DWP Issues Urgent Pension Alert for Brits: The UK Department for Work and Pensions (DWP) has issued a pressing warning for British citizens, specifically those born between April 6, 1960, and March 5, 1961. If you fall into this age group—or if you’re supporting a parent, partner, or client who does—this alert could significantly impact your financial planning and retirement timeline. With the government reviewing the State Pension age and ongoing discoveries of historical underpayments, it’s essential to know where you stand. This comprehensive guide is designed to help both individuals and professionals navigate these complex but important developments.

DWP Issues Urgent Pension Alert for Brits

The DWP’s pension alert isn’t just a bureaucratic formality—it’s a chance to reclaim your rightful money, adjust your financial planning, and avoid unnecessary retirement delays. Whether you’re born in the 1960s, raised kids in the ’80s, or retired a decade ago, now is the time to act. Don’t let red tape rob you of what you’ve earned.

These errors have affected hundreds of thousands—many of whom are unaware they’re missing out. By staying informed and proactive, you can protect your financial security and help others do the same. Remember, your pension isn’t a gift—it’s something you’ve worked for and paid into your entire life. If you don’t check, you could lose out on thousands that you rightfully deserve.

| Topic | Details |

|---|---|

| Who is affected? | Brits born between April 6, 1960 – March 5, 1961 |

| Primary issue | Changes to State Pension age and large-scale underpayments |

| Underpayment estimates | Up to £4,200 per person, £1.3 billion total owed |

| Groups impacted | Women born in 1950s, mothers pre-2000, widowed/divorced women, and 1960s cohort |

| Official resource | DWP State Pension Portal |

Understanding the State Pension System

The State Pension is a regular payment from the UK government to people who have reached retirement age and have made sufficient National Insurance (NI) contributions. As of 2024:

- The full new State Pension is £221.20 per week.

- To qualify, individuals need 35 qualifying years of NI contributions.

- You need at least 10 qualifying years to receive any payment at all.

The pension age used to be 60 for women and 65 for men, but since 2010, it’s been equalized and increased in stages. Now it’s 66 for everyone, and the government plans to raise it further.

Who Is Affected and How?

Born Between April 6, 1960 – March 5, 1961

If you were born in this range, your State Pension Age (SPA) is under review. It was previously scheduled for age 66, but under new proposals, it may be increased to 67 as early as 2026. For some, retirement may be delayed by up to 12 months or more.

Why this matters:

- Delayed access to pension payments

- Postponement of related benefits (e.g., free prescriptions, bus passes, and winter fuel allowance)

- Need to extend working years or rely more heavily on private pensions

Example:

Margaret, born in July 1960, planned to retire at 66. Under new plans, she may need to wait until nearly 67, which would delay roughly £11,500 in pension payments.

Born Before 1959 – Pension Underpayments

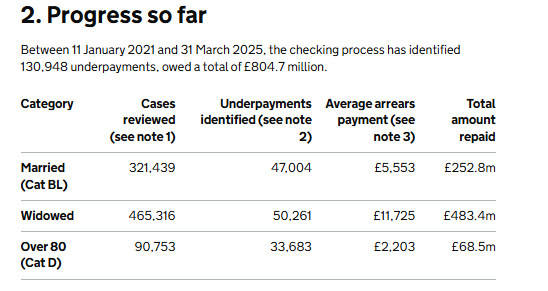

A report from the National Audit Office (NAO) in 2023 uncovered widespread underpayments of the State Pension. These errors were mainly due to outdated systems, manual miscalculations, or failure to apply inherited pension rights correctly.

Groups most affected:

- Women who should have benefited from their husband’s NI record

- Widows whose pensions weren’t updated after their partner’s death

- People over 70 who never questioned their payments

Key data:

- Over 230,000 individuals identified as underpaid

- Average amount owed: £3,000 – £4,200 per person

- Total liability: £1.3 billion

The DWP has launched a correction program, but progress is slow. As of late 2024, only about half the cases have been resolved.

Mothers Who Claimed Child Benefit Before 2000

This group includes mothers who received Child Benefit before 2000 but were not credited with Home Responsibilities Protection (HRP). HRP was a scheme designed to safeguard pension rights for parents and caregivers, but many qualifying women were not given the credits.

What went wrong:

- Incomplete digitization of records

- HRP data was lost or never recorded correctly by HMRC

- Failure to transfer HRP credits into NI records after 2010

Impact:

- Some women have lost over 10 years of pension entitlement

- Estimated 200,000+ mothers affected

- Loss of up to £50,000 over a full retirement

Married, Divorced, or Widowed Women

Historically, women could claim a pension based on their husband’s NI contributions. After 2016, this system changed, but those on the old State Pension may still qualify for a 60% pension uplift based on their spouse’s record.

Common issues:

- Divorce not properly recorded by the DWP

- Husband’s death not triggering an automatic reassessment

- Data mismatch between HMRC and DWP

Who qualifies:

- Women whose husbands had a full NI record

- Widows whose pension wasn’t adjusted

- Divorced women whose entitlements were missed

If your pension is under £85 per week, you should check whether you’re entitled to more.

Common Mistakes to Avoid as DWP Issues Urgent Pension Alert for Brits

- Assuming DWP calculations are always correct

- Not checking NI contributions after raising children

- Believing pension age is fixed

- Missing voluntary contributions deadline (you can backpay only for the last six years)

How to Make a Pension Complaint or Appeal

If you believe you’ve been underpaid, treated unfairly, or given incorrect information about your State Pension, you have the legal right to file a complaint or appeal. While the process can seem overwhelming, it’s actually straightforward when broken down step by step.

Step-by-Step Guide to Making a Pension Complaint

Step 1: Contact the DWP’s Pension Service Directly

Start by calling 0800 731 0469 or writing a formal letter outlining your concern. Be specific—include your National Insurance number, dates, and the nature of the issue (e.g., missing NI credits, incorrect payment amount, or lost spousal entitlement).

Step 2: Request a Reassessment or Correction

Ask for a recalculation of your pension based on updated information, such as new NI credits, spousal records, or missed contributions. The DWP will send you a written response.

Step 3: Escalate to the Independent Case Examiner (ICE)

If you’re unhappy with the response from DWP, you can escalate your case to the ICE, who investigates complaints impartially. You must contact ICE within six months of receiving the final DWP decision.

Website: www.ind-case-exam.org.uk

Phone: 0800 414 8529

Step 4: Take It to the Parliamentary and Health Service Ombudsman (PHSO)

If ICE cannot resolve the issue to your satisfaction, your final step is contacting the PHSO. You’ll need a referral from an MP, but the process is well documented and free of charge.

Action Checklist

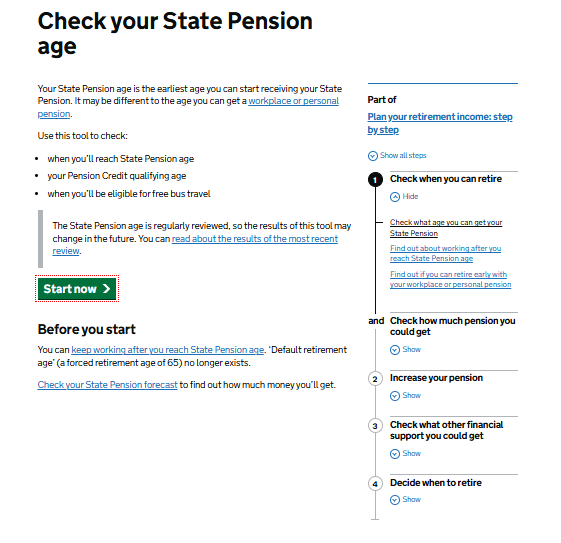

Step 1: Check your State Pension age

Visit: www.gov.uk/state-pension-age

Step 2: Review your NI record

Check for any gaps: www.gov.uk/check-national-insurance-record

Step 3: Request backdated NI credits if applicable

Especially for stay-at-home parents or caregivers: Apply here

Step 4: Contact DWP about possible underpayments

Phone: 0800 731 0469

Or write:

The Pension Service

Mail Handling Site A

Wolverhampton

WV98 1AF

Step 5: Seek independent advice if needed

Try Age UK, Citizens Advice, or a qualified financial adviser.

DWP Benefits Payment Dates Changed — Check Your Updated Details Now!

State Pensioners Born Before 1959 Set to Receive £1,362 in Surprise Extra Benefits

DWP Bonus: State Pensioners Could Get Extra £230 – But Only If You Tick These Boxes

Case Study: Real Story of a Pension Correction

Jim’s Story – Widower, 74, Leeds

Jim’s wife passed away in 2010. He continued receiving his basic State Pension of £80/week. In 2023, after reading about the DWP review, he called the Pension Service. It turned out he was entitled to £130/week due to his wife’s full NI contributions.

He received a back payment of £5,200 and now gets £50 more every week.

Future Forecasts

The UK government is under increasing pressure to:

- Raise the State Pension age to 68 sooner than expected

- Automate and modernize pension calculation systems

- Offer financial compensation to affected individuals

- Publish a national pension error register for transparency

Political groups and campaigners, including the WASPI movement (Women Against State Pension Inequality), are demanding full restitution for women born in the 1950s who were never properly informed about the pension age changes.