Next SSDI Deposit Coming Soon: If you’re receiving Social Security Disability Insurance (SSDI), you’ve probably asked yourself: “When will my next payment hit my bank?” or “How much can I really get this month?” The short answer: The next SSDI deposit is right around the corner—and depending on your situation, you could receive up to $4,018 in June 2025.

Whether you’re new to SSDI or a long-time recipient, this guide breaks down exactly when and how your payments will be deposited, how much you may receive, and what you need to do to stay on track. We’ll also show you how to handle delays, use SSA tools, avoid scams, and make the most of your benefit.

Next SSDI Deposit Coming Soon

Staying informed about your SSDI payments is more than just knowing when the check lands. It’s about taking charge of your financial independence, understanding your rights and responsibilities, and using tools like My Social Security to stay ahead. Whether you’re earning the average SSDI payment or near the $4,018 max, this guide helps you get the most from your benefits—on time, every time. Take these steps seriously, stay proactive, and you’ll be ready for anything the SSA throws your way.

| What | Details |

|---|---|

| Program | Social Security Disability Insurance (SSDI) |

| Maximum Monthly Benefit (2025) | $4,018 |

| Average SSDI Payment | $1,580 (individual), $2,826 (with dependents) |

| Payment Schedule | Based on birthday or eligibility date |

| June 2025 Payment Dates | June 3, 11, 18, or 25 |

| Eligibility Factor | Work history + qualifying disability |

| Where to Track | ssa.gov/myaccount |

| Learn More | ssa.gov/disability |

What Is SSDI and Who Qualifies?

Social Security Disability Insurance (SSDI) is a federally funded program run by the Social Security Administration (SSA). It provides monthly cash payments to people who are unable to work due to a qualifying disability.

To be eligible, you must meet two key requirements:

- You’ve worked long enough and recently enough under Social Security (typically 5–10 years).

- You have a medical condition that meets the SSA’s strict definition of disability.

Disabilities must:

- Prevent you from engaging in substantial gainful activity (SGA)

- Be expected to last at least one year or result in death

Common qualifying conditions include severe back injuries, neurological disorders, cancer, and mental health disorders like bipolar disorder or schizophrenia.

Why SSDI Payments Are Important?

SSDI provides essential financial support for millions of Americans. These benefits help pay for:

- Housing and utilities

- Food and basic necessities

- Transportation and medical care

- Childcare and dependent expenses

In 2024, over 8 million disabled workers received SSDI benefits. For many, it’s their main source of income.

SSDI Payment Schedule: When to Expect Your Money

Your SSDI payment schedule is tied to either:

- Your birth date, or

- The date you started receiving benefits (especially if it was before May 1997)

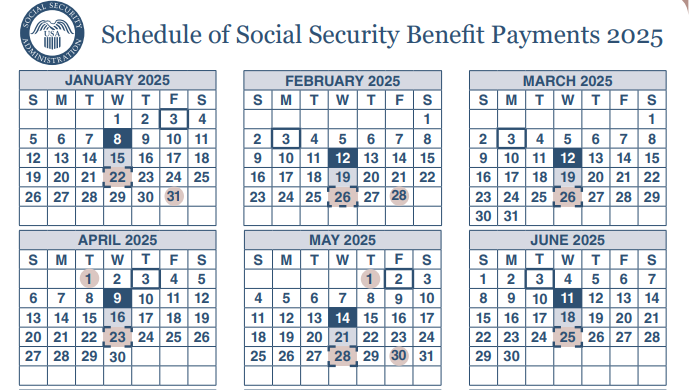

SSDI Payment Dates for June 2025

| Birthday Range | Payment Date |

|---|---|

| 1st – 10th | Wednesday, June 11, 2025 |

| 11th – 20th | Wednesday, June 18, 2025 |

| 21st – 31st | Wednesday, June 25, 2025 |

| All recipients before May 1997 | Tuesday, June 3, 2025 |

If your payment date falls on a weekend or holiday, it is usually deposited on the preceding business day.

How Much Will You Get From SSDI in 2025?

Your SSDI benefit amount depends on:

- Your average indexed monthly earnings (AIME)

- When you became disabled

- If you have qualifying dependents (children, spouse)

2025 SSDI Payment Tiers

| Benefit Type | Amount |

|---|---|

| Maximum SSDI (individual, high earnings) | $4,018/month |

| Average SSDI (individual) | $1,580/month |

| Average SSDI (with dependents) | $2,826/month |

| Supplemental Benefits (SSI + SSDI combo) | May vary per state |

Important: The $4,018 monthly max is rare—it typically applies to people who had high income and delayed retirement to age 67. Most SSDI recipients fall into the $1,200–$2,000 range.

How to Check Your Next SSDI Deposit Coming Soon and Status?

Here’s how you can stay on top of your SSDI benefits and avoid surprises:

Step 1: Create or Log Into Your My Social Security Account

Go to ssa.gov/myaccount

Use it to:

- View your payment history

- Confirm upcoming payment dates

- Check or change your bank info

Step 2: Set Up Direct Deposit

SSA requires direct deposit for fast, secure payment.

You can set it up through:

- SSA’s website

- Your local SSA office

- Calling 1‑800‑772‑1213

Step 3: Track Delays and Know When to Act

If your SSDI isn’t deposited on your scheduled date:

- Wait 3 business days

- Contact your bank

- Then call the SSA

Pro Tip: Set up text or email alerts from your bank to know the second your deposit lands.

Real-Life Example: How Payment Timing Works

Meet Sarah, 47, from Texas.

She became eligible for SSDI in 2020 and was born on June 7.

- Since her birthday falls between the 1st–10th, her June 2025 deposit will arrive on Wednesday, June 11.

- Her monthly SSDI amount is $1,850.

- She uses My Social Security to check payment status and verify her banking info monthly.

Because she keeps track of everything online, she’s never missed a deposit.

What Happens If You Go Back to Work?

The SSA encourages beneficiaries to try working again through programs like:

Trial Work Period (TWP)

- You can work and still get SSDI for up to 9 months

- As of 2025, you can earn up to $1,110/month without it affecting benefits

After TWP ends, you enter the Extended Period of Eligibility (EPE)—you get benefits for any month your income falls below SGA limits.

Substantial Gainful Activity (SGA) Limits

- Non-blind individuals: $1,550/month

- Blind individuals: $2,590/month

Always report your income to SSA. Failure to do so could result in overpayment or suspension.

Protect Yourself from SSDI Scams

Scammers often pose as SSA officials. Here’s how to stay safe:

- SSA will never call to threaten you or ask for payment

- Never provide your Social Security number, banking info, or PIN over the phone

- Report suspicious calls at oig.ssa.gov

Extra Benefits You Might Be Missing

State Supplements

Some states provide additional financial support on top of SSDI or SSI.

Examples:

- California: Up to $100–$300 extra/month

- New York: Automatically added to SSI

- Texas: Limited but available for certain Medicaid-eligible individuals

Medicare Eligibility

If you’ve been on SSDI for 24 months, you’re eligible for Medicare, regardless of age.

Covers:

- Hospital care (Part A)

- Outpatient care (Part B)

- Prescription drugs (Part D, optional)

You’ll be enrolled automatically and receive a card in the mail.

SSDI Payments Up to $4018 Confirmed—Check Your Next Payout Date Now!

SSDI Payment Update: SSA Confirms New Dates for Millions Starting Next Week

How to Unlock the Highest Monthly Social Security Benefit; 3 Smart Strategies

Frequently Asked Questions (FAQs)

Q1: Can SSDI payments be garnished?

Yes, for child support, federal taxes, or some student loans—but not credit cards or personal debt.

Q2: Are SSDI payments taxable?

In most cases, no. But if you have other income (like a pension or a spouse working), a portion may be taxable.

Q3: Can I receive both SSDI and SSI?

Yes, if your income and resources are low enough. The programs are different but can work together.

Q4: What happens if I move or change banks?

Update your address and bank account info via My Social Security or by calling SSA.

Q5: How often are SSDI benefits reviewed?

Typically every 3 to 7 years. SSA may request medical updates or documents during a Continuing Disability Review (CDR).