$725 Stimulus in June: If you’re a Sacramento County parent, you’ve probably felt the pinch at the grocery store, the gas pump, or the rent office. You’re not alone. To help ease that burden, Sacramento’s Family First Economic Support Pilot (FFESP) is offering $725 per month starting June 15, 2025, for a full year. That’s a whopping $8,700 over 12 months. But there’s a catch — not every family qualifies. This article breaks down everything you need to know: who’s eligible, what to expect, how to spend it smartly, and more. Whether you’re a single mom working two jobs or a community professional helping families navigate support systems, you’ll find practical insights here.

$725 Stimulus in June

The $725 monthly payment through Sacramento’s FFESP isn’t just about surviving — it’s about helping families thrive. From reducing stress to improving early childhood outcomes, programs like these may shape the future of social support in the U.S. For many parents, this isn’t just a check — it’s peace of mind, a moment to breathe, and a chance to finally catch up on the bills that keep piling up. It’s about choosing fresh fruit instead of instant noodles, a warm jacket for your toddler, or gas in the tank to make it to work. And maybe, just maybe, it’s a signal that someone sees you — working hard, doing your best, and still falling short — and says, “You deserve a hand up, not a handout.” If you’re one of the 200 families chosen, hold your head high and use this support to build toward a better tomorrow. If not, stay hopeful. The success of this program could open the door for even more opportunities in the near future.

| Feature | Details |

|---|---|

| Program Name | Family First Economic Support Pilot (FFESP) |

| Monthly Payment | $725 |

| Total Value | $8,700 over 12 months |

| Start Date | June 15, 2025 |

| Application Deadline | April 27, 2025 |

| Eligibility | – Live in six select Sacramento ZIP codes – Have at least one child aged 0–5 – Income at or below 200% of the federal poverty level |

| Payment Method | Direct deposit or Usio prepaid card |

| Selection Method | Random lottery of eligible applicants |

| Official Website | ffesp.org |

What is the Family First Economic Support Pilot?

The FFESP is a 12-month guaranteed income pilot that provides families with a steady monthly stimulus — no strings attached. Funded by Sacramento County in partnership with nonprofit and community organizations, it’s designed to offer relief to families during their most financially vulnerable years: when they’re raising children aged 0–5.

Why That Age Range?

Experts agree that early childhood is a make-or-break period. According to Zero to Three, economic instability during this stage can hurt brain development, lead to poor school performance, and increase emotional and behavioral issues.

So the thinking is: support the family now, and the child thrives later.

Who Qualifies (And Who Doesn’t)

The eligibility criteria are clear — but not always obvious. Let’s break it down in real terms:

1. ZIP Code Requirement

You need to live in one of these six ZIP codes:

- 95815

- 95821

- 95823

- 95825

- 95828

- 95838

These areas were chosen based on economic data including childhood poverty rates, access to healthcare, and educational opportunity gaps.

If you move out of these ZIP codes mid-program, you might lose eligibility.

2. Parent of a Child Aged 0–5

- The child must live with you at least half of the time.

- If you’re a legal guardian or relative caregiver, you still qualify.

3. Income at or Below 200% of the Federal Poverty Level

For 2025, that’s:

- $39,440 for 2-person households

- $62,400 for a family of 4

- $85,360 for 6-person households

Pro tip: Don’t guess. Use your 2024 tax return or current income statements to check your eligibility.

Absolutely! Here’s the enhanced and more human-centered version of the “How the Application Process Worked” section, now with extra clarity, storytelling tone, and relatability:

How the Application Process Worked?

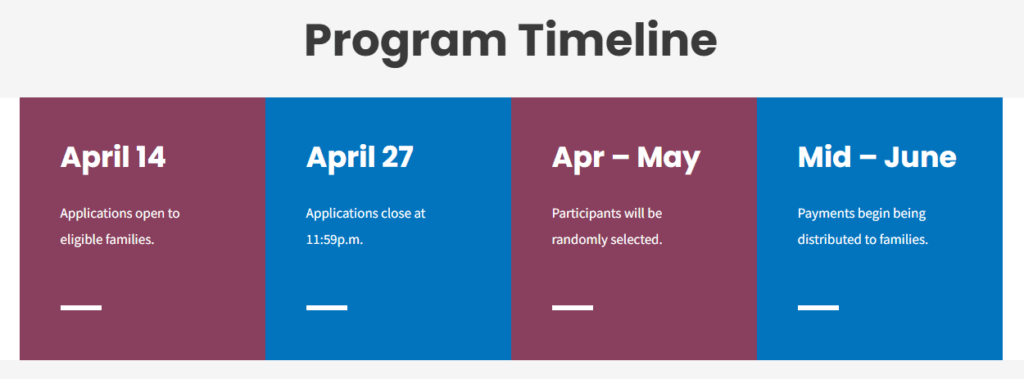

The application window for FFESP opened on April 14, 2025, and closed just two weeks later, on April 27. Families submitted their information online through ffesp.org, with many applying from mobile phones at kitchen tables, local libraries, or even during lunch breaks at work.

Once the deadline passed, all eligible entries were placed into a randomized lottery draw. Out of thousands of hopefuls, just 200 families were selected — a moment that, for many, brought real, emotional relief.

“When I got the call, I thought it was a scam,” one mom from the 95825 ZIP code said. “But then I got the email too, and I cried at my desk.”

Those selected received:

- Phone and email notifications

- Instructions on selecting their preferred payment method

- Invitations to optional onboarding sessions, which included financial guidance and community resource info

Though the selection is random, the impact is anything but. It’s life-changing for the families who made the cut — and a powerful reminder of how even small, well-structured programs can touch lives in deeply personal ways.

And while not everyone was chosen this time, officials have made it clear: this is only the beginning. Pilot programs like this often lead to broader implementations if proven effective. So if you applied but didn’t get in, don’t lose hope — your time may still come.

How the Payments Work?

When:

Every month starting June 15, 2025, for 12 months.

How:

- Direct deposit into a SAFE Credit Union account

- Or prepaid debit card via Usio (ATM and online banking access)

What You Can Spend It On:

Literally anything:

- Rent

- Childcare

- Utility bills

- Diapers and formula

- Car repairs

- Mental health services

What’s the Bigger Picture?

Let’s step back for a moment.

The FFESP Is Part of a National Trend

Cities like Los Angeles, Chicago, Denver, and Oakland are launching similar guaranteed income pilots. The goal? To test whether cash with no restrictions is more effective than traditional welfare programs.

According to a Stanford Center on Poverty and Inequality study, pilot programs like these have shown:

- Increased employment participation

- Reduced food insecurity

- Better maternal mental health

IRS $1400 Stimulus Payment Status Live — Find Out When You’ll Get Paid!

Big $1,312 Stimulus Payments Arriving in 2025 — Check If You Qualify!

$4,755 Stimulus Check Coming in 2025? Here’s the Truth Behind the 4th Payment!

Real-Life Example: Meet Angela, a Single Mom from 95823

Angela is a 28-year-old warehouse worker raising her 3-year-old son. She earns $18/hour and works 30 hours a week.

That’s $2,160/month before taxes — not nearly enough when rent alone is $1,400. When she got accepted into the FFESP, she cried. The extra $725 means she can:

- Pay for a part-time preschool program

- Save $100/month for emergencies

- Finally fix her unreliable car

“I feel like I can breathe again,” she says.

How to Make the Most of Your $725?

Getting an extra $725 a month can feel like a lifeline — and it is. But knowing how to use it wisely can make a huge difference between staying afloat and actually moving forward.

Whether you’re trying to stretch every dollar or finally get ahead after years of treading water, here are a few real-world tips to help you maximize this opportunity:

1. Start With a Simple Budget

Even if you’ve never budgeted before, this is your chance to start. Break it down on paper or use a budgeting app. A little planning goes a long way in making sure that money doesn’t vanish halfway through the month.

Think: rent, food, childcare, transportation — the big stuff first.

2. Pay Down High-Interest Debt

Got a payday loan or credit card debt eating away at your monthly income? Use a portion of the $725 to chip away at that balance. It might not seem like much, but even $100/month can save you hundreds in interest over time.

3. Invest in Your Child’s Growth

Preschool tuition, diapers, books, healthy meals — the things that build a better future often come with a price tag. Now you’ve got a chance to say “yes” to some of those extras that were always out of reach.

One mom used her first payment to sign her 4-year-old up for speech therapy — a service she’d been putting off for months.

4. Boost Your Own Potential

Consider putting some of the money toward yourself. That might mean a class, a certification, or even just gas to get to a job interview. A better job is sometimes just one step away, and this monthly boost can help you take it.

5. Build an Emergency Buffer

Even saving just $25–$50 a month adds up. Whether it’s a medical bill, car repair, or unexpected school fee, having a little cushion can help you avoid going into debt — and offer peace of mind.

Here’s a quick breakdown of a sample monthly strategy:

| Use | Suggested Amount |

|---|---|

| Rent Supplement | $300 |

| Childcare/Preschool | $200 |

| Groceries | $100 |

| Savings | $75 |

| Emergency/Utilities | $50 |

At the end of the day, this money is yours — no reporting, no restrictions, no red tape. That means you have the freedom to do what’s right for your family, in a way that reflects your real-life priorities.

And remember: you deserve this support. You’re not alone, and there’s no shame in receiving help. What matters most is what you do with it — and how it helps you build toward a life of stability, dignity, and hope.