One High School Class Could Drastically Boost Your Financial Future: When you think about high school, what comes to mind? Probably a mix of sports, friends, homework, and the occasional life lesson from a teacher. But what if one class—just one semester—could set you up for a lifetime of financial success? Sound too good to be true? Well, experts are saying that it’s not only possible, but it could be your ticket to financial security. Welcome to the world of financial literacy education, a class that, according to studies, could make a huge difference in your financial future.

Many of us were never taught how to budget properly, what credit scores really mean, or how to start saving for retirement. It’s no wonder financial stress is one of the leading causes of anxiety for adults. But what if you could change all of that by taking a single class in high school? Personal finance courses—designed to teach students how to manage money—could not only change your perspective on money but also put you on a path toward financial independence that many adults still struggle to reach. In this article, we’re going to dive deep into why taking a high school personal finance class can drastically boost your financial future, break down what you’ll learn, and provide real-world examples of how this knowledge can shape your life. Whether you’re a student looking to understand why this class is worth it, or a parent wanting to give your child a head start, we’ve got you covered.

One High School Class Could Drastically Boost Your Financial Future

A personal finance class might just be the most important thing you can take in high school. With the potential to boost your wealth by up to $100,000 over your lifetime, the knowledge you gain will stay with you for years. Whether you’re managing student loans, saving for a house, or planning for retirement, the lessons from this class will empower you to make smarter, more confident financial decisions. Don’t miss out on an opportunity that could change your financial future forever!

| Key Takeaways | Details |

|---|---|

| Lifetime Impact | Financial education can increase wealth by up to $100,000 over a lifetime. |

| What You Learn | Key skills include budgeting, saving, investing, and understanding credit. |

| Benefits for Adults | Financial literacy leads to better credit scores, higher savings rates, and less debt. |

| Real-World Application | Students have been able to start investment accounts, apply for scholarships, and more. |

| Widespread Adoption | 36 U.S. states require some form of financial education for graduation. |

| Organizations Supporting Education | Resources from Next Gen Personal Finance and Jump$tart Coalition are available for schools. |

Why This Class Matters: Understanding the Financial Landscape

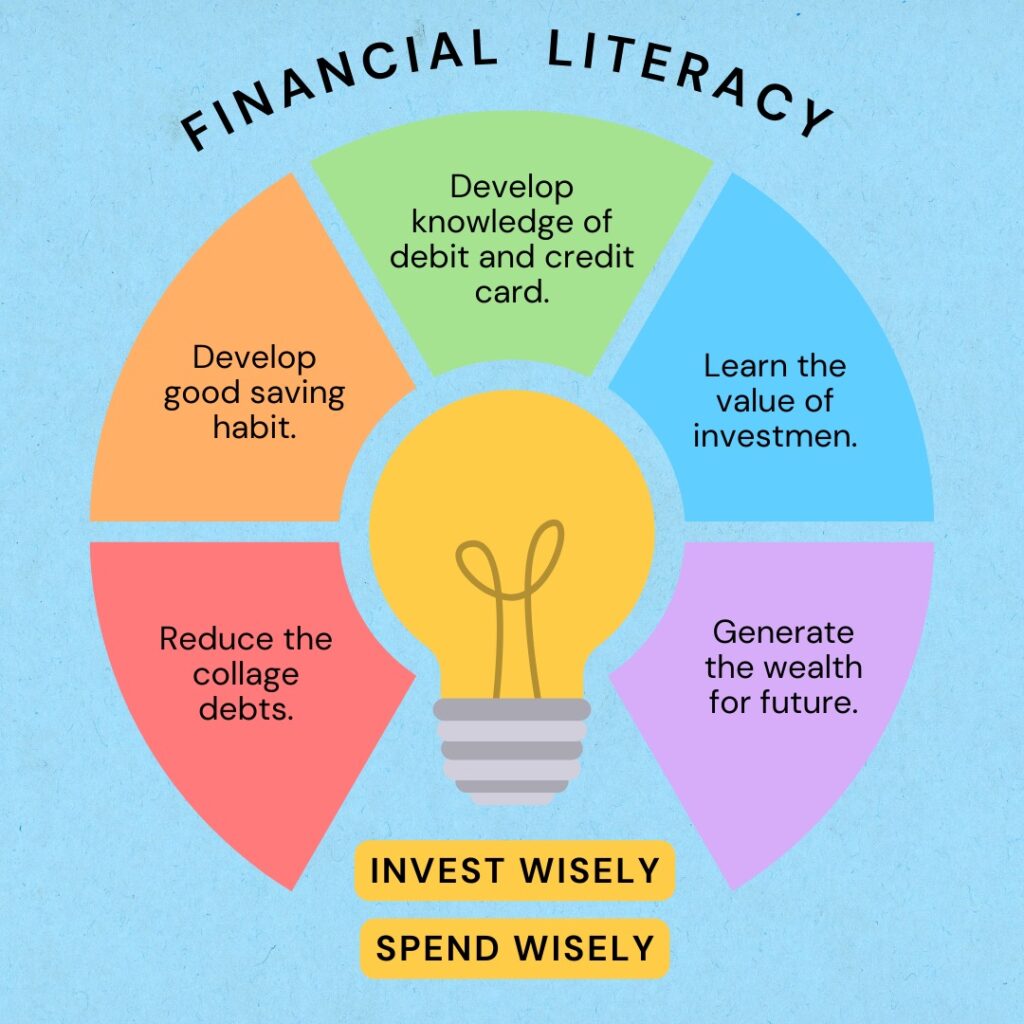

Now, you might be wondering: What exactly will you learn in a high school personal finance class? Think about all the financial challenges people face in their adult life. Whether it’s figuring out how to save for a house, choosing the right credit card, or understanding how to invest your money, personal finance education arms you with the tools to tackle these challenges head-on.

When you take a financial literacy class in high school, you’re not just learning about money—you’re learning how to make smart, informed decisions that will shape your life. It’s about building a foundation for financial success that you can stand on for years to come.

What Will You Learn in One High School Class Could Drastically Boost Your Financial Future?

A solid personal finance course will cover the following:

- Budgeting: Learning how to track and manage your income versus expenses is one of the most important lessons you’ll ever learn. By knowing how to budget, you avoid falling into debt and can start saving for your future.

- Saving and Investing: From building an emergency fund to understanding stocks, bonds, and mutual funds, this part of the class teaches you how to make your money work for you over time.

- Understanding Credit: Knowing how credit works can save you hundreds (or even thousands) of dollars in the long run. You’ll learn about credit cards, loans, and how to maintain a good credit score—a crucial aspect of securing future financial opportunities like buying a car or a house.

- Debt Management: Debt doesn’t have to be a lifelong burden. A personal finance class will teach you how to manage student loans, credit card balances, and other debts in a way that minimizes interest and maximizes repayment.

- Retirement Planning: Even though you might be far from retirement, learning how to start saving for it early is one of the best ways to ensure you have financial security when the time comes.

The Impact of Financial Literacy Education on Your Life

You might be thinking, “Okay, this all sounds good, but does it really matter?” Let’s talk numbers. According to a study by Next Gen Personal Finance and Tyton Partners, students who took a personal finance class in high school had the potential to increase their lifetime wealth by up to $100,000. Yes, you read that right—a single class could result in a financial boost that’s far more significant than you might expect.

The Proof Is in the Numbers

Studies have shown that individuals who took personal finance classes are more likely to save, invest, and avoid credit card debt. For example, according to the Jump$tart Coalition, students who received financial education in high school are more likely to open investment accounts, start a savings plan, and even seek out scholarships for college. These actions—small as they might seem in the moment—add up over time and lead to substantial financial benefits.

In fact, people who have a basic understanding of money often make better financial decisions in their everyday lives. They’re more likely to keep track of their spending, compare prices, and avoid debt traps.

Real-World Application: How It Changes Lives

Let’s take a look at a few real-world examples of how financial literacy education can shape the future:

- Opening an Investment Account: Many high school graduates who take a financial literacy class start an Individual Retirement Account (IRA) or open a brokerage account as soon as they get their first job. They understand the importance of compounding interest, and as a result, their money starts growing faster than they realize.

- Choosing the Right Bank: Understanding how banking works allows students to make informed decisions about where to store their money. They might switch to a low-fee bank or invest in higher-interest accounts, which can lead to more savings over time.

- Making Informed Decisions: In one instance, a student who took a financial literacy class was able to avoid taking out an expensive car loan and opted for a used car instead. This decision saved them thousands of dollars in interest and kept them out of debt.

Widespread Financial Literacy Education: A Growing Trend

In 2025, a record 36 U.S. states now require some form of financial literacy education for high school graduation. The push for these classes has grown as more people recognize the importance of teaching students how to manage their money at an early age. Financial literacy isn’t just a nice-to-have skill anymore; it’s a necessity for navigating adulthood successfully.

Organizations like Next Gen Personal Finance and the Jump$tart Coalition provide free resources to schools across the country, ensuring that financial education is accessible for all students, regardless of background.

The Role of Technology in Financial Education

Today, technology is changing how we learn, and personal finance education is no different. Apps like Mint, YNAB (You Need A Budget), and Acorns allow students to track their spending, set up budgets, and start investing—practices that were once reserved for adults. These tools not only make learning fun but also help students put their knowledge into practice immediately.

Financial Education in a Digital World

The digital age has changed the way we manage money. Cryptocurrency, online shopping, and digital banking are all parts of the modern financial landscape. Financial literacy education helps students understand the risks and opportunities associated with these digital tools, preparing them to navigate the future of finance with confidence.

Challenges to Implementing Financial Literacy Education

While the benefits are clear, there are some challenges in providing financial literacy education. Not every school has the budget for dedicated personal finance instructors, and some may lack the resources to implement these lessons effectively. However, organizations like Next Gen Personal Finance are working to provide free, comprehensive curricula that schools can use to integrate financial education without additional costs.

Feeling the Squeeze? 10 Smart Financial Moves to Survive Economic Uncertainty

Terrified of Going Broke in Retirement? These 9 Expert Tips Can Save Your Future

Say Goodbye to Budget Stress—This Viral Ring Trick Is Flipping Financial Education on Its Head