New Pension Benchmark Revealed: A new benchmark is making waves in the world of UK retirement planning. Experts now say that you’ll need a pension pot of £682,000 to enjoy a comfortable retirement in Britain. But here’s the kicker: even that might not be enough.

If that figure sounds intimidating, you’re not alone. Retirement planning in 2025 is a whole different ballgame compared to past generations. With skyrocketing living costs, longer life spans, and increased reliance on personal savings over employer pensions, the burden is on the individual like never before. Whether you’re in your 20s or late 50s, it’s critical to understand what this number means—and how to actually hit it. This article breaks everything down in plain English, with real-life examples, practical strategies, expert insights, and trusted tools to help you get retirement-ready.

New Pension Benchmark Revealed

Retirement today isn’t what it was 30 years ago. A comfortable life after work now demands a six-figure pension, careful planning, and smart decisions along the way. While £682,000 is a good benchmark, it’s not a one-size-fits-all answer. Your needs, lifestyle, and circumstances will shape your personal retirement number. But don’t be overwhelmed—start where you are. Take small steps, stay consistent, and keep your goals in focus. Because the best retirement plan is the one that works for you.

| Feature | Details |

|---|---|

| New Pension Benchmark | £682,000 required for a comfortable retirement for one person in the UK |

| Annual Income Needed | £43,900 for a single person; £60,600 for a couple |

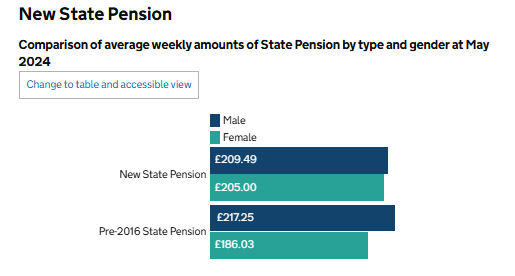

| State Pension | Full amount is £11,502 per year (2024/25) |

| Main Assumptions | Retired, mortgage-free, no rent costs, average life expectancy |

| Inflation Impact | Can erode pension power by up to 40% over 20 years |

| Single Person Penalty | Needs approximately £225,000 more than a couple due to no cost-sharing |

| Lost Pensions in the UK | Estimated £31.1 billion remains unclaimed |

| Official Resource | Retirement Living Standards |

What Does “Comfortable Retirement” Actually Mean?

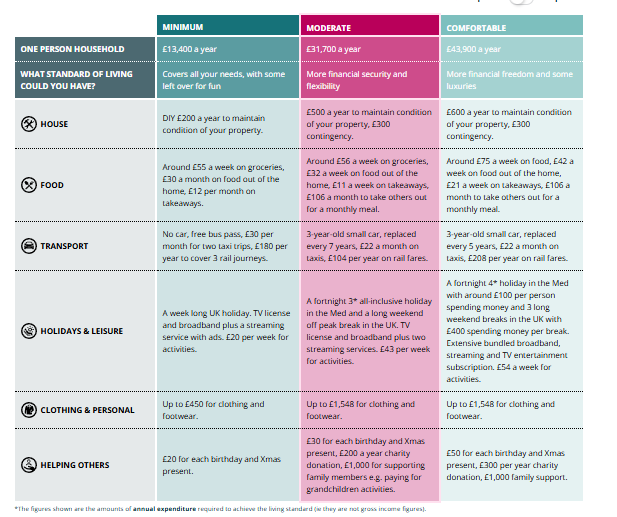

The term “comfortable retirement” refers to a standard of living that covers not just the essentials—like food, heating, and transport—but also life’s pleasures. That includes a reliable car, occasional holidays abroad, new clothes, gifts for grandchildren, and dining out regularly.

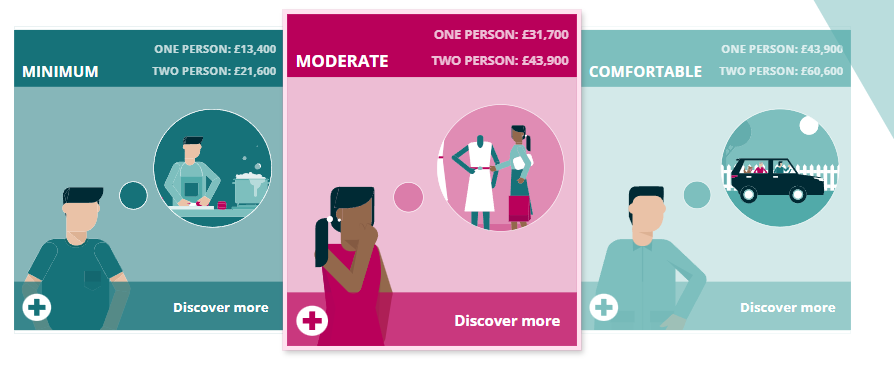

According to the Pensions and Lifetime Savings Association (PLSA):

- A single person needs about £43,900 per year.

- A couple needs around £60,600 per year.

These figures assume you own your home outright, have no debt, and qualify for the full UK State Pension.

But with inflation, rising rents, and longer retirements, that comfort zone is quickly being squeezed.

Why Even New Pension Benchmark Revealed May Not Be Enough?

Despite being the new benchmark, there are four critical reasons why £682,000 may still fall short of funding a truly secure and satisfying retirement.

1. Housing Costs Are Rising Faster Than Incomes

The average monthly rent in the UK recently surpassed £1,300, and in cities like London, it’s over £2,000. If you enter retirement still renting, you’ll need at least £20,000 to £25,000 annually just to cover housing—leaving far less for everything else.

And with home ownership declining among under-40s, many people may face housing bills well into their retirement years.

2. Singles Pay More for the Same Lifestyle

Being single in retirement is expensive. Unlike couples, single retirees don’t get to split the cost of utilities, food, and travel. Research shows a single person needs around £225,000 more in retirement savings than a couple to maintain the same lifestyle.

In other words, living alone means you’ll need to save significantly more.

3. Inflation Is the Silent Killer of Retirement Savings

A pound saved today doesn’t go as far tomorrow. Over 20 years, a 2.5% annual inflation rate reduces purchasing power by about 40%. That means your money buys less, especially when it comes to travel, health care, and food.

This makes it crucial to invest your pension wisely to outpace inflation.

4. Most People Are Severely Underestimating Their Needs

A study by St. James’s Place Wealth Management found that 23% of UK adults believe £50,000 is enough to retire comfortably. That’s not even close.

The real minimum for a “moderate” lifestyle is around £23,300 per year, which still requires a pension pot north of £300,000—far more than most people expect.

The Three Retirement Lifestyles Explained

To better understand your savings target, it helps to know the three tiers of retirement lifestyles, as defined by the PLSA:

Minimum

- Budget: £14,400/year (single)

- Covers essentials only: food, heating, public transport, UK holidays.

Moderate

- Budget: £23,300/year (single)

- Includes: one UK holiday and one European trip/year, dining out monthly, a car.

Comfortable

- Budget: £43,900/year (single)

- Includes: regular holidays, new car every 5 years, frequent dining out, home improvements.

Real-Life Examples

Sarah, Age 32 – Junior Marketing Assistant

- Salary: £30,000

- Currently contributes 5% + 3% employer match

- Total savings: £8,000

- Retirement Goal: Moderate lifestyle

Next Step: Increase contributions to 12%, consolidate old pensions from internships, and invest in higher-growth funds to close the gap.

Martin and Liz, Age 52 – Married, Two Kids

- Household income: £90,000

- Pension savings: £220,000 combined

- Retirement Goal: Comfortable lifestyle at 65

Next Step: Maximise annual allowances, start tracking expenses, explore income drawdown strategy and possibly delay retirement by 2–3 years.

How to Actually Plan for a Comfortable Retirement?

Step 1: Set a Target

Use an online retirement calculator to estimate how much you’ll need based on the lifestyle you want.

Tools to try:

- MoneyHelper Retirement Planner

- PLSA Lifestyle Calculator

Step 2: Save More Than the Minimum

The minimum contribution under auto-enrolment is 8% (employee + employer). But experts suggest aiming for 12–15% of your salary to hit a comfortable level.

Even an extra £50/month in your 30s can add more than £75,000 by retirement.

Step 3: Track Down Lost Pensions

Don’t leave free money on the table. An estimated £31 billion in lost pensions is sitting unclaimed.

Use the Gov.uk Pension Tracing Service to locate old workplace pensions.

Step 4: Consolidate and Review Investments

Review your pension funds regularly. Many providers allow switching to higher-yield funds or ethical investments. Consolidating smaller pots may also reduce fees.

Step 5: Consider Working Longer or Part-Time

Even two extra years of work can add tens of thousands to your pension and reduce how long you’ll need to draw from it.

Step 6: Get Professional Advice

A certified financial advisor can help with:

- Tax planning

- Choosing between annuities or drawdown

- Managing risk levels

Tax Planning in Retirement

Taxes don’t stop once you retire. Planning ahead can help you legally reduce what you owe and stretch your savings further.

- 25% of your pension pot can be taken tax-free.

- Avoid withdrawing too much in one tax year to stay in lower tax brackets.

- Use ISAs alongside pensions to draw tax-free income.

Also consider using your Personal Allowance and Dividend Allowance to minimise tax on investments.

UK Pension Alert: Millions of Savers Unknowingly Losing Money to Hidden Fees – Are You One of Them?

Thousands of UK Pensioners Could Be Owed £11,725—Check This DWP List Now

DWP Issues Urgent Pension Alert for Brits Born Between These Dates – Are You Affected?

Retirement Action Checklist

| Task | Why It Matters |

|---|---|

| Increase pension contributions | Helps reach target faster through compounding |

| Locate and consolidate lost pensions | Avoids unnecessary fees and duplication |

| Review fund performance annually | Keeps growth on track and adjusts for risk |

| Use retirement calculators | Sets realistic goals and tracks progress |

| Speak with a financial advisor | Customises your strategy for maximum results |

| Plan for inflation and longevity | Ensures your money lasts throughout retirement |