Panic Over Inheritance Tax: Inheritance tax (IHT)—a phrase that once felt like a distant concern—has suddenly become front and center for thousands of UK families. Since Chancellor Rachel Reeves’s announcement in the 2024 Autumn Budget, families with farms, businesses, pensions, and even modest homes are scrambling to safeguard what they’ve spent a lifetime building. The weapon of choice? Life assurance. But this isn’t just a panic move—it’s a strategic one. And for many, it might be the only way to keep their legacy intact.

Panic Over Inheritance Tax

Rachel Reeves’s inheritance tax reforms have shaken the financial landscape. Middle-class families, especially those with farms, homes, or businesses, are now being hit with complex tax issues that demand immediate attention. The good news? Life assurance, when used strategically, can provide a reliable buffer against this financial uncertainty. Add in proper estate planning, smart gifting, and professional advice, and you can avoid nasty surprises down the road. Don’t wait for tax season to plan your legacy. Start today—and make sure your family inherits your assets, not your tax problems.

| Topic | Details |

|---|---|

| Inheritance Tax (IHT) | A tax on the estate (property, money, and possessions) of someone who’s died |

| Rachel Reeves Reforms | Reliefs capped, pensions included in taxable estate, nil-rate band frozen |

| IHT Threshold | £325,000 (frozen until at least 2030) |

| IHT Rate | 40% on amounts above the threshold |

| Life Assurance Boom | 230% increase in whole-of-life insurance policies reported by LifeSearch |

| Effective Planning Tools | Life insurance in trust, gifting, business asset restructuring |

| Official Resource | GOV.UK – Inheritance Tax Overview |

What Is Inheritance Tax, and Why Is Everyone Panicking?

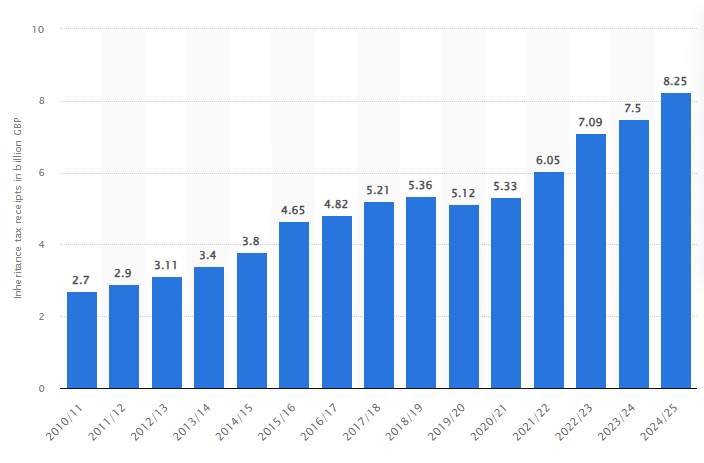

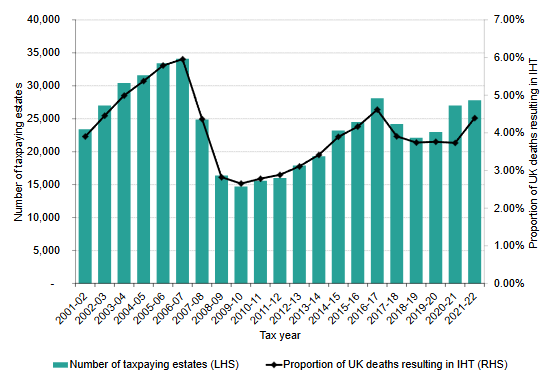

Inheritance tax (IHT) is a tax charged on a person’s estate when they pass away. If your estate is worth more than the current nil-rate band of £325,000, anything above that threshold could be taxed at a staggering 40%.

For years, certain assets—such as pensions, farms, and businesses—could be passed on tax-free due to special reliefs. But Rachel Reeves’s reforms changed all that. Now, families that once felt “safe” from IHT are suddenly finding themselves in the crosshairs.

Here’s why people are panicking:

- The nil-rate band has been frozen until 2030, meaning as inflation and property values increase, more people will be dragged into the IHT net.

- From April 2026, Business Property Relief (BPR) and Agricultural Property Relief (APR) will be capped at £1 million. Anything over that will be taxed at 20%.

- From April 2027, unused pensions will be included in IHT calculations—a dramatic shift in policy that could trigger six-figure tax bills for many retirees.

What was once a concern only for the ultra-wealthy has now become a real threat for middle-income families across the UK.

Why Life Assurance Is the Talk of the Town

Following these changes, families are rushing to protect their assets. And one tool stands out from the rest: whole-of-life insurance, commonly referred to as life assurance in the UK.

This isn’t your typical term life insurance. Whole-of-life assurance guarantees a payout when you die—no matter when that is—making it the perfect tool to cover IHT liabilities.

And it’s not just hype. Insurance broker LifeSearch reported a 230% spike in whole-of-life policy sales immediately after the Chancellor’s announcement.

Why the sudden interest?

- The payout can be written in trust, so it’s not counted as part of your estate and is free from IHT.

- It provides your heirs with immediate liquidity to pay tax bills without selling assets like the family home or business.

- Policies can be structured to match your estimated IHT liability, making it a targeted, efficient solution.

Real-Life Example: Meet Sarah, the Small Business Owner

Sarah owns a family-run bakery in Oxfordshire. It’s valued at £1.2 million. She also owns her home, worth £600,000, and has a pension pot of £300,000.

Before the reforms:

- The business qualified for full BPR.

- Her pension was safe from IHT.

- Her family would likely owe nothing.

After the reforms:

- Only £1 million of her business value qualifies for relief.

- Her pension is now taxable after death.

- Her estate faces an estimated £400,000 tax bill.

To prepare, Sarah took out a £400,000 whole-of-life policy in trust, ensuring her children can pay the tax without touching the bakery or home.

What Changed Under Rachel Reeves’s Tax Reforms?

Let’s break it down.

1. Capped Relief on Business and Farm Assets

Until now, qualifying business or farm assets could be passed on completely tax-free using BPR or APR.

From April 2026:

- Relief will be capped at £1 million.

- Any value over that is taxed at 20%, with potential clawback provisions if assets are sold.

This significantly affects rural families and small business owners—many of whom are asset-rich but cash-poor.

2. Pensions Count Toward IHT

From April 2027, unused pensions—once excluded from your estate—will be treated as taxable.

That means:

- A £500,000 pension pot left to your spouse or children could face a 40% IHT hit if your total estate exceeds the threshold.

This overturns years of pension planning and means many retirement strategies now need urgent review.

3. Frozen Nil-Rate Band

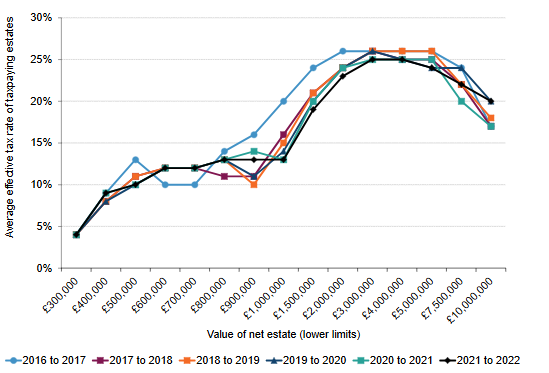

The £325,000 threshold hasn’t moved since 2009—and inflation has chipped away at its value.

Meanwhile, average UK house prices have soared:

- In 2009: ~£160,000

- In 2024: ~£285,000

That means even people with just a modest home and savings are being swept into the IHT bracket.

Step-by-Step Guide: How to Protect Your Estate As There Is Panic Over Inheritance Tax

Let’s walk through the actions you should take.

Step 1: Assess the Value of Your Estate

Add up the value of:

- Property (your home, rental, land)

- Pensions and savings

- Business or farm assets

- Insurance payouts not written in trust

Step 2: Speak With a Professional

Contact a Chartered Financial Planner or estate solicitor. They’ll review your assets, advise on tax efficiency, and help you develop a tailored strategy. Search FCA-registered professionals to ensure your adviser is legitimate.

Step 3: Consider Whole-of-Life Insurance

This policy pays a lump sum on death. Key features:

- Best taken sooner than later, as premiums are lower when younger.

- Write the policy in trust to keep it outside your estate.

- Tailor the cover to match your estimated IHT bill.

Step 4: Gift Strategically

Use HMRC’s annual gifting rules:

- £3,000 annual gift allowance (per person)

- £5,000 wedding gifts to children

- Unlimited “potentially exempt transfers”, provided you live 7 years after the gift

Step 5: Set Up a Trust

If structured properly, family trusts can protect assets from tax and probate delays. But trust law is complex—get expert legal advice before setting one up.

Pros and Cons of Life Assurance for IHT

Pros:

- Immediate liquidity for heirs

- Avoids forced asset sales

- Tax-efficient when held in trust

Cons:

- Can be costly later in life

- Requires ongoing premium payments

- Needs to be managed and reviewed

Who’s Hit the Hardest?

- Farmers and Landowners: Large landholdings often exceed £1 million and are now partially taxable.

- Small Business Owners: Family businesses once protected are now subject to partial IHT.

- Middle-Class Retirees: With homes, pensions, and savings combined, many face taxes they never anticipated.

Industry Reaction and Public Backlash

Not everyone’s taking the news lightly.

- James Dyson called the budget “spiteful,” warning that the new IHT rules could “stifle ambition.”

- Farmers’ associations have raised concerns about multi-generational family farms being forced into liquidation.

- Mental health advocates noted cases of distress and anxiety among aging landowners facing inheritance worries.

UK Eyes New Tax on Pensioners to Reclaim Winter Fuel Payments; Here’s What It Means

Extra £90 Coming Soon for Millions in the UK—Check If You Qualify!

The Truth About European Pensions: These Countries Are Paying £8K More Than the UK – Find Out Why!