Student Loan Payments Are About to Spike: As of mid-2025, millions of Americans with federal student loans are once again facing a reality check—payments are coming back, and fast. For borrowers enrolled in the Saving on a Valuable Education (SAVE) repayment plan, this moment is especially confusing. The program, which promised lower monthly payments and forgiveness options, is currently on pause due to a federal court ruling. Whether you’re a recent graduate or a long-time borrower planning for Public Service Loan Forgiveness (PSLF), understanding the current environment and preparing proactively is more critical than ever.

Student Loan Payments Are About to Spike

Navigating student loans in 2025 feels a little like walking through a maze blindfolded. If you’re on the SAVE plan, you’ve probably felt a mix of hope, frustration, and confusion lately. You’re not alone. The system is shifting, and while that can be scary, it also means there’s still time to regroup, rethink, and take action. Whether you’re trying to get back on track, aiming for forgiveness, or just figuring out how to make that next payment, know this: you have options, and you don’t have to go it alone.

Take the time now to explore your repayment plans, update your info with your loan servicer, and start thinking about what life will look like once payments restart. A little prep today can save you a lot of stress tomorrowYou’ve worked hard to get this far—your education, your job, your future. Let’s make sure your student loans work for you, not against you.

| Topic | Details |

|---|---|

| SAVE Plan Status | Currently paused by a federal court; payments on hold until at least September 2025. |

| Impact on Borrowers | Payments paused, no interest accrual, but time doesn’t count toward forgiveness. |

| Delinquency Spike | Nearly 25% of borrowers are now over 90 days delinquent on federal loans. |

| Collections Resumed | The Department of Education has resumed garnishments and tax refund seizures. |

| Alternative Repayment Plans | IBR, PAYE, ICR options available. Use the Loan Simulator to compare plans. |

| Helpful Links | studentaid.gov, ed.gov |

What Is the SAVE Plan?

The SAVE plan was introduced in 2023 as a replacement for the REPAYE plan. Its goal was to provide lower monthly payments based on income and family size, offer interest subsidies to prevent balances from ballooning, and grant forgiveness after 10 to 25 years depending on the borrower’s original balance and repayment history.

Unfortunately, in 2024, a federal court temporarily blocked portions of the plan. That means:

- Payments aren’t being calculated under SAVE.

- Forgiveness through SAVE is paused.

- The Department of Education placed borrowers into automatic forbearance.

This pause, while helpful for the short-term budget, is actually problematic for long-term loan forgiveness tracking.

What You Should Know About Forbearance and Forgiveness

Forbearance might seem like a break, but it’s not free. While interest isn’t accumulating for now, time in this forbearance doesn’t count toward income-driven repayment forgiveness or PSLF. That means if you’re working in public service and hoping for forgiveness after 120 payments, these paused months don’t count.

Tip: Consider switching to an eligible plan like IBR or PAYE if you want your payments to continue counting toward forgiveness.

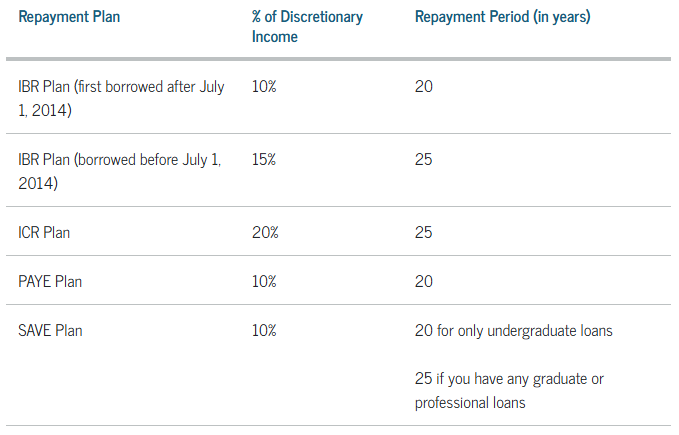

Student Loan Payments Are About to Spike: Breakdown of Repayment Plans

1. Income-Based Repayment (IBR)

- Caps payments at 10-15% of discretionary income.

- Forgiveness after 20-25 years.

- Available for both Direct and FFEL loans (after consolidation).

2. Pay As You Earn (PAYE)

- Payments capped at 10% of income.

- Only available to borrowers who took out loans after October 2007 and received a disbursement after 2011.

3. Income-Contingent Repayment (ICR)

- Oldest income-driven plan.

- Payments can be higher, but available for parent PLUS borrowers (after consolidation).

- Forgiveness after 25 years.

Not sure where to start? Use the Loan Simulator provided by the Department of Education to find a plan that best fits your financial situation.

Why Delinquencies Are Rising?

Recent data from the Federal Reserve shows that nearly 25% of federal loan borrowers are more than 90 days late on payments in 2025. The reasons include:

- Confusion due to multiple program changes.

- Income instability post-pandemic.

- Loss of communication with servicers after servicing transitions.

If you’re already behind, take action now by applying for an income-driven plan or hardship forbearance to avoid collections.

Certainly! Here’s an expanded and detailed version of the “What to Do If You’re in Default” section. It’s written in a clear, conversational tone suitable for both younger readers and professionals, while maintaining expertise and trust:

What to Do If You’re in Default?

Falling behind on student loan payments can feel overwhelming—but if you’ve gone long enough without paying that your loan is officially in default, don’t panic. You’re not stuck. There are clear, manageable steps you can take to fix it, and the sooner you act, the better.

First, What Does “Default” Actually Mean?

Federal student loans are considered in default if you haven’t made a payment in 270 days (about nine months). Once in default, serious consequences kick in:

- Your credit score takes a hit

- Your wages can be garnished

- Your tax refunds or even Social Security benefits may be seized

- You lose eligibility for deferment, income-driven repayment, and future federal aid

But here’s the good news: You have two proven paths to get out of default and rebuild your financial standing.

1. Loan Rehabilitation

Loan rehabilitation is like a one-time “clean slate” program for your student loans.

How it works:

- You agree to make 9 affordable, on-time payments within 10 consecutive months.

- The payment amount is usually 15% of your discretionary income, but you can request a lower amount by showing financial hardship.

- After successful completion, your loan is no longer in default, and the default status is removed from your credit report (though late payments remain).

Why choose rehabilitation?

- It helps rebuild your credit.

- You regain access to federal benefits like income-driven repayment and loan forgiveness programs.

- You only get one chance to rehabilitate each loan.

Best for people who want to clean up their credit and get back on track slowly.

2. Loan Consolidation

Consolidation is faster and simpler for some borrowers, especially if you want to move forward quickly.

How it works:

- You combine your defaulted loan into a new Direct Consolidation Loan.

- To qualify, you must either:

- Agree to repay the new loan under an income-driven repayment (IDR) plan, or

- Make three consecutive on-time payments on the defaulted loan before consolidating.

Why choose consolidation?

- It’s faster than rehabilitation—you can get out of default in weeks instead of months.

- It immediately stops collections and wage garnishment once processed.

- You’re eligible for forgiveness programs and federal aid again.

One downside: The default mark stays on your credit report for up to 7 years, even after consolidation.

Best for people who want to resolve default quickly and start repayment under an IDR plan.

Other Key Steps You Should Take

Regardless of which option you choose:

- Contact your loan servicer or debt collection agency right away. You can find your loan info at studentaid.gov.

- Avoid private “debt relief” companies that charge fees—most will just do what you can do for free.

- If you’re confused, contact a trusted resource like The Institute of Student Loan Advisors for free help.

What If Your Wages Are Already Being Garnished?

If your employer is withholding part of your paycheck for student loan debt, you can still:

- Request a rehabilitation agreement to stop future garnishments.

- Apply for consolidation under an IDR plan to prevent further collection.

You’ll need to act quickly and provide documentation of income and expenses, but collections can be paused during the resolution process.

How Default Affects You Long-Term

- Credit score: A default can drop your score by 100+ points.

- Employment: Some employers check credit during hiring.

- Housing: Renting an apartment can become harder with bad credit.

- Future borrowing: Mortgages and car loans may come with higher interest or get denied.

That’s why it’s crucial to get out of default and stay out.

Loan Consolidation: Is It Right for You?

Loan consolidation can simplify your repayment process, especially if you have multiple federal loans. Benefits include:

- Access to income-driven repayment plans.

- Resetting the clock for PSLF eligibility (with risks).

- Avoiding default collections on older loans.

However, consolidating loans resets your progress toward forgiveness, so be strategic.

Tips to Prepare for Payment Resumption

- Update Contact Information with your loan servicer.

- Log in to studentaid.gov and review your loans and repayment plan.

- Calculate your monthly payment using the Loan Simulator.

- Budget accordingly — payments may resume as soon as December 2025.

- Set up auto-debit to avoid missed payments and receive a 0.25% interest rate reduction.

Over 20 Million Americans Are Behind on Student Loans; How This Crisis Could Shake the U.S. Economy

How to Graduate Debt-Free: Proven Tips to Slash College Costs Before It’s Too Late

The Big Domestic Policy Bill Just Dropped; Here’s How It Powers Trump’s Vision

Protect Your Credit

Loan delinquencies and defaults hurt your credit score. To protect your financial future:

- Check your credit reports at annualcreditreport.com.

- Dispute any inaccuracies, especially if your loan was in forbearance.

- Communicate with your servicer immediately if you’re at risk of falling behind.