Pensions Revolution Incoming: A pensions revolution is underway in the UK, and it’s not just a political slogan. Chancellor Rachel Reeves has introduced a sweeping plan that could reshape the UK’s retirement savings system, redirecting billions of pounds into the British economy. With the country seeking stronger economic footing post-Brexit and amid global financial uncertainty, this could be the spark needed to fuel growth, innovation, and better retirements for millions. Whether you’re a worker trying to understand where your pension is going, a business owner navigating new rules, or a fund manager facing shifting regulations—this article breaks it all down in plain terms, with expert-backed insight and practical guidance.

Pensions Revolution Incoming?

This pension reform isn’t just a headline—it’s a fundamental shift in how the UK treats retirement savings and economic development. By directing pension power inward, Rachel Reeves is betting on Britain to deliver not just returns, but renewal. Whether this plan becomes a landmark success or faces obstacles will depend on execution, transparency, and public trust. But one thing is clear: pensions will no longer be passive—they’re becoming a powerful lever for national progress.

If implemented effectively, these changes could position the UK as a global model for combining private savings with public good. They could also empower a new generation of savers to feel more connected to where their money goes and how it grows. In a time of economic uncertainty, this reform could offer something rare: a long-term, purpose-driven path to prosperity.

| Feature | Description |

|---|---|

| Policy Name | UK Pension Schemes Reform |

| Who’s Behind It? | Chancellor Rachel Reeves |

| Goal | Redirect pension investments into UK economy |

| Key Target | £50 billion invested in UK private markets by 2030 |

| Fund Consolidation | Merge small pension pots into megafunds worth £25B+ each |

| Mandatory UK Investment | At least 5% of pensions into UK infrastructure and startups |

| Savings for Savers | Estimated £1 billion in admin cost savings |

| Implementation Timeline | 2025–2030 rollout |

| Official Website | UK Government Pension Reform Plan |

What Is This Reform All About?

In the UK, pension schemes control over £2.5 trillion in assets, but much of that money is invested overseas or in ultra-safe assets with limited returns. That approach might keep things stable, but it does very little to stimulate domestic economic growth.

Rachel Reeves wants to change that by unlocking more of that money to be invested back into the UK—in areas like clean energy, affordable housing, tech startups, and regional infrastructure.

The reform includes three major moves:

- Combining small pension pots into larger “megafunds”

- Mandating a 5% minimum investment into UK private markets

- Introducing a “value for money” test for pension funds

1. Megafunds: Bigger, Stronger, Smarter Pensions

Right now, the UK has over 27,000 small pension schemes, many of which are underperforming or inefficient. The plan aims to merge these into megafunds with assets of at least £25 billion by 2030.

The advantages of megafunds:

- Lower administrative costs

- More efficient investment strategies

- Access to better deals, such as infrastructure projects

- Room for higher-risk, higher-return ventures

This move follows successful models in countries like Canada and Australia, where larger pension funds have become major investors in their domestic economies.

2. Mandatory UK Investment: 5% Minimum Rule

To ensure the pension industry supports the broader economy, new rules will require pension funds to invest at least 5% of their assets in UK private markets. That includes:

- Infrastructure projects

- Startup and venture capital

- Green energy initiatives

- Local business growth programs

The goal is to inject £50 billion into the UK economy by 2030, creating jobs, modernizing infrastructure, and helping new industries grow.

Investing domestically also means savers’ money is working in the real world around them—not just on spreadsheets or in overseas markets.

3. Auto-Merging Small Pension Pots

Many people today work multiple jobs over their lifetime, and that means they end up with multiple small pension pots—some as little as £500 or £800. These are inefficient and often forgotten.

The reform includes a new rule: any pension pot under £1,000 will be automatically merged into your main account. This reduces:

- Administrative costs

- Confusion for savers

- Lost or inactive accounts

More importantly, it simplifies the retirement journey and helps your savings grow more efficiently over time.

4. Value-for-Money Assessments

Another big change is a “value for money” performance test. Pension providers will need to demonstrate they are delivering:

- Strong investment returns

- Competitive fees

- Clear reporting

Funds that consistently underperform or charge too much could be forced to consolidate or lose their licenses.

How Pensions Revolution Incoming Affects Different Groups?

For Everyday Workers and Savers

- You may see higher long-term returns from your pension

- You’ll have fewer accounts to track

- You’ll indirectly contribute to building the UK economy

- Your pension provider may contact you with updated statements or options

For Employers

- You may need to update your payroll systems or work with pension administrators to meet compliance standards

- Your staff may have questions about their pension changes—consider offering an education session

For Pension Fund Managers

- You must meet the 5% domestic investment target

- Your fund must pass the value-for-money assessments

- You may need to restructure portfolios, hire private equity expertise, or consolidate with other funds

What the Experts Say?

Sarah Smart, Chair of The Pensions Regulator, has supported the plan, stating:

“This is about modernizing how pensions serve the UK economy and the people who pay into them.”

Michael Taylor, Economist at Manchester Business School, said:

“Investing in the UK isn’t just patriotic—it’s strategic. If the private markets perform well, this could be a win-win for savers and the state.”

But not everyone is convinced.

Tom Selby, head of retirement policy at AJ Bell, warns:

“We must ensure that fiduciary duty is not diluted. Trustees must always act in the best interest of members, even under government pressure.”

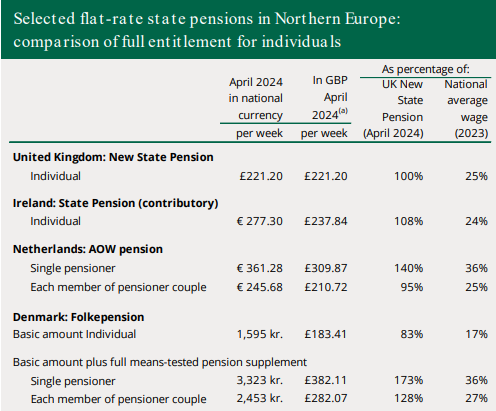

Global Comparisons: Are We Catching Up?

| Country | Pension Strategy | Domestic Focus? |

|---|---|---|

| UK | Mandated private investment | Now yes (5% minimum) |

| USA | 401(k), state-led innovation | Mostly market-driven |

| Canada | Large-scale public-private funds | Strong local investment |

| Australia | Superannuation with aggressive growth | High domestic participation |

Countries like Canada (CPPIB) and Australia (AustralianSuper) have successfully used pension funds as growth engines. Reeves’ reform looks to follow that playbook.

Potential Risks and Challenges

While the reforms look promising, there are valid concerns:

Investment Risk

UK startups and infrastructure can offer high returns—but they come with volatility. A recession or poor investment decisions could mean losses for pensioners.

Fiduciary Pressure

Trustees have a legal duty to act in members’ best interests. Critics argue mandatory investments may conflict with this principle if returns aren’t competitive.

Execution Risk

If the UK doesn’t have enough quality investment opportunities, funds may struggle to meet the 5% target without taking excessive risk.

Rachel Reeves’ Pension Megafund: A £6,000 Boost or a Gender Pay Gap in Disguise?

UK Pension Alert: Millions of Savers Unknowingly Losing Money to Hidden Fees – Are You One of Them?

Thousands of UK Pensioners Could Be Owed £11,725—Check This DWP List Now

Actionable Tips for You

1. Track Your Pension

Use the Government Pension Tracing Service to locate all your accounts, especially if you’ve changed jobs often.

2. Review Statements

Check your fund’s performance annually. Ask whether your provider is complying with the new reforms and delivering good value.

3. Talk to Your Employer

If you’re unsure about how these changes affect your workplace pension, ask HR or payroll for a breakdown.

4. Stay Informed

Follow updates via The Pensions Regulator or financial news outlets like FT and City A.M..