Average 401(k) Contribution Rate Revealed: That’s the million-dollar question every working American should be asking. And in 2025, the answer may surprise you. Whether you’re a young professional, a mid-career parent, or approaching retirement, understanding how your 401(k) contributions compare to national averages—and how to improve them—can significantly impact your financial future. This article breaks down everything you need to know in a conversational yet expert tone that makes sense for everyone, from high schoolers to finance pros.

Average 401(k) Contribution Rate Revealed

The average 401(k) contribution rate has reached an all-time high in 2025, with most Americans saving about 14.3% of their salary (employee plus employer contributions). That’s fantastic progress—but don’t stop there. Aim for the golden 15%, avoid common mistakes, and take full advantage of tax strategies, catch-up contributions, and smart investments. With the right plan and consistency, your 401(k) can grow into a million-dollar retirement engine—no matter your age or income level.

| Key Point | Data | Professional Insight |

|---|---|---|

| Average Employee Contribution (Q1 2025) | 9.5% of salary | Near all-time high (Fidelity) |

| Average Employer Match | 4.8% | Typically 50% up to 6% of salary |

| Total Average Contribution Rate | 14.3% | Close to 15% target often recommended by financial planners |

| Ideal Savings Target | 15% total (employee + employer) | Supported by Vanguard, Fidelity, and Investopedia |

| Catch-Up Contributions (2025) | Up to $11,250 | For savers aged 60–63 under SECURE 2.0 |

| Average Retirement Savings (Ages 55–64) | $408,000 | Based on Empower and Vanguard data |

| Roth 401(k) Usage | 16.8% | Growing in popularity, especially among younger savers |

Why Do 401(k) Contribution Rates Matter?

Your 401(k) isn’t just a savings account—it’s a retirement engine fueled by tax benefits, employer contributions, and investment growth. And the earlier you start, the more powerful it becomes thanks to compound interest.

Let’s say you’re 30, earning $60,000 annually, and you contribute 10% of your salary. Your employer kicks in another 5%. In 30 years, with average annual returns of 7%, you could have close to $1.1 million in retirement savings. That’s the power of consistency and compounding.

If you’re not keeping up with national contribution averages or missing out on your employer match, you’re potentially leaving hundreds of thousands of dollars behind.

How Do You Compare to National Averages?

According to Fidelity’s Q1 2025 Retirement Trends Report:

- The average employee contribution to a 401(k) is 9.5% of salary.

- The average employer match is 4.8%, bringing the total savings rate to 14.3%—the highest ever recorded.

- Vanguard’s 2024 report shows a slightly lower average: employee contributions at 7.7%, and total contributions (including employer match) around 11.7%.

These numbers show a clear trend: more Americans are getting serious about retirement. But there’s still room for improvement, especially for those under 40, who tend to contribute less.

Step-by-Step Guide: How to Maximize Your 401(k)

Step 1: Enroll Immediately

The first step is the simplest: sign up. Many employers offer automatic enrollment, but if yours doesn’t, ask HR how to enroll manually. Don’t wait. The earlier you start, the more time your money has to grow.

Step 2: Contribute Enough to Get the Full Employer Match

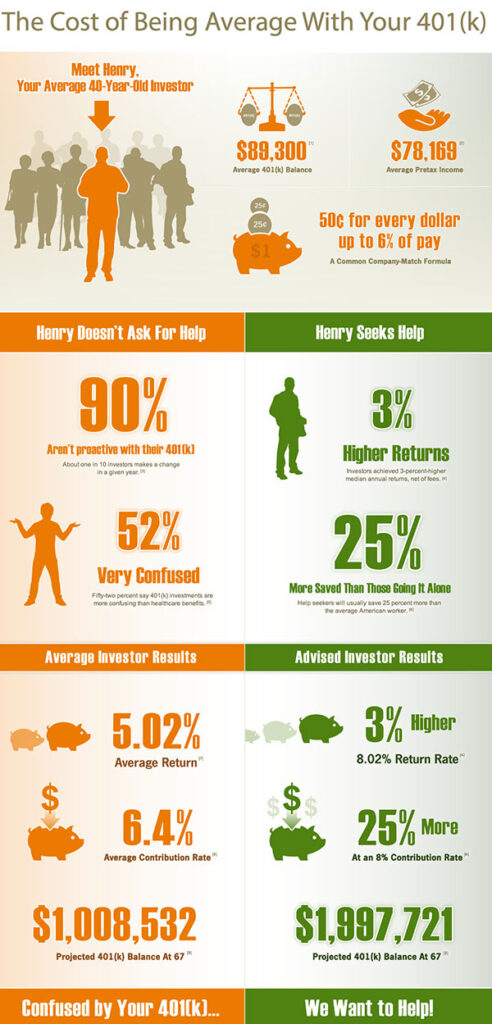

Most companies offer some form of matching contributions—often 50 cents on the dollar up to 6% of your pay. If you’re only contributing 3%, you’re leaving free money on the table.

Always contribute at least enough to receive your employer’s full match. It’s a 100% return on your investment before market growth even kicks in.

Step 3: Aim for a 15% Total Savings Rate

Financial planners recommend saving 10% to 15% of your salary toward retirement. That includes your own contributions and your employer’s match. If you’re just starting out and can’t hit that mark yet, start smaller—say 6%—and increase by 1% every year.

Many plans offer auto-escalation features that bump up your contribution by 1% annually. Use them.

Step 4: Choose the Right Investments

Most 401(k) plans offer a range of investment options:

- Target-date funds: Ideal for beginners. These funds automatically adjust asset allocation based on your retirement year.

- Index funds: Great for low fees and steady growth. Look for ones tracking the S&P 500 or total stock market.

- Bond funds: Useful as you near retirement to reduce volatility.

Watch out for high fees—known as expense ratios. Over decades, even a 1% fee can reduce your retirement balance by six figures.

Step 5: Rebalance Your Portfolio Every Year

Markets change, and so should your investment mix. If one fund grows faster than others, your portfolio could become too aggressive or too conservative. Most plans allow automatic rebalancing, which adjusts your investments annually to keep them aligned with your goals.

Step 6: Make Catch-Up Contributions If You’re Over 50

Starting in 2025, workers aged 50 and up can contribute an extra $7,500 to their 401(k), bringing the total annual limit to $30,750. If you’re between 60–63, that number can climb as high as $11,250 extra, thanks to changes under the SECURE 2.0 Act.

Real-Life Example: Two Savers, Two Outcomes

Erica, 28, contributes 10% of her $55,000 salary and gets a 5% match. She starts at her first job and never stops saving.

Mike, 28, waits until age 38 to start saving, contributing the same 10% but losing out on 10 years of growth.

By age 65, Erica has over $1.3 million, while Mike has just under $800,000—even though they contributed the same amount yearly. The difference? Time.

Common 401(k) Mistakes to Avoid

| Mistake | Why It’s a Problem | How to Fix It |

|---|---|---|

| Not contributing enough for the match | Misses out on free money | Always meet your match |

| Early withdrawals | 10% penalty + taxes | Only use for true emergencies |

| High-fee funds | Eats into returns | Choose low-cost index funds |

| Forgetting old accounts | Disconnected savings | Roll over to new employer or IRA |

| No investment strategy | Misses growth potential | Use target-date or diversified funds |

Understanding Roth vs Traditional Average 401(k) Contribution Rate Revealed

| Feature | Traditional 401(k) | Roth 401(k) |

|---|---|---|

| Taxes | Pre-tax now, taxed later | Taxed now, tax-free later |

| Ideal For | Higher income today | Lower income today, expected to rise |

| Withdrawals | Taxed at ordinary rate | Tax-free after age 59½ and 5 years |

| RMDs (Required Minimum Distributions) | Yes, at age 73 | Yes, unless rolled into Roth IRA |

If you’re young or in a lower tax bracket now, the Roth 401(k) may be the better bet. If you’re in your peak earning years, a Traditional 401(k) may offer more immediate tax savings.

Advice for Different Career Paths

Freelancers and Self-Employed

Use a Solo 401(k). You can contribute as both employee and employer, allowing for high contribution limits. It’s ideal for independent contractors or side-hustlers.

Federal Workers

You’re likely enrolled in the Thrift Savings Plan (TSP). It has some of the lowest fees around and a solid range of index and lifecycle funds.

Teachers and Nonprofits

403(b) plans work similarly to 401(k)s but can have different investment options and fees. Always compare plan providers and consider opening a Roth IRA for more flexibility.

Your 401(k) Crypto Dreams May Be Over — Here’s Why the Labor Department Pulled the Plug

Americans Are Saving More Than Ever for Retirement — So Why Are 401(k) Balances Shrinking?

Her Boyfriend Says 401(k)s Are a Scam; Dave Ramsey’s Response Left Her Speechless