Social Security Faces Collapse by 2034: For many Americans, Social Security represents the backbone of their retirement planning. It’s been a safety net for seniors for decades, providing monthly benefits to retirees, people with disabilities, and surviving family members of deceased workers. But recent projections show that Social Security is facing some serious financial challenges, and if action isn’t taken soon, retirees could face significant cuts to their benefits by 2034. So, what exactly is going on, and what can you do to protect yourself?

Social Security Faces Collapse by 2034

The future of Social Security and Medicare is at a crossroads. While these programs have provided financial support to millions of Americans for decades, their financial stability is under serious strain. Without reform, we could see major cuts to benefits by 2034. However, there are steps you can take now to secure your financial future, from saving more and diversifying your investments to advocating for policy changes. Stay informed, plan ahead, and take proactive steps to ensure that you can weather whatever changes lie ahead.

| Key Information | Details |

|---|---|

| Projected Depletion of Trust Funds | Social Security’s trust fund is projected to run dry by 2034, with only 81% of benefits payable. |

| Cause of the Issue | Key factors include an aging population, fewer workers paying into the system, and increased demand for benefits. |

| Impact on Beneficiaries | Beneficiaries could see a 19% reduction in their monthly Social Security checks if no reforms are made. |

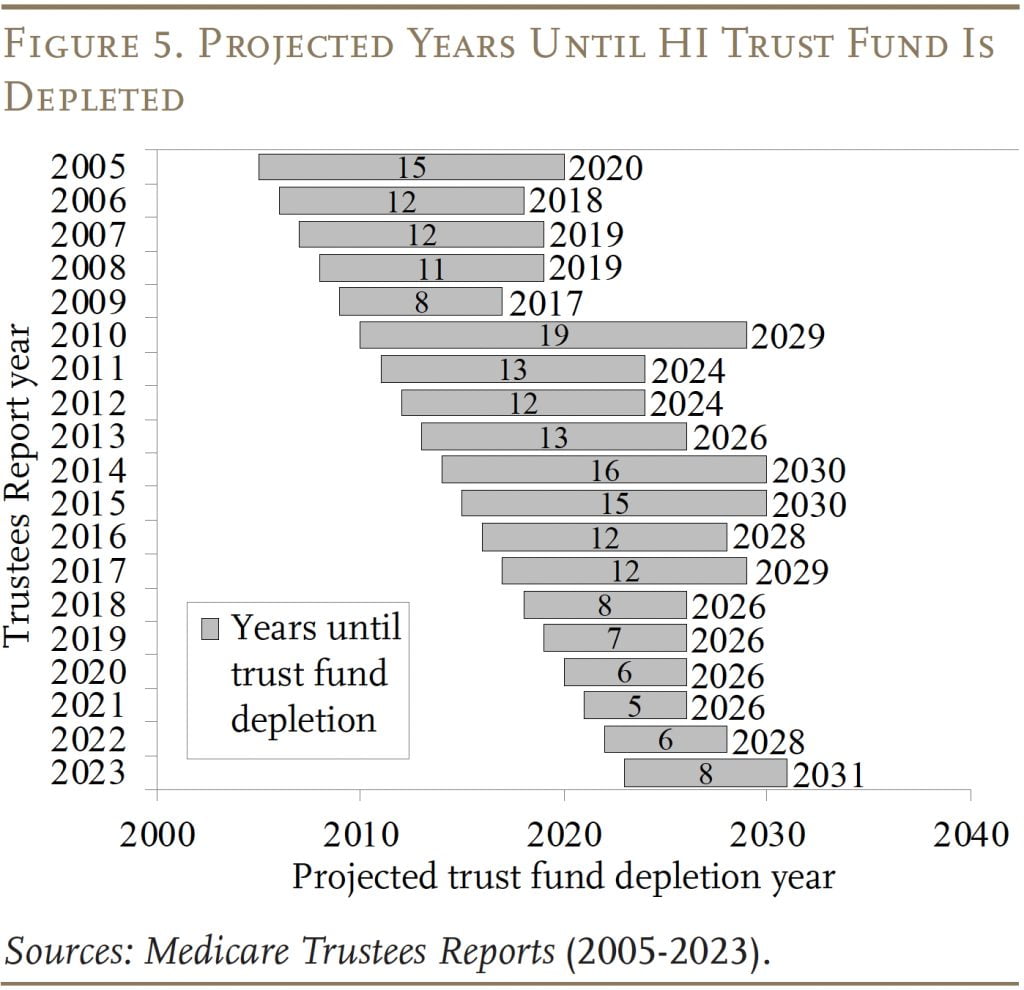

| Medicare Facing Similar Trouble | Medicare’s trust fund (Part A) is expected to be depleted by 2033, potentially leading to an 11% cut in benefits. |

| The Role of Lawmakers | Congress must act quickly to avoid drastic cuts and secure the future of these critical programs. |

| Possible Solutions | Possible actions include increasing Social Security taxes, reducing benefits, or implementing both strategies. |

| Official Resources | Social Security Administration, Trustees Report, Medicare Trustees Report |

What’s Happening with Social Security?

Social Security has been a cornerstone of retirement security for millions of Americans. Originally signed into law in 1935, it was designed to provide financial assistance to people who could no longer work due to age or disability. Over time, Social Security expanded to cover survivors of deceased workers. However, in recent years, the system has encountered serious financial problems.

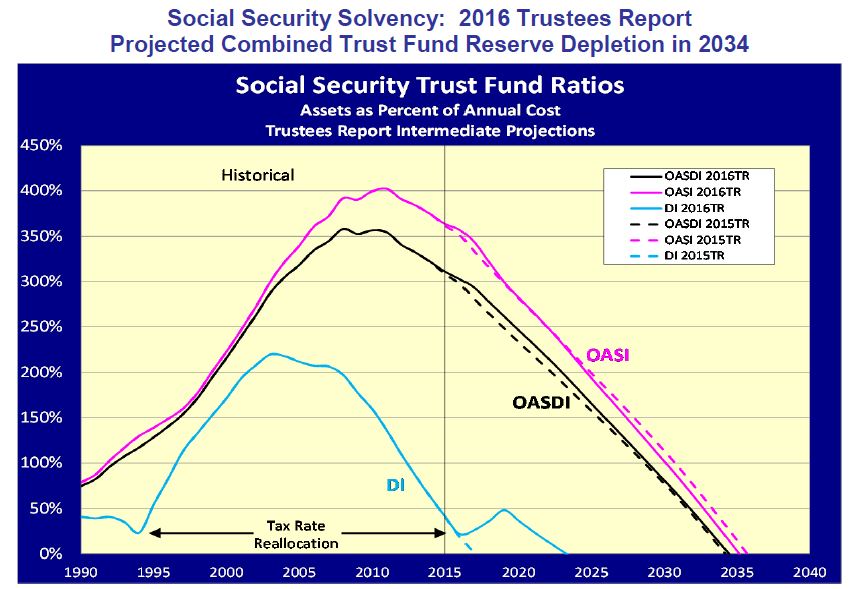

Social Security is funded through payroll taxes, which are collected from workers and their employers. These taxes flow into two trust funds: one for Old-Age and Survivors Insurance (OASI) and the other for Disability Insurance (DI). While the system has worked well for decades, recent projections show that the program’s trust fund is expected to be depleted by 2034. If the fund runs dry, only 81% of promised benefits will be payable based on the current payroll taxes, leading to a significant reduction in monthly payments for retirees, survivors, and people with disabilities.

This projected shortfall is not a sudden development. It has been a concern for policymakers and experts for years, but now the reality is closer than ever. If no legislative changes are made, millions of Americans could face substantial cuts to their Social Security benefits.

Why Are Social Security and Medicare in Trouble?

The financial challenges faced by Social Security and Medicare are not new, but they’ve been growing more urgent in recent years. Several factors are contributing to the looming crisis:

1. Demographic Shifts

The U.S. population is aging. The Baby Boomer generation is retiring, and with fewer young people entering the workforce, there are fewer workers paying into the system. This means the payroll taxes that fund Social Security are not keeping up with demand.

In 1960, there were approximately 5.1 workers for every Social Security beneficiary. By 2020, that number had decreased to 2.8 workers per beneficiary. By 2034, this number is projected to be just 2.2 workers per beneficiary. This demographic shift is putting an immense strain on the system, and the ratio of workers to retirees will continue to shrink as more Baby Boomers retire.

2. Longer Life Expectancy

People are living longer than ever before. While this is great news for individuals, it’s putting a strain on the Social Security program because people are receiving benefits for longer periods. The life expectancy of an average American has increased by about 30 years since the inception of Social Security, which means retirees are drawing benefits for much longer than the system was designed to accommodate.

For example, if someone starts claiming Social Security at age 65, they could live for another 20 years or more, drawing benefits for two decades or more. In fact, as of 2024, the average life expectancy in the U.S. is around 79 years, and those reaching age 65 are likely to live even longer. This increases the amount of benefits paid out by Social Security, contributing to the depletion of the trust fund.

3. Rising Healthcare Costs

Medicare, which covers healthcare costs for seniors, is facing similar financial struggles. An aging population, combined with rising healthcare costs, is depleting the Medicare trust fund faster than expected. Medicare Part A (hospital insurance) is funded by payroll taxes, just like Social Security. However, as healthcare expenses rise due to inflation and medical advancements, the program faces greater financial strain.

4. Economic Challenges

Slower earnings growth and increased healthcare spending are adding to the financial strain. The economy has not been growing at the rate needed to sustain these programs, and this has exacerbated the situation. Tax revenue is not growing fast enough to match the rising demand for Social Security and Medicare benefits.

5. Unforeseen Economic Crises

Global economic disruptions, such as recessions, pandemics, and financial crises, have hindered tax revenue growth. The COVID-19 pandemic, for example, led to widespread job losses, reducing the amount of payroll taxes collected by the government. These economic shocks further stressed an already strained system.

What Happens If the Trust Fund Runs Out?

When Social Security’s trust fund is depleted, it won’t mean that the program just ends. Payroll taxes will still be collected, but they will only cover about 81% of the benefits that are promised. This means that retirees could see a reduction of up to 19% in their monthly benefits unless Congress takes action.

For example, if you were receiving $2,000 a month in Social Security benefits, that could drop to $1,620. For someone who relies on these payments for their day-to-day expenses, that’s a huge impact. In many cases, people rely on Social Security as their primary source of income during retirement, and a cut in benefits could lead to financial hardship.

How Can You Protect Yourself?

While Social Security’s future may seem uncertain, there are several steps you can take to help protect your financial future. Here’s how you can start planning for a secure retirement, even if Social Security benefits are reduced.

1. Start Saving and Investing Early

You can’t rely solely on Social Security for retirement. The earlier you start saving and investing, the better. Consider setting up an individual retirement account (IRA) or a 401(k) if your employer offers one. Even small contributions can add up over time, thanks to compound interest.

Example: Let’s say you start investing $100 a month at age 25 and continue until you retire at 65. Even with modest returns of 6% annually, you could end up with over $160,000 by retirement. The key is to start early.

2. Plan for Lower Social Security Benefits

If you’re nearing retirement, it’s wise to assume that your Social Security benefits could be reduced. Build your retirement plan with that possibility in mind. Focus on saving more, reducing debt, and diversifying your income streams to ensure that you can maintain your standard of living, even if Social Security cuts occur.

3. Stay Informed and Engage in Advocacy

Stay up-to-date with the latest information about Social Security and Medicare. Consider reaching out to your elected officials and encouraging them to address the funding issues of these programs. Lawmakers need to hear from the public about the importance of these programs. Get involved in discussions, attend town halls, and support advocacy groups that are working to preserve these benefits.

4. Consider Delaying Social Security Benefits

If you’re not yet retired and are able to, consider delaying your Social Security benefits until you reach full retirement age (or even age 70, when you can earn delayed retirement credits). This could help increase the amount you receive each month, which will help mitigate any future cuts.

Example: If your full retirement age is 66 and you start benefits at 70, you can increase your monthly payment by about 32%. Delaying Social Security is a smart move for those who are in good health and can afford to wait.

5. Consult a Financial Planner

A certified financial planner (CFP) can help you navigate your retirement savings and make informed decisions about your future. They can offer personalized strategies to ensure you’re maximizing your savings and investments, taking into account the potential risks associated with Social Security cuts. A financial planner can also help with budgeting and creating a sustainable income plan for retirement.

Social Security Faces Collapse by 2034: What Are the Potential Solutions?

There are several options available to lawmakers to address the solvency of Social Security and Medicare, and some of these could impact you directly. Here are a few potential solutions:

1. Increase Payroll Taxes

One way to address the shortfall is to increase the payroll taxes that fund Social Security. Currently, workers pay 6.2% of their earnings into Social Security, and employers match that amount. Raising the payroll tax rate, or removing the cap on earnings subject to the tax, could help boost the system’s solvency.

Fun Fact: In 2024, the maximum taxable earnings for Social Security is $160,200. If you make more than this, you don’t pay Social Security tax on the excess income.

2. Reduce Benefits

Another option is to reduce benefits for future retirees. This could be done by raising the age at which people can start receiving Social Security benefits, reducing the amount paid to higher-income earners, or adjusting how benefits are calculated.

3. Invest in the Trust Fund

Some experts suggest that the trust fund could be bolstered by allowing the Social Security Administration to invest its funds in the stock market or other higher-yield investments, rather than just holding them in low-interest government bonds. This could provide a higher return and help extend the life of the trust fund.

4. Means Testing

Another possibility is means testing, where higher-income individuals would receive reduced benefits or no benefits at all. This would help preserve Social Security funds for those who need them the most.

How to Unlock the Highest Monthly Social Security Benefit; 3 Smart Strategies

Social Security COLA 2026: June Estimate Reveals Exactly How Much Your Check Could Increase