State Pensioners Can Claim 10 Freebies: Are you a UK state pensioner wondering how to make your retirement income stretch further? Well, this June, you might be in for a pleasant surprise. Pensioners across the country could be eligible for a bundle of government-backed freebies and financial perks that add up to more than £14,000 a year—and many don’t even know they qualify. From free TV licences and discounted utility bills to extra monthly payments and free NHS care, these benefits aren’t just helpful—they can be life-changing. The catch? You’ve got to know what’s out there and how to claim it.

This article is your complete guide to the top 10 financial benefits available to state pensioners in the UK this June. Whether you’re just reaching retirement age or have been receiving your pension for years, these perks are designed to help you live more comfortably—and with less stress about money. We’ll walk you through each one, explain how much it’s worth, who qualifies, and most importantly, how to get it.

State Pensioners Can Claim 10 Freebies

Navigating the world of benefits can be daunting, but it’s essential to ensure you’re receiving all the support you’re entitled to. With potential annual savings and benefits worth over £14,000, taking the time to check your eligibility and apply can significantly enhance your financial well-being. Don’t leave money on the table—explore these opportunities today.

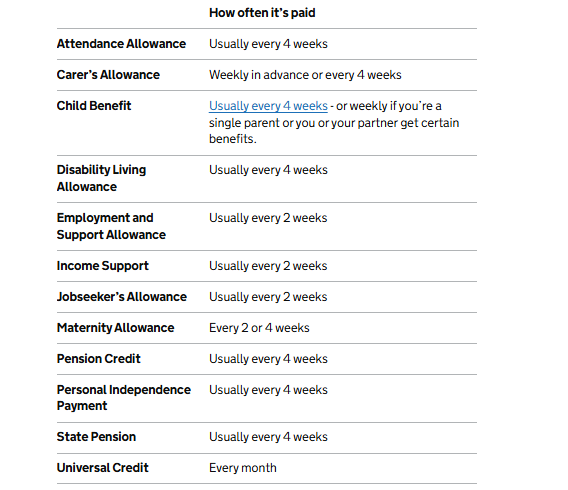

| Benefit | Annual Value | Eligibility |

|---|---|---|

| Pension Credit | Up to £4,300 | Low-income pensioners |

| Housing Benefit | Approx. £1,000 | Renters receiving Pension Credit |

| Council Tax Reduction | Up to £1,600 | Pension Credit recipients |

| Free TV Licence | £174.50 | Over 75s on Pension Credit |

| Warm Home Discount | £150 | Pension Credit recipients |

| Free NHS Prescriptions | Variable | Over 60s in England |

| Free NHS Eye Care | Up to £215 | Pension Credit recipients |

| Free NHS Dental Treatment | Up to £1,000 | Pension Credit recipients |

| Royal Mail Redirection Discount | £24 | Pension Credit recipients |

| Attendance Allowance | Up to £5,740.80 | Pensioners needing care |

Understanding Pension Credit

Pension Credit is a tax-free, income-related benefit for those who have reached the qualifying age and live in Great Britain. It comprises two parts:

- Guarantee Credit: Tops up your weekly income to a minimum level.

- £227.10 for single individuals

- £346.60 for couples

- Savings Credit: An extra payment for those who saved some money towards their retirement.

Detailed Breakdown of State Pensioners Can Claim 10 Freebies

1. Housing Benefit

If you’re renting and receive the Guarantee element of Pension Credit, you might be eligible for Housing Benefit to assist with your rent payments. The amount varies based on your circumstances.

2. Council Tax Reduction

Pensioners on Pension Credit can get a reduction or even full exemption from Council Tax. The exact amount depends on your local council’s policies.

3. Free TV Licence

If you’re over 75 and receive Pension Credit, you’re entitled to a free TV licence, saving you £174.50 annually.

4. Warm Home Discount

This scheme offers a £150 discount on your electricity bill during the winter months. Eligibility is primarily for those on Pension Credit.

5. Free NHS Prescriptions

In England, individuals aged 60 and over can get free NHS prescriptions, saving £9.90 per item.

6. Free NHS Eye Care

Pension Credit recipients are entitled to free NHS eye tests and may receive vouchers towards the cost of glasses or contact lenses.

7. Free NHS Dental Treatment

Those on Pension Credit can access free NHS dental treatments, which can include check-ups, fillings, and dentures.

8. Royal Mail Redirection Discount

If you’re moving house, Pension Credit recipients can get a discount on mail redirection services, saving £24 annually.

9. Attendance Allowance

For pensioners who require assistance due to illness or disability, Attendance Allowance provides financial support:

- Lower rate: £73.90 per week

- Higher rate: £110.40 per week

This can amount to up to £5,740.80 annually.

Additional Support: Cost of Living Payment

In June 2025, eligible pensioners may receive a one-time, non-taxable £450 Cost of Living Payment. This payment is automatic for those receiving means-tested benefits like Pension Credit. No application is necessary.

How to Apply

Applying for these government benefits doesn’t have to be complicated. Whether you’re doing it online, by phone, or with the help of a friend, here’s how to make the process smooth and successful. Getting Pension Credit is your golden key—it not only boosts your income but also unlocks several other valuable freebies automatically.

Step-by-Step Guide to Applying for Pension Credit

1. Check Your Eligibility First

Before applying, use the free online eligibility checker on the official government website:

You’ll need to know:

- Your total weekly income (including pensions, savings, and investments)

- Any savings you have over £10,000

- Your marital or partnership status

- Your housing situation (owning vs renting)

Even if you think you’re not eligible, it’s worth checking—around 850,000 pensioners are missing out on Pension Credit they’re entitled to, according to Age UK.

2. Gather Necessary Information

To apply, you’ll need:

- Your National Insurance number

- Bank account details (for payments)

- Details of your income, savings, and investments

- Information about your pension(s), if you receive any

- Details about your housing costs (like rent, mortgage, or service charges)

Pro Tip: If you’re applying for someone else (such as a parent), make sure you have their consent and full documentation.

3. Apply for Pension Credit

There are three ways to apply:

Online

Apply directly through the official Pension Credit portal.

- Available 24/7

- Easy to follow

- You can save and return to your application

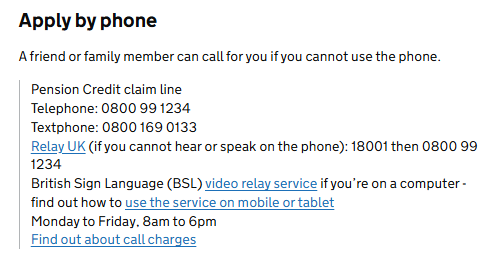

By Phone

Call the Pension Credit claim line:

- Telephone: 0800 99 1234

- Textphone: 0800 169 0133

- Relay UK (if you can’t hear or speak on the phone): 18001 then 0800 99 1234

- Lines are open: Monday to Friday, 8am to 6pm

A trained agent will fill out the application for you over the phone. This is ideal if you’re not comfortable using the internet.

By Post

If you prefer paper forms, you can request a form by calling the same number above and sending it back via mail.

What Happens After You Apply?

- You’ll usually get a decision within 6 weeks.

- If approved, your payments can be backdated for up to 3 months, so don’t wait!

- You’ll receive an award letter confirming how much you’ll get and when your payments start.

Applying for Additional Benefits

Many other benefits are automatically triggered once you receive Pension Credit. These include:

- Free TV Licence (if over 75)

- Warm Home Discount

- Free NHS Prescriptions and Dental Care

- Housing Benefit

- Council Tax Reduction

But for some, you’ll need to apply separately:

Attendance Allowance

If you have a long-term illness or disability and need help with personal care:

- Apply via GOV.UK – Attendance Allowance

- Or call 0800 731 0122 to request a form

- Fill out and mail the detailed form explaining your care needs

Council Tax Reduction

- Visit your local council’s website

- Each local authority has slightly different rules

- Provide your Pension Credit award letter as proof of eligibility

Housing Benefit (If Not on Universal Credit)

- Often included with Pension Credit applications

- If you didn’t apply for it during your Pension Credit application, ask your local council or DWP

TV Licence Fee Waiver

- Once your Pension Credit is confirmed, contact TV Licensing:

- Visit www.tvlicensing.co.uk

- Call 0300 790 6117

- Provide proof of Pension Credit to activate your free licence

DWP Benefits Payment Dates Changed — Check Your Updated Details Now!

DWP Just Dropped a Bombshell—Sickness Benefits Could Be Slashed for Millions!

DWP Reveals Full List of Benefits That Qualify for £12.50/Month Broadband; Are You Eligible?