£694 State Pension Error: Imagine hitting retirement age, finally ready to enjoy some peace of mind—only to find out the government might owe you nearly £12,000 in missed pension payments. Sounds like a bad dream, right? Unfortunately, for tens of thousands of pensioners across the UK, this is a very real issue. This is the story of the £694-a-year State Pension error, a bureaucratic mess that mostly affects women and caregivers. If you—or someone you love—claimed Child Benefit before May 2000, you need to read this. It could mean you’ve been underpaid for over 17 years. Let’s break it all down so it makes sense, no matter if you’re 70 or 17.

£694 State Pension Error

This isn’t about handouts. It’s about claiming what you’ve earned. If you gave up a career—or part of one—to raise your children or care for family, you were promised support in retirement. The £694 State Pension error has denied that to too many people for far too long. Don’t let red tape stand in your way. Check your record, ask questions, file a claim. It’s your right. And every year you wait could mean another year of missed income.

| Detail | Information |

|---|---|

| Error Affected | Women and caregivers, mainly those who claimed Child Benefit before May 2000 |

| Potential Loss | £694/year; up to £11,798 over 17 years |

| Total Underpayments | Over £804.7 million (as of March 2025) |

| People Affected | Estimated 130,000+ individuals |

| Average Repayment | £7,859 per case |

| Main Cause | Missing HRP NI credits due to incomplete Child Benefit records |

| Official Website | gov.uk HRP error page |

What Is the £694 State Pension Error?

This issue starts with something called Home Responsibilities Protection (HRP). Between 1978 and 2010, HRP was designed to help people—mostly women—who weren’t in paid work because they were looking after children or vulnerable adults. It gave them National Insurance (NI) credits, which kept their pension records intact even though they weren’t paying into the system.

But here’s where things went sideways: if you claimed Child Benefit before May 2000, and your National Insurance number wasn’t included, the system didn’t always link that benefit to your pension record.

So you may have done everything right—raised kids, stayed home, looked after family—but the government didn’t count those years toward your State Pension. That could mean losing out on £694 per year, every year for nearly two decades.

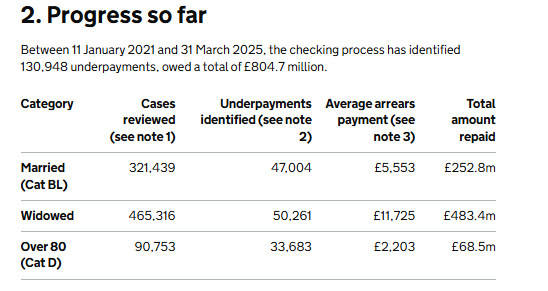

The Scale of the Problem

We’re not talking about a small glitch here. This is a massive error that’s been building for decades.

According to government reports published in March 2025:

- Over 251,000 pension records have been reviewed so far.

- More than 130,000 underpayments have been confirmed.

- The government has paid out over £804.7 million in back payments.

- The average repayment? Around £7,859, but some people have received over £20,000.

What’s shocking is how long it took to uncover. Many people affected didn’t know anything was wrong until they read a newspaper article or saw a report on TV.

If you’re reading this now, you could be one of them.

Who Is Most at Risk?

You’re most likely affected if you fall into one of these categories:

- You’re a woman born before 1953, now receiving the basic State Pension.

- You claimed Child Benefit between 1978 and May 2000.

- You were a stay-at-home parent or part-time worker during those years.

- You didn’t include your National Insurance number on the Child Benefit form (and back then, you weren’t required to).

- You’ve noticed your pension is lower than others with similar work histories.

The government believes the vast majority of cases involve women, because they were typically the ones claiming Child Benefit and stepping out of the workforce to raise families.

Step-by-Step: How to Check If You’ve Made £694 State Pension Error

If you’re wondering whether this applies to you, don’t worry. Here’s a simple, step-by-step process to check and correct your record:

1. Check Your National Insurance Record

Go to Gov.uk’s NI Checker and sign in with your Government Gateway ID. You’ll see a breakdown of your contribution history by year.

Focus on the years between 1978 and 2010. If there are gaps, and you weren’t working but were caring for a child, that’s a red flag.

2. Use the HRP Eligibility Tool

The government offers an online tool to help determine if you should have received HRP credits. It asks about childcare responsibilities, benefit claims, and the ages of your children.

If you were home with your kids and claimed Child Benefit but still see gaps in your record, something’s likely wrong.

3. Contact HMRC or the DWP

Call HMRC or write to the Department for Work and Pensions (DWP). Ask for a manual review of your record. Be ready to provide:

- Your Child Benefit reference number

- National Insurance number

- Names and birthdates of your children

- Previous addresses where you lived while claiming

It may take a few weeks—or even a few months—but if you’re owed money, you will get it.

4. Receive Your Back Pay and Correction

Once approved, your National Insurance record will be updated, your weekly pension increased, and you’ll receive a lump sum for the money you missed.

Why This Matters: It’s More Than Just Money

Sure, £694 a year may not seem like a fortune—but over time, that adds up. And for many retirees, it could be the difference between choosing heating or eating during the winter months.

But this isn’t just about cash. It’s about fairness and recognition. These are people—mostly women—who stepped out of the workforce to care for others. The system was supposed to have their backs.

Now, after years of underpayment, many are struggling to catch up in retirement—and that’s just not right.

Legal and Government Oversight

The government has acknowledged the problem. The Public Accounts Committee called the error “one of the worst examples of state failure in recent years.”

And while the DWP has begun what they call a “correction exercise,” watchdogs say the pace is still too slow.

If you believe your case is being mishandled or delayed, you can:

- Contact the Independent Case Examiner

- Escalate to the Pensions Ombudsman for independent review

Some individuals have also consulted solicitors to recover unpaid benefits, especially in cases where relatives have died before getting compensation.

How This Affects Retirement Planning?

If you’re not yet retired, this still matters. An incorrect National Insurance record can:

- Undermine your State Pension forecast

- Make you ineligible for Pension Credit

- Impact your entitlement to other benefits like Winter Fuel Allowance

- Distort your retirement income planning

It’s worth double-checking your record now, even if retirement feels a few years away.

State Pension Age Could Soar to 70—Triple Lock Under Threat in Shocking New Forecast

State Pensioners Born Before 1959 Set to Receive £1,362 in Surprise Extra Benefits

DWP Bonus: State Pensioners Could Get Extra £230 – But Only If You Tick These Boxes

Talk to a Financial Advisor

This is one of those situations where professional advice pays off. A certified pensions advisor or chartered financial planner can help you:

- Verify your NI record

- Estimate how much you’re owed

- Assist in communicating with the DWP

- Help you adjust your retirement strategy