91% of Social Security Fairness Act Payouts Have Been Processed: If you’re a retired teacher, police officer, firefighter, or another public employee—and your Social Security check always seemed smaller than it should be—you were likely hit by outdated federal policies called WEP and GPO. But that’s finally changed. In January 2025, the Social Security Fairness Act (SSFA) became law, repealing the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). These two rules had penalized millions of public sector retirees for decades. Fast forward to May 2025—91% of the new payments have been processed, and millions are seeing bigger monthly checks and even lump-sum back payments.

91% of Social Security Fairness Act Payouts Have Been Processed

The repeal of WEP and GPO through the Social Security Fairness Act is more than just a policy change—it’s a long-overdue victory for millions of hardworking Americans. For decades, public servants lost thousands of dollars due to unfair, outdated rules. With 91% of the payouts already completed, now is the time to review your benefits, ask questions, and take action. Whether you’re already receiving benefits or still on the sidelines—you’ve earned this.

| Topic | Details |

|---|---|

| Law Signed | January 5, 2025 |

| Key Changes | Repeals WEP (1983) and GPO (1977) |

| Who Benefits | Retired teachers, police, firefighters, federal workers with non-covered pensions |

| % Processed | 91% of all eligible payouts processed as of May 2025 |

| Payment Type | Monthly increases and retroactive checks (back to Jan 2024) |

| Deadline for Final Payouts | November 2025 |

| Source | Social Security Administration |

What Were WEP and GPO—and Why Were They So Controversial?

Windfall Elimination Provision (WEP)

The WEP, passed in 1983, reduced Social Security retirement benefits for people who received a pension from work not covered by Social Security (like state or local government jobs). It assumed your pension was a “windfall,” when really, you paid into both systems fairly.

Government Pension Offset (GPO)

Enacted in 1977, GPO reduced or eliminated spousal or survivor Social Security benefits if you received a government pension. This disproportionately affected widows and women, who often rely on survivor benefits after their spouse passes away.

These provisions were widely criticized for being outdated, unfair, and especially harmful to low-income retirees and dual-career households.

Timeline: The Long Road to Repeal

| Year | Milestone |

|---|---|

| 1983 | WEP introduced to fix Social Security funding gap |

| 1977 | GPO passed to prevent perceived “double-dipping” of government pensions |

| 2001–2023 | Multiple bipartisan bills introduced, but stalled in Congress |

| 2022 | Over 300 House co-sponsors sign HR.82, bringing national attention |

| Jan 2025 | Social Security Fairness Act passed with bipartisan support and signed into law |

Who Gets More – And How Much?

Who’s Eligible?

The repeal impacts over 3 million Americans who:

- Worked in non-covered employment (no Social Security taxes taken)

- Also qualify for Social Security benefits (from other work or through a spouse)

Typical groups include:

- Public school teachers (especially in TX, CA, IL, MA)

- Police officers and firefighters

- Postal and federal employees under the old CSRS system

- Retirees with foreign pensions (often penalized under WEP)

How Much More Are People Getting?

It varies based on work history, but here are average increases:

- Monthly benefits: +$300 to $1,100+

- Retroactive lump sums: Average = $6,710 (some >$20,000)

Real-World Examples

Linda – Retired Teacher, Texas

Before the SSFA: $500/month due to WEP

After repeal: $1,250/month + $16,800 retro check

Mike – Retired Police Sergeant, New Jersey

Before: No survivor benefits from spouse’s Social Security (due to GPO)

After repeal: $1,850/month + $20,200 lump-sum payment

What You Should Do Now As 91% of Social Security Fairness Act Payouts Have Been Processed?

- Check Your SSA Account

Visit ssa.gov/myaccount and log in to view updated payment information. - Wait for the Letter

SSA is mailing official notices about the change. You may receive payment before the letter. - Haven’t Applied Before?

If WEP or GPO discouraged you from filing—now’s your time. Apply online at ssa.gov/apply. - Update Your Information

Moved? Changed banks? Make sure SSA has your latest address and direct deposit info.

Tax Implications: Plan Ahead

If you’ve received a large lump-sum back payment, this could push you into a higher tax bracket—at least temporarily.

Social Security Taxes Overview

For Individuals:

- Under $25,000: 0% taxable

- $25,000–$34,000: Up to 50% taxable

- Over $34,000: Up to 85% taxable

For Married Filing Jointly:

- Under $32,000: 0%

- $32,000–$44,000: Up to 50%

- Over $44,000: Up to 85%

Tip: Consider speaking with a tax professional to determine if a Form 4972 (lump-sum averaging) or adjusted withholding can help.

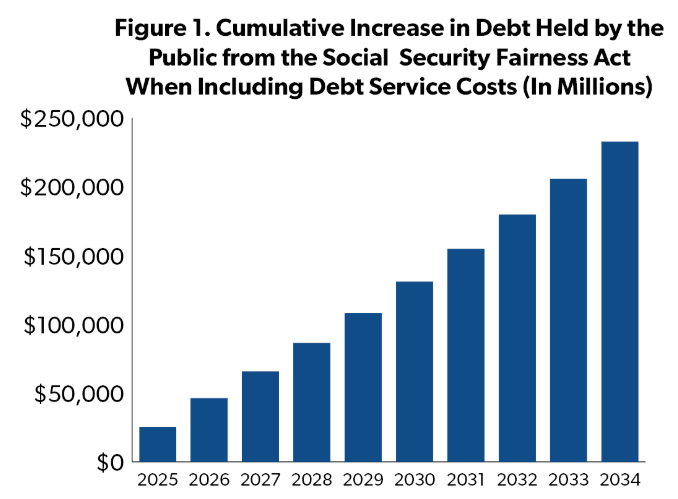

Remaining 9%: Why the Delay?

While most cases have been processed, about 200,000–300,000 are still pending due to:

- Overpayment disputes

- Incomplete earnings records

- Death of a spouse or primary beneficiary

- Manual processing needs

SSA aims to complete all remaining cases by November 2025, but expects delays in unrelated services (like Medicare or SSI processing) while this backlog is cleared.https://x.com/reason/status/1869178276549124112

State-by-State Impact

Certain states had the highest concentration of WEP/GPO-affected retirees:

- Texas – Over 350,000 teachers impacted

- California – Largest number of public sector pensioners

- Illinois & Massachusetts – Long histories of non-covered employment

- Colorado, Louisiana, Georgia – High impact zones

These states are now seeing huge increases in benefits and local SSA offices have added staff to deal with the inquiries.

Advocacy & Lobbying: The People Who Made It Happen

Organizations like:

- National Education Association (NEA)

- American Federation of Teachers (AFT)

- National Active and Retired Federal Employees Association (NARFE)

fought tirelessly for this repeal. Letters, lobbying trips, and online petitions helped pressure lawmakers to act. Over 300 House representatives signed on as co-sponsors of the bill before it passed in late 2024.

Social Security Fairness Act Update: Here’s When You Could Finally Get Your Retroactive Payment

Congress Just Passed the GPO Fairness Act; Here’s What It Means for Your Social Security

Trump’s Emergency Tariff Tactic Backfires; Could It Collapse His Trade War Strategy?

Myths and Misconceptions

Myth 1: “The repeal only helps high-income retirees.”

Truth: Many affected retirees were low- to middle-income public servants who saw their benefits slashed unfairly.

Myth 2: “You’ll automatically be paid—no action needed.”

Truth: Most will be paid automatically, but if your contact info changed, or you never applied due to WEP/GPO, you need to act.

Myth 3: “SSA is calling people to collect banking info.”

Truth: SSA will never call you for banking details. Beware of scammers taking advantage of SSFA changes.