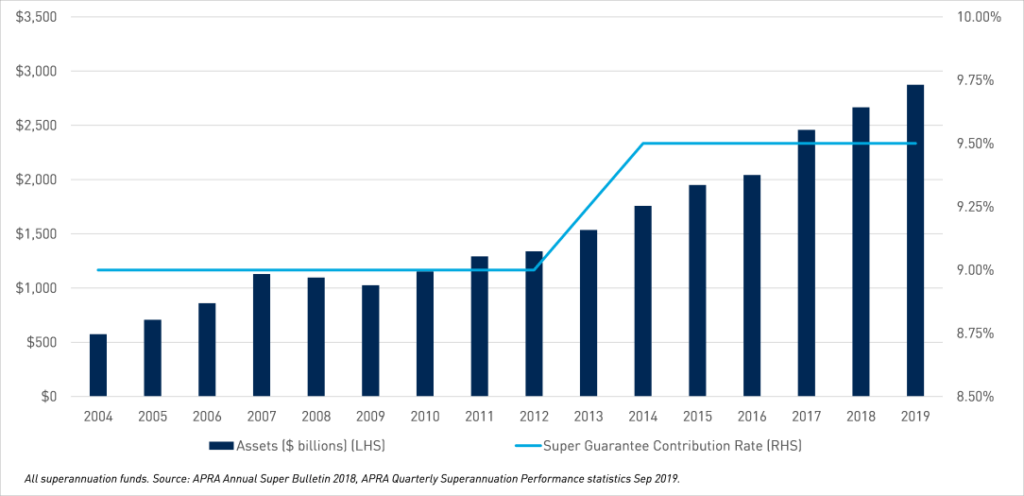

Super Guarantee Hits 12 Percent: Australia’s superannuation system is undergoing a crucial transformation. Starting July 1, 2025, the Super Guarantee (SG), which is the percentage of an employee’s wages that employers must contribute to their superannuation fund, will rise to 12%. This marks the final increase in a phased plan that has been underway for the last decade. The goal? To help Australians save more for their retirement, ensuring they are financially secure in their later years. In this article, we’ll break down everything you need to know about this change, why it matters, how it impacts different people, and what steps you can take to ensure that your retirement savings are maximized.

Super Guarantee Hits 12 Percent

The increase in the Super Guarantee to 12% is a major change designed to secure Australia’s retirement future. For workers, this means more money in your super, especially for younger workers who have time on their side. To make the most of these changes, consider strategies like salary sacrifice, consolidating super accounts, and tracking your contributions regularly. If you’re unsure about how to proceed, consulting with a financial advisor could be a wise step.

| Key Information | Details |

|---|---|

| New SG Rate | 12% (effective from July 1, 2025) |

| Current SG Rate | 11.5% (until June 30, 2025) |

| Estimated Retirement Boost | $125,000 more for a 30-year-old on $100,000 salary |

| Median Income Retirement Estimate | $610,000 for a $75,000 salary |

| Salary Packaging Impact | Increased SG may lower take-home pay |

| Employer Compliance | Employers must comply with the new rate from July 2025 |

| Future Changes | “Payday Super” starting July 2026 for more frequent payments |

What is the Super Guarantee?

The Super Guarantee (SG) is the mandatory percentage of an employee’s wage that employers must pay into their superannuation account. Think of it like a retirement savings plan: you contribute part of your salary to it, and your employer adds to it. The idea is that when you retire, you’ll have enough money saved up to support yourself.

The current SG rate is 11.5%, but from July 1, 2025, it will increase to 12%. While this may seem like a small jump, the compound interest over time will have a significant impact, especially for younger workers who are still many years away from retirement.

Why the Super Guarantee Hits 12 Percent?

The 12% SG rate means more money flowing into your superannuation fund. If you’re young, this is even more important, as it gives your savings more time to compound. Compound interest is the process where the interest on your super balance earns interest itself, creating exponential growth over time.

For example:

- A 30-year-old earning $100,000 a year will see $11,500 annually in contributions under the current SG rate. With the 12% rate, that number increases by $500 each year. Over 35 years, that extra $500 per year adds up to $125,000.

This additional amount could make a world of difference when you’re looking to retire comfortably.

The Big Picture: How Does the SG Increase Affect Your Retirement?

Whether you’re 25 or 50, the increase in SG contributions will have an impact on your retirement savings. The more you save now, the better off you’ll be later. Here’s how the increase affects various scenarios:

For a 30-Year-Old on $75,000:

- Before the increase: With an 11.5% contribution, they would receive $8,625 a year in super contributions.

- After the increase: The 12% rate boosts this to $9,000 a year. Over 35 years, that could mean an extra $125,000 in their super by the time they retire.

For a Median-Income Worker:

If you earn around the median salary of $75,000, the increase in SG contributions will help you retire with approximately $610,000. This amount surpasses the $595,000 deemed necessary for a comfortable retirement.

Real-World Example: What Does It Mean for Your Superannuation?

If you’re already making voluntary contributions or using salary sacrifice, the new SG rate will complement your efforts to build your super. Combining salary sacrifice and the increased SG could significantly boost your retirement fund.

Impact on Different Demographics

1. Younger Workers:

Young people have the most to gain from the SG increase. The earlier you start saving, the more you’ll benefit from compounding growth. For young workers, a higher SG rate means that their super balance can grow exponentially over the course of their careers.

2. Older Workers:

For older workers nearing retirement, the 12% SG rate will still make a difference, although they may not have the luxury of as many years of compounding. However, any extra money in the super will still help to boost their final retirement balance.

3. Women:

Women tend to retire with less super than men due to factors such as career breaks for child-rearing or lower pay. The SG increase can be especially impactful for women, as it will increase the funds they have at their disposal in retirement.

How to Maximize Your Retirement Savings?

While the SG rate increase is a great step toward building a solid retirement, there are additional strategies you can employ to maximize your superannuation savings:

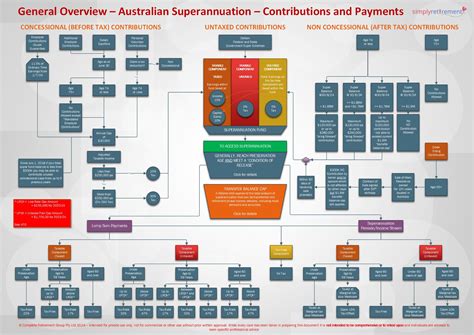

1. Salary Sacrifice:

You can choose to sacrifice part of your pre-tax salary to make additional contributions to your super. This will lower your taxable income and boost your super balance. Just remember that the concessional contributions cap is $30,000, so be mindful of exceeding this limit.

2. Voluntary Contributions:

In addition to the compulsory SG contributions, you can make voluntary after-tax contributions to your super. This is a great way to boost your balance, particularly if you receive a bonus or windfall.

3. Consolidate Your Super Funds:

Many people have multiple super funds from different employers. This can lead to unnecessary fees. By consolidating your super accounts into one, you can save on fees and simplify your retirement savings strategy.

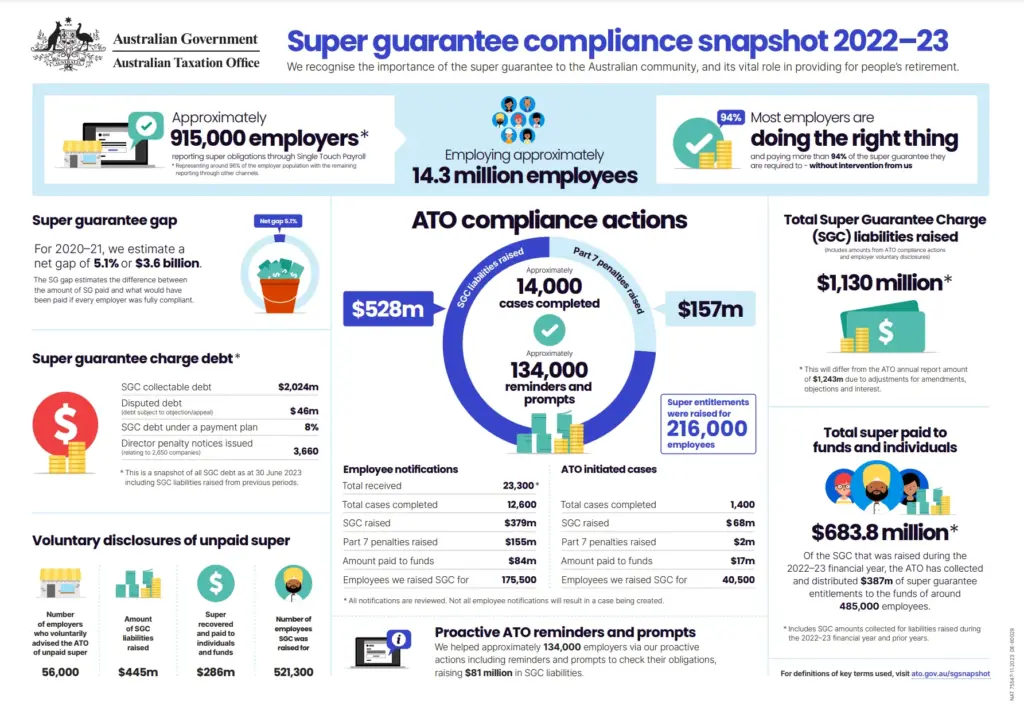

Tracking Your Superannuation Contributions

As an employee, you have the right to ensure that your employer is paying your super contributions correctly. If you think your employer isn’t contributing enough or hasn’t made contributions for a period, you should:

- Check your super fund statements regularly.

- Use the ATO’s online tools to track your super contributions.

- Speak to your employer if there’s a discrepancy.

You can also consolidate your superannuation accounts by transferring multiple funds into a single account to reduce fees.

Salary Packaging and the SG Increase: What You Need to Know

Some workers opt for salary packaging, which means part of their salary is set aside for superannuation contributions. If you’re on a salary package, the increased SG rate could mean that your take-home pay might reduce unless your package is adjusted to account for the higher contribution. If you’re in this situation, it’s essential to discuss your options with your employer to avoid unexpected reductions in your paycheck.

$750 One-Time Utility Rebate for Australian Pensioners—Claim Yours Before It’s Gone!

$400 Centrelink Cost of Living Payment Coming in 2025; Check Eligibility and Payment Date

Centrelink Youth Allowance Review 2025 — New Age Rules Could Change Your Benefits!