IRS Paying $3,034 on Average: is a headline with real financial weight behind it. For U.S. citizens and green card holders living abroad, the IRS reports that average refunds are coming in at a healthy $3,034 on 2024 returns. That’s not a gimmick—it’s real money you could be leaving on the table if you don’t file. And while Americans living abroad automatically get two extra months to file (moving the April 15 deadline to June 15—pushed to June 16 in 2025 due to the weekend), that extension only gives you more time to file, not time to pay. If you owe taxes, interest has already been ticking away since April 15. That’s why now’s the time to get on top of your tax situation—file, pay, and claim every credit you qualify for.

IRS Paying $3,034 on Average

If you’re a U.S. citizen living abroad, the IRS is still watching—and rewarding those who play by the rules. With refunds averaging $3,034, it literally pays to file. The key deadlines were June 16 (auto-extension) and October 15 (final). If you haven’t filed yet, there’s still time—but interest is adding up. Use tools like the Foreign Earned Income Exclusion, Foreign Tax Credit, and Streamlined Filing to your advantage. Avoid FBAR penalties, file the right forms, and consult a pro if your financial life is complex. File smart, stay compliant, and claim your share.

| What | Details |

|---|---|

| Average Refund | $3,034 on average for expat filers (2024 returns) |

| Automatic Filing Deadline | June 16, 2025 (extended from June 15 due to weekend) |

| Extended Filing Deadline | October 15, 2025, if Form 4868 was filed before June 16 |

| Interest on Unpaid Tax | Accrues from April 15, 2025, at ~7% compounded daily |

| Late-Filing Penalty | 5% per month, up to 25% of unpaid taxes |

| Late-Payment Penalty | 0.5% per month, up to 25% |

| FBAR Requirement | FinCEN Form 114 due April 15 (extended to October 15) if foreign accounts > $10,000 |

| Common Credits for Expats | Foreign Earned Income Exclusion (FEIE), Foreign Tax Credit (FTC), Child Tax Credit |

| Tax Tools Used | IRS Form 2555, Form 1116, Form 8938, Form 8621, Form 8865, Form 5471 |

| IRS Official Link | IRS – Citizens Abroad |

Why IRS Paying $3,034 on Average?

The $3,034 average refund for overseas filers is no accident. Many expats qualify for credits and exclusions that dramatically lower or even eliminate their U.S. tax liability:

1. Foreign Earned Income Exclusion (FEIE):

This lets qualifying expats exclude up to $126,500 (2024) of earned foreign income. If you live and work abroad, this is your best friend.

2. Foreign Housing Exclusion or Deduction:

You can also deduct reasonable housing costs in high-cost locations—up to around $37,950 for 2024 depending on location.

3. Foreign Tax Credit (FTC):

If you pay taxes in your country of residence, the FTC helps you offset U.S. tax liability on the same income. No double taxation.

4. Child Tax Credit & Additional Child Tax Credit:

Parents earning income overseas may still qualify for a refund of up to $1,600 per child under current rules—even if no U.S. tax is due.

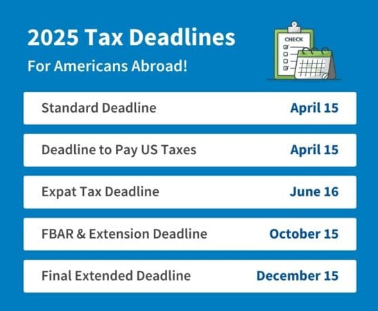

Understanding the Filing Deadlines

Expats automatically get an extra 2 months to file, but it’s easy to get confused. Here’s how it really breaks down:

- April 15, 2025: Taxes are due, regardless of where you live. This is when interest starts if you owe money—even if you don’t file until June.

- June 16, 2025: Last day of the automatic two-month filing extension for expats.

- October 15, 2025: Final day to file your 2024 return, only if you submitted Form 4868 by June 16.

You may also qualify for additional extensions if you’re in a combat zone or a federally declared disaster area—but these must be documented with your return or account.

What Happens If You Miss the June Deadline?

You still have options—but it’s a game of interest and penalties now:

- Interest: 7% annually (rate subject to change), compounding daily starting April 15.

- Late Payment Penalty: 0.5% per month of tax due, up to 25%.

- Late Filing Penalty: 5% per month of unpaid tax, up to 25%.

Example:

If you owed $2,000 and didn’t file or pay until October 15, you could owe over $400 in penalties and interest.

How to File Taxes from Abroad?

1. Gather Documents:

- Foreign income (wages, self-employment, dividends)

- Foreign tax returns and proof of taxes paid

- Bank statements for FBAR

- Travel records (to meet Physical Presence or Bona Fide Residence tests)

2. Choose Filing Method:

- IRS Free File if AGI under $79,000

- Tax software with expat support (e.g., TurboTax, H&R Block, TaxAct)

- Expat tax professional—best option if you have investments, crypto, foreign businesses, trusts, etc.

3. File the Right Forms:

- Form 2555 – to claim FEIE

- Form 1116 – for FTC

- Form 8938 – FATCA reporting for foreign financial assets

- FinCEN 114 – FBAR (not filed with your return)

- Other Forms – 5471, 8865, 3520 if you own foreign corporations, partnerships, or trusts

FBAR and FATCA: Avoid Big Trouble

FBAR (Foreign Bank Account Report):

If your foreign accounts exceeded $10,000 at any time in 2024, you must file FinCEN Form 114 by October 15 (with extension).

FATCA (Foreign Account Tax Compliance Act):

Requires Form 8938 if your foreign assets exceed:

- $200,000 (single) or $400,000 (married filing jointly) at year-end

- Or $300,000/$600,000 at any point during the year

Penalties:

- FBAR: $10,000 for non-willful violations, $100,000+ for willful ones

- FATCA: $10,000 initial penalty, plus more if not fixed within 90 days

What If You Haven’t Filed in Years?

You may qualify for the IRS Streamlined Foreign Offshore Procedures, which:

- Waive failure-to-file and FBAR penalties

- Require 3 years of tax returns + 6 years of FBARs

- Are intended for non-willful delinquency (i.e., you didn’t know you were supposed to file)

This is an excellent path to get compliant without facing thousands in penalties.

State Taxes: Watch Your Residency

Some states—especially California, Virginia, New Mexico, and South Carolina—are aggressive about taxing expats if they haven’t severed residency.

To stop state tax obligations, you may need to:

- Close voting registration and driver’s license

- Prove permanent relocation abroad

- File a “final” state return

Failure to do this could result in unexpected tax bills—even years later.

Don’t Forget Virtual Currency

Even if you live overseas, you must still report transactions involving:

- Bitcoin

- Ethereum

- Stablecoins

- NFTs

If you traded crypto in 2024, you must check “Yes” on your tax return and report gains/losses on Form 8949. The IRS now works with blockchain firms to track this data, and penalties for failing to disclose can be severe.

Who Should File as an Expat?

Even if you don’t owe taxes, you must file a U.S. return if:

- You earn more than $13,850 (single), $27,700 (married filing jointly)

- You’re self-employed with income over $400

- You have foreign assets over the FATCA threshold

- You want to claim a refund, even with $0 tax due

Common Myths About Expat Taxes

Myth 1: I don’t owe U.S. taxes because I pay foreign taxes.

Fact: You may not owe, but you still must file.

Myth 2: The IRS can’t track me if I live abroad.

Fact: The IRS has agreements with over 110 countries. Your foreign banks must report you under FATCA.

Myth 3: If I file late, I’ll automatically get penalized.

Fact: The IRS often waives penalties for expats filing under Streamlined procedures or with a reasonable cause letter.

Tax Refunds Are Hitting Bank Accounts This Week—Are You on the IRS Payment List?

IRS $2000 Economic Relief Package In 2025 – Check Eligibility Criteria & Payment Date

IRS Free File 2025 Opening Date Revealed — Don’t Miss These Key Details!

Real Case Examples

Lisa in London:

Earned $130K. Used FEIE + housing exclusion to exclude all income. Paid $0 U.S. tax. Filed Form 2555, Form 114, and Form 8938. Got a $1,600 child tax credit refund.

Tariq in Tokyo:

Freelancer earning $55K. Filed late but used Streamlined Filing. Claimed FTC. IRS waived penalties. Saved over $4,000 in penalties and interest.

Carlos in Mexico City:

Held $75,000 in foreign mutual funds. Didn’t know about PFIC rules. Hired a CPA to file Form 8621 and amend past returns. Avoided IRS audit thanks to proactive compliance.