Japan’s Debt Is Shrinking: Japan has long been a country of immense global influence, both economically and culturally. For years, Japan’s debt has been a looming concern, drawing the attention of economists and policymakers worldwide. Recently, however, a surprising shift has occurred: Japan’s national debt appears to be shrinking. While this may sound like a sign of recovery, many experts warn that the real economic trouble may just be beginning. The challenge lies not in the size of the debt, but in the growing costs of servicing it, a shrinking workforce, and complex demographic challenges.

In this article, we’ll explore the situation in Japan, why experts are sounding the alarm, and what this could mean for both Japan and the global economy. We’ll break down the issues into manageable pieces and explain the technical details in a way that anyone can understand. Whether you’re a professional in the field of economics or just someone curious about global financial trends, this guide will help you make sense of Japan’s shifting economic landscape.

Japan’s Debt Is Shrinking

Japan’s national debt may be shrinking, but the country faces rising borrowing costs, a shrinking workforce, and other economic pressures. The Bank of Japan’s policy changes and global economic trends only add to the uncertainty. For Japan to navigate these turbulent waters, it will need a combination of smart economic reforms, investments in technology, and a shift toward sustainable fiscal policies. This complex issue requires not only Japan’s internal focus but also global cooperation and understanding, especially in an interconnected world. Whether you’re a professional economist or a curious observer, keeping an eye on Japan’s economic developments is essential, as they could have far-reaching consequences for the global economy.

| Key Point | Data/Information |

|---|---|

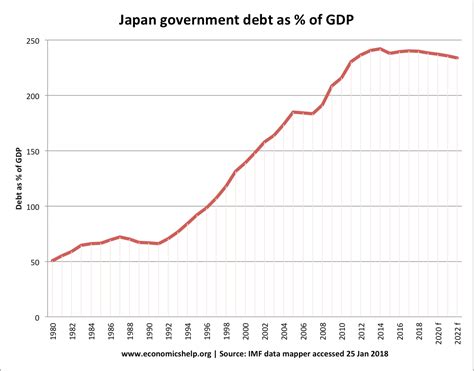

| Debt-to-GDP Ratio | 250% in 2025, slightly reduced |

| Economic Contraction | 0.7% decline in Q1 2025 |

| Aging Population | Declining working-age population, rising elderly |

| Interest Rates & Borrowing Costs | 30-year bond yields over 3% |

| Bank of Japan’s Policy Change | Gradual reduction in bond purchases |

The Current State of Japan’s Debt

For years, Japan’s national debt has been one of the highest in the world, often surpassing 250% of its GDP. This means that Japan owes more than two and a half times the value of everything it produces in a year. It’s a staggering figure, and it has raised concerns about the country’s ability to manage this massive debt. However, in recent times, Japan’s debt-to-GDP ratio has shown slight improvement. This has happened thanks to factors like modest economic growth, inflation, and even changes in government policies. On the surface, it might seem like Japan is on the mend.

What Does It Mean for the Average Citizen?

Imagine you owe a lot of money—more than you can earn in a year. Now, let’s say you manage to pay off a little of that debt, but it’s still a huge burden on you. That’s kind of the situation Japan is in right now. While there’s a bit of relief in seeing that the debt ratio has reduced, the country still faces serious challenges in paying off what it owes. As borrowing costs rise and the economy slows, Japan’s debt problem isn’t going away anytime soon.

What’s worse, a significant chunk of the government’s revenue is now being spent just to cover interest payments. The government is essentially using money to pay off money, with interest rates steadily climbing. The idea of tackling Japan’s debt has been further complicated by the need for spending on social programs aimed at an aging population. More people are retiring and drawing pensions, while fewer young workers are entering the job market.

The most concerning part of this equation is the cost of debt servicing. While debt may appear to shrink in terms of GDP, the reality is that servicing the debt is becoming more expensive, and it’s likely to be one of Japan’s top economic challenges in the coming years.

Japan’s Debt Is Shrinking

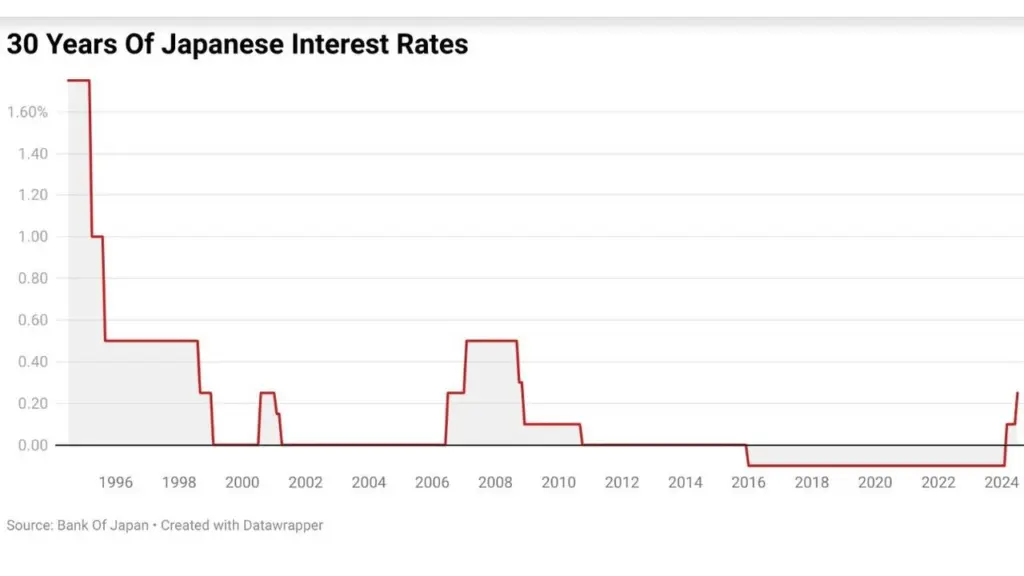

One of the biggest issues Japan faces is the cost of borrowing. Japan’s government has been able to keep borrowing costs relatively low for many years. However, in recent months, interest rates have started climbing. For instance, the yield on Japan’s 30-year government bonds recently surged to over 3%. This might not sound like a lot, but when you’re talking about trillions of yen in debt, those extra percentage points mean a lot.

The problem here is that Japan’s debt isn’t just static—it grows over time due to the cost of interest. So, as borrowing costs rise, Japan has to spend more just to keep its debt manageable, which strains the country’s finances even further. This could ultimately lead to higher taxes, reduced government services, or other austerity measures in the future.

Japan has been able to borrow at low rates for a long time because of its reputation for stability and the fact that most of its debt is held domestically. However, if interest rates continue to rise, the government might find it increasingly difficult to manage this debt without making tough decisions, such as cutting vital services or raising taxes—moves that could exacerbate the country’s economic challenges.

The Global Ripple Effect

Japan’s debt situation doesn’t just have national implications. Being the third-largest economy in the world, Japan’s financial stability—or instability—affects global markets. If Japan struggles to meet its debt obligations, investors may lose confidence in Japanese bonds, which could lead to market volatility. A lack of confidence could also affect other Asian economies, leading to ripple effects across global markets. Additionally, Japan’s large-scale bond holdings in foreign markets mean that a shift in Japanese capital could tighten global liquidity.

For businesses and investors, these changes in Japan’s debt situation could lead to higher borrowing costs worldwide. This is particularly relevant in an interconnected world where global markets often react to shifts in major economies.

Key Causes of Economic Trouble: Demographic Challenges

While Japan’s debt is certainly a big issue, it’s not the only one the country faces. One of the underlying problems is Japan’s aging population. Japan is one of the fastest-aging countries in the world, with a growing number of elderly citizens and a shrinking workforce. This demographic shift has huge implications for the economy.

Japan’s working-age population has been steadily declining for years. The country’s birthrate is well below the replacement rate, and as a result, the population is aging rapidly. As people live longer, the proportion of elderly individuals is expected to grow significantly in the coming decades. This puts an even greater strain on Japan’s already overstretched social security system, as more and more people retire and require pension payments and healthcare.

What Does This Mean for Japan?

An aging population means fewer people are working, which means less tax revenue for the government. At the same time, the demand for healthcare, social services, and retirement benefits is increasing as the elderly population grows. This creates a perfect storm: more government spending on services for the elderly, but less money coming in from taxes because fewer people are working.

Japan has long struggled with its low birth rate, and despite efforts to encourage more births, these measures have not been sufficient to reverse the trend. Immigration, which could provide a solution by bolstering the working-age population, remains politically controversial in Japan, limiting its potential impact.

This situation has forced Japan to rely more on debt to fund its growing social security costs, but as we’ve seen, the rising interest rates make this more expensive. Over time, the situation could become unsustainable.

The Bank of Japan’s Policy Adjustments

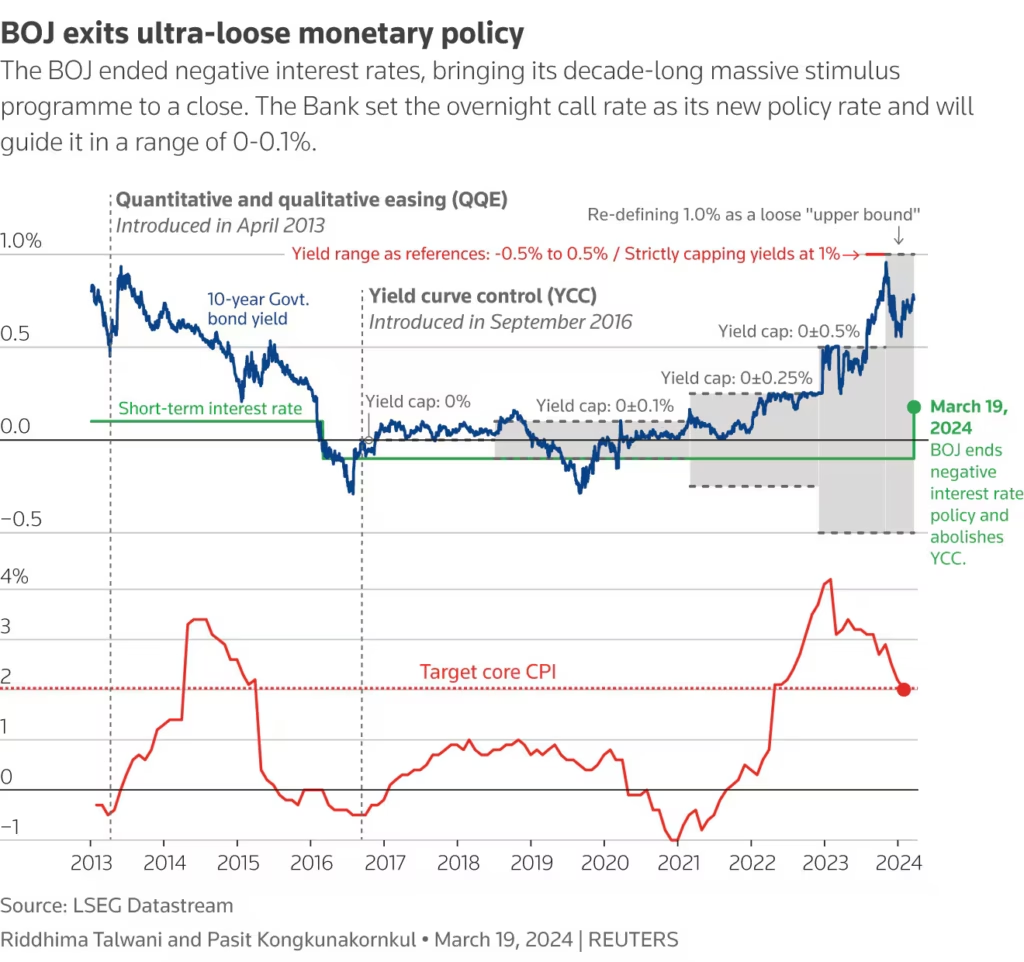

In response to these growing economic pressures, the Bank of Japan (BOJ) has been adjusting its monetary policies. For years, the BOJ kept interest rates at rock-bottom levels to stimulate economic activity and keep the country’s debt costs low. However, with inflation starting to creep up and global interest rates rising, the BOJ is gradually reducing its bond purchases, a process known as quantitative tightening.

What Does Quantitative Tightening Mean?

Quantitative tightening is essentially the opposite of quantitative easing (QE). While QE involves central banks buying bonds to inject money into the economy, quantitative tightening is when central banks sell off those bonds to take money out of the economy. The goal is to slow down inflation and bring interest rates back to more normal levels. However, this also means that Japan will face higher borrowing costs, and the government may struggle to find enough buyers for its bonds.

Japan is essentially trying to normalize its monetary policy after years of ultra-loose policies. While the move towards tightening may help control inflation, it comes with the risk of exacerbating Japan’s fiscal burden and making it harder for the government to finance its debt.

Potential Solutions and Long-Term Strategies

Japan needs a multifaceted approach to tackle these challenges. First and foremost, the government must focus on fiscal reforms to ensure that its debt remains manageable. This could include finding ways to reduce public spending, especially on social services, while still ensuring that the aging population is supported.

Another critical element will be boosting labor force participation. This could be achieved by encouraging greater involvement from women and the elderly in the workforce, as well as making Japan a more attractive destination for foreign workers.

Technological advancements will also play a huge role. Japan has long been a leader in robotics, automation, and AI. Leveraging these technologies could help mitigate the impacts of a shrinking labor force and support economic growth.

Finally, Japan must focus on innovation and investment in new industries, such as green energy and digital infrastructure. By diversifying its economy, Japan can reduce its reliance on debt and build a more resilient future.

International Cooperation and Lessons for Other Nations

While Japan’s specific issues may seem unique, they offer valuable lessons for other countries facing similar challenges. Aging populations and high national debt are problems that many developed nations will face in the coming decades. Japan’s experience offers insights into how countries can manage these issues, including through careful monetary policy, demographic adjustments, and innovation-driven economic strategies.

Countries facing similar demographic challenges could look to Japan for lessons in coping with these shifts. The importance of balancing debt management, social services, and economic growth is something that will become more and more relevant for global leaders in the years ahead.

How to Graduate Debt-Free: Proven Tips to Slash College Costs Before It’s Too Late

Americans Are Saving More Than Ever for Retirement — So Why Are 401(k) Balances Shrinking?

It’s Official: Japan’s New Zero-Emission Car Could Make Gas-Powered Vehicles Obsolete