New York Is Sending Out $400 Stimulus Checks: New York is offering $400 stimulus checks to eligible residents, a much-needed relief amidst inflation and rising living costs. This initiative comes as part of the state’s effort to provide financial support to its citizens, and it’s available to those who qualify through their 2023 tax returns. The best part? There’s no need to apply – if you’re eligible, you’ll automatically receive the check. Let’s dive into the details and help you understand how this works.

New York Is Sending Out $400 Stimulus Checks

The $400 stimulus checks from New York are a great way for the state to support its residents during tough times. If you’ve filed your 2023 taxes and meet the eligibility requirements, you’re in for some financial relief – and the best part is that you don’t have to do anything. The process is simple, and your check will be mailed to you without any extra hassle. Just ensure your address is updated, sit back, and await your check starting in October 2025.

| Key Points | Details |

|---|---|

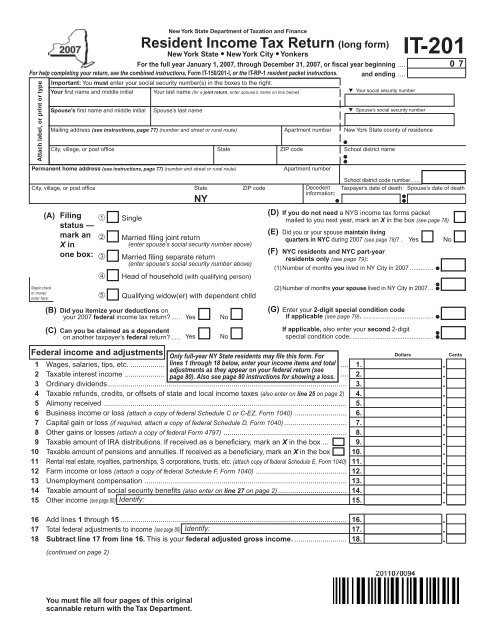

| Eligibility Criteria | Taxpayers who filed a 2023 NYS Resident Income Tax Return, meet AGI thresholds, and are not claimed as dependents. |

| Refund Amounts | Up to $400, depending on filing status and AGI. |

| Payment Distribution | Starting mid-October 2025, continuing through November. |

| No Application Required | Eligible individuals will receive checks automatically based on tax returns. |

| Eligibility Details | Refunds based on income, filing status, and not being claimed as a dependent. |

Why Is New York Sending Out Stimulus Checks?

We’re all feeling the crunch from rising prices, whether it’s at the gas pump, grocery store, or in other everyday expenses. As inflation continues to stretch household budgets, states across the U.S. are offering financial assistance to ease the burden. In this case, New York State is stepping up to provide one-time inflation refund checks to eligible residents.

This effort is part of the state’s 2025–2026 budget, designed to provide relief for the middle and lower-income households facing the brunt of price hikes. Governor Kathy Hochul and the New York State Legislature approved this initiative to help taxpayers, allowing them to keep a bit more of their hard-earned cash.

These checks are automatic, meaning you won’t have to lift a finger or fill out additional forms to receive them. If you qualify, you’ll get a check sent right to your mailbox.

A Brief History of Stimulus Checks

The idea of stimulus checks isn’t new. We’ve seen the federal government roll out similar checks over the years, especially during times of economic downturn. During the COVID-19 pandemic, federal stimulus payments helped Americans survive a period of uncertainty and widespread job losses. Since then, some states have taken it a step further, offering their own checks to address local economic challenges. New York is no exception. The state’s decision to issue $400 stimulus checks is a way to respond to the financial strain many New Yorkers have been under, partly due to inflation and the higher cost of living in the state.

In recent years, state-level stimulus programs have become more common, reflecting a growing recognition that local governments can provide direct financial support to their residents. New York’s initiative is a testament to this, aimed at supporting those who need help most and encouraging economic stability within the state.

Who Is Eligible for the $400 Stimulus Check?

Eligibility for the $400 stimulus check depends on two main factors: your filing status and your adjusted gross income (AGI). Let’s break down the specifics.

- Single Filers with an AGI of $75,000 or less will get $200. If your AGI is between $75,001 and $150,000, you’ll receive $150.

- Married Couples Filing Jointly with an AGI of $150,000 or less are eligible for the full $400. If their AGI is between $150,001 and $300,000, they’ll get $300.

- Married Filing Separately individuals will get a $200 refund if their AGI is $75,000 or less, and $150 if it’s between $75,001 and $150,000.

- Head of Household filers with an AGI of $75,000 or less will also get $200. If their AGI is between $75,001 and $150,000, they’ll receive $150.

- Qualified Surviving Spouses are eligible for $400 if their AGI is $150,000 or less, and $300 if it’s between $150,001 and $300,000.

If your income is above these thresholds or you were claimed as a dependent on someone else’s tax return, you won’t be eligible for the stimulus check.

Why You Don’t Need to Apply?

One of the most convenient aspects of the $400 stimulus check is that you don’t have to apply. If you’re eligible, you’ll receive the check automatically. In the past, some stimulus programs required residents to fill out forms or apply for benefits. With New York’s stimulus check, everything is streamlined. The New York State Department of Taxation and Finance will use information from your 2023 tax return to determine eligibility and send the check directly to your registered address.

This is a big win for residents who may not be familiar with navigating government programs. The process is designed to be easy and efficient—simply ensure that your tax filing information is up-to-date, and you’re good to go.

How Will the Stimulus Checks Be Distributed?

The state’s Department of Taxation and Finance will start sending the $400 stimulus checks in mid-October 2025, continuing through November. The checks will be mailed to the address listed on your most recent tax return. It’s important to ensure that your address is up-to-date with the tax department. If you’ve moved since you filed your taxes, you’ll need to update your address to avoid delays.

What’s helpful about this process is that you don’t have to worry about the timing or any complicated application forms. The checks will be sent directly to those who qualify, based on their tax filing information. This ensures a seamless distribution with minimal effort required from eligible residents.

The Role of the New York State Department of Taxation and Finance

The New York State Department of Taxation and Finance plays a critical role in the distribution of these stimulus checks. Their team will verify that each individual is eligible based on the most recent tax return and ensure that checks are sent to the correct address. This department is well-versed in handling tax-related matters and stimulus distributions, making them a reliable source for executing this program.

In case you need assistance or have any questions about the status of your payment, you can easily reach out to the Department of Taxation and Finance. They provide contact options for residents, including phone support and online resources.

How to Check If You Qualify for the New York Is Sending Out $400 Stimulus Checks?

The best way to check if you qualify for the $400 stimulus check is to log into your New York State Department of Taxation and Finance online account. Here’s how you can do it:

- Create or Log In to Your Online Account: If you haven’t set up an account, you can quickly do so on their website. If you already have one, simply log in using your username and password.

- Review Your 2023 Tax Return: Ensure your filing status and AGI are listed correctly on the tax return, as this is the basis for your eligibility.

- Check for Updates: Once logged in, you’ll be able to check the status of your refund and see if you’re eligible for the stimulus check.

What If You Don’t Receive Your Check?

If you are eligible but haven’t received your $400 stimulus check by mid-November, the first thing you should do is check that the address the Department of Taxation and Finance has on file is accurate. If everything looks good there and you’re still waiting for your check, you can contact the department to inquire about the status of your payment.

Tips for Making the Most of Your $400 Stimulus Check

While a $400 stimulus check may not seem like a lot to some, it can make a significant difference in your daily expenses. Here are some tips on how to maximize this payment:

- Pay Down Debt: Use the check to reduce high-interest debts like credit cards. It’s a great way to improve your financial health.

- Save It: If you don’t have immediate financial needs, consider putting it into an emergency savings fund for unexpected expenses.

- Invest in Necessities: Use the funds to cover rising costs of necessities such as groceries, gas, or even utility bills. This can ease your monthly budget burden.

- Consider Giving Back: If you’re financially comfortable, consider donating part of your stimulus to charities or causes that are important to you.

Key Takeaways on the $400 Stimulus Check

- Automatic Payments: If you qualify, your check will be mailed directly to you. No need to fill out forms or apply.

- Refund Amounts: Refunds vary depending on filing status and AGI, ranging from $150 to $400.

- Start Date: Payments will begin in mid-October 2025 and continue through November.

- Eligibility: You must have filed a New York State Resident Income Tax Return in 2023 and meet the income requirements.

- No Application Necessary: There’s no need to sign up, just check if you qualify based on your tax information.

IRS $1400 Stimulus Payment Status Live — Find Out When You’ll Get Paid!

Big $1,312 Stimulus Payments Arriving in 2025 — Check If You Qualify!

$2,500 Stimulus Checks Coming Soon; Who Qualifies and When to Expect Your Payment