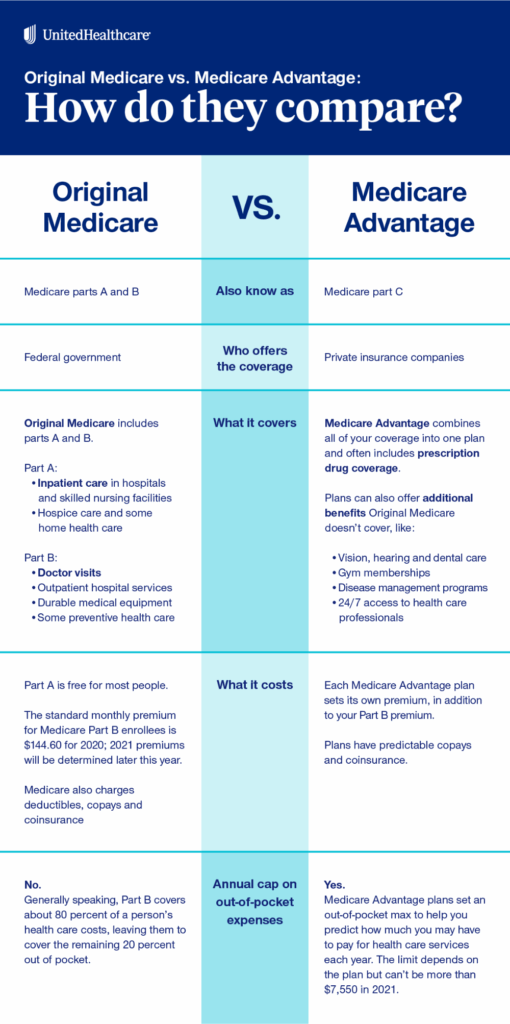

This Shocking New Age for Full Social Security Kicks In by 2026: Have you heard the big update in Social Security? Starting January 1, 2026, the Full Retirement Age (FRA) officially rises to 67 years old for everyone born in 1960 or later. So if you were planning to grab full benefits at 65—or even 66 and some months—it’s time to rethink your timeline. This shift marks the final step in a long, planned increase that began back in the 1980s. But now, it’s real—and it’s here. So what does this mean for your paycheck, your future, and how you plan retirement? Let’s break it all down in plain terms.

This Shocking New Age for Full Social Security Kicks In by 2026

The increase to Full Retirement Age (FRA) to 67 in 2026 is the final step in a multi-decade plan to modernize Social Security. If you’re born in 1960 or later, your retirement strategy needs to reflect this change. Whether you’re working longer, claiming early, or delaying for the bonus, the key is knowing your options and making decisions with intention. This isn’t just about money—it’s about how you walk into the next chapter of life. Do it with strength, wisdom, and a plan.

| What | Why It’s Important | Stat / Data | More Info |

|---|---|---|---|

| FRA Becomes 67 | Final update from 1983 Social Security Amendments | Affects everyone born in 1960 or later | ssa.gov |

| Early Claim Penalty | Claiming at 62 reduces monthly checks | ~30% permanent reduction | Age Reduction Chart |

| Delayed Retirement Credit | Waiting past FRA increases benefits | +8% per year up to 70 | SSA DRC Info |

| Social Security Trust Fund | Risk of benefit cuts if Congress doesn’t act | May face 23% reduction by 2033 | Trustees Report Summary |

| Medicare Timing | Still starts at age 65 | Separate from Social Security | Medicare.gov |

A Quick History of Full Retirement Age

Let’s rewind a bit to understand why this is happening.

When Social Security was signed into law in 1935, the full retirement age was set at 65. It stayed that way for nearly half a century. But in 1983, Congress passed amendments to gradually raise the FRA to account for people living longer and drawing benefits for more years.

Instead of making a sharp jump, they increased it slowly:

- FRA remained 65 for people born before 1938.

- From 1938 to 1959, FRA increased in 2-month intervals per birth year.

- Now, for those born in 1960 or later, FRA will be 67—effective starting 2026.

This is not a sudden change. It’s just the final step in a 40-year phase-in.

How This Shocking New Age for Full Social Security Kicks In by 2026 Impacts Your Benefits?

The Full Retirement Age is the age at which you’re eligible to receive 100% of your Social Security benefits, based on your earnings history. If you claim before that age, you’ll receive reduced monthly payments—and that reduction is permanent.

Early Claiming = Lower Checks

You can start receiving Social Security benefits as early as 62, but here’s the catch:

- If your FRA is 67, claiming at 62 gives you about 70% of your full benefit.

- That’s a 30% cut—for life.

- The SSA uses this formula:

- First 36 months early: 5/9 of 1% reduction per month.

- Any additional months: 5/12 of 1% per month.

For example, let’s say your full benefit at 67 is $2,000/month. If you claim at 62, you’ll only get $1,400/month. That’s a $600 loss every month.

Delayed Claiming = More Money Later

Waiting past your FRA can significantly boost your benefits.

- You get 8% more per year for each year you delay, up until age 70.

- That’s a total increase of 24% if you wait from 67 to 70.

- So instead of $2,000/month, you could get $2,480/month at 70.

It’s like getting a guaranteed return—no market risk, no paperwork. Just patience.

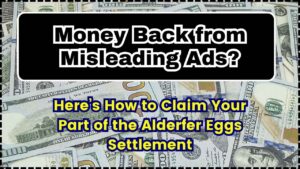

Medicare vs. Social Security: Know the Difference

One of the biggest misunderstandings we see is people confusing Medicare with Social Security.

- Medicare eligibility still starts at 65, no matter your FRA.

- You must enroll in Medicare within a 7-month window—starting 3 months before your 65th birthday.

- Missing that window can lead to penalties.

So even if your Social Security FRA is 67, you might still need to handle Medicare at 65.

Taxes on Social Security Benefits

Think Social Security is always tax-free? Think again.

Depending on your combined income, up to 85% of your benefits could be taxable.

- Single filers: If income > $25,000, you’ll pay taxes on part of your benefits.

- Joint filers: Over $32,000 combined income? Same deal.

- Over $34,000 (single) or $44,000 (joint)? Up to 85% of your benefits may be taxed.

Your “combined income” includes:

- Adjusted Gross Income (AGI)

- Nontaxable interest (like municipal bonds)

- 50% of your Social Security benefits

Real-Life Example: Meet Linda

Let’s say Linda was born in 1960. That means her FRA is 67.

- If she claims at 62, she’ll receive about 70% of her benefit.

- If she waits until 67, she gets 100%.

- If she holds out until 70, she gets 124%.

Let’s do the math with a $2,000 base benefit:

- At 62: $1,400/month

- At 67: $2,000/month

- At 70: $2,480/month

If Linda lives until age 90, she’ll receive:

- $470,000 total if she starts at 62

- $552,000 if she starts at 67

- $595,200 if she waits until 70

Coordinating with Your Career: Still Working?

Many Americans keep working into their 60s and beyond. Here’s how that impacts Social Security:

- If you’re under FRA and still working, there’s an earnings limit:

- In 2025: Earn up to $22,320/year before benefits are reduced.

- For every $2 over the limit, SSA takes back $1 in benefits.

- The year you reach FRA, a higher limit applies: $59,520 (approx.).

- After FRA, there’s no earnings cap at all.

So yes—you can work and claim Social Security, but be mindful of the limits until FRA.

Common Mistakes to Avoid As This Shocking New Age for Full Social Security Kicks In by 2026

- Claiming at 62 without understanding the consequences

- Forgetting about Medicare deadlines at 65

- Ignoring delayed retirement credits

- Not considering life expectancy when planning

- Assuming Social Security will cover everything—it won’t

Native Wisdom on Aging and Patience

In Native American culture, elders are honored for their wisdom and for understanding the rhythms of time. As the old saying goes: “The river never rushes to the ocean—but it always gets there.”

Waiting to claim your full Social Security benefits isn’t just about the money. It’s about stepping into a wiser version of yourself—ready, steady, and in control of your legacy.

SSI and Social Security 2025 Payouts Revealed—Check the New National Averages Now

Social Security Just Raised Full Retirement Age—And It Might Not Stop There

Say Goodbye to Retiring at 62; Social Security Rule Changes in 2025 Will Raise the Minimum Age

FAQs

Q1. Will FRA go higher than 67?

Possibly. Some lawmakers have proposed increasing it to 68 or 69, but nothing is passed yet. For now, FRA caps at 67.

Q2. Can I still retire at 65?

Yes, but if your FRA is 67, you’ll get a reduced monthly benefit.

Q3. Is Social Security going bankrupt?

Not exactly. The trust fund may run dry by 2033, triggering a 23% benefit cut unless Congress acts.

Q4. Can I get both Medicare and Social Security at 65?

Yes—but they are separate programs. You must enroll in Medicare at 65, even if delaying Social Security.

Q5. Is delaying benefits really worth it?

If you live into your 80s or 90s, yes—delaying to 70 often results in higher lifetime payouts.