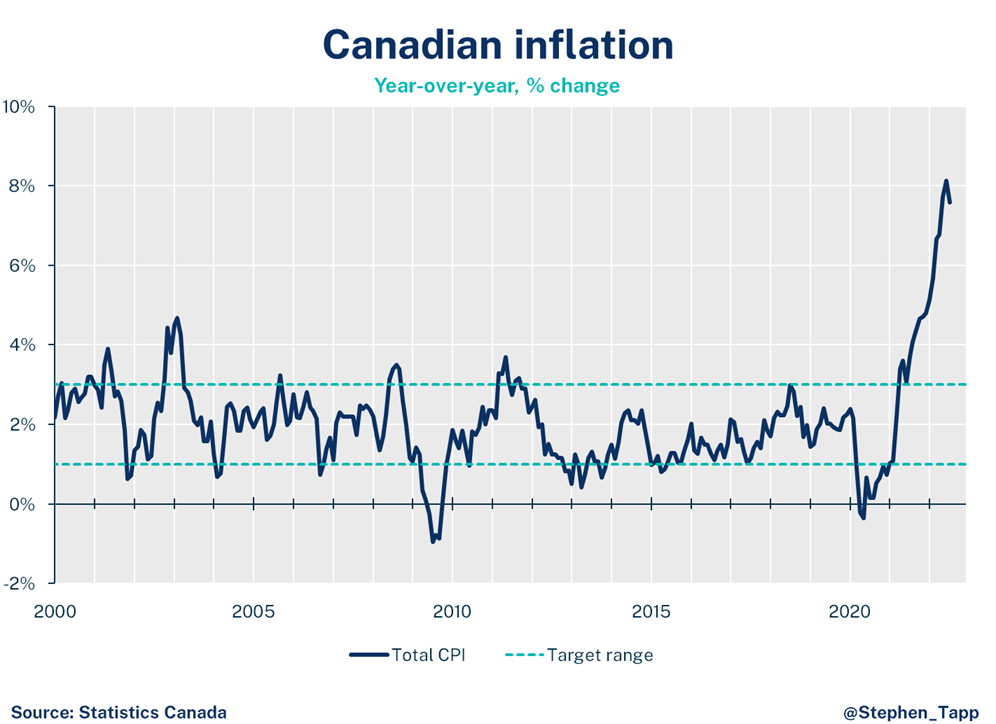

The percentage increase is based on the Consumer Price Index (CPI). This keeps your pension from losing value when prices rise.

For example:

- The OAS rate held steady in April 2025, reflecting flat CPI.

- It’s projected to increase by 1.0% in July 2025 due to CPI gains in May.

Note: There are no reductions if inflation is negative; benefits either stay the same or increase.

Do CPP and OAS Increases Happen on Your Birthday: How It Works

CPP is a work-based pension that most Canadians contribute to throughout their careers. Unlike OAS, CPP is funded by contributions from you and your employer, and your payout depends on how much and how long you paid in.

Here’s how to understand CPP benefits:

- You can start as early as age 60.

- The “standard” start age is 65.

- You can delay up to age 70.

Timing matters a lot. If you start early, you’re penalized:

- -0.6% per month before age 65 (up to -36% if starting at 60).

If you delay:

- +0.7% per month after 65 (up to +42% if starting at 70).

So, starting CPP at 70 gives you a much larger monthly payment, but fewer years of collecting.

Your first payment starts the month after your application is approved—again, not exactly on your birthday.

CPP Cost-of-Living Increases

CPP is also indexed to inflation, but unlike OAS, adjustments happen only once per year—in January.

The increase for January 2025 was 2.6%, based on CPI increases from the previous year.

Important: You don’t need to reapply to get this increase—it’s automatic.

What Is the CPP Enhancement?

Introduced in 2019, CPP Enhancement is a phased-in program to increase future CPP payments by requiring slightly higher contributions from workers and employers. Over time, this enhancement is expected to boost maximum retirement benefits by up to 50%, assuming full contribution for 40 years.

For example:

- Pre-2019 maximum retirement benefit: ~$1,364/month

- With enhancement (after full career contribution): ~$2,000/month

But to get the full benefit, you need to contribute at the higher rate for 40 years. Even short contributions to the enhanced portion will improve your pension.

Practical Examples

Example 1: OAS 75+ Boost

- John turns 75 on June 10, 2025.

- He’s already receiving OAS.

- His payments go up 10% starting July 2025.

Example 2: CPP Starting at 60

- Anna applies at age 60.

- She gets 64% of the full amount (after 36% reduction).

- If full CPP is $1,300, she receives about $832/month.

Example 3: CPP Starting at 70

- David waits until 70.

- He gets 142% of the standard amount (42% bonus).

- If standard CPP is $1,300, he receives around $1,846/month.

Step-by-Step Guide to Managing Pension Increases

Step 1: Know Your Milestones

- 65 – OAS starts (month after birthday).

- 60–70 – You can start CPP (you choose when).

- 75 – OAS increases by 10% (month after birthday).

Step 2: Mark the Calendar for Inflation Adjustments

- OAS adjusts quarterly.

- CPP adjusts annually in January.

Step 3: Choose When to Start CPP

Ask yourself:

- Do I need the money now?

- Do I expect to live into my 80s or 90s?

- Am I still working?

Step 4: Use Online Tools

- My Service Canada Account lets you view your pension estimates and application status.

- The Canadian Retirement Income Calculator estimates your total income in retirement.

Step 5: Monitor the CPI

CPI numbers are released monthly by Statistics Canada. Pension increases are tied directly to these stats. For example:

- CPI in May 2025: up 1.7% year-over-year.

- Food inflation: 3.3%

- Shelter: 3%

- Gasoline: down 15.5%

$1700 CPP Payments In July 2025; Check Payment Date, Eligibility

$750 + $890 Double CPP Payment in June 2025 – Fact Check Here, Eligibility & Payment Date

CPP and OAS Getting a Raise This June; CRA Reveals Exact Pension Increases

Extra Tips for Maximizing Pension Income

- Consider combining CPP/OAS with private pensions, RRSPs, or TFSAs to meet retirement goals.

- Apply early—processing times can take weeks.

- Keep track of tax implications. OAS is subject to a clawback if your income exceeds about $90,000 (as of 2025).

- Don’t forget GIS (Guaranteed Income Supplement) if your income is low—it can add hundreds of dollars monthly.