This Disaster May Spike U.S. Gas Prices Overnight: U.S. gas price spike is becoming the talk of dinner tables and boardrooms from coast to coast. I’ve got decades of experience watching energy markets, and I’m here to give it to you straight, friendly, and with authority—like elders around a fire sharing insight. We’ll break it down for kids and seasoned pros alike, with real talk, practical advice, and clear steps.

This Disaster May Spike U.S. Gas Prices Overnight

This isn’t a gas crisis from a hurricane, but the U.S. gas price spike is very real—driven by events halfway across the world. With summer demand, tight markets, and risk lingering, prices could hover in the mid‑$3s or even rush toward $4+ in a downside scenario. But here’s the good news: being smart and proactive makes a massive difference. Keep your tank half-full, track prices, optimize your ride, explore carpool or EV options, and build realistic budgets for families or fleets.

| Key Point | Current Status | Why It Matters | Official Source |

|---|---|---|---|

| WTI crude | $72–75 per barrel | Up 20%+ in June due to Middle East flashpoints | EIA WTI Data |

| Average gas price | ~$3.28 per gallon | Up 10–15¢ since early June; could hit mid-$3s | [AAA & GasBuddy] |

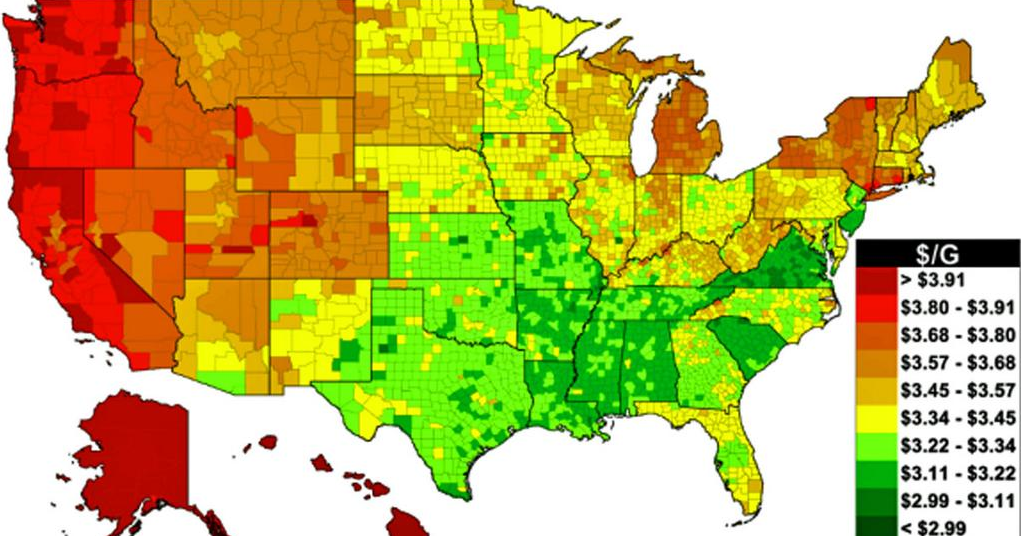

| Regional variation | East: $2.98, Midwest: $3.03, Gulf: $2.74, West Coast: $4.13 | Southwestern drivers hit the hardest | [Automotive Fleet] |

| Global supply/demand | Supply +330k bpd YoY; Demand +720k bpd in 2025 | Markets tightening despite OPEC+ easing | [IEA] |

| Fuel economy | 2025 new car avg: 26.4 mpg | 35% better vs. 2002 (19.5 mpg) — saves $400 yearly | [LendingTree] |

| Tech trends | AI/ML and IoT at pumps | Smarter fueling, dynamic pricing, customer loyalty | [ArXiv research] |

Context: Why Gas Prices Are Climbing Now

In mid‑June 2025, West Texas Intermediate (WTI) crude surged to around $72–75 per barrel, a nearly 20–22% jump in just one month, triggered by Middle East tensions—especially missile exchanges between Israel and Iran. That kind of spark in the oil world ripples right to your local gas station.

- National average gas prices rose from about $3.12–$3.17 to $3.25–$3.30 per gallon by mid‑June.

- Analysts predict prices could inch another 30¢ by July 4, potentially pushing the national average over $3.60 per gallon.

- In a worst‑case scenario—like shipping disruptions in the Strait of Hormuz—crude could skyrocket to $120–150/barrel, pushing gas to $4–$5 per gallon.

That’s the headline—what’s driving it, what it means for you, and how to respond smartly. Let’s dig deeper.

What’s Driving This Spike?

Middle East Tensions

Oil futures reacted sharply when missile exchanges between Israel and Iran escalated. Since early June, futures climbed 10–15%, nearing $75–76 per barrel. Why? Traders worry about the Strait of Hormuz, a key oil shipping lane that carries 12–20% of global supplies. Any military incident there could slash supply and send crude prices into orbit.

Tightening Supply, Rising Demand

The International Energy Agency (IEA) reports that global oil supply grew by ~330,000 barrels/day year-over-year, but global demand is up even more—~720,000 barrels/day forecasted in 2025. So even with OPEC+ easing production cuts, the market is running tight.

U.S. Production and Long-Term Trends

According to the U.S. Energy Information Administration (EIA), domestic production is projected to hit about 13.5 million barrels per day in 2025. That helps cushion global shocks but 2026 could see U.S. growth plateau. As global demand continues to rise, there’s less room for error in stability.

How This Disaster May Spike U.S. Gas Prices Overnight and Hit Your Wallet?

For Daily Drivers

- A 10–30¢ per gallon rise means $5–15 more per fill-up. For families or long commuters, that’s serious cash.

- Depending on where you live:

- East Coast ~ $2.98/gal

- Midwest ~ $3.03/gal

- Gulf ~$2.74/gal

- West Coast ~$4.13/gal – significantly higher than the national average.

For Fleets & Small Businesses

Rising fuel directly increases operational costs. That spells higher shipping costs, route adjustments, and possible fuel surcharges or price adjustments. Smart businesses invest in:

- Fuel hedging strategies

- Route optimization software

- Customer transparency on pricing changes

Economic & Inflation Impact

Fuel prices are a direct input to the Consumer Price Index (CPI). A sustained bump in gas can sway inflation numbers and influence Federal Reserve decisions. If prices keep climbing, rate cut plans might get delayed or reversed.

Smart Moves for Consumers & Businesses

Fill-Up Smarter

- Use apps like GasBuddy, AAA’s Price Finder, or your card’s gas reward portal.

- Fuel up in the early morning when prices are typically lower.

- Know your regional cycle—some areas lag behind others due to competition and tax policies.

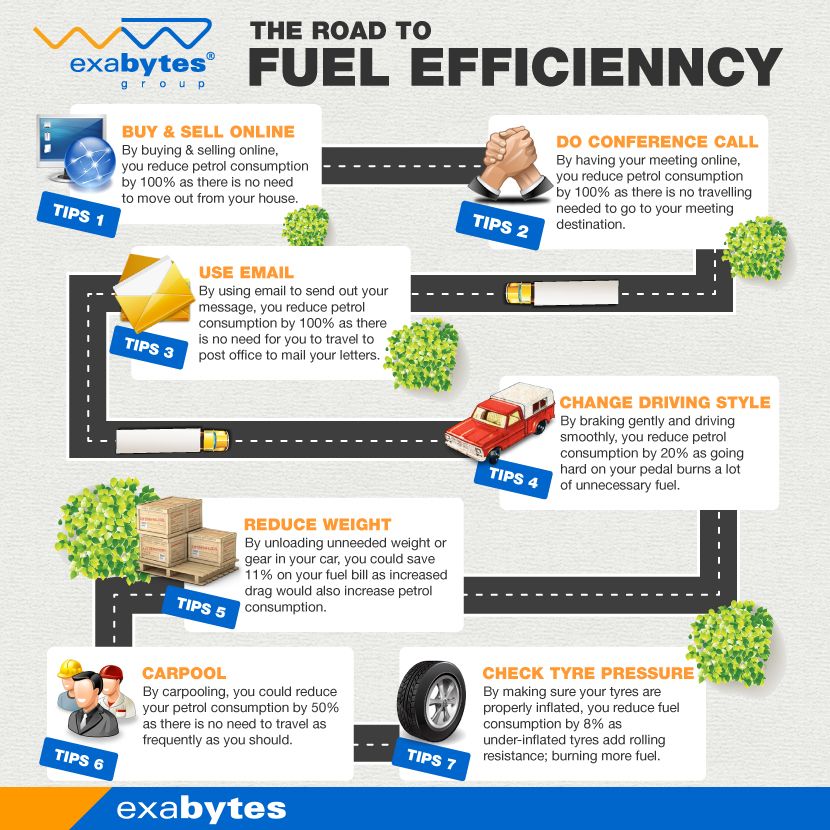

Increase Fuel Efficiency

- Keep your vehicle well-maintained—air filters, spark plugs, oxygen sensors. These can improve MPG up to 40%.

- Check tire pressure monthly—2 psi low can cost ~1% in efficiency.

- Drive gently—accelerate slowly and keep steady speed around 50–60 mph.

- Declutter your car, remove unused racks or boxes—each additional 100 lbs can reduce MPG by ~2%.

Embrace Alternatives

- Carpooling and public transit cut down on personal fuel use.

- Biking and walking where feasible help you save while staying active.

- Hybrid and electric vehicles bypass traditional fuel entirely. Numerous rebates and incentives are available—check your state’s DMV or energy office.

Budgeting & Business Planning

- Plan for three possible scenarios:

- Baseline: ~$3.30/gal

- Elevated: ~$3.60/gal

- Spike: $4+/gal

- Use route-planning and fuel prediction tools for fleets.

- Consider pre-purchasing fuel, leveraging volume discounts, or loyalty programs.

What Could Happen Next

- Scenario A – De-escalation: Tensions ease, supply lines stay open → oil dips to $65–70, gas settles near $3.10–3.25.

- Scenario B – Escalation: Strait of Hormuz hit → oil spikes to $120–150, pushing gas to $4–$5 per gallon—painful, but manageable with proactive planning.

- Med-term: Efficiency gains and EV adoption help reduce future spikes, especially as autopilot and AI/ML get baked into gas station tech. Predictive pricing and app-based loyalty saves pennies that add up.

Tech & Innovation: Fuel’s Digital Future

- AI/ML platforms at fueling stations are coming—automating dynamic pricing and loyalty offers.

- IoT sensors on storage tanks optimize inventory and reduce delivery costs.

- Smartphone integration will allow pre-paying, locating cheapest pumps, and even booking EV charging slots.

- Blockchain-based fuel loyalty programs could tie gas purchases to rebates or carbon credits.

Regional Differences & Tailored Tips

- East Coast: Usually lower prices due to high station density—check early morning prices.

- Midwest: Balanced prices with low competition—that’s good for mileage, less so for deals.

- Gulf Region and Texas: Some of the lowest prices. Use this to your advantage on long hauls.

- West Coast: Highest pump prices—consider weekends or travel stops out of state for cheaper fueling.

Nevada Just Struck ‘White Gold’—The Shocking Discovery That Could Fuel the Nation

Moody’s Shocks Markets By Slashing America’s Pristine Credit Rating Over Soaring Debt

Americans Admit Wasting Tons of Money on These 5 Things—Are You Guilty Too?

What Long-Term Strategies Can You Use?

- Average down by upgrading to a fuel‑efficient ride (hybrid, high‑mpg sedan, or EV).

- Invest in solar or workplace EV charging to reduce reliance on gas.

- Adopt telecommuting, flexible hours, and EV fleets for corporate sustainability and savings.

- Advocate for regional policy changes like low-carbon fuel standards or higher-efficiency mandates.