Medicare 2025: When it comes to healthcare in the United States, Medicare is one of the most vital programs available, especially for older adults. But, as with any insurance program, navigating the details of what’s covered and how much you’ll have to pay can be confusing, particularly when it comes to extended hospital stays. So, you might be wondering: how much will you really pay for a hospital stay that lasts over 90 days under Medicare in 2025? In this article, we’ll break down the costs associated with long hospital stays under Medicare, specifically for stays lasting longer than 90 days, and give you some practical advice on how to manage those costs. We’ll also explore the ins and outs of Medicare Part A, how it works, what’s covered, and where the costs can start to add up. Whether you’re planning for your own hospital stay or helping a loved one prepare, this guide will make the numbers clearer and provide valuable tips for saving money.

Medicare 2025

Navigating Medicare costs for extended hospital stays in 2025 can be overwhelming, especially when the bills start to add up. By understanding how Medicare Part A works, knowing how much you’ll pay for a hospital stay longer than 90 days, and exploring ways to reduce out-of-pocket expenses, you can prepare yourself for the financial realities of extended hospital care. Remember, it’s all about planning ahead. Whether it’s using lifetime reserve days wisely or considering Medigap insurance, being proactive will help you manage the costs and avoid surprises down the road.

| Topic | Details |

|---|---|

| Medicare Part A Deductible | $1,676 per benefit period in 2025. |

| Hospital Stays (Days 1–60) | $0 per day after the deductible. |

| Hospital Stays (Days 61–90) | $419 per day. |

| Hospital Stays (Days 91–150) | $838 per day (using lifetime reserve days). |

| Cost Beyond 150 Days | All costs are your responsibility. |

| Medicare Part B Premium | $185 per month in 2025. |

| Medicare Part D Average Premium | $36.78 per month in 2025. |

| Lifetime Reserve Days | 60 days, after which you pay all costs. |

Understanding Medicare 2025 Part A and Hospital Stays

Medicare is a federal health insurance program primarily for people age 65 or older, though younger individuals with disabilities can qualify as well. Part A of Medicare, also known as Hospital Insurance, helps cover inpatient care in hospitals, skilled nursing facilities, hospice care, and some home health care.

If you’re admitted to the hospital for an extended period, understanding how Part A works can save you from unexpected bills. While it covers a lot, there are still out-of-pocket costs that you’ll need to be prepared for. In 2025, the first thing to know is that you’ll have a deductible.

The Medicare Part A Deductible

In 2025, the deductible for Medicare Part A is $1,676 per benefit period. This means before Medicare starts paying for your hospital stay, you’ll need to pay this amount out of pocket. This deductible covers your first 60 days in the hospital. Keep in mind that a “benefit period” starts the day you’re admitted to the hospital and ends when you’ve been out of the hospital for 60 consecutive days. If you’re readmitted before those 60 days are up, you’ll need to pay another deductible.

The Cost of Hospital Stays Over 90 Days

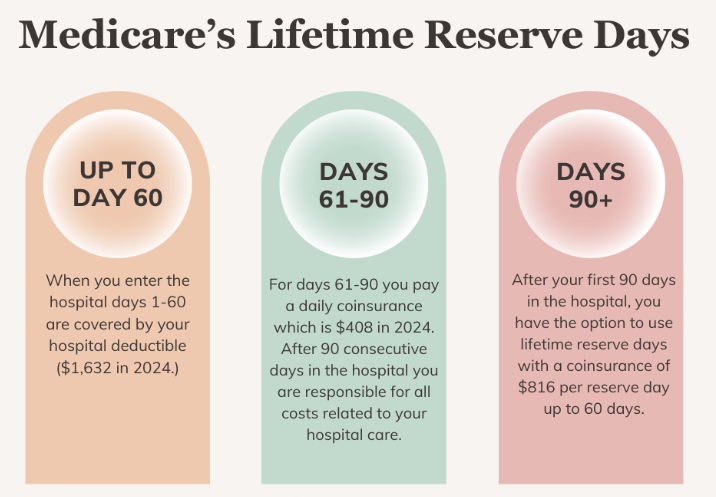

When you’re in the hospital longer than 60 days, the costs begin to rise. Let’s break this down:

- Days 1 to 60: As mentioned, Medicare Part A covers the costs after you pay your $1,676 deductible. That means for the first 60 days, you’re looking at no additional charges.

- Days 61 to 90: After day 60, you will pay $419 per day for each additional day in the hospital. While Medicare still covers a portion of the costs, you’re now responsible for a chunk of the daily expenses. This is where things can start to get pricey, especially if you need to stay in the hospital for a long time.

- Days 91 to 150: Medicare gives you 60 lifetime reserve days, which can only be used once during your lifetime. After day 90, if you continue to stay in the hospital, Medicare will pay most of the costs, but you’ll have to cover $838 per day. Once your lifetime reserve days are used up, you’re on your own for covering the costs.

- Beyond 150 Days: If your stay extends past 150 days, Medicare doesn’t cover any costs at all. You’ll be responsible for the full amount of the hospital bill, which can get extremely expensive.

Why Costs Add Up: Real-Life Example

Let’s look at an example to illustrate just how quickly the costs can stack up if you’re in the hospital for an extended period.

Let’s say you need a 120-day hospital stay in 2025:

- First 60 Days: Your out-of-pocket cost is the deductible of $1,676. No daily fees during this time.

- Days 61–90: For 30 days, you’ll pay $419/day, totaling $12,570.

- Days 91–120: For the remaining 30 days, you’ll pay $838/day, totaling $25,140.

So, for a 120-day hospital stay, you could be looking at $39,386 in out-of-pocket costs.

The Impact of Extended Hospital Stays on Long-Term Health Care Costs

It’s important to understand that a prolonged hospital stay doesn’t just involve the daily room charges. The overall cost of an extended hospital stay often includes additional treatments, medical procedures, and follow-up care, such as physical therapy, medication, or visits from specialists. This can quickly escalate, especially if your condition requires special attention or if there are complications during your stay.

For many people, the cost of a long hospital stay can lead to financial hardship, particularly if you have limited income or don’t have supplemental insurance like a Medigap or Medicare Advantage plan. In some cases, patients may require post-hospital care in a skilled nursing facility (SNF) to continue their recovery. While Medicare Part A can cover up to 100 days of skilled nursing care, after day 20, you’ll be responsible for a daily co-pay, which increases after day 100.

Managing Hospital Stay Costs: Practical Advice

Long hospital stays are financially challenging, but there are strategies you can use to help manage these expenses:

- Use Your Lifetime Reserve Days Wisely: You only get 60 lifetime reserve days, so make sure you’re using them for the longest hospital stays you can. Try to get out of the hospital before you hit the 91-day mark, if possible. If you use your lifetime reserve days early, you may face significant costs later in the benefit period.

- Consider Medicare Advantage Plans: Medicare Advantage (Part C) plans often offer extra benefits, like out-of-pocket maximums, that help limit your hospital stay costs. These plans typically combine Parts A and B and may include extra coverage for things like vision, dental, and hearing.

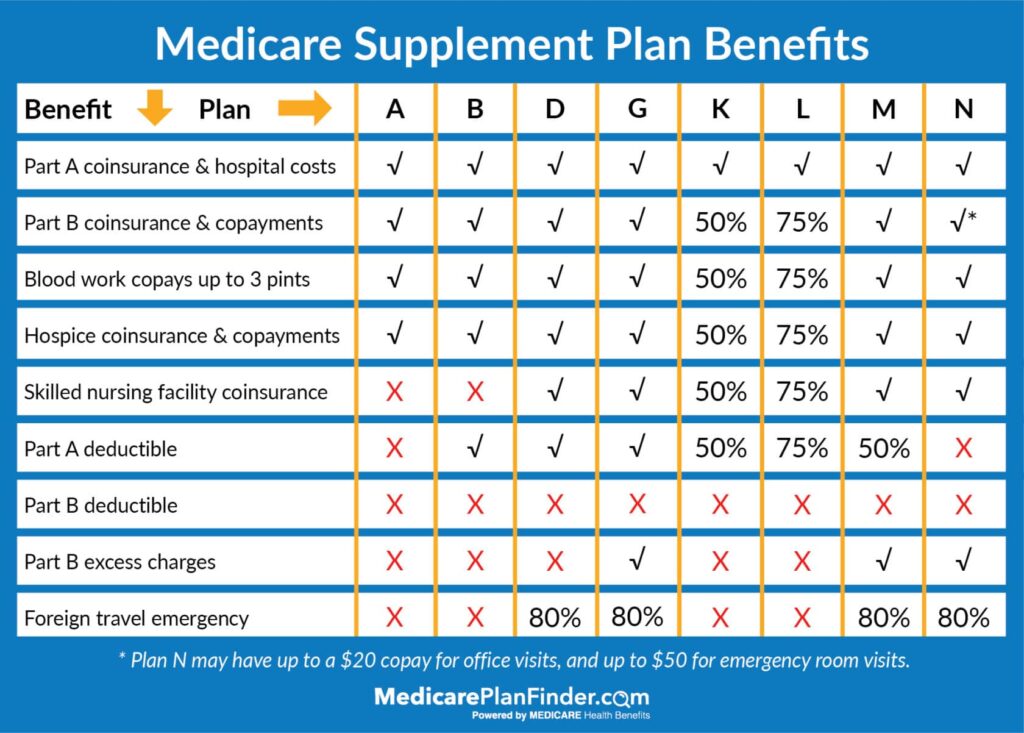

- Look Into Medigap Insurance: Medigap (Medicare Supplement) plans can help cover some of the out-of-pocket costs, including the daily hospital charges after 60 days. These plans vary by provider and location, so it’s important to compare options.

- Speak to the Hospital: Hospitals sometimes have programs to assist with payment or offer discounts. Don’t hesitate to ask the billing department about options, especially if your stay is expected to be lengthy. Many hospitals have financial assistance programs that could reduce your costs.

- Track Your Benefit Period: Stay on top of your Medicare benefit period to avoid paying unnecessary costs. If you’re admitted to the hospital again after 60 days, you’ll be starting a new benefit period, which means you’ll be charged another deductible.

- Medicaid for Low-Income Beneficiaries: If your income is low enough, you may qualify for Medicaid, which could cover many of the costs Medicare doesn’t pay for extended hospital stays. Medicaid eligibility varies by state, so it’s important to check with your state Medicaid office to see if you qualify.

- Appeal Your Bill: If you feel that you’ve been incorrectly charged or believe that there’s an error on your bill, don’t hesitate to appeal it. Many people do not realize that they can challenge their medical bills, especially if there are mistakes in the way the charges are calculated.

Medicare Part B Premiums Surge in 2025; Is Your Income Pushing You Into a Higher Bracket?

Staying Less Than 60 Days? Here’s Exactly What Medicare Will Charge You in 2025

The Truth About Vegetable Milk—Why Scientists Say It’s Not as Healthy as You’ve Been Told

Additional Resources and Tools for Managing Hospital Stay Costs

- Medicare’s Hospital Costs Explained: For an official breakdown of costs and how benefits work, visit Medicare.gov.

- Medicare Part A Costs for 2025: The official website provides a detailed guide to the cost structure for Part A hospital insurance, along with what’s covered under each level of care.

- Medicare Advantage vs. Medigap: If you’re unsure whether Medicare Advantage or Medigap is right for you, you can compare the two options on Medicare’s official site to see which one best fits your needs.

- State Medicaid Resources: Find out more about Medicaid eligibility and coverage options in your state by visiting your state’s Medicaid website.