SSI and Social Security 2025 Payouts: we’re talkin’ about the fresh numbers, straight facts, and what this means for everyday Americans. Whether you’re retired, disabled, or helping family navigate benefits, this guide breaks it down in plain English, with all the new updates and expert-level advice you can trust.

Here’s the scoop: in 2025, a 2.5% Cost-of-Living Adjustment (COLA) increased both Supplemental Security Income (SSI) and Social Security payouts. These increases rolled out in December 2024 for SSI and January 2025 for Social Security retirees, helping folks better manage rising prices. This annual bump impacts roughly 72.5 million Americans—including retired workers, people with disabilities, low-income seniors, and survivors. Whether you’re getting benefits now or planning your future retirement, these changes can have a serious impact on your wallet.

SSI and Social Security 2025 Payouts

SSI and Social Security 2025 payouts revealed a 2.5% boost, lifting average Social Security payments to just over $2,000/month and bringing SSI up to $967 for individuals and $1,450 for couples. These changes help millions of Americans handle rising costs, while tax updates and legislative reforms like the repeal of WEP and GPO give some folks long-overdue fairness. Whether you’re receiving benefits now or planning for the future, knowing how the system works—and staying ahead of changes—is key.

| Category | 2025 Amount / Note | Source |

|---|---|---|

| COLA Increase | 2.5% increase for Social Security & SSI | SSA COLA Info |

| Average Social Security Benefit | ~$2,002.39/month (as of May 2025) | SSA Snapshot |

| Max Social Security (Age 70) | $5,108/month | SSA COLA Fact Sheet |

| Max SSI – Individual | $967/month | SSA COLA Fact Sheet |

| Max SSI – Couple | $1,450/month | SSA COLA Fact Sheet |

| Social Security Tax Cap | $176,100 | SSA Contribution Base |

| Employee Social Security Tax Rate | 6.2% (12.4% if self-employed) | IRS & SSA |

| Retirement Earnings Limit | $23,400 (under full retirement age); $62,160 (year you reach FRA) | SSA Guidelines |

| WEP/GPO Repealed | Yes, as of Jan 5, 2025 (Social Security Fairness Act) | Public Law Info |

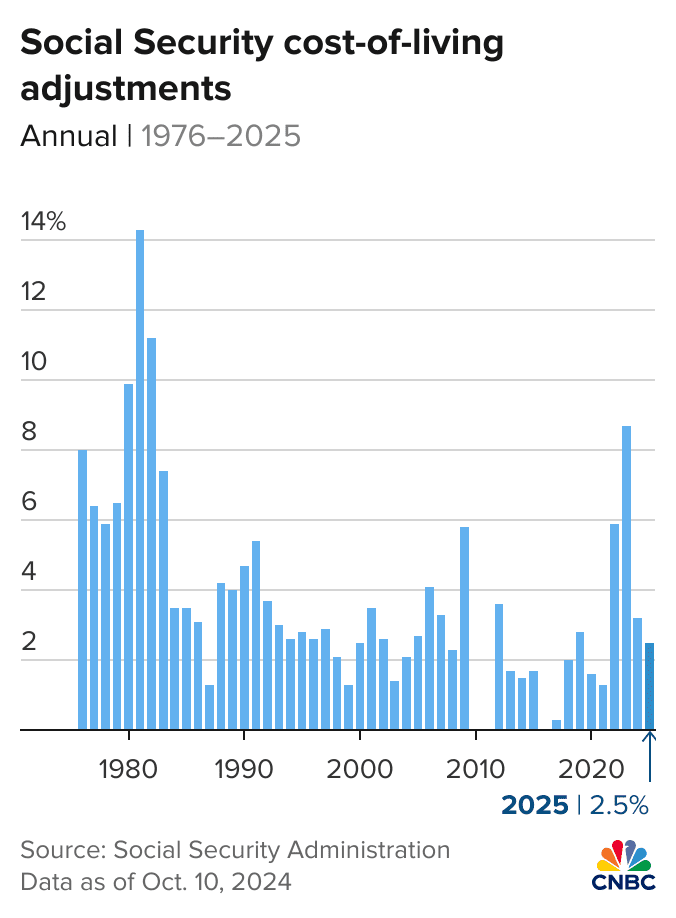

What’s This COLA Thing?

COLA, or Cost-of-Living Adjustment, is an annual increase in Social Security and SSI payments designed to keep up with inflation. The Social Security Administration calculates it based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) during July, August, and September.

In 2025, the COLA increase came out to 2.5%. That may sound small compared to recent years (2022’s was a record 5.9%), but it’s still a necessary bump to help recipients stay ahead of rising living expenses.

How Much Are We Talking?

Social Security Benefits

- The average monthly benefit for a retired worker was about $2,002.39 in May 2025, up from roughly $1,950 in early 2024.

- Married couples, both receiving benefits, averaged around $3,089/month.

- The maximum benefit for someone retiring at age 70 reached $5,108/month, up from $4,873 the previous year.

- If you retire at full retirement age (around 66–67 depending on your birth year), the maximum you can collect is $4,018/month.

Supplemental Security Income (SSI)

SSI is a federal assistance program for elderly, blind, or disabled individuals with limited income and resources. It’s not based on work history.

- Individual SSI recipients can receive up to $967/month.

- Couples who both qualify can receive up to $1,450/month.

- These are federal maximums. Some states add a little more through state supplements.

Keep in mind, SSI benefits can be reduced if you earn income, live with someone who supports you, or receive help with food or shelter.

Tax Considerations in 2025

Social Security Taxes

- You pay 6.2% Social Security tax on earnings up to $176,100. If you’re self-employed, you pay both sides (12.4% total).

- The Medicare tax remains 1.45% on all earnings, with an additional 0.9% surtax for high earners.

Taxability of Benefits

Depending on your income, a portion of your Social Security benefits may be taxable.

- If you’re single and earn over $25,000, or married and earn over $32,000, up to 85% of your benefits may be taxable.

- SSI benefits, however, are not taxable.

WEP and GPO Repealed in 2025

Big news: the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) were repealed under the Social Security Fairness Act, signed into law in January 2025.

This is a massive win for public-sector employees like teachers, police officers, and firefighters who were penalized under the old rules. With these provisions gone:

- They now receive full Social Security benefits without unfair reductions.

- Many may qualify for retroactive benefits dating back to January 2024.

When Do Payments Arrive?

SSI Payments

- Deposited on the 1st of each month.

- If the 1st falls on a weekend or holiday, payments come the business day before.

Social Security Retirement & SSDI

- If your birthday is between the 1st and 10th, you get paid on the second Wednesday.

- Between the 11th and 20th? Paid on the third Wednesday.

- 21st to end of the month? You’re on the fourth Wednesday.

- If you started receiving benefits before May 1997, you’re usually paid on the third of each month.

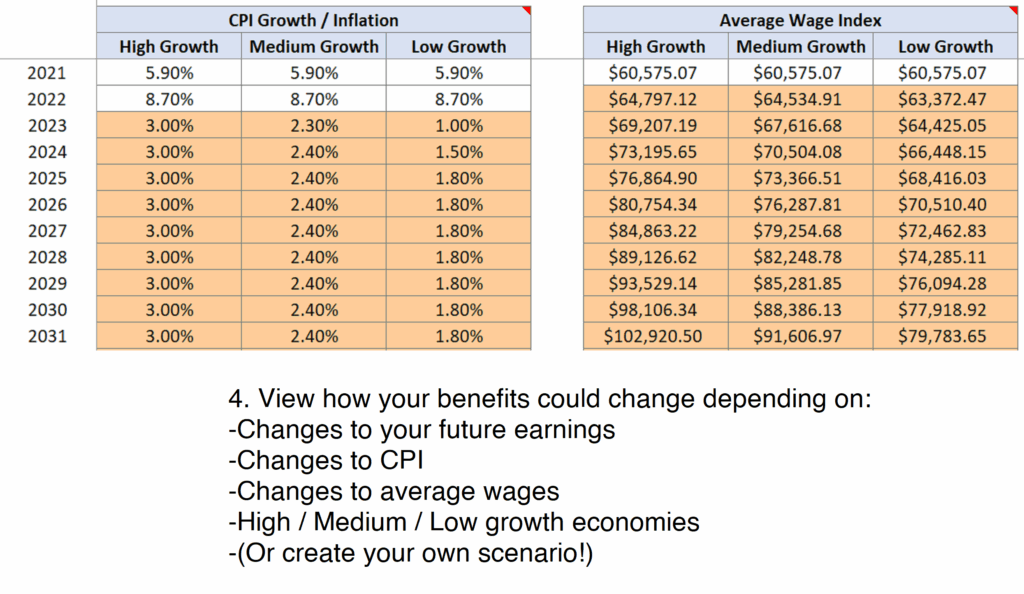

How Long Can Social Security Last?

It’s no secret—Social Security’s future has folks worried.

- The trust fund that helps cover Social Security retirement benefits is projected to be depleted by the mid-2030s if no action is taken.

- After that, the system would still be able to pay about 75–80% of benefits from ongoing payroll taxes.

- Proposed fixes include raising the tax cap, increasing payroll tax rates, or adjusting future COLAs.

Congress will need to step in soon if they want to keep the system fully solvent for future generations.

Practical Tips for Families and Financial Planners

- Open a “My Social Security” account on SSA.gov to view your estimated benefits and manage your direct deposit info.

- If you’re still working, understand how your earnings could reduce your Social Security if you’re below Full Retirement Age.

- If you’re nearing retirement, consider the advantage of delaying benefits to age 70—higher checks can make a big difference later in life.

- Report changes in income or household situation promptly if you receive SSI to avoid overpayments or penalties.

- Talk to a tax professional if you have mixed income or other financial complexities. Your Social Security benefits could impact your overall tax bill.

Step-by-Step Breakdown of SSI and Social Security 2025 Payouts

- Understand how COLA affects your 2025 payout.

- Check new maximum SSI and Social Security figures.

- Confirm whether your benefits are subject to taxes.

- Review the WEP/GPO repeal if you were affected.

- Learn payment schedule rules to know when your money arrives.

- Create or update your My Social Security account.

- Plan for the long-term future—don’t rely solely on government programs.

- Consult a professional for retirement planning or income strategy.

June 2025 Social Security Payment Dates Revealed; See When Your Check Is Coming

Social Security COLA 2026: June Estimate Reveals Exactly How Much Your Check Could Increase

How to Unlock the Highest Monthly Social Security Benefit; 3 Smart Strategies