$2,002 Direct Deposits Are Coming: For retirees across the United States, June 2025 brings another round of vital income support—the $2,002 Social Security direct deposit. It’s not just a number on a bank statement. For over 48 million retired Americans, this payment represents a safety net, a budget anchor, and for many, their primary source of income.

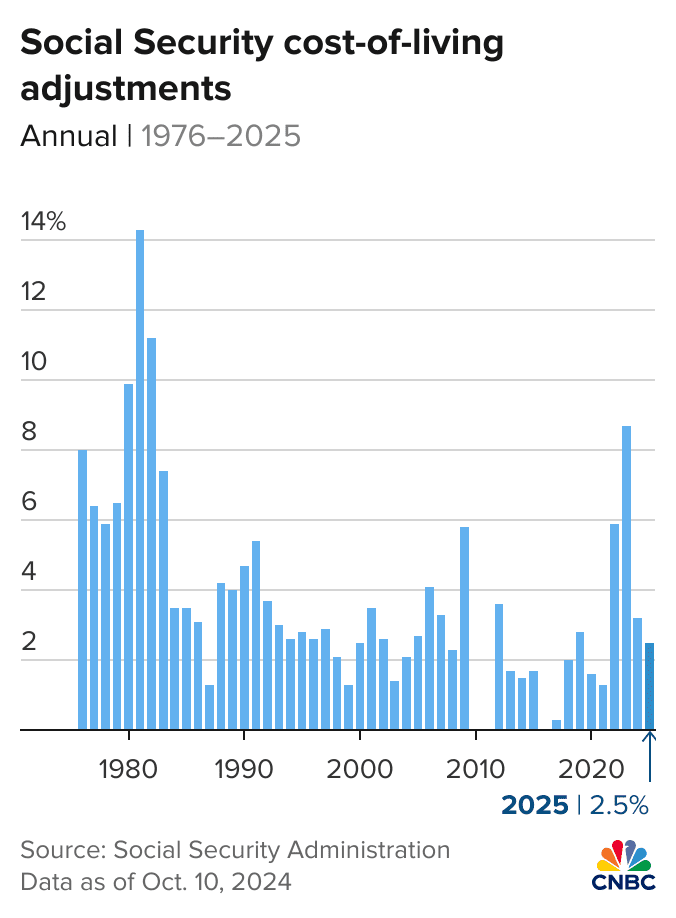

Thanks to a 2.5% Cost-of-Living Adjustment (COLA) announced in October 2024, the average retirement benefit rose from $1,916 to $2,002. And this June, those updated payments are landing in accounts according to the Social Security Administration’s 2025 schedule. If you’re unsure when your payment will hit—or what to do if it’s late—this article breaks it all down in plain English. From understanding payment dates to managing your My Social Security account, we’ve got you covered with accurate, easy-to-follow information and advice based on official sources, including the SSA, IRS, and Congress.

$2,002 Direct Deposits Are Coming

The $2,002 Social Security direct deposit may seem like just another number, but for millions of Americans, it’s a lifeline—carefully budgeted and critically needed. Knowing when your check arrives, how to manage your account, and how to plan for the future can make all the difference in your retirement years. Whether you’re living on a fixed income, managing Medicare costs, or navigating taxes, staying informed ensures your retirement remains stable, secure, and dignified.

| Feature | Details |

|---|---|

| Average Monthly Benefit | $2,002 for retired workers in 2025 |

| COLA Increase | 2.5% (announced October 2024) |

| June 2025 Payment Dates | June 3, 11, 18, 25 (based on birthday) |

| SSA Official Contact | www.ssa.gov or 1-800-772-1213 |

| Last COLA Announcement | October 12, 2024 |

| Next COLA Announcement | Scheduled for October 2025 |

| Payment Method | Direct deposit or Direct Express card |

| SSA Online Services | MySSA account, payment tracking, form downloads |

When Will You Get Your $2,002 Direct Deposit in June 2025?

Social Security follows a strict payment schedule based on your birth date and the start date of your benefit. Knowing where you fall in this schedule is crucial to avoid confusion or panic if your check hasn’t arrived yet.

Social Security Payment Schedule – June 2025

| Birth Date | Payment Date |

|---|---|

| Before May 1997 or receiving SSI | June 3, 2025 |

| 1st – 10th of the month | June 11, 2025 |

| 11th – 20th of the month | June 18, 2025 |

| 21st – 31st of the month | June 25, 2025 |

If your birthday falls within the 1st–10th, you’ll receive your payment on the second Wednesday of the month. The 11th–20th group gets paid the third Wednesday, and the 21st–31st group receives theirs on the fourth Wednesday.

Payments are typically posted overnight, but can take up to 72 hours depending on your financial institution.

Why Are Retirees Receiving $2,002?

The Social Security Administration (SSA) adjusts benefit amounts each year based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This is what drives the Cost-of-Living Adjustment (COLA), which ensures your benefits keep up with inflation.

Here’s how the average monthly benefit changed over the last few years:

| Year | COLA % | Avg. Benefit |

|---|---|---|

| 2022 | 5.9% | $1,658 |

| 2023 | 8.7% | $1,827 |

| 2024 | 3.2% | $1,916 |

| 2025 | 2.5% | $2,002 |

While this year’s 2.5% bump might not feel dramatic, it’s still essential in protecting your purchasing power in a time of economic uncertainty and rising healthcare costs.

How to Set Up or Check Your $2,002 Direct Deposits Are Coming?

The safest, fastest, and most reliable way to receive your Social Security payments is through direct deposit. If you haven’t enrolled yet, or you’ve changed banks recently, here’s how to update your info:

Steps to Set Up or Update Direct Deposit:

- Go to www.ssa.gov/myaccount

- Log in or create a free My Social Security account.

- Select “My Profile” and choose “Update Direct Deposit.”

- Enter your new bank information and save changes.

If you prefer not to use a bank, you can opt for a Direct Express Debit Mastercard.

What to Do If Your Payment Doesn’t Arrive?

Late or missing payments happen, and while they’re rare, they can cause stress. Here’s a plan of action if your deposit doesn’t show up on time:

- Wait 3 full business days past your payment date.

- Contact your bank or credit union—they often resolve deposit issues internally.

- If no resolution, call the SSA at 1-800-772-1213.

- Consider visiting your local SSA office if the issue is not resolved over the phone.

The Importance of Social Security for Retirees

Social Security is not just a supplement—for many, it’s the foundation of retirement income. According to the Social Security Administration, over 40% of retirees rely on their benefits for more than 90% of their monthly income.

A $2,002 monthly check might go toward:

- Housing (rent, mortgage, taxes)

- Utilities and groceries

- Prescription drugs and Medicare premiums

- Transportation and fuel

- Small savings and leisure expenses

Tax Implications: Will You Owe the IRS?

Many retirees don’t realize that Social Security income can be taxed, depending on your total income level and the state you live in.

Federal Tax Rules:

- Single filers: If your combined income is above $25,000, up to 50% of your benefits may be taxable.

- Married filing jointly: Income over $32,000 may be partially taxable.

States That Tax Social Security:

As of 2025, these states impose state-level taxes on Social Security income:

- Colorado

- Connecticut

- Kansas

- Minnesota

- Montana

- New Mexico

- Rhode Island

- Utah

- Vermont

- West Virginia

Watch Out for Scams

With millions of dollars in monthly payments going out, Social Security fraud is an ongoing threat. Stay alert and protect your information.

Common Scam Tactics:

- Phone calls claiming your SSN is “suspended”

- Texts or emails asking you to verify bank information

- Fake SSA representatives asking for payments

Remember: The SSA will never call or email you to demand money or threaten arrest.

Social Security Fairness Act: What’s Coming Next?

The Social Security Fairness Act, currently under review in Congress, aims to repeal two controversial rules:

- Windfall Elimination Provision (WEP)

- Government Pension Offset (GPO)

These rules reduce Social Security benefits for certain public servants like teachers, police, and firefighters who receive pensions from jobs not covered by Social Security.

If passed, this law could increase benefits for over 2 million retirees.

Long-Term Tips for Maximizing Your Social Security

Planning for the future? Here are a few tips to get the most out of your Social Security:

- Delay Benefits if Possible: Waiting until age 70 increases your monthly benefit by up to 8% per year after full retirement age.

- Coordinate with Spouse: Optimize your filing strategy to maximize combined lifetime benefits.

- Understand Medicare Premiums: Part B premiums are deducted from your check, so know what to expect annually.

- Track Earnings Carefully: Only your highest 35 years of income are counted in the benefit formula—keep working if you can boost those averages.

SSI and Social Security 2025 Payouts Revealed—Check the New National Averages Now

CPI Surprise Alters 2026 COLA Forecast; Social Security Recipients Could See Unexpected Changes

91% of Social Security Fairness Act Payouts Have Been Processed; Are You Getting More?