No June SSI Check? If your wallet’s feeling a little lighter this June and you’re wondering, “Where’s my SSI check?”, you’re not the only one. But don’t stress—it’s not a government glitch or budget cut. This situation actually comes down to the Social Security Administration’s (SSA) routine scheduling.

We’ve heard from folks across the country—grandparents, caregivers, and young adults with disabilities—worried that their lifeline just vanished. That’s why we’re breaking it all down in plain English. Because when your benefits are involved, you deserve clear answers, not confusion. Let’s unpack the why, when, and what you should do next. We’ll also guide you on how to apply for SSI, manage early payments, and ensure your benefits keep flowing on time.

No June SSI Check?

If you didn’t get an SSI check in June 2025, now you know why: it already arrived on May 30. This isn’t a glitch—it’s part of how the SSA handles weekend and holiday payments. Understanding this small shift can help you manage your money better and avoid unnecessary stress. Knowing how and when payments come, what to do if something’s wrong, and how to apply if you’re eligible gives you the power to take control of your benefits. We get it—every dollar counts, especially when you’re budgeting on fixed income. That’s why staying informed isn’t just helpful, it’s empowering. You’ve got enough on your plate; your SSI shouldn’t be another mystery to solve.

| Topic | Details |

|---|---|

| Why no SSI check in June 2025? | June 1 falls on a Sunday. SSI payments aren’t issued on weekends or holidays, so the payment was sent early on May 30, 2025. |

| Next SSI payment | Scheduled for Tuesday, July 1, 2025. |

| SSI Payment Rule | Payments are generally made on the 1st of each month unless that date is a weekend or holiday. Then it’s issued the business day before. |

| 2025 Max SSI Benefit | $943/month for individuals, $1,415/month for couples. |

| How to Apply for SSI | You can apply online at SSA.gov, over the phone, or in person at your local SSA office. |

| SSA 2025 Calendar | Click here for the 2025 SSI Payment Calendar |

What Is Supplemental Security Income (SSI)?

Supplemental Security Income (SSI) is a needs-based federal program designed to help older adults, and people with disabilities or blindness, who have little to no income. The goal? To make sure they can meet their basic needs—food, clothing, shelter—without falling through the cracks.

SSI is different from Social Security benefits, which are based on your work history. SSI is for folks who might not have had the opportunity to build up those earnings, but still need support.

To qualify, you generally must:

- Be 65 or older, blind, or have a qualifying disability

- Have limited income (wages, pensions, etc.)

- Have limited resources (bank accounts, vehicles, etc.)

Why Is There No June SSI Check?

June 1, 2025, falls on a Sunday. Since the SSA doesn’t process payments on weekends or holidays, they bumped up the distribution to Friday, May 30. That means your June check came early.

And here’s the catch: that early May 30 payment counts for June. So if you’re looking at your account in mid-June wondering why nothing new arrived—it’s because it already did.

This is a routine schedule shift that happens multiple times a year depending on how the calendar shakes out. Your benefits haven’t been cut, and you haven’t been skipped. It’s just a timing thing.

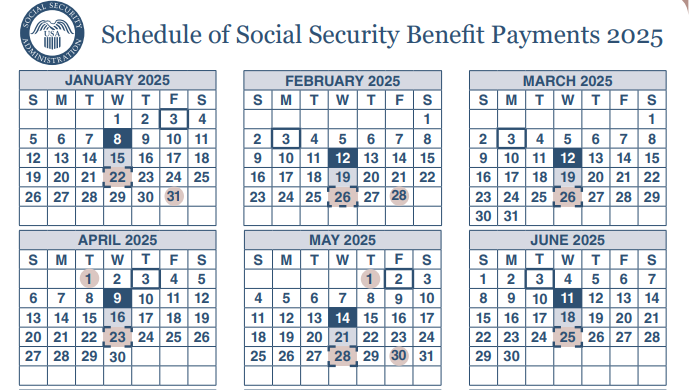

Complete SSI Payment Schedule for 2025

To help you plan ahead, here’s the full SSI payment calendar for 2025. The SSA has already accounted for holidays and weekends, so these are the expected payment dates:

- January 1 – Paid early on December 31, 2024

- February 1 – Friday

- March 1 – Saturday, paid early on February 29

- April 1 – Tuesday

- May 1 – Thursday

- June 1 – Sunday, paid early on May 30

- July 1 – Tuesday

- August 1 – Friday

- September 1 – Monday (Labor Day), paid early on August 29

- October 1 – Wednesday

- November 1 – Saturday, paid early on October 31

- December 1 – Monday

- January 1, 2026 – Paid early on December 31, 2025

How to Apply for SSI in 2025?

Think you or someone you love might qualify for SSI? The application process isn’t too tough—especially if you know what to expect.

Step 1: Get Your Documents Ready

To start, gather this info:

- Social Security Number

- Birth certificate or immigration documents

- Proof of income (pay stubs, benefits, pensions)

- Bank statements or account balances

- Medical evidence (doctor’s notes, test results, prescriptions)

- Rent or housing information

Step 2: Choose Your Application Method

You can apply:

- Online at ssa.gov/benefits/ssi

- By phone: Call 1-800-772-1213 (TTY 1-800-325-0778)

- In person at your local SSA office (make an appointment first)

Tip: Applying online is convenient, but some people prefer the personal touch of speaking to a representative. There’s no wrong way—as long as you get it done.

Step 3: Complete the Interview

The SSA may schedule an interview (in person or by phone) to verify your info. Be honest and thorough—they’re there to help.

How Your SSI Payment Is Calculated?

Not everyone gets the full $943 (individual) or $1,415 (couple). Your actual benefit depends on a few factors:

- Other income: Wages, pensions, SNAP, etc.

- Living arrangements: Living rent-free? It could lower your check.

- State supplements: Some states chip in extra money on top of the federal SSI amount.

Practical Tips for Managing Early SSI Payments

Getting your SSI check a few days early might feel like a bonus, but it’s actually just a timing shift—not extra money. Without a good plan, it’s easy to spend it too soon and come up short the next month. Here’s how to stay on track and avoid those stressful “end-of-the-month” money gaps:

1. Treat Early Payments as Next Month’s Money

It might hit your account in May, but that check is meant for your June expenses. Label it mentally—or even physically in your budget—as “next month’s funds.” If you use an envelope system, stash it in a “Do Not Touch Until June” envelope.

2. Use Budgeting Tools That Work for You

Whether it’s a simple notebook, a phone app like Mint, or an old-school calendar, tracking your expenses helps prevent overspending. Try dividing your monthly check into weekly spending limits to stretch it further.

3. Set Up Automatic Transfers or Bill Payments

If you’re worried about dipping into your early payment too soon, consider scheduling automatic payments for rent or utilities on the first of the month. That way, the money goes where it’s needed without tempting impulse buys.

4. Build a Mini Safety Net

It’s not always easy, but setting aside even $10–$20 a month can add up over time. A small emergency fund can help cover late-month medication, groceries, or transportation when you’re in a pinch.

5. Lean on Community Resources if Needed

If your benefits don’t stretch far enough, don’t hesitate to tap into support programs like food banks, energy assistance, or local nonprofits. They’re there for a reason—to help you get by without falling behind.

Californians, Don’t Count on That June SSI Check—Here’s the Real Payment Date

Will Your Check Arrive Late? What Memorial Day Means for SSI and Social Security Deposits

June 2025 Social Security Payment Dates Revealed; See When Your Check Is Coming

Avoiding Scams and Keeping Your Benefits Safe

Scammers love to target SSI recipients, especially around payment days. Here’s how to protect yourself:

- The SSA will never call to ask for your SSN or banking info.

- Don’t click on random links in texts or emails claiming to be from SSA.

- Use only official websites like ssa.gov.

If something feels off, call SSA directly at 1-800-772-1213.