Can Artificial Intelligence Help You Save for a Down Payment? Yes—and it’s transforming the way Canadians (and Americans) prepare for homeownership. Whether you’re just starting out or deep into saving, AI tools can automate savings, optimize budgets, and even suggest investments to help you hit your down payment goal faster. In the past, saving for a home meant spreadsheets, complicated financial planning, and sheer willpower. But now? AI-powered tools are stepping in to simplify and personalize the journey. Whether you’re 18 or 48, AI can help you stay on track—without requiring an MBA in finance.

Can Artificial Intelligence Help You Save for a Down Payment?

Artificial Intelligence can absolutely help you save for a down payment. It’s like having a smart financial buddy that watches your habits, nudges you to do better, and makes saving feel automatic. From budget tracking and round-ups to goal-based investing and alerts, AI takes the friction out of reaching your goals.

But remember: AI doesn’t know your dreams, your fears, or your full story. Use it as a tool—not a replacement for your judgment. When paired with real insight and values, AI becomes a powerful partner in building your financial future—especially that first step onto the property ladder.

| Highlight | Fact & Source | Official Link |

|---|---|---|

| Canadians using AI for finance | 33% overall; 55% of Gen Z use AI to manage money | RBC |

| Smart AI saving features | Round-up savings, goal tracking, smart alerts, auto-transfers | BMO |

| AI financial planning tools | Platforms like Conquest help build plans for over 1.5 million Canadians | Barron’s |

| Government AI investment | Canada is investing $2 billion into AI strategy, including $300 million for computing access | Canada.ca |

| Business AI adoption | 12.2% of Canadian companies use AI; over 30% in financial sectors | StatCan |

| Official home savings accounts | First Home Savings Account (FHSA) & Home Buyers’ Plan (HBP) offer tax benefits | Canada Revenue Agency |

What Exactly Is AI in Saving and Investing?

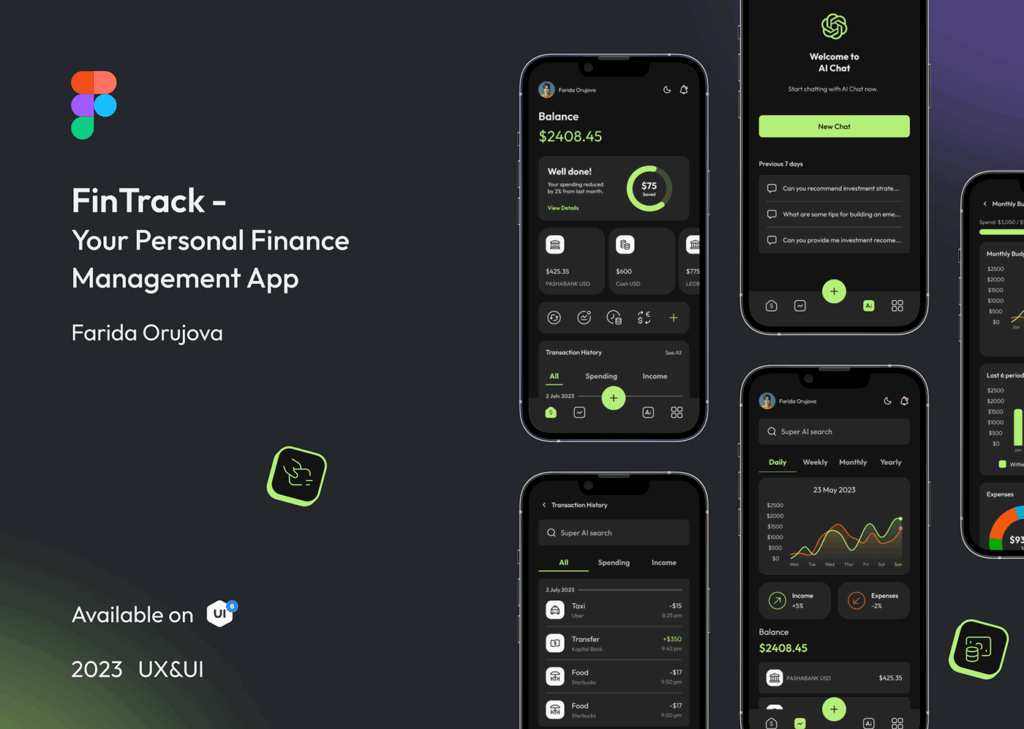

Artificial Intelligence (AI) in personal finance refers to machine-learning-powered tools that assess your financial behavior and help you make smarter money decisions. These tools can analyze spending patterns, offer recommendations, and automate actions like transfers and investments.

Examples include:

- Apps that track your daily coffee and suggest cutting back.

- Tools that automatically invest small amounts into ETFs.

- Bank features that predict your spending and recommend a savings plan.

These aren’t just generic calculators—they learn from your specific behavior and adjust advice accordingly.

Why Artificial Intelligence Help You Save for a Down Payment??

Saving for a down payment isn’t just about discipline. It’s about strategy, consistency, and adapting to change. That’s where AI shines:

Personalized Recommendations

AI tools analyze your income, expenses, and habits. They can:

- Flag when you’re spending more than usual on dining.

- Recommend setting aside an extra $50/month based on income spikes.

- Suggest when it’s better to invest vs. save in cash.

Automated Micro-Saving

Many platforms now use “round-up” features:

- Spend $4.25 on coffee? It rounds to $5 and drops $0.75 into savings.

- These add up—hundreds of dollars per year saved without thinking.

Portfolio Rebalancing

If you’re investing your down payment savings, AI-based robo-advisors:

- Choose a portfolio based on your timeline and risk tolerance.

- Rebalance automatically as markets shift.

- Reduce emotional decision-making during market volatility.

The Canadian Context: Tools and Adoption

AI’s influence on Canadian personal finance is growing rapidly.

- RBC NOMI: An AI-powered assistant that forecasts weekly cash flow and moves extra funds into savings. It helped users save over $1.5 billion since launch.

- Wealthsimple: A Canadian robo-advisor that builds smart portfolios, tracks goals, and lets you name your investment buckets (like “House Fund”).

- Conquest Planning: This AI-driven tool used by advisors personalizes financial roadmaps with real-time variables. It’s backed by RBC and U.S. investors like Goldman Sachs.

- FHSA & HBP: Canadians can combine AI tools with these government programs to turbocharge their savings with tax benefits.

Step-by-Step: How to Use AI to Save for a Down Payment

Step 1: Define the Goal

Decide:

- How much do you need? (e.g., $50,000 for a 20% down payment on a $250,000 home)

- By when? (e.g., in 3 years)

That breaks down to about $1,400/month—doable with the right systems in place.

Step 2: Choose an AI-Powered Tool

Bank-based tools:

- RBC NOMI (auto-saves and forecasts)

- TD MySpend (tracks and categorizes)

- CIBC Insights

Fintech options:

- Wealthsimple (for investing)

- Mint or YNAB (for budgeting)

- KOHO or Mogo (for round-ups and credit insights)

Step 3: Enable Smart Features

Activate:

- Auto-transfers every payday

- Round-ups for every transaction

- AI-generated budget alerts

- Notifications when you’re off-track

Step 4: Consider Investing With AI

Robo-advisors help if your goal is 3+ years away. Example platforms:

- Wealthsimple Invest (Canada)

- Betterment (U.S.)

- Questwealth (Questrade’s robo service)

They’ll ask a few questions, create a portfolio, and automatically rebalance it to keep you on track.

Step 5: Monitor Monthly

AI does the heavy lifting, but you still need to check:

- Are you hitting your targets?

- Did your income change?

- Any new expenses?

Tweak your settings as needed.

Step 6: Get a Human’s Input

Even the best AI doesn’t know if you’re having a baby next year or thinking of switching careers. Talk to a human advisor occasionally to match your tools to your life.

Real Talk: Where AI Helps—and Where It Doesn’t

Where AI Shines:

- Predictable routines (savings, budgeting)

- Low-risk investing with passive income

- Identifying hidden spending

- Sending real-time alerts

Where You Still Need a Brain:

- Making major home buying decisions

- Understanding mortgage products

- Deciding when to lock in rates

- Evaluating emotional impacts of big financial moves

Also, keep in mind AI bias and data privacy. These tools rely on your data—make sure you’re using secure platforms and that you understand how your info is used.

Real Stories from the Field

Amara, 31, Toronto:

“I used NOMI and Wealthsimple side-by-side. I saved $6,000 in 5 months without trying. NOMI caught that I was overspending on subscriptions I never used!”

Carlos, 27, Calgary:

“I didn’t trust AI until I saw how much faster I could save with automated transfers and round-ups. It removed the temptation to spend my extra cash.”

Maya, 42, Vancouver:

“As a single mom, I didn’t have time to manage money. AI tools helped me set and forget my investments—but I still meet with a planner once a quarter.”

Future Trends in AI and Home Savings

- Predictive home pricing: AI can now help forecast regional housing prices based on trends—helpful when timing your down payment.

- AI mortgage advisors: Tools are emerging that help compare mortgage products, including rate negotiations.

- Voice-activated financial coaching: Expect tools like Alexa or Google Home to offer savings advice soon.

- Integrated tax planning: AI is starting to help optimize which accounts to use—like RRSP withdrawals vs. FHSA savings—for max returns and deductions.

Apple Intelligence’s AI Features Shut Out from Meta Apps: What’s Behind the Clash?

Dailyhunt Parent VerSe To Lay Off 350 Employees This Month – Check What It Means!

How AI is Revolutionizing the Classroom: Key Developments in EdTech